Knowing how much your accounting service cost could make or break your accountancy practice.

Post summary:

- Which pricing model – hourly or value-based?

- Making Tax Digital – charge more or less?

- How technology is boosting profit

When you start a new practice or wish to become a more profitable and competitive practice, deciding how much your accounting practice will cost often poses a conundrum.

Do you charge by the hour? If so, how much per hour?

Do you charge per service? If so, how much and what is the real value for your clients?

Should you offer more advisory services?

Should you bill to cover software expenses?

There are but a few questions you’ll need to ask yourself when calculating the price. You’ll also need to consider the number of clients you have, your range of services, and even your location.

What’s measured improves – knowing your commitment’s scope helps you bill your clients accordingly.

Accounting service cost: hourly or value-based pricing?

Here’s the point about hourly billing, clients focus on how you spend your time rather than the results you’re achieving. Simultaneously, hourly billing opens you up to comparisons with your competitors, who may charge a lower or higher hourly rate.

It is better if your clients focus on the value you bring to a service, and not the amount of time taken to complete it – hence the name: value-based pricing.

Clients will want to know what your accounting service cost is upfront, mainly if you’ll be working on a large accounting project and the investment will be significantly higher.

Offering value-added packages makes it easier for clients to say yes to your sales pitch. Knowing the project cost in advance allows them to budget more comfortably and confidently invest in your services per se.

For accountants and practice managers, value-based pricing permits you up to do your best work whilst earning a decent rate for your services with the potential to increase revenue.

Typically, accountants who charge by the hour don’t feel as motivated to work both efficiently and quickly. With a set number of working hours per day, charging by the hour – even if you’re billing for more hours – limits your practice’s earning potential.

Unsurprisingly, accountants who trade hours for pounds eventually end up burning out trying to earn more money within the same amount of time.

When you switch to value-added packages, optimising your work more efficiently’s in your best interest. Doing so means you can earn more for the same time worked, making both your clients happier at a faster turnaround time.

Making Tax Digital – full transparency is now the norm

Since the UK government announced its Making Tax Digital (MTD) initiative in 2015, companies across the UK have been working to ensure they become digitally compliant to new HMRC regulations.

At Uku, we feel that Making Tax Digital is not the solution to an old way of working.

Instead, we believe MTD it is laying the foundations for businesses that are not as technologically advanced that can now begin implementing more powerful tax digitisation – digital bookkeeping.

Digital bookkeeping like MTD means that not only do accountancy practices have to rise to this inevitable digitisation, it also represents an opportunity to charge more.

MTD has impacted accountancy firms in the same way that it has its business customers. Business clients who are digitising are demanding the same from their accountants. But digitisation goes way beyond complying with MTD.

Accountants must reassess their roles, processes and technologies to align with clients expectations.

Proper utilisation of technology empowers firms to focus their time on areas away from compliance and more on advisory services, meaning pricing models like value-based pricing should be considered as your accounting service cost.

When considering value-based pricing, clients will understandably want to see the final results for this new type of service accountancy practices have charged for.

However, having visibility on the time you spend on their accounts and being able to produce reports will help you document and justify the changes to the services prices services you provide.

Needless to say, having an overview of the tasks and time spent on each client helps you to understand which clients and services are more profitable based on that knowledge and make adjustments to the pricelist with your clients.

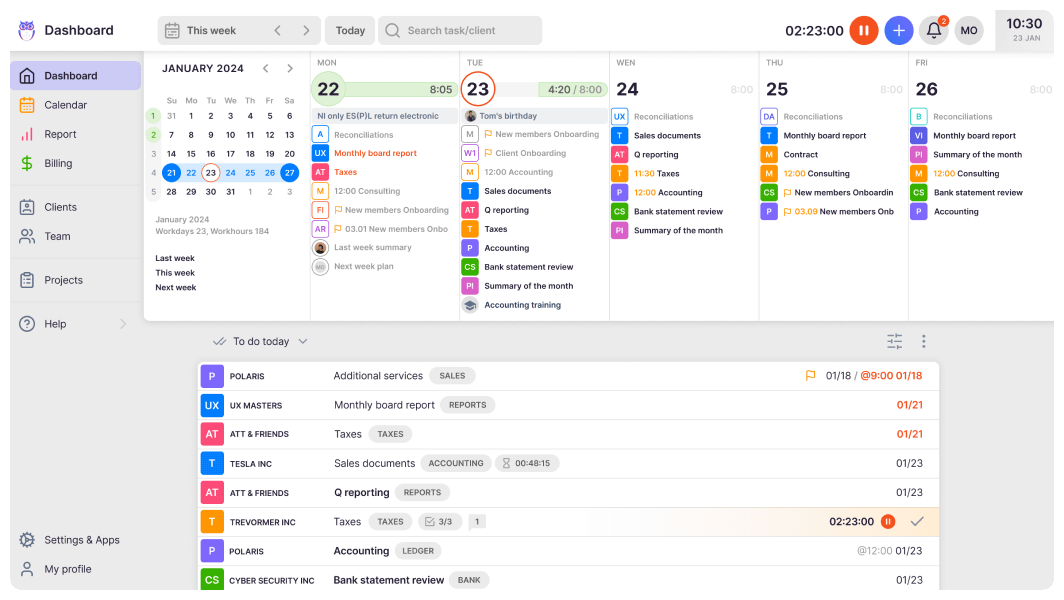

Uku, with its powerful reports, gives you full visibility of all your clients, employees, tasks and time spent on each activity.

The monitoring feature tracks the client’s workload in real-time, comparing the customer agreements with the real workload. This is the quickest way to seeing workload increases or dips with each client and based on that knowledge, to take action on.

How technology boosts profit for accountancy practices

HMRC has seen that Making Tax Digital has boosted SMEs productivity gains by £815 million in the first six months after its launch.

Using technology to digitise has demonstrable business gains.

Accounting practices can now move away from meeting HRMC compliance regulations to now viewing long it takes to complete accounting tasks, and adding any additional value to a client.

For example, Uku’s client profile allows you to specify the budget for the work volume and monitor in real-time. If you were billing hourly, you would probably lose out as digitisation has reduced or automated the time taken to complete the task.

Instead, you could offer additional value to your clients that not only improves customer satisfaction rates, but it also retains the amount you charge plus is more interesting that manual data work.

Furthermore, unplanned projects can be marked as additional work and invoiced accordingly, boosting business revenue.

Offering additional value to a client only works if you can provide evidence to what you offered them.

For example, if a client calls and asks for a different report on top of the ones they receive usually, the request can be registered in the software and show up in an end-of-the-month overview, reflecting all the work that has been done for the client.

Critical business knowledge like this allows practices to increase prices by up to 30 or 40% for clients by having an overview of the work that is actually being done.

This is not only useful to increase prices but to begin negotiations based on the service evidence report.

Even if a client wishes to remain on hourly pricing, then as a practice owner you will need to know how much work has been actually done.

Using accountancy practice software like Uku makes it easier to flag (and thus get paid for) doing extra work; including those phone calls from clients and special requests via email that are often not written anywhere, and therefore not billed to the clients.

To help you through your billing, using software like Uku you can view what the cost is to your firm by having a clear overview of the tasks in hand plus time spent on each activity, client, and topic.

Illustration: Icons8