Accountants are feeling a tremendous amount of stress and emotional overload, and a low point in their mental health right now.

They have seen an increase in heart-breaking cases of clients whose businesses are suffering due to the COVID-19 pandemic and, in several instances, on the verge of collapse.

Such stories take their toll on accountants’ mental health. Combined with all the additional hours they must put into responding to client queries about new UK government-backed schemes, burnout has increased concern amongst accounting practice managers.

Post summary:

- Mental health and the impact on business

- Accountants and the rise in poor mental health

- How digitisation & tech is making the workplace happier

- Identifying stress, anxiety and depression at work

Mental health and stress

Mental health and stress and regulating our general wellbeing impacts everybody from all backgrounds. It could be teenagers worried about their final exams, to a loss of a job and worries about being employed again.

The loss of a loved one and divorce is widely acknowledged to be the most depressing and stressful life events people face during their lives.

Mental health and wellbeing are impacted not only by personal circumstances but societal changes too.

Social media has been accused of increasing desire for a lifestyle way beyond what most can achieve. You only have to consider how Instagram influencers’ ‘influence’ you to aspire to the lifestyle they lead.

Furthermore, social media platforms including Facebook, LinkedIn and Twitter provide instant messaging and communication to people not only in your ‘network’ but from across the globe.

These platforms have accelerated how we can communicate, meaning more of us are online and ‘switched on’ to doing more work or chatting to others.

How mental health impacts businesses

According to Health and Safety statistics, 57% of all working days lost due to ill health were caused by work-related stress, anxiety or depression.

These figures demonstrate that physical illness, once assumed to be the significant factor in workplace illness, is waning. That mental wellbeing is far more critical to business operations and profitability.

It should be noted though that individual worker wellbeing is often a combination of different factors.

Even employers who prioritise mental health and wellbeing understand that their employees are being impacted by concerns that lie outside of their work environment.

However, employers are not counsellors.

How much should they ask about what is going on in their employee’s lives?

Is it ethical for them to ask these questions?

When does caring about employees become snooping?

There is no definitive answer.

Wellbeing in the workplace is complicated. Many workers come to work and use it as a place to forget what is occurring in their personal lives. Work provides a respite to stresses caused elsewhere.

Others, however, use work to meet with like-minded individuals who not only have the same stresses at home but suffer from pressures at work and discuss it together, whether at the water cooler or over a cup of tea in the office kitchen area.

Accountants also suffer from poor mental health

Research from ICAEW highlighted that 1 in every 3 accountants suffer from mental health issues. More than half of them admit that depression and anxiety make them fear going to work every day.

Clients are placing pressure on accountants, ensuring they pay less tax. Probably questioning how many billable hours they spent on the company accounts, or worse, asking to do end of year accounts within a week or they will leave the accounting firm.

These are common pressures that accountants face daily.

What’s more, it is the younger and female accountants that suffer most with anxiety and stress according to a survey conducted by Monash University.

The age group suffering from stress the most was those aged between 30-50, with the highest levels of stress recorded were aged between 30 and 34. These years are when accountants are in between starting as a junior accountant and becoming senior partners, whilst combing the aspirations of starting a family.

So, are accountants suffering more now from depression or stress than they were in the past generations?

Having a family is certainly nothing new. Yet with the new ways of communicating, (see social media above) and the changing roles of gender; has certainly added more pressure to those wanting a family.

As our lives change in a rapidly digitising society, where we either need to upskill to reskill, others fear being left behind. Suppose they are unable to transform their way of working or begin prioritising family over work. In this scenario, they start to worry about their job security.

These fears then become highly sensitised:

- fear of losing a job (how will I pay for my family expenses?)

- damage to reputation (don’t promote him, he prioritises family over our practice)

- afraid of failure (what does this say about me as a person?)

These are some widespread causes of anxiety and stress within accountants.

Accountants thus become habituated to seeing tangible results from hard work.

The harder they work, the more billable hours they can charge, the more problems they solve, the more knowledgeable they become. Accountants are rewarded with raises, bonuses, promotions, job offers, and the esteem of their clients and colleagues.

This work ethic, whilst admirable, has a devastating impact on both the mental and physical health of accountants.

Accountants are rushing to complete work on a timescale, like processing payroll, monthly accounting, end of year company statements, for example.

It is probably widespread to see staff working until late into the evenings to meet these deadlines, combining the work with their own private lives.

Factor in illness, and there becomes a resource shortage. Those helping to cover the needs of the ill accountant’s client demands begin to experience burnout quicker and thus become more stressed.

There are ways to combat this rising stress and anxiety. Read on.

How tech tools and automation is helping against workplace anxiety

Ensuring (or at least minimising) that your practice accountants do not suffer from anxiety, stress or depression, consider the following topics to implement.

1# Make accounting work varied and interesting

With millennial talent forming a significant part of the accounting workforce, accounting practice managers need to be mindful of what roles and tasks that staff find both stimulating and rewarding.

Likely, accountants wish to do more than merely carry out the mundane bookkeeping job of their clients.

They likely prefer more challenging work, including preparing financial statements, one-off audits or annual compliance for companies. Likely they detest doing bookkeeping, client engagement letters or preparing VAT returns.

Ensure the work is varied and exciting, and automate more tasks like bookkeeping and client template letters. They will enjoy their daily work more.

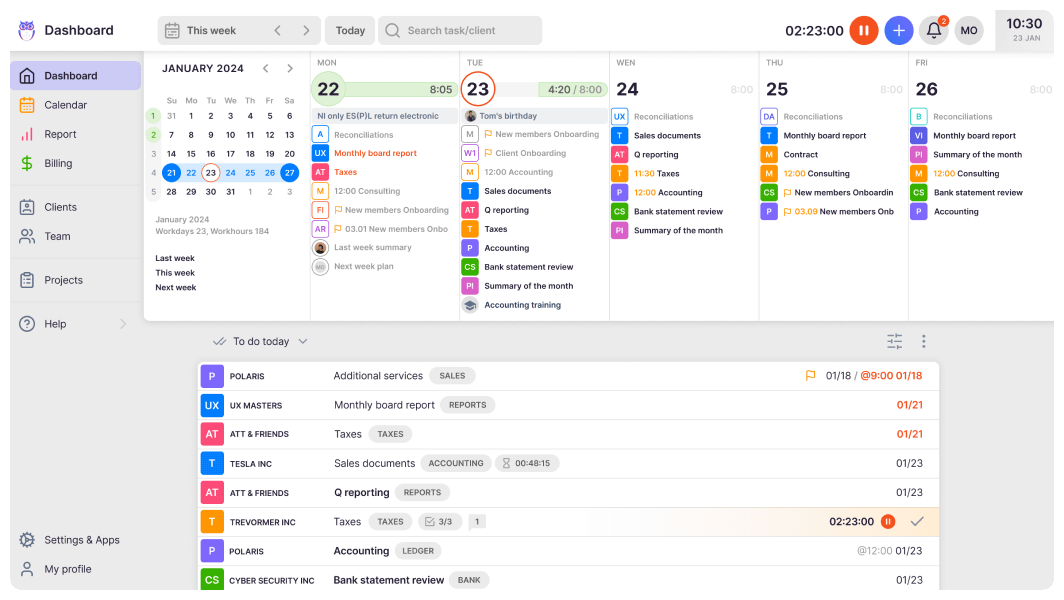

2# Take advantage of technology

Doing manual paperwork is no longer efficient or productive. Today’s accountants believe that manual accounting is both antiquated and time-consuming.

There are lots of excellent accounting practice management software that can automate several workflows within a practice.

So, why not procure one and automate your practice?

Using software like Uku makes accounting work less mundane and a joy to use for accountants. Furthermore, it boosts the efficiency, accuracy and profitability of your team.

With improved workflow efficiency and accuracy, the accountants for your practice will undoubtedly feel more confident. Thus boosting their mental health and being more productive in earning more from billable hours as they can speak more with clients and less on servicing monotonous tasks.

3# Examine practice capacity

Whilst software can remove manual workflows from accountants and make them more efficient. There still may be a time when you need to outsource more mundane work.

Rather than overloading existing staff with more tasks that do not make the best use of their skill sets (and thus cause more anxiety) – outsource to other accounting practices more menial tasks.

For example, outsourcing bookkeeping to a bookkeeper is one example of removing menial task workflows from accountants.

Okay, granted this is an additional overhead. Still, the accountant can then prioritise more value-adding and lucrative services for the practice.

Most accounting software providers can manage both in-house and outsourced stakeholders so that outsourced tasks are kept on track.

Uku is able to invite outsourced professionals onto tasks so they can work on it instead of the accountant, but the accountant can still check on task’s progress so the client can be updated.

4# Enhance the working environment

Enhancing a working environment will naturally depend on individual business premises (right now, most of us are working from home).

But from planning workflows better to ensuring staff leave the office for lunchtimes to getting a break to even allowing pets (provided they are not too distracting) into the office, all contribute to a healthier, happier working place of work.

You can also introduce fun wellness activities using QR-based games or scavenger hunts, created with the Best QR Generator – Uniqode, making mental health initiatives more engaging and interactive.

Using more automation within your workflows means that you take time out of your day to attend yoga classes, a walk or even some downtime meditating.

5# Fall in love with time management

The very thought of time tracking can even make some anxious. But unless you know how long it takes you to complete tasks, you are unable to ask for help.

Using tech tools like Uku can determine how long tasks take, and whether you need to assign to others to support you in completing client deadlines.

Other ways to manage your tasks more efficiently is to set recurring tasks at the right times so they can be dealt with in advance before a deadline approaches. By viewing which tasks are appearing on the horizon, you avoid any stressful last-minute tasks to complete.

Even better, by using a timer on tasks avoids clients questioning how many billable hours were worked. Thus, at the end of the month the client has the precise hours worked, avoiding any arguments over invoices.

Identifying stress, anxiety and depression at work

For both accountants and accounting practice managers, identifying when someone in your team is suffering from poor mental health is daunting.

After all, you are not a counsellor, nor wish to pry into their personal affairs.

Workplace stress typically occurs when there is a mismatch between the requirements of the role, staff capabilities and the support offered.

Stress, depression and anxiety can induce both physical and non-physical symptoms.

Yet, without insisting, staff have regular medical checks and share the results with you; it is almost impossible to diagnose stress and poor wellbeing.

If something is up with your fellow colleagues, then you could try these identifiers to determine stress levels of the accountants at your practice:

- Think carefully through the list of work they have, are they meeting deadlines on time, or suffering to keep pace?

- Are they asking for support in helping to do their tasks? They may not for fear of being labelled ‘unable to do their job.’

- Is their demeanour different from their usual self? Are they easily irritated?

- Are they off work due to physical illness? Often physical illness is a symptom of stress and depression.

- Talk to them, make them aware that you have some concerns. Maybe the issue is not at work but at home, but it is impacting their employment, and you are concerned they are not getting enough support. Reassure them that their job is not under threat.

Naturally, should there be an indication of a colleague being stressed, anxious, or worse depressed, then there are external factors to ask them to seek (see the section below).

Depending on the severity of their feelings, it may be that all they need is a little tweaking to improve their work environment.

If you feel that you or someone else has depression then ask them to contact their GP, or complete the NHS depression self-assessment to gauge how severe the depression could be.

Changing the way accountants work

An ever-increasing amount of accountants across the UK are suffering from poor wellbeing and mental health.

Overworked, manual and monotonous work, fear of job security, personal factors at home are all contributing to many accountants feeling anxious and depressed, damaging the accounting practice operability.

Utilising technology to improve time management, meeting deadlines and more efficient task workflows and panning, helps in removing stressful working.

Then, by discussing with staff their mental wellbeing and putting in place some of the discussions above, accounting practices can be a happier and more productive place to be.