It’s a common misunderstanding that apps for accountants make us procrastinate and waste time. Whether you’re working from home or in your office, apps are a great way to enhance work and life overall. Let’s bust that myth and reveal the best apps for accountants the internet offers!

Technology can help you be more efficient, never miss any deadlines and easily handle communication. You can be the accountant of your client’s dreams. Apps also come in handy after work. They provide a break and help you to unwind and relax.

We have combined the ultimate accounting tech stack with apps for accountants that you can use to make work easier. Each category has particular examples of apps Uku’s clients and employees swear by.

Facing the Reality of Remote Accounting Work

By now, thanks to COVID-19 and the time we all spent at home, more of us have faced the reality of managing our own time and workloads, along with balancing the conflicting attention needs of team productivity, immediate problem-solving, and business strategy. Even years after the pandemic, we’re still making the most out of remote work.

Now, we must also cope with family demands and go shopping for food while being on the phone with client after client, trying to answer questions.

After all, to say that the life of a modern practice manager is busy would be an understatement. Whether you work for a company or own the practice outright, your workday interruptions come from many directions.

With the right tech stack or apps for slight work to manage your practice, you can benefit from the current situation and keep your business operating. But with the technology ecosystem already so extensive and growing, it’s an arduous task to decide which accounting tech stack to use.

How to Choose the Best Apps for an Accountant?

The best advice for modern-day remote work is to use a set of tried-and-tested apps and connected services that help you do your daily tasks. The aim is to stay organised and connected to your team and clients.

Your clients likely have their favourite accounting software you’ll need to master. So this ‘list’ goes beyond that to provide accounting practice tools for productivity.

These tools can help you communicate and stay on task with clients, colleagues, friends, and family!

Accountant Apps for Communication

Communication is key – I am sure we’ve all heard that before.

There is no accounting without communication. Face-to-face is the best way to share information with a colleague, but we can’t all be available at all times. It’s often impossible with remote teams or when working from different locations. This is where communication apps come in handy.

Communication Apps Slack and Teams

Slack and Teams are two of the most popular apps that can help facilitate real-time communication, file sharing, and collaboration among team members.

In addition to practical information sharing, connecting with coworkers helps people feel and work better. A study by BetterUp found that those who cultivated friendships in the workplace had more positive relationships,

36% greater life satisfaction, and 27% more job satisfaction. They also had a 34% improvement in reaching their goals.

Both Microsoft Teams and Slack address specific needs within accounting:

- Communication apps help accountants respond to client needs more quickly and manage deadlines more effectively.

- Real-time collaboration reduces miscommunications and errors, providing more reliable financial reports and documentation.

- The ability to communicate effectively from anywhere supports flexible work arrangements, which can be crucial for balancing the intense periods typical in the accounting cycle.

Microsoft Teams – Meetings and Chats

Microsoft Teams is a platform tailored to facilitate communication and collaboration among accountants. Integrated with Microsoft Office, it ensures that familiar tools are just a click away, enhancing usability across the board. Here’s what Teams offers:

- Secure video meetings are vital for discussing sensitive financial details remotely, ensuring privacy and a personal touch.

- Simultaneous document editing allows multiple users to edit documents simultaneously, reducing the need to send multiple versions back and forth via email.

- Organized channels allow you to set up channels for specific clients or projects to keep all related discussions, files, and tools in one place, making it easy to manage and retrieve information.

Slack – Simplified Team Communication

Slack is a cool messaging tool that divides your work between channels and direct messages. Plus, Slack can integrate with various other tools (Google Docs is an example), streamlining workflows.

Slack is free, so it is a reliable small business tool, but you can pay for an upgrade and get more features.

Tip: Use different Slack channels to maintain the “coffee corner” chats. It’s important that you maintain the same culture on the Web as it was in the office. Also, Slack is perfect for solving problems. For example, create a channel #help and post your question there if you’re stuck somewhere. That way, anyone can follow your question and brainstorm solutions together.

Win-win-win!

Here’s why Slack is beneficial as an accountant app:

- Immediate messaging simplifies quick queries and updates, ensuring that information is forwarded as soon as possible.

- Extensive app integrations connect Slack with numerous other tools, including project management and time tracking software, centralizing your workspace in one app.

- Interactive collaboration allows Easy file sharing, quick polling, and group discussions in a relaxed format, encouraging more open and frequent communication among team members.

Apps for Accounting Team Collaboration

Calendly – App for Scheduling Meetings

Calendly is an easy-to-use scheduling tool. It organises meetings with clients and schedules webinars and colleagues.

The app sends a calendar invite to any person you wish to schedule a meeting with. Recipients receive an email with multiple meeting slots, and they pick the slot that best matches their availability.

Once you and your invitee have agreed on a suitable time slot, you can add it to your calendar, whether iCal, Gmail or Outlook. Plus, any invitee you send invitations to does not have to sign up when choosing available slot times.

Skype – Small business video conferencing (CLOSED)

Moving from face-to-face interaction to sitting in a room all day can be disorienting. Fortunately, video calling with Skype allows you to interact with your colleagues at least.

There is a lot of video calling software on the market, including Google Meets, Microsoft Teams, Zoom, GoToMeeting, Facetime (for Mac users), and even Facebook.

One such tool we like using for video conferencing is Skype (we have to; it originates from Estonia, as do we!). We also love its screen-sharing capabilities, which can aid in file (ex. PDF file sharing) sharing and team building.

Best Bookkeeping Apps

Today, there’s no longer a need to wrestle with complex Excel formulas and manual entries. The move to cloud accounting software transformed how accountants work, providing powerful tools for automation, collaboration, and management. These apps for accounting simplify traditional processes and enhance accuracy and efficiency. Usually, accounting work apps integrate with practice management, CRM, and other software essential for accounting work.

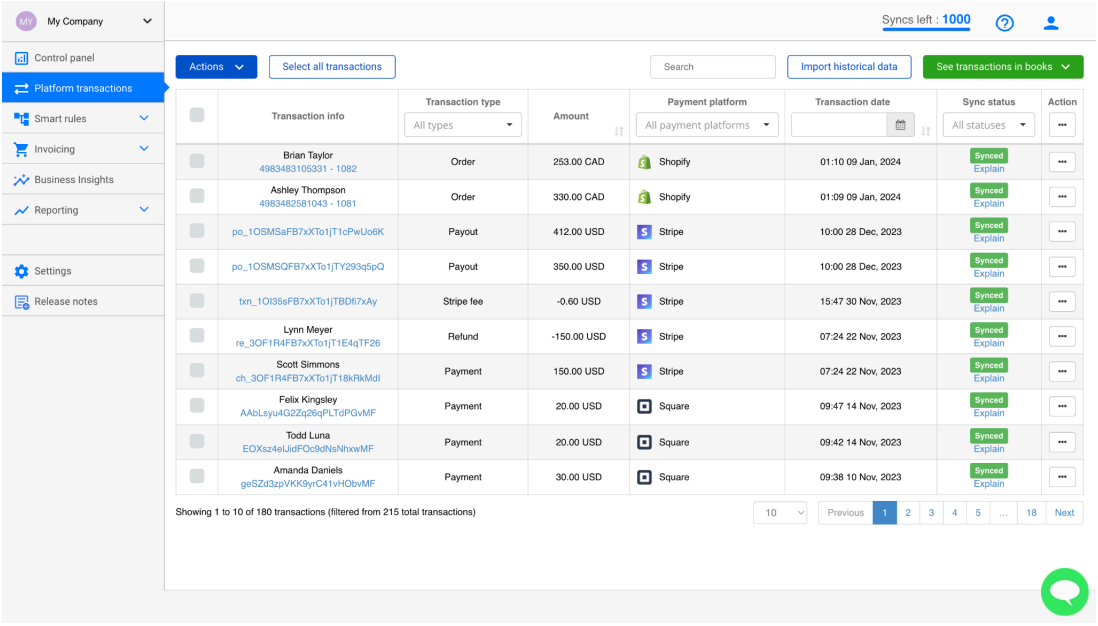

Synder – Accounting Automation Software

Synder automates the transfer of financial data, reducing manual work and errors. By integrating with popular payment platforms and accounting software (e.g., Stripe, PayPal, Square, QuickBooks, and Xero), Synder synchronizes invoices and transactions in real-time. This allows accountants to spend less time on repetitive tasks and focus more on strategic client advising, ultimately improving overall efficiency and accuracy.

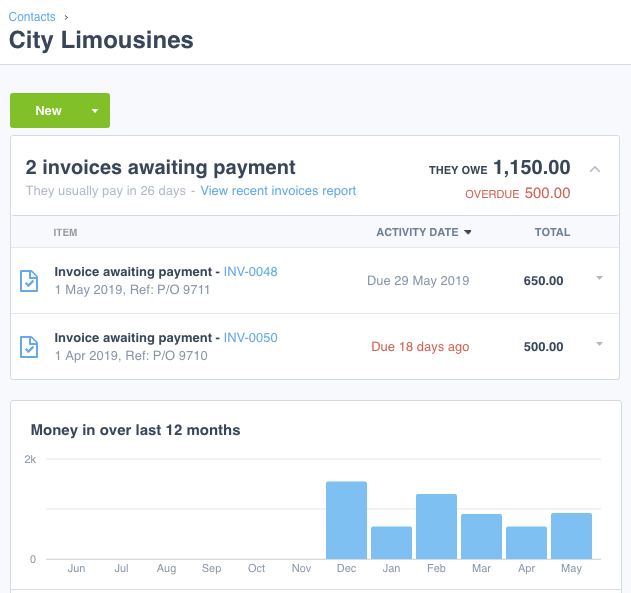

Xero – Accounting Software for UK Accountants

Xero stands out as a globally recognized leader in accounting software favoured by small businesses, accountants, and bookkeepers. It is used by nearly 4 million people around the world. Xero helps with everyday accounting and reduces the manual workload by automating daily accounting tasks. It is with you anywhere you go.

With Xero, you can:

- Automate financial processes such as bank reconciliations and repetitive invoice preparations—supported by tools for automated integration testing – saving valuable time and reducing human error.

- Enhance collaboration by providing real-time access to financial data for both accountants and their clients, ensuring transparency and facilitating easier decision-making.

- Integrate seamlessly with over 1,000 applications, including CRM systems like Pipedrive, practice management software like Uku, and time-tracking tools like Toggl, creating a connected ecosystem that simplifies various business processes.

QuickBooks – Accounting Software for US Accountants and CPAs

QuickBooks is another cornerstone among apps for accountants, noted for its comprehensive functionality and flexibility to suit various business sizes and needs.

Here’s how QuickBooks improves your accounting :

- Versatile financial management that enables accountants to handle payroll, sales tax calculations, expense tracking, and invoicing all in one platform

- Insightful reporting with customizable dashboards and reporting tools that provide deep insights into business performance, aiding accountants in offering precise, data-driven advice

- Scalability to meet the needs of different types of users, from freelancers to small businesses and growing enterprises, ensuring it remains a suitable tool as client requirements evolve

- Integrate with many useful accounting apps like accounting practice management software, similar to Xero.

E-conomic – Accounting Software for Danish Accountants

E-conomic is the preferred accounting software in Scandinavia. It is highly regarded for its powerful features, which cater specifically to the needs of Danish accounting firms.

E-conomic enhances accounting workflows by:

- Automating essential tasks like invoicing, VAT reporting, and receipt uploads reduces manual data entry.

- They simplify client management through streamlined and automated workflows, allowing accountants to focus more on strategic activities than routine tasks.

- Offering extensive app integration, similar to Xero, facilitates a more cohesive operation and allows for an all-in-one solution that manages various aspects of a business.

Adopting one of these advanced accounting software allows accountants to provide high-quality, efficient services, turning tedious tasks into organized, manageable processes. Make the technological shift to free up valuable time for strategic advising and position accountants as indispensable advisors to their client’s financial success.

AML Software for Accountants

Anti-Money Laundering (AML) is an accountant’s compulsory task in many countries nowadays. Failing to comply with AML regulations can result in fines and damage to a firm’s reputation. Luckily, technology has made AML processes much more accessible and efficient, so accountants can spend their valuable time doing more complicated tasks.

Ondato – AML & KYC

Ondato is a pioneering KYC compliance platform incorporating all the necessary know-your-customer (KYC) and anti-money laundering (AML) tools and services for safe client onboarding, AML screening, and lifecycle management. Reduce non-compliance risk and ensure your client’s financial activities are legitimate and transparent. By incorporating AML compliance apps into workflows, accountants can provide better service and value to their clients while maintaining high levels of regulatory compliance.

Your work management software might help you with AML processes as well. For example, Uku, the work management software for accountants, has a simplified AML process management. New fields will be added to your client’s data, and the system will remind you to update them.

Check out their new product – AML Ranger, it’s AI-based AML compliance assistants. Faster, smarter checks for adverse media, sanctions & PEP screening.

App for Accounting Firm Marketing

Convertkit- Email Marketing for Accountants

ConvertKit is email marketing software for professional businesses. Users create email sequences, can grow and segment their lists. Even better, much of the email marketing can be automated.

Newsletters or drip emails can filter various customer types so you can determine what type of future emails to send them. The more relevant, the more likely they will engage with your business.

MeetEdgar – Social Media Management

Whether you use social media or not, there is no escaping that it is part of our culture, and as a business, you must use it.

Most of us will schedule the odd post here and there, yet to be successful it’s best to post consistently. Where do you have the time and reminders to log in each day and post? Well, you can use a social media management platform like MeetEdgar.

With MeetEdgar, you schedule content into a queue all at once, reducing the time spent scheduling individual posts daily.

If you use core social media platforms of LinkedIn, Facebook and Twitter, then MeetEdgar is the tool for you to reach your audience and promote your practice online.

Time Tracking Apps for Accounting Firms

Efficient work is the key to success. One of the ways to guarantee effectiveness is to know the time you spend on work tasks to ensure accurate billing. Unlike the popular opinion, that time-tracking wastes time, the time-tracking apps also provide valuable insights into work habits to identify areas for improvement and increase productivity. Tracking time manually is quite ineffective because we humans tend to get distracted by tasks or deadlines.

Toggl – Simple Time Tracking App

Toggl is a popular time-tracking app for accountants. You can start and stop the timer with just one click, and the app will automatically track the time spent. Toggl also offers detailed reports that provide valuable insights into time spent on specific projects or clients. Read more about how Toggl compares to other time-tracking apps for accountants.

Work Management App for Accountants

Accounting is complex and requires high organisation and attention to detail. Accountants must keep track of time spent on specific tasks, clients, and projects to ensure they are billing accurately and efficiently. Invoicing can be time-consuming, especially when regularly creating and sending invoices for multiple clients.

Instead of using several different apps for CRM, time tracking, and other work management-related actions – use work management software. It does all of these and even more!

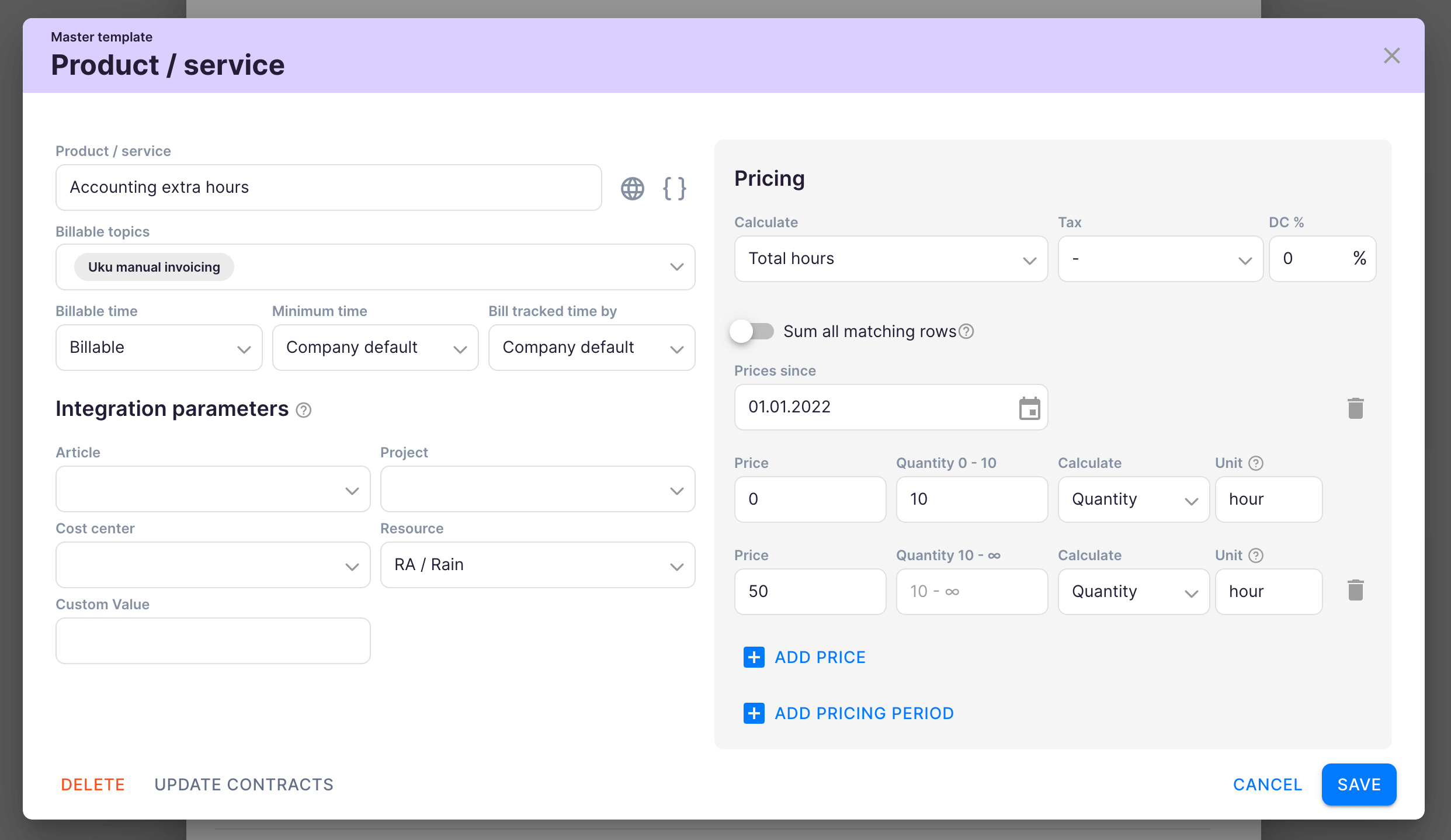

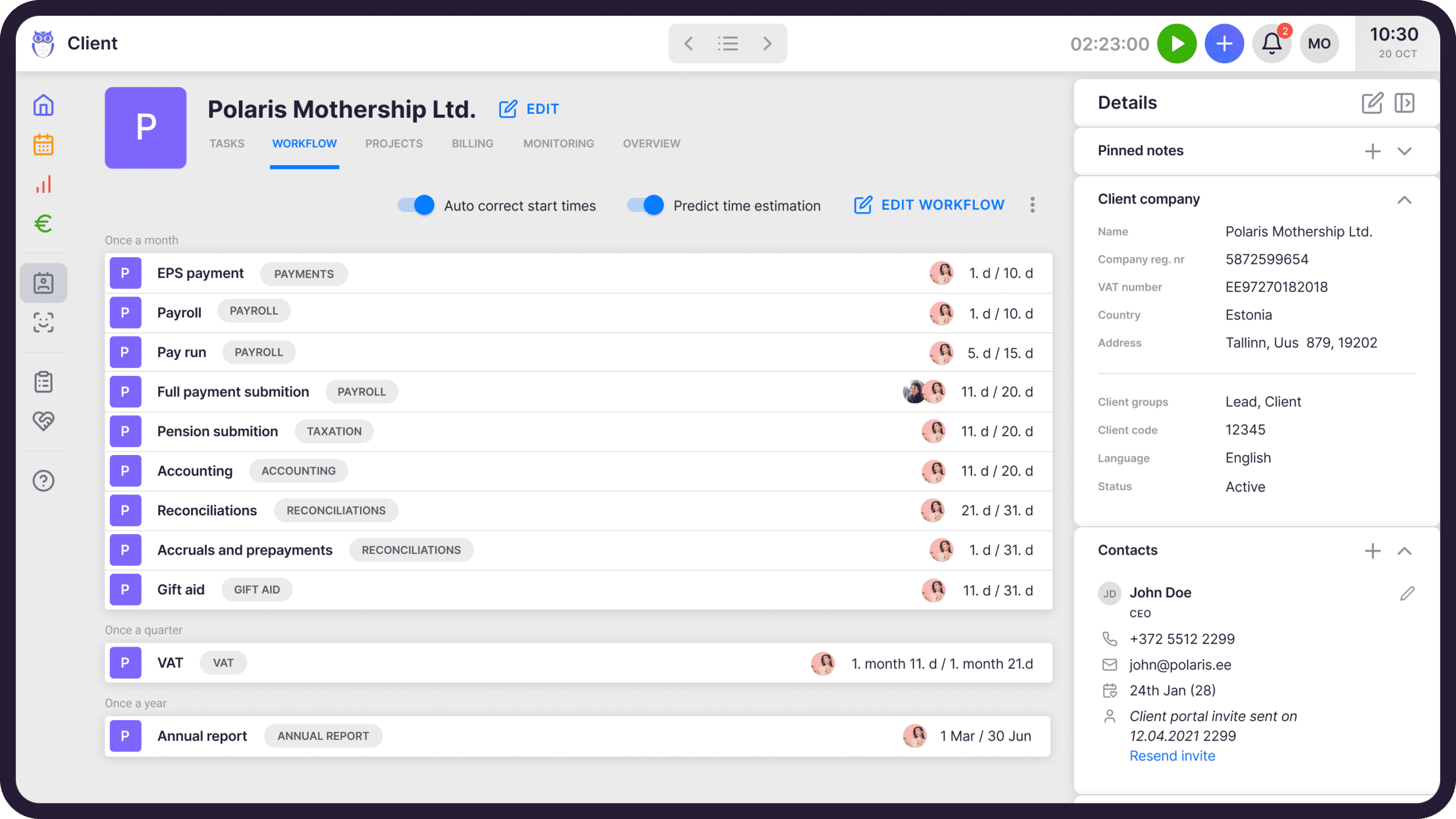

Uku – Accounting Practice Management Software

Uku is a work management app designed for accountants. It has advanced work management features such as time tracking, task plans and templates, recurring tasks, and detailed reports. With Uku, accountants can easily keep track of their tasks, have a thorough overview of working hours and monitor client agreements.

In addition to work management, Uku offers billing features that automatically generate and send invoices based on the data you enter. It’s highly personalizable, as every contract is different. Uku can also automate email communication with clients, allowing accountants to stay in touch without manual intervention.

A convenient client base covers the need for a separate CRM app. All of your clients, documents, accesses, and notes are available in one place and accessible to anyone who needs them. In addition, you can communicate with your clients, send and receive documents, and assign tasks to your clients in Uku’s Client Portal.

Like other apps, Uku integrates seamlessly with accounting software, like Xero and QuickBooks, allowing smooth data exchange with clients and invoices.

Sharing and Managing Files for Accountants

For decades, companies have handled their files on paper, which they combined into binders and stacked on bookshelves. Although the colourful display is fun, managing files online is much easier.

Google Drive – File Sharing Cloud Depository

Google Drive is a popular cloud-based storage app allowing users to store or share files and documents easily. This can be especially useful for accounting offices that need to collaborate on documents or access files from different locations. You can share the files or folders of files with clients and hide he ones that need to be a secret.

Google Drive integrates with many other software applications, such as Uku. Accountants can send documents from practice management software to Google Drive or store documents in both. You can also edit documents using Uku’s document management feature.

Dropbox – Document Collaboration

Dropbox is unquestionably the most recognised brand name in cloud storage. It enables users to externally store files in the cloud that can then be either saved as storage items or shared with others who have access to the web.

All files sync across devices that Dropbox provides platform support for web, mobile and desktop. Dropbox stores and manages any file type available.

To get started with Dropbox on your computer, you download the application that creates a specific Dropbox folder on your computer.

Then you begin syncing files. Millions of internet users across the planet use Dropbox to store their files.

App for Password Management

Using different passwords is the best way to stay safe and avoid scammers.

So to remember them, should you write them in a notebook? Absolutely not! We never know who might want to steal our data.

For managing multiple unique passwords securely, using a dedicated password manager can help accountants keep sensitive information protected and easily accessible.

Did you know that the most commonly used password in 2021 was “123456”?

NordPass – Keep Your Passwords Safe

NordPass is a reliable tool designed to help you securely manage all your passwords and sensitive information in one place. With NordPass, you can save, organize, and access your passwords effortlessly while benefiting from advanced security features like zero-knowledge encryption, ensuring only you can unlock and view your data.

Additionally, NordPass offers features like an emergency access option, password health checker, and data breach scanner, giving you peace of mind that your accounts are secure and up to date.

If you’re considering NordPass, check out Cybernews’ NordPass review to explore its strengths, pricing, and how it compares to other password managers.

Psono – Password manager

Psono is a reliable, open-source password manager designed for both individuals and teams who prioritize their privacy and want complete control over their data. With Psono, you can securely store and organize your passwords, credentials, and sensitive files, all protected by robust end-to-end encryption that only you and those you authorize can access your information.

Psono is a reliable, open-source password manager designed for both individuals and teams who prioritize their privacy and want complete control over their data. With Psono, you can securely store and organize your passwords, credentials, and sensitive files, all protected by robust end-to-end encryption that only you and those you authorize can access your information.

It also offers features like team sharing, syncing across multiple devices, and self-hosting options, providing you with the flexibility to manage and safeguard your digital life. Whether using it for personal needs or enterprise-level security, Psono ensures your data remains safe and easily accessible.

App for Listening to Music

Accounting work can be demanding and stressful sometimes, so the need to take breaks and unwind is not a surprise. Engaging in fun activities during breaks or after work can help reduce stress and prevent burnout, which is essential for maintaining good mental health.

Music is a powerful tool that can positively affect mood and reduce stress and anxiety. Whether you need to focus on a task or relax and unwind during a break, find the playlist suitable for your mood and go on.

Spotify – The Most Popular Music Streaming App

Spotify is the world’s most popular music streaming service. It offers various playlists and genres, including instrumental music designed to improve concentration, upbeat hits from numerous genres, calming classical music, and jazzy vibes.

Check out some more accounting memes.

App for Mental Health

In a high-stress industry like accounting, taking care of your mental health and managing stress levels is important. Yoga, pilates or meditation classes are often expensive and require commuting to the location they are held. A much easier (and cheaper) solution is to use apps.

Many successful business leaders, including Steve Jobs, Bill Gates, and Arianna Huffington, credit meditation with helping them achieve success.

Headspace – Guided Meditation App for Accountants

Meditating apps like Headspace offer guided meditation and mindfulness exercises to help reduce stress and anxiety and improve focus. By taking a few minutes to meditate, you can improve your overall well-being and mental clarity, boost immunity and sleep quality, and reduce symptoms of depression.

Nebula

Nebula is a spiritual guidance platform offering personalized insights to bring clarity to your life and relationships. It provides free tools like daily horoscopes, a compatibility checker and helpful articles on love, astrology, and spirituality. Even if you’re skeptical, Nebula invites you to try a reading—you might just enjoy a meaningful conversation with someone who truly listens.

Nebula is a spiritual guidance platform offering personalized insights to bring clarity to your life and relationships. It provides free tools like daily horoscopes, a compatibility checker and helpful articles on love, astrology, and spirituality. Even if you’re skeptical, Nebula invites you to try a reading—you might just enjoy a meaningful conversation with someone who truly listens.

Technology has become an integral part of the accounting industry, and many apps can help you stay organized and productive and relax after working hours.

By embracing technology and incorporating these apps into daily routines, you, as an accountant, can become more productive, efficient, and a well-rounded professional to be the accountant of your client’s dreams.