New technology, combined with less red tape, is transforming the way accountants manage their fintech clients.

The stereotypical image of the steady, cautious accountant is going through a shake-up.

New tech, new software and new regulations mean the accountant’s role, and particularly those within fintech companies is ripe for an overhaul.

Transparency, cloud accounting, automation, Open Banking, Making Tax Digital all promise to remodel the accountancy profession and create huge new possibilities for the businesses they serve.

So, what is driving this change? Is it down to the fintech’s themselves? What is the significance for accountants? And what will be the impact on businesses?

Change is not happening; it’s here, now

Financial data is flowing faster than ever.

More access to information, automation of processes and integration of newer software tools is placing more power at the fingertips of crucial decision-makers within businesses, allowing for faster, more responsive and better-informed decisions.

Artificial intelligence, machine learning, and task management in fintech software apps, supported by platforms like Quarule — unearth far more significant insights than manual analysis can provide.

Increasing automation around task and invoice management, credit control and cash flow forecasts, has reduced the time accountants need to spend on traditional tasks, freeing up resources and expertise to focus on more value-adding projects.

Cloud accounting providers like Quickbooks and Xero bring together these capabilities and offer businesses access to accounting services from any location when required.

To fuel this change, there is a proliferation of financial technology and software providers like Uku – aided in part to the launch of Open Banking in 2018.

UK banks must now open up their data, with verified third-parties accessing information to offer new products to help businesses and customers.

It is fintech companies who are offering newer products and services to their customers and other companies.

These fintech developments have had a wide-ranging and transformative effect on accounting tasks within their businesses.

Both clientele and fintech clients experiment with the new services offered by fintech company technology, especially when it eases their banking needs.

Fintech companies, therefore, must adopt their own technology to succeed in this new Open Banking era, meaning the accountancy practices who serve them must do the same.

Fintech accounting includes spending smart, tracking expenses consciously and using secure applications that fulfil all their requirements at a click of a button.

Tedious steps involving faxing and copying documentation or a visit to the bank only for a signature fuels frustration and annoyance.

Looking for a better way to manage your accounting practice?

Join Uku!

What has changed within Fintech accounting?

Payments gateways like Stripe, invoicing and billing programmes like Freshbooks, along with more advanced cloud accounting software like Uku, are examples of applications that continue to reinvent the way fintech accounting is automating their business functionality.

Although not all fintech companies are fully modernised, those transforming understand that creating manual invoices and payments are a thing of the past, being made redundant by the very technology they have created for their customers.

And the advantages are easy to see why.

Automation cut costs and gets businesses paid faster. Their customers benefit from the greater efficiency with both lower prices or higher value delivered for their services.

For example, most cloud-based software can automate accounting, bookkeeping, and tax filing functions of fintech businesses.

Traditional accounting software like Quickbooks and bookkeepers/accountants, still have an essential role to play in the accounting arena. Yet, the number of them involved is likely to shrink as automation takes over these functionalities.

Ultimately, fintech businesses and their customers will benefit from these lower operating costs allowing for better value to be delivered, rather than time and resources spent on administrative functions like the accounting itself.

Furthermore, automation impacts fintech employees in a variety of ways. Employees must embrace new technology and not view it as a threat to their jobs.

More automation equals more time saved, that can be used for training, taking on more clients, or even a better work-life balance.

Fintech companies and their accounting service providers must ensure they are kept abreast of the changing trends, so they reinvent fintech industry roles.

There is no way to stop this new technology; it is not going to become redundant.

The impact of fintech itself on accounting practices

Fintech companies, due to their transformative practices and ethos, have access to real-time financial information and reporting — allowing them to make pre-emptive decisions or to react instantly to evolving financial situations.

Their reliance on data access and more robust reporting tools leads to better insights concerning real-time analysis, forecasting, budgeting and resource management.

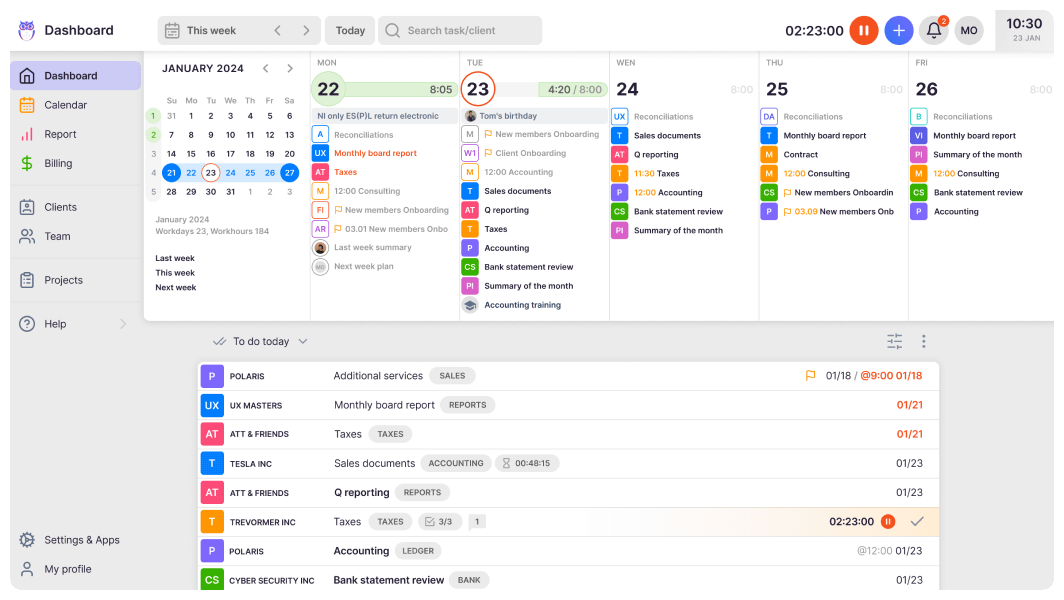

For example, applications like Uku are leading the way for accountants, offering better task management, a UK tax calendar, reporting and a CRM that not only automates workflows for you but prompts you when something is missing (the so-called ‘mini-Uku’).

Newer software is particularly transformative for accountancy practice managers who may have previously relied on ad-hoc, or even annual, access to financial reporting and forecasting.

The prospect of having both real-time and month-end reports without the cost of employing management accountants is a very welcome arrival for many.

Fintech’s progression leads to new challenges for accountants – how do they remain worthwhile in a rapidly changing automated fintech environment?

Does this mean the end of accountants per se? Well, not yet.

The changing dynamics of accountants

How fintech accounting providers choose to respond to these changes will, of course, be very individual.

Many will be tempted to reduce their overheads and replace in-house staff with outsourced professionals. Whilst this is a popular choice, it doesn’t build businesses if you are an accountancy practice manager.

Those practice managers looking to build a business foundation to meet the accounting demands on fintech companies will plough their resources into software automation. By doing so, they can focus on reducing the administrative work on accounting to building their business yet remain even more profitable.

By streamlining resources, accountants can now either obtain a favourable work-life balance or redefine the future direction of their business, for example, moving to value-based pricing.

Thus, there are enormous incentives for accountants to shed their cautious style and embrace the practices adopted by fintech companies.

Those accountants that navigate this fintech landscape; that of delivering the financial information to stakeholders, ensuring businesses are profitable and compliant with regulations, will see their business gain a huge advantage.

Conclusion

Fintech is not only disrupting the banking and finance sectors; it is disrupting service providers with whom they interact with.

Accountants must continuously search to become a more lean, faster and transparent business to satisfy their fintech customers.

The opportunities for fintech accounting is wide open and how well the accounting practices rise to the new fintech revolution will determine whether they remain profitable in this new world.

Embracing this proliferation of new technology, software and regulation promises several exciting opportunities for accountants and their fintech clients.