Botkeeper, the AI-powered bookkeeping platform that raised over $100 million in funding, is shutting down. If you’re one of the many accounting firms that relied on Botkeeper for automated bookkeeping and AI bookkeeping workflows, you’re likely asking one urgent question: what now?

This guide covers everything you need to know — from what happened and how to protect your data, to the 7 best Botkeeper alternatives available right now for accounting firms.

What Happened to Botkeeper?

In a letter to the Botkeeper community, founder and CEO Enrico Palmerino announced the permanent closure of the company. According to the announcement, a “perfect storm” of macroeconomic shifts and unexpected industry consolidation in late 2025 significantly impacted major clients and revenue.

Despite achieving impressive technical milestones — including 80%+ automated transaction coding with 98% accuracy — the company couldn’t find a sustainable path forward. Acquisition talks, lender negotiations, and bridge capital efforts all fell through.

The key takeaway for accounting firms: Even well-funded technology platforms can disappear. This is why building your firm’s operations on a diversified, resilient tech stack matters more than ever.

What Botkeeper Customers Should Do Right Now

If your firm was using Botkeeper, here’s your immediate action plan:

1. Export Your Data Immediately

Before Botkeeper’s servers go offline permanently, export everything:

- Client financial records and transaction histories

- Bank reconciliation data

- Custom categorization rules

- Any reports or templates you’ve created

2. Notify Your Clients

Proactive communication builds trust. Let your clients know:

- That you’re transitioning to a new solution

- That their data is safe and accounted for

- What the timeline for the switch looks like

3. Evaluate Your Replacement Options

Don’t rush into the first alternative you find. Consider:

- What Botkeeper features your firm actually used and relied on

- Whether you need a like-for-like replacement or want to rethink your workflow

- Integration requirements with your existing tech stack (QBO, Xero, etc.)

Best Botkeeper Alternatives for Accounting Firms

Here are the top AI bookkeeping and automation solutions that can fill the gap Botkeeper left, organized by what they do best.

For AI-Powered Bookkeeping Automation

1. Docyt

Best for: Accounting firms wanting AI-driven back-office automation

Docyt is the closest direct alternative to Botkeeper for AI bookkeeping automation. It uses AI to automate transaction categorization, reconciliation, and financial close processes. Unlike Botkeeper’s hybrid model, Docyt focuses on giving accountants AI tools they control directly.

- Key features: AI transaction categorization, automated reconciliation, real-time revenue reporting, multi-entity support

- Integrations: QuickBooks Online, Xero, major banks

- Pricing: From $299/month (custom quotes based on transaction volume)

- Why it’s a strong alternative: Purpose-built for accounting firms with a focus on AI bookkeeping automation you own, not outsource

2. Vic.ai

Best for: Mid-to-large firms processing high volumes of invoices

Vic.ai specializes in autonomous invoice processing using AI. While it’s more focused on accounts payable than full-service bookkeeping, it excels at automating one of the most time-consuming aspects of accounting work.

- Key features: AI invoice processing, autonomous approval workflows, GL coding, spend analytics

- Integrations: Major ERP and accounting platforms

- Pricing: Custom pricing (contact sales)

- Why it’s a strong alternative: Best-in-class AP automation that learns from your firm’s patterns

3. Dext (formerly Receipt Bank)

Best for: Firms that need reliable data capture and document management

Dext has been a staple in accounting tech stacks for years. Now part of the IRIS Software Group (acquired December 2024), Dext continues to operate independently and handles the critical first step of bookkeeping — capturing, extracting, and organizing financial data from receipts, invoices, and bank statements. While it doesn’t offer the full AI bookkeeping automation that Botkeeper provided, it’s a rock-solid foundation for any bookkeeping workflow.

- Key features: Automated data extraction, receipt capture, supplier management, bank statement processing

- Integrations: Xero, QuickBooks, Sage, FreeAgent

- Pricing: From $235/month for accounting firms (varies by number of clients)

- Why it’s a strong alternative: Proven data capture tool now backed by IRIS Software’s resources, feeding into any bookkeeping workflow

For Bookkeeping Services (Outsourced)

4. Bench

Best for: Small businesses that want bookkeeping done for them

If you had clients who used Botkeeper directly (not through your firm), Bench offers a similar outsourced model — with a caveat. Bench itself shut down abruptly in December 2024, locking thousands of businesses out of their financial data. It was rescued three days later by Employer.com and resumed operations, but the experience reinforced the exact lesson Botkeeper’s closure teaches: no single platform is guaranteed to survive.

Bench combines proprietary software with human bookkeepers to deliver monthly financial statements.

- Key features: Dedicated bookkeeper, monthly financial statements, year-end tax-ready reports

- Integrations: Major banks and financial institutions

- Pricing: From $249/month

- Note: Bench serves businesses directly, not through accounting firms. Its own near-shutdown is worth considering when evaluating reliability.

5. Pilot

Best for: Startups and growing businesses needing bookkeeping + CFO services

Pilot targets high-growth startups and offers bookkeeping, tax, and CFO services. Like Bench, this is a service rather than a tool for accounting firms.

- Key features: Dedicated finance team, accrual-basis bookkeeping, R&D tax credits, CFO services

- Pricing: From $499/month

- Note: Direct-to-business service, not a tool for accounting firms

For Automated Accounting Workflows

6. Digits

Best for: Firms looking for an AI-native accounting platform

Named a “2026 Top New Product for Accountants” by Accounting Today, Digits is building what they call the world’s first Autonomous General Ledger — an AI-native accounting platform trained on $825B+ in transactions. Rather than augmenting existing accounting software, Digits aims to replace the general ledger itself with AI agents for bookkeeping, reconciliation, and reporting.

- Key features: AI bookkeeping agents, autonomous reconciliation, AI-generated financial reports, anomaly detection, invoicing and payments

- Integrations: QuickBooks Online, QuickBooks Desktop

- Pricing: From $65/month (Essentials); Core plan from $100/month; full-service with dedicated accountant from $350/month

7. Hubdoc (by Xero)

Best for: Xero-centric firms needing document collection automation

Now part of the Xero ecosystem, Hubdoc automatically fetches bills, receipts, and statements from over 700 financial institutions and suppliers. It’s free with Xero subscriptions.

- Key features: Automated document fetching, data extraction, cloud storage, audit trail

- Integrations: Xero (native), QuickBooks

- Pricing: Included with Xero subscription

- Why it’s a strong alternative: If you’re already in the Xero ecosystem, this is a no-brainer addition

Quick Comparison Table

| Solution | Type | AI Level | Best For | Starting Price |

|---|---|---|---|---|

| Docyt | Automation tool | High | Accounting firms | $299/mo |

| Vic.ai | AP automation | High | High-volume AP | Custom |

| Dext | Data capture | Medium | Data extraction | $235/mo (firms) |

| Bench | Service | Medium | Small businesses | $249/mo |

| Pilot | Service | Medium | Startups | $499/mo |

| Digits | AI accounting platform | High | AI-native GL | $65/mo |

| Hubdoc | Doc collection | Low | Xero users | Included w/ Xero |

The Bigger Picture: What Botkeeper’s Closure Teaches Us

Botkeeper’s shutdown carries a lesson that goes beyond finding a replacement tool. When a single platform that handles a critical function for your firm disappears overnight, it exposes a deeper vulnerability: over-reliance on any one tool.

Here’s what forward-thinking firms are doing differently:

Build a Resilient Tech Stack

Instead of depending on one AI bookkeeping software platform to handle everything, the most resilient firms use a modular approach:

- Data capture layer (Dext, Hubdoc) — gets the raw data in

- Accounting engine (Xero, QuickBooks) — processes the transactions

- Practice management platform — manages clients, deadlines, billing, and team workflows

- AI automation (Docyt, Vic.ai) — accelerates specific tasks

Each component can be replaced independently without disrupting your entire operation.

Don’t Outsource Your Operating System

Botkeeper’s appeal was convenience — hand off the bookkeeping and get it back done. But when that convenience disappears, firms that had outsourced a core function were left scrambling.

The firms that weathered this best are those who used Botkeeper as a tool within their workflow, not as the workflow itself. They had practice management systems that tracked deadlines, managed client communication, and maintained institutional knowledge — regardless of which bookkeeping tool they used underneath.

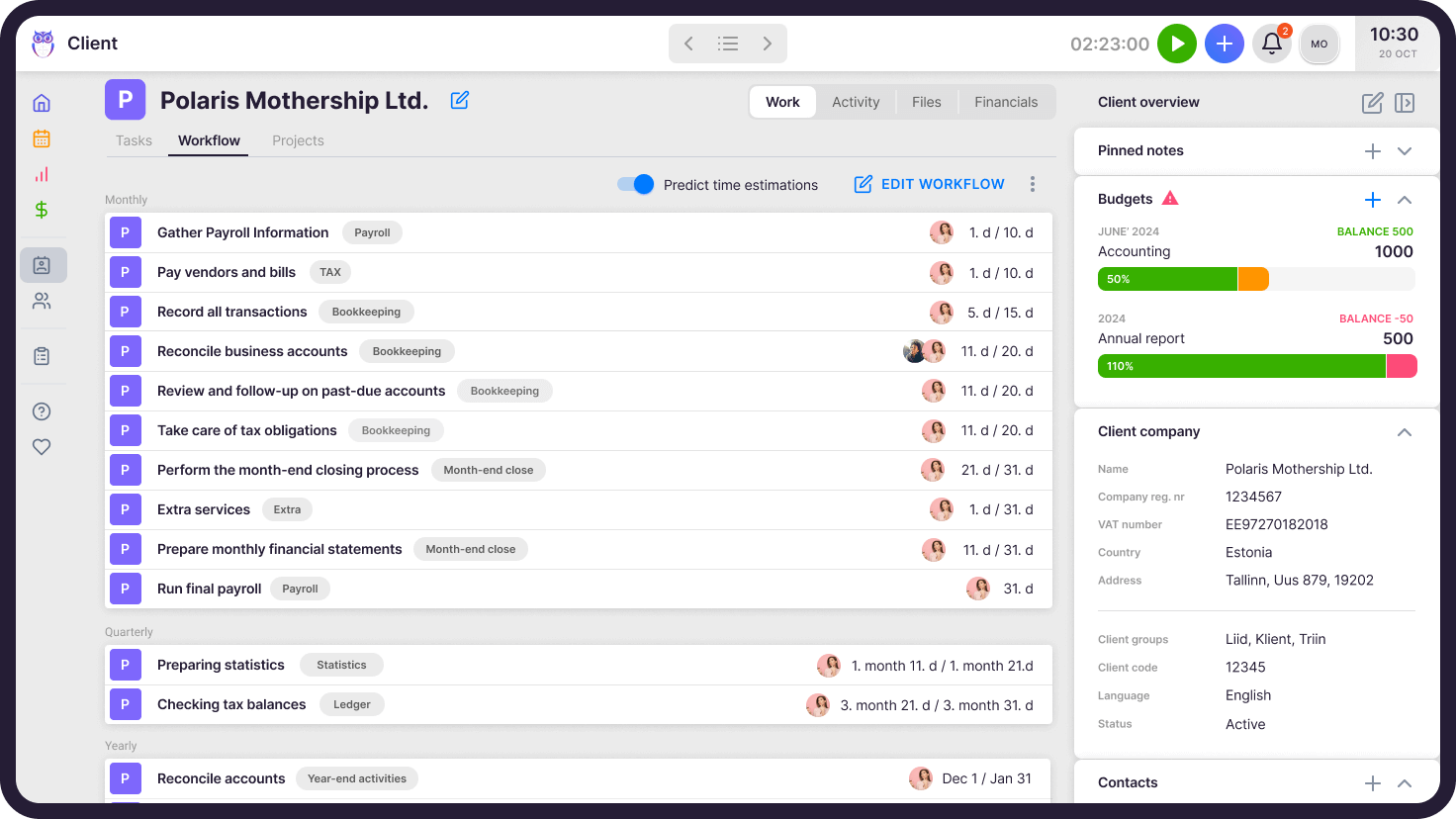

Consider a Practice Management Platform

If Botkeeper’s closure has you rethinking your firm’s infrastructure, this is the right time to evaluate whether you have a proper foundation in place.

A dedicated practice management platform like Uku gives your firm:

- Client management — every client, deadline, and task in one place

- Automated billing — track time, generate invoices, get paid faster

- Team workflows — assign work, track progress, never miss a deadline

- Email management — client communication linked to the right tasks

- Client portal — let clients upload documents and track progress

The point isn’t to replace Botkeeper with Uku — they solve different problems. The point is that your firm needs a layer that doesn’t go away when one tool shuts down. Practice management is that layer.

Book a free demo to see how Uku can serve as the operating system for your accounting firm — no matter which bookkeeping tools you choose to plug in.

Frequently Asked Questions

Is Botkeeper completely shut down?

Yes. Botkeeper announced its permanent closure in early 2026, citing macroeconomic challenges and industry consolidation that eliminated a sustainable path forward. The platform is no longer operational.

Can I still access my Botkeeper data?

This depends on where Botkeeper is in its wind-down process. We recommend contacting Botkeeper’s support team immediately and exporting any available data as soon as possible before servers are decommissioned.

What’s the best direct replacement for Botkeeper?

For AI-powered bookkeeping automation that accounting firms control directly, Docyt is the closest alternative. For data capture and document automation, Dext combined with your existing accounting software offers a reliable workflow.

Should I switch to another AI bookkeeping service?

Consider whether you want another all-in-one AI service (which carries the same risk of dependency) or a modular approach with specialized tools for data capture, automation, and practice management. Many firms are choosing the modular approach after Botkeeper’s closure.

How do I prevent this from happening again?

Build a diversified tech stack where no single tool is irreplaceable. Use a practice management platform as your firm’s foundation, and layer specialized tools on top. If any one tool shuts down, your client relationships, deadlines, and workflows remain intact.