Download template

Share

Year-end Payroll Template

Streamline client offboarding with this detailed process BOSS uses to part ways with their clients.

Download template

Share

Free Year-end Payroll Template: Your Guide to Perfect Year-end Closing

Make your year-end payroll processing simple and accurate. Replace chaos and stress with an organized system that ensures every detail is handled correctly, on time, every time.

Why Your Firm Needs Uku's Year-end Payroll Template

Managing year-end payroll is one of the most critical tasks for accounting firms. Our template helps you:

- Turn complex payroll closing into a systematic, repeatable process

- Ensure 100% compliance with tax regulations and reporting requirements

- Never miss crucial deadlines for W-2s, 1099s, and tax deposits

- Maintain consistency across your entire team

- Reduce errors and save valuable time during the busy season

- Deliver exceptional service that keeps clients loyal

What's Inside Our Comprehensive Template?

Our template includes 6 essential components for successful year-end payroll management:

1. Final Paycheck Verification (December 15-20)

Critical verification period to ensure all compensation is properly recorded before year-end closing. Our template guides you through systematic verification of:

- Regular Payroll Accuracy

- Base salary and hourly wage payments

- Overtime calculations

- Shift differentials

- Holiday pay rates

- Special Compensation Items

- Year-end bonuses and commissions

- Performance-based payments

- Retroactive pay adjustments

- Off-cycle payment verification

- Deduction Verification

- Tax withholding accuracy

- Benefit deduction amounts

- Garnishment calculations

- Special deduction items

This mid-December timing ensures you have adequate time to:

- Resolve any discrepancies before final payroll

- Process additional payments if needed

- Make corrections before tax forms are generated

- Communicate any issues with clients

2. Benefit Changes Implementation (December 15-31)

Organize and process all benefit updates for the new year:

- Health insurance adjustments

- Retirement plan changes

- PTO policy updates

- Other benefit modifications

3. Year-end Payroll Processing (December 23-25)

Execute final payroll with precision:

- Process last payroll run

- Include all outstanding payments

- Verify tax withholdings

- Confirm benefit deductions

4. Wage and Deduction Verification (January 1-31)

Comprehensive review of:

- Employee wage records

- Tax withholdings

- Benefit deductions

- Special compensation items

5. W-2 Distribution Management (January 1-31)

Streamlined process for:

- W-2 form preparation

- Accuracy verification

- Timely distribution

- Record keeping

6. Tax Reporting and Deposits (January 1-31)

Complete management of:

- FUTA tax deposits

- Federal income tax reporting

- FICA tax submissions

- State tax requirements

How Uku's Template Transforms Your Year-end Process

Standardization

Create a unified approach to year-end payroll across your entire firm. Eliminate guesswork and inconsistencies with our proven system.

Time Efficiency

Cut hours off your year-end process with our streamlined workflow. Focus on growing your firm instead of managing paperwork.

Risk Reduction

Built-in verification steps and compliance checks help prevent costly errors and missed deadlines.

Client Satisfaction

Deliver consistent, professional results that showcase your firm’s expertise and attention to detail.

Why Choose Uku's Template?

At Uku, we’re not just another software company – we’re your partners in accounting success. Our template is:

- Customizable: Tailor it to fit your firm’s unique needs and workflows.

- Simple to use: Intuitive design means you can start using it right away.

- Regularly updated: Stay current with the latest industry standards and best practices.

- Created by experts: Benefit from the knowledge of seasoned accounting professionals.

Getting Started with Uku's Templates is Simple

- Download your free template from the sidebar -›

- Customize it to your firm’s needs

- Upload it to your Uku task templates

- Add to client’s workflows

- Celebrate your bookkeeping efficiency boost

FAQs

How customizable is the template?

Yes! While the template includes all essential tasks, you can modify it to match your firm’s specific processes and client needs.

Is this suitable for firms of all sizes?

Whether you’re a solo practitioner or managing multiple teams, our template scales to fit your needs.

How often is the template updated?

We regularly update our templates to reflect the latest tax regulations and industry best practices.

Can I share this with my team?

Absolutely! The template is designed for team collaboration and can be shared across your entire firm.

You may also be interested in:

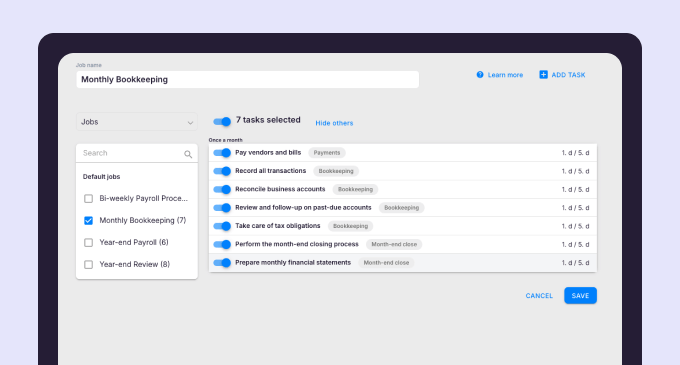

Transform your monthly bookkeeping workflow into a systematized process. Goodbye forgotten tasks and hello to consistent, reliable bookkeeping that keeps your clients' businesses healthy and compliant.

Transform your year-end review process into a systematized workflow. Say goodbye to missed deadlines and hello to consistent, reliable year-end reviews that keep your clients' businesses compliant and ready for tax season.

Start a free trial or get a demo.

Elevate your efficiency with Uku, the powerful yet easy-to-use accounting practice management software.

“

Let’s create a dream, where the team is happy, clients are well served and profits are fair.Rain Allikvee / Uku’s co-founder