Creating value for the customer retains loyalty and is also a way to command a higher price for your knowledge, product or service. How to use value-based pricing as your secret weapon?

Yet, what does this value crea tion look like?

One famous story illustrates how one can charge more for simply knowing what to do.

The famous automobile pioneer Henry Ford observed that one of the production lines within his factories had stopped working.To solve the problem, he asked the legendary electrical engineer and physicist Nikola Tesla to remedy the issue.

Upon arrival, Tesla immediately began to walk around the factory and check the machines. After a few minutes, he stopped, took a piece of chalk from his pocket, and made a white ‘X’ on the boilerplate before him. “That’s what you need to fix,” he said.

Ford employees followed Tesla’s recommendations and production was up and running in less than an hour. Ford was thrilled about the resumption of production and asked Tesla to send him an invoice for his recommendations.

The next day, Ford received the invoice for the amount of $10,000 (a vast sum at the time). Ford, stunned at the amount, asked Tesla to elaborate on how he could justify the high cost.

Tesla replied, and wrote on the invoice:

$1 for making the white ‘X’;

$9,999 for knowing where to place the ‘X’.

Tesla had demonstrated the value of his work. Now imagine if he had charged an hourly rate?

How much would the amount be?

It definitely would have not been $10,000. Not even close.

How can one price a service in such a way that it demonstrates more value to your customers plus significantly increasing your revenue?

Is it workable? If so, how can you do it?

Typical ways to price accountancy services

The following pricing types are the most used for accounting services:

- Hourly accounting. This pricing model is based on the time taken to complete the work and how much an hour’s work costs.

- Entry or volume-based accounting. This model is dependent on the volume of documents processed.

After using these pricing models for years, or even decades it is likely that you have not considered the disadvantages of using them.

Disadvantages of hourly and volume based accounting

Both hourly and volume accounting can limit a company’s potential turnover and long-term profitability. Meaning it will be tougher to grow your accountancy practice. The 5 core challenges are:

1# Not seeing the value

Due to being unable to appreciate the customer value created – customers select accountants based on price alone. Meaning that the accountancy practices enter into a bidding war for customers.

2# Working faster yet making less profit

In today’s technologically advanced world, the concept is to work more efficiently and achieve more in less time. However, by working faster, not only do you receive less pay, you end up burning out trying to get more done. As you work more quickly – you can do more, which ends up creating more stress – meaning you and your business suffer as a result.

3# Your work takes precedence over your business input

Customers begin to prioritise the number of entries you do or the time spent to complete tasks. They do not consider your input as an equal partner in managing the financial aspects of their business. If your value to a customer is so low, it is easy to replace your practice with a competitor.

4# Unable to justify an increase in pricing

If your business is mainly judged on the amount of work completed, then you are in a rather vulnerable position where it doesn’t matter who you are, how much do you know – your services are replaceable. Meaning that if you wish to raise your prices, your customers will look elsewhere to complete the same amount of work for a cheaper price.

5# Unable to build the right customer relationship

Lastly, in business, personal relationships are what truly matter. Meaning that the more personal communication and trust your practice can develop throughout a partnership, the more the customer will relate and appreciate your work.

If your communication is solely based on receipts and expenses alone – it is hard to foster a client relationship so invaluable for maintaining a business. Relationship with an accountant lasts longer than an average marriage. Make your customers your partners, not your enemies.

Value-based pricing – what is it?

What is value-based pricing?

Value-based pricing is a pricing strategy of setting prices primarily based on a consumer’s perceived value of a product or service. Where it is successfully implemented, it will improve company profitability by generating higher rates without impacting sales volumes.

In value-based pricing, companies begin by working with their clients to get an understanding of their accounting and financial needs and concerns.

As you complete the analysis, you identify where you can improve their business by demonstrating knowledge, experience and skillsets.

Next, you calculate the revenue that you can earn or save for your client. You determine how much of it you will need to do (this becomes the fixed cost of the project).

In the final assessment phase, you present to your client your findings. Placing emphasis on the value you create at each step, selling your services along the way.

At the presentation’s end, the cost of the project should be evident to the client. The value highlighted alone should be enough to convince the customer of the merits of paying for your services.

The concept behind value-based pricing is that you can take on more big-budget projects. These projects provide a stable platform for revenue growth without having to deal with smaller, more time-consuming tasks. The project has a clear goal that all necessary work done by your business will achieve for your client.

What is the requirement for value-based pricing?

You must have a belief of what your business can offer, with well-described packages with prices for all your services.

You do not quote prices publicly, with clients only knowing the project’s total cost. This way you remain flexible, and you can test the price limit with each new customer. The aim is to find the highest price that the market is willing to pay for the value you create.

Secondly, you have the confidence and courage to value yourself. You will need to have the confidence to ask for a fee that can make your competitors and colleagues raise their eyebrows at.

Value-based pricing – a working example:

A customer’s business is plagued by constant shortages of money and suppliers’ debt. By doing preliminary analysis, you investigate the causes and formulate a plan on how to remedy the business.

By crunching the numbers, it becomes evident that you will be able to manage their cash flow more efficiently save your customer £100,000 per year.

You believe your value is worth at least 10% of that amount.

Thus, you set your minimum cost at £10,000. Yet, what value does your customer get?

- Financial Value: After your customer has paid your final invoice, they have more than £90,000 in their account than a year earlier, and their cash flow is now flowing smoothly. A clear financial value has been delivered.

- Reputable Value: Once the financial situation has stabilised, the supplier’s confidence in the customer will be restored. They will be able to conduct further business without financial worry.

- Emotional Value: A business manager’s stress levels drop, they can relax and sleep better. They are more satisfied with their life – being able to make new life and business decisions.

The Advantages of Value-Based Pricing

1. It broadens your approach to business

A value-based approach makes you consider how to maximise the benefits for your customer.

Even if you sell hours or volume, a customer will never buy those things from you – they will buy the result. Value-based pricing provides an opportunity to not only get the task done but other benefits including financial savings, streamlined resources and/or emotional satisfaction.

2. Customer know how much they are paying each month

Invoice amounts fluctuate with the amount of work completed or hours worked. Customers become concerned if they see a higher cost than they usually expect.

A package service, the cost of which is always agreed before work has begun, provides reassurance that the fee will not be a penny over that amount. Yet, clients know they are still receiving value for their fee.

3. Your business becomes more stable

Value-based pricing provides you and your business with a solid easy-to-predict cash flow. Receiving a stable monthly fee is no longer dependent on how many hours worked. Instead, knowing that you have the same amount each month means you can focus on consulting your client and delivering better results.

The Difficulties of Value-Based Pricing

Whilst there is a tremendous amount to gain from value-based pricing, it does have its disadvantages.

1. Being more than an accountant

Is your company capable of thinking and acting with a new approach if you switch to value-based pricing?

The transition to value-based pricing will highlight the need for additional skills your business needs.

Maybe you or your team don’t have them.

You can no longer be a classic accountant with a penchant for crunching numbers and inputting them on spreadsheets.

To get the full benefits of value-priced pricing, you will need to sell the bigger picture of how you will make a profit and to be able to sell this to a customer.

2. Reinventing your business model

Switching to value-based pricing means re-inventing the business model of your own business.

This can result in large-scale changes. Staff will need to re-trained from being number-inputting accountants to financial business managers.

Can your team adapt to this way of thinking?

To avoid any breaks in business revenue, it is best to start value-based pricing with one or two clients first. This way, you evolve your business and don’t install too much change at once.

3. Bigger IT investment required

Value-based pricing prioritises customer consultation to maximise customer value being created. Meaning that accounting tasks cannot occupy your primary focus.

Accountancy practices will need to invest more in their IT capabilities. Mainly because value-based pricing requires more automation of smaller tasks, plus the need for accessing real-time data.

Can your business handle a significant investment in your IT infrastructure?

A cloud-based platform is one solution as it is cheaper and has a substantial advantage that it can be accessed anytime and anywhere.

4. You need a lot of patience

“Patience is a virtue!” So goes the saying…

Before you begin adopting a value-based pricing model, you will need to measure how much time it will take, and how profitable it will be for you.

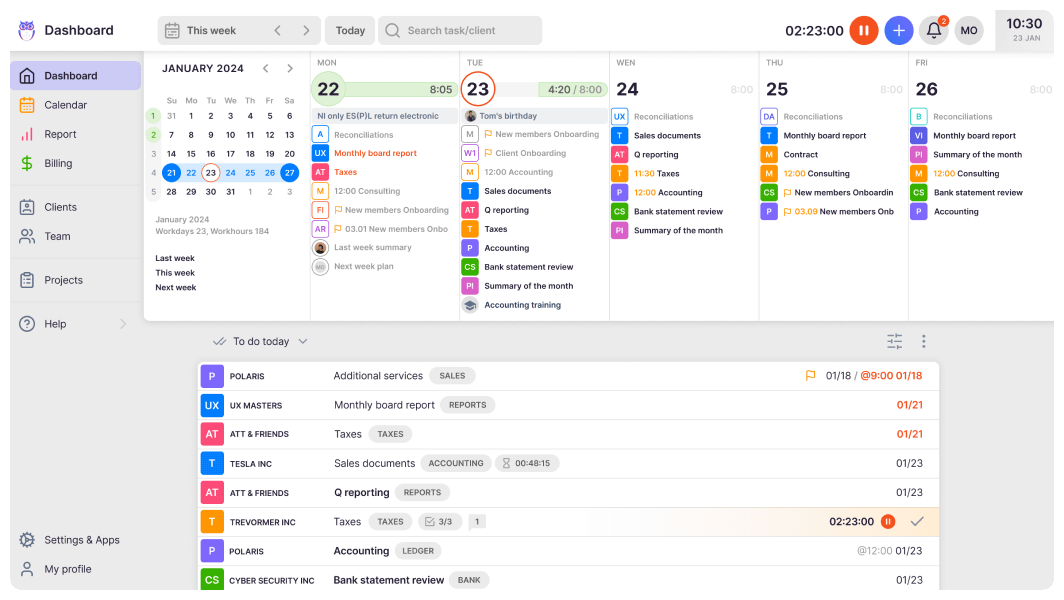

Uku is the perfect tool for time tracking and organising your tasks. To get an understanding on which tasks your team is completing for clients and how much time has been spent on each task/project/client.

Practice managers and business owners will need the patience to determine how effective this strategy is.

Plus, with a value-based approach, you will have to dig deep into the customer’s business. Meaning several months of negotiation, rigorous calculations, consulting with colleagues and presenting the project in a way that you can get your requested project fee.

Conclusion

Does value-based accounting look like a good fit for your business?

Implementing this pricing method does need a mountain of preparatory work, yet even with the disadvantages listed above; moving to this model could increase both profitability and better work-life balances.

Moreover, it is your opportunity to become a customer service creator that better builds businesses and earns both respect and increased revenue.

Ready to work smarter?

Sign up for a 30-day free trial and start identifying where your revenue is created and learn how much time you spend on tasks.

Illustration: icons8