We’re working in an age where company loyalty is not what it used to be. Millennial accounting talent can be hard to find, but not impossible.

Post summary:

- Why hire millennial accounting talent anyway?

- Why retaining millennial talent matters

- 8 strategies to attract and retain millennial accounting talent

Whether harshly judged or not, millennial workers have a reputation for moving from workplace to workplace, continually searching for the next best opportunity. But this does not mean they can’t be the millennial accounting talent you seek.

Businesses have realised they must promote their work as the only location for top talent to do their job.

And yet, most businesses plan for shorter employee tenures.

But why is it this way?

Attracting and retaining millennial accounting talent is a continual struggle for many businesses, not only accountancy practices.

However, there are several strategies business owners can do to increase the likelihood of their talented teams sticking around a little longer than average.

Why hire millennials anyway?

Let’s face it; there’s much negativity about millennials in the press these days.

This generation is supposedly ruining everything; from dating and pensions to home buying and holidays.

Those judgements aside, there are several positives to hiring millennials.

This cohort grew up in the digital era, question the world around them, knowing the latest trends and can confidently explain what a hashtag, meme or gif is.

Millennials are more loyal than you think

Firstly, millennials are loyal – 43% will remain in jobs for at least two years. That may not sound that long, but it gives businesses ample time to convince them to stay in their companies for longer.

Ultimately, investing in millennials is worth the effort.

They bring fresh ideas

When you hire millennials, they bring new perspectives on key issues, suggesting how to target other millennials and customers of their cohort.

Unlike previous generations, whose workflow logic was to follow a top-down approach, millennial accounting talents prefer to question the status quo, whether the world around them or their working environment.

Ultimately, not hiring millennials means neglecting your future clients’ opinions.

Millennial accounting talents are digitally savvy

Millennials have grown up around technology; they have been infused with it since childhood. Simultaneously, their ability to use this technology to promote your company is essential for surviving today’s changing market.

Digitally savvy talents can give your business an upper hand in reaching more people on platforms like Twitter, Instagram, Facebook and LinkedIn. They’re already familiar with using social media to promote their own personal brand.

Another positive of this tech-savvy generation is how quickly they learn and adopt technology. Meaning employers won’t have difficulties training them to use software, computer systems or other new hardware.

Hiring tech-savvy workers is a massive bonus for businesses and a key reason why they should hire them. Millennials may even be able to show new ways to boost employer efficiency.

More dynamic in the workplace

Lastly, another reason why you should hire millennials is that they have less career baggage; meaning they are more flexible for you as the employer.

After all, it’s hard to mould an employee who is set in a specific way and has previous expectations from past jobs. It is likely a business may not be able to satisfy this employee’s need.

However, millennials are less likely to have these expectations; primarily because they have not been in the workplace for as long as the generation before them or more experienced colleagues.

As an employer, it means you can shape these employees into the workers your business needs.

Why retaining millennial accounting talent matters

Employee retention is a critical issue for companies competing for talent in a tight economy. The costs of employee turnover are astronomically high — in some cases as much as x2.5 an employee’s salary depending on the role. Plus, there are other costs to factor in: lowered productivity, training costs, decreased engagement and any cultural impact.

If businesses focus on attracting the right talent and then focus on employee retention, they will retain talented and motivated employees who genuinely want to be a part of the company — more focussed workers contribute to a business’s overall success.

In the financial sector alone (including accountants), according to a survey by Monster, the turnover rate was as high as 13.7%. The number may seem a low per se, yet equates to a lot of company time recruiting and training new employees.

8 strategies to attract and retain millennial accounting talent

1. Encourage flexibility.

Millennial accounting workers want flexibility and mobility in the workplace. Gone are the days of the same 9-5 shift pattern for every worker. Now, In their place are remote working options, flexible hours and even sabbaticals for several months at a time.

Flexible workers are both more productive, engaged and therefore, happier. They time-track their hours rather than doing traditional shift patterns.

By allowing employees the mobility they desire, they’ll likely stick around longer and have a more positive impact on your business.

2. Streamline your onboarding process.

Seventy per cent of workers say they are more likely to remain within their new role for three or more years if they underwent a pleasant application process.

The application stage is the first critical touchpoint you have with your future colleagues. Ensure your company’s brand is targeted at the right workers. Millennials find jobs through social media – create engaging videos of what it will be like if you worked at your practice.

By making the process as straightforward, quick and fluid as possible, you’ll be sending a positive message of efficiency and easy to do business with to your prospective talent.

Once you’ve convinced a new employee to join you, the hiring process is not over. Ensuring your employees have an impactful, engaging and positive onboarding experience is just as critical as the application stage.

If employee tenures are getting shorter and shorter, it’s not practical to take one to two years to train people to become acclimatised to a new role.

3. Level up your employee engagement strategy.

Only about 8 per cent of newly-employed UK workers are fully engaged in their new job role. That’s a saddening statistic considering the significant investment many companies do to create a positive onboarding experience.

Invest time and money in implementing the right strategy alongside the right technology ensures your engagement is both impactful and useful to new employees.

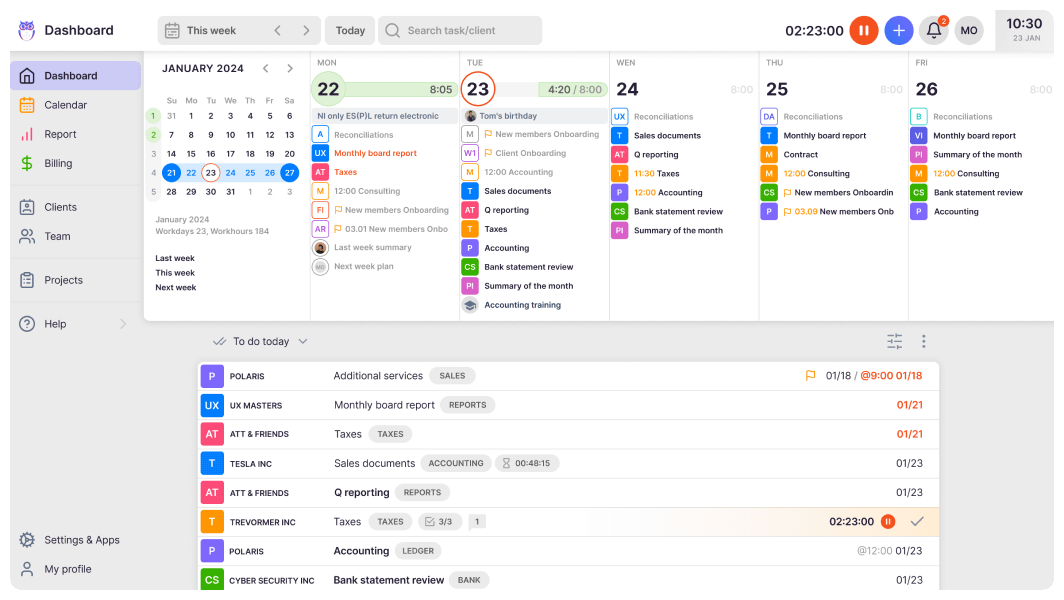

Emerging trends in employee engagement include the latest software tools that prevent managers from becoming overbearing in their task assignments. Software like Uku permits greater transparency of everyone’s workflows so that both manager and employee can view each other’s work.

4. Invest in consumer-grade tools and technology for all of your employees.

45% of employees complain that having outdated technology creates additional manual work and inefficiencies in their workflows.

Not only does legacy software slow down your productivity, but it also sends the message to your new hires that your business isn’t concerned in remaining ahead of the curve with the latest, automated accounting tools.

Millennials are very tech-savvy and prefer online tools that they can self-train and use with minimal fuss, often preferring to seek the answer online rather than ask for management support.

Demonstrate to your workers that you care about them and their ability to do well in their jobs, arming them with the leading accounting tools and technology.

5. Provide regular praise and constructive criticism.

Negative criticism can deflate even the most productive and motivated employees. Offering constructive criticism is a skill in itself, and how you present and communicate; it will vary from employee to employee.

Rather than focus on the year-end reviews, consider overhauling or replacing your year-end reviews with a more informal and honest way of communicating constructive criticism.

Regular, consistent, one-on-one meetings are a better way to provide your talent with praise, constructive criticism, feedback and advice. It is also a better way to discover any issues that may be felt by the employee. It is your chance to remedy their concerns before they pack up and leave for another company.

6. Eliminate barriers to getting the job done.

Employees spend an average of four hours per week, merely searching for the right information. Not only is this frustrating but a very poor utilisation of their time. Even logging into various software systems has caused unnecessary delays in getting work started.

80% of business leaders felt that these various systems never ‘talk’ to each other, with 43% of their employees having to re-key in the information from one system to another.

Employers and practice managers should eliminate unnecessary barriers to information within the workplace. To do this, they can arm their employees with the right tools, devices and access; plus ensuring that their software systems integrate and sync to avoid duplication of work.

7. Offer opportunities for professional development and a roadmap for progression.

Make your employees aware of the latest accounting certifications, training and education options available, and encourage them to complete the courses.

Several businesses offer partial or entire tuition reimbursement, or even time work if their employees complete the programmes.

Motivating your workers with professional development goals creates a path to future senior positions at your accounting practice. Thus, creating an environment where learning, education and motivation to remain in your company are valued.

8. Continue to nurture your employer advocates.

If your business does a stellar job retaining its employees, you’ll inevitably develop employer advocates. These advocates will become both brand and business evangelists – promoting positive internal influences with your accounting practice.

However, your work retaining these employees is not over.

Continue to nurture and support these workers to your accountancy practice. When you onboard new employees, they will be the ones who will be turned to and discuss the working environment.

These advocates will promote positivity, and this becomes infectious – reducing the likelihood of newer hires leaving.

Final thoughts

Attracting and retaining millennial talent is a process that begins before managers start to think about hiring new employees to their firms.

To attract millennial talent begins at the hiring process and continues through onboarding, career development, software tools, right down to your company evangelists.

These strategies may seem a high investment in time and resources, yet compared to the costs of hiring, not really. By fostering a more flexible, more efficient, more productive and a happier work-life balance – businesses will not only retain millennial talent, but save in the long-term.

Illustration: Icons8