Choosing between Financial Cents and TaxDome for your accounting practice management often comes down to these five critical questions:

- Do you prioritize ease of use and quick implementation, or are you willing to invest significant time upfront for more comprehensive features?

- Is your firm looking for a simple, intuitive solution or an all-encompassing platform that replaces multiple tools?

- Are you a solo practitioner or small firm watching costs, or do you have the budget for enterprise-grade features?

- Do you need basic workflow automation or complex, multi-stage pipelines with conditional logic?

- Is your focus primarily on workflow management and collaboration, or do you need integrated tax preparation and compliance features?

In short, here’s what we recommend:

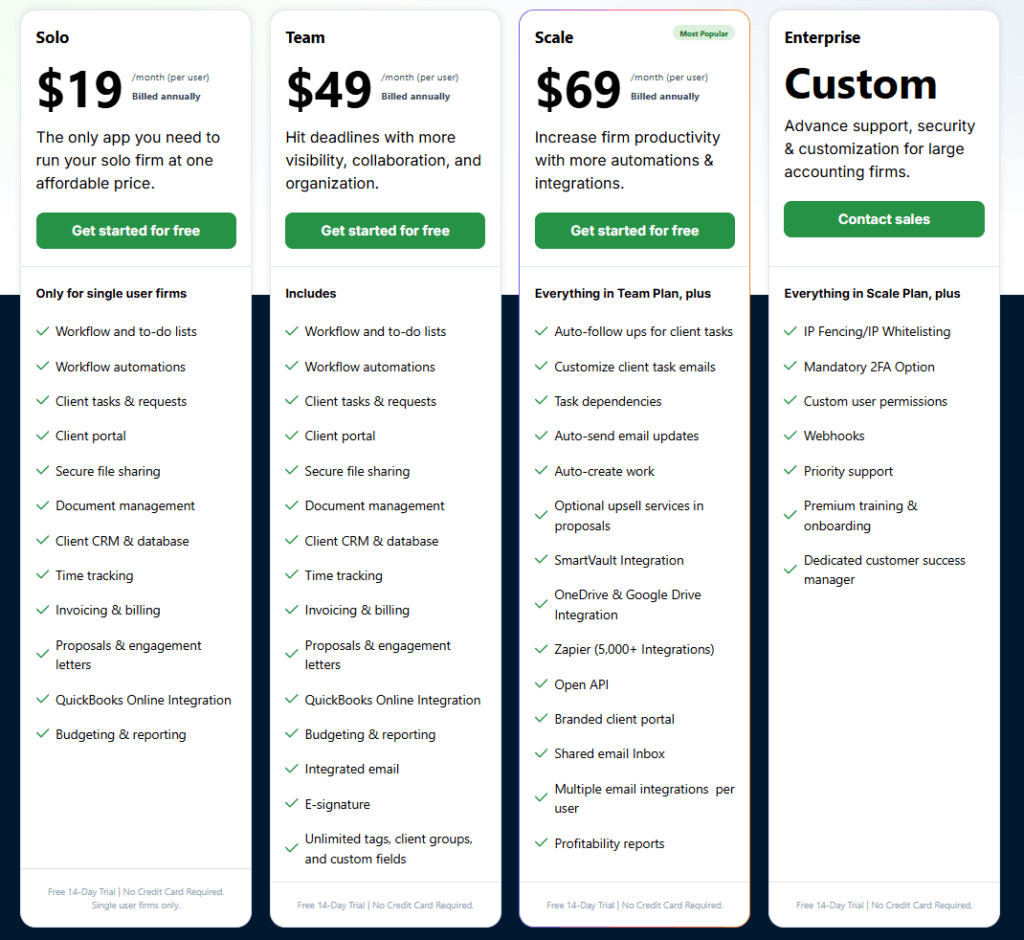

👉 Financial Cents is the intuitive choice for small to mid-sized accounting and bookkeeping firms in the US and Canada that value simplicity and quick adoption. With its user-friendly interface and focus on core practice management features, it excels at organizing workflows, tracking time, and collaborating with clients without overwhelming users. While it may lack some advanced features found in enterprise solutions and doesn’t integrate with Xero, its affordable Team pricing at $49/month ($588/year) and minimal learning curve make it ideal for firms that want to get organized fast without the complexity.

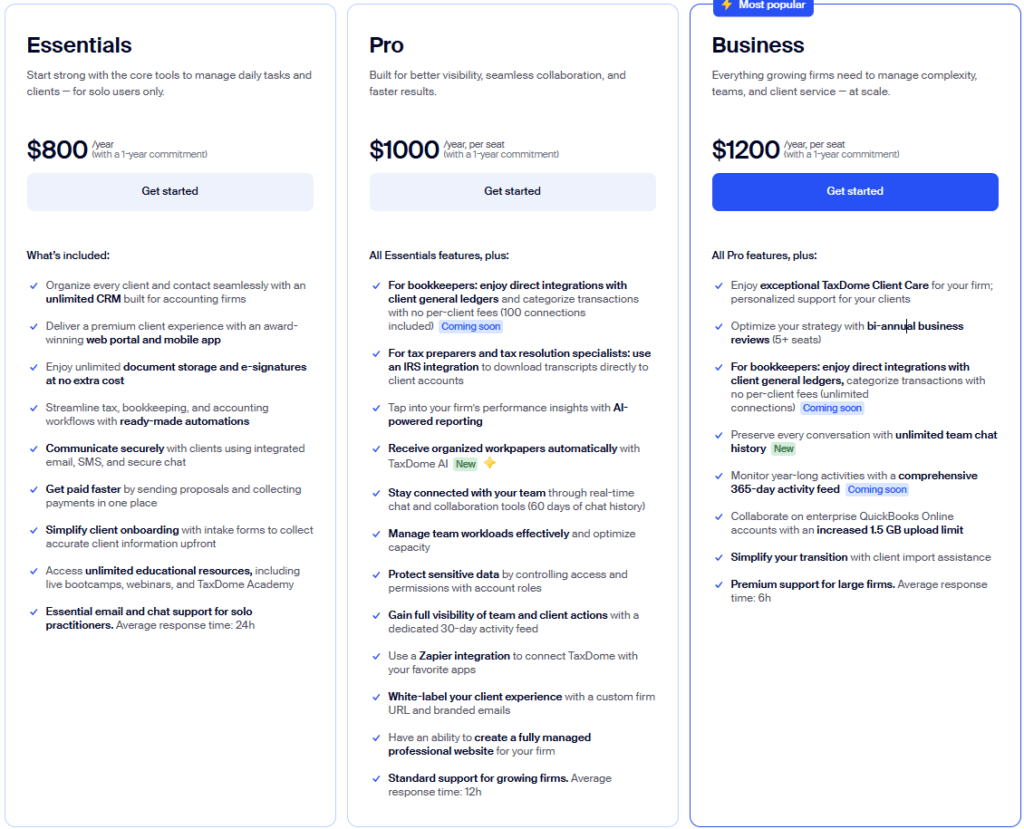

👉 TaxDome is the comprehensive powerhouse for firms seeking an all-in-one solution that goes beyond basic practice management. It combines workflow automation, document management, billing, and a robust client portal with unlimited storage and e-signatures included. The platform’s depth of features and automation capabilities can transform how firms operate, though the steep learning curve and higher price point starting at $66/month ($800/year) for the Essentials plan mean it’s best suited for firms ready to invest time and resources into a complete digital transformation.

Both platforms are strong contenders, but they serve different practice management philosophies. What if there’s a solution that delivers sophisticated automation without months of implementation?

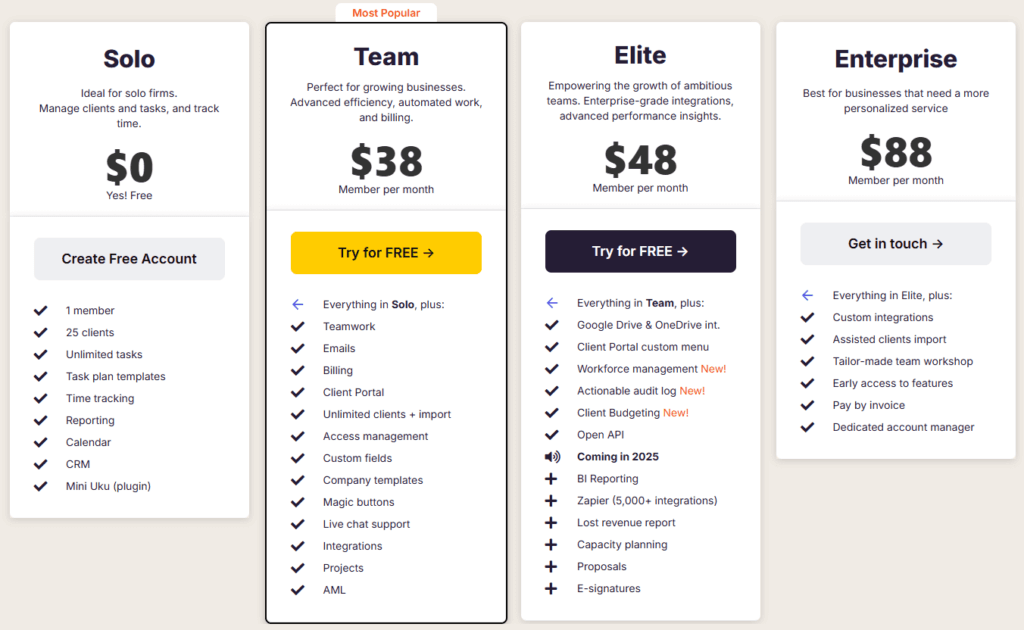

👉 Uku approaches practice management with automated billing that turns time-consuming invoicing into a streamlined process. Built for growing firms transitioning from Excel, it delivers enterprise-grade features through a modular approach that lets you start working on day one and scale as needed. With sophisticated billing automation that handles complex pricing rules and an integrated client portal where accountants and clients work on the same tasks, Uku helps firms improve profitability while actually enjoying their practice management system. Starting from $38/month ($456/year) for the Team plan with flexible monthly payments, it’s the fastest path from spreadsheets to sophisticated automation.

If you’re ready to stop losing money on outdated agreements and want a system your team will actually enjoy using, see how Uku transforms practice management with a 14-day free trial.

Table of contents:

- Financial Cents vs TaxDome vs Uku at a glance

- The philosophical divide: Simplicity vs comprehensiveness vs modular power

- Automated billing: The game-changer for firm profitability

- Client portal and communication capabilities

- Workflow automation reveals each platform’s true nature

- Time tracking approaches and profitability insights

- The real cost of implementation: From Excel to greatness

- Document management and security considerations

- Reporting and insights show platform maturity

- Which platform should you choose?

Financial Cents vs TaxDome vs Uku at a glance

Here’s how these three platforms approach the challenge of practice management:

| Financial Cents | TaxDome | Uku | |

|---|---|---|---|

| Core Philosophy | Simple, intuitive practice management | All-in-one comprehensive platform | Modular approach with automated billing focus |

| Starting Price | $49/month ($588/year) – Team | $66/month ($800/year) – Essentials | $38/month ($456/year) – Team |

| Geographic Availability | ⭐⭐ US/Canada only | ⭐⭐⭐⭐⭐ Global with 14 languages | ⭐⭐⭐⭐⭐ Global with multi-currency |

| Billing Automation | ⭐⭐⭐ Automated: recurring & payments | ⭐⭐⭐ Good with setup required | ⭐⭐⭐⭐⭐ Industry-leading automation |

| Implementation Time | ⭐⭐⭐⭐⭐ Days to weeks | ⭐⭐ Weeks to months | ⭐⭐⭐⭐⭐ Start working on day one |

| Learning Curve | ⭐⭐⭐⭐⭐ Minimal | ⭐⭐ Steep | ⭐⭐⭐⭐ Moderate |

| Workflow Automation | ⭐⭐⭐ Basic but effective | ⭐⭐⭐⭐⭐ Advanced with conditions | ⭐⭐⭐⭐⭐ Sophisticated yet simple |

| Client Portal | ⭐⭐⭐⭐ Password-less, modern | ⭐⭐⭐⭐⭐ Feature-rich, multi-language | ⭐⭐⭐⭐⭐ Unified task system |

| Time Tracking | ⭐⭐⭐⭐ Well-integrated | ⭐⭐⭐⭐ Comprehensive | ⭐⭐⭐⭐⭐ Multiple methods, deep insights |

| Profitability Analysis | ⭐⭐⭐⭐ Realization & profit reports | ⭐⭐⭐⭐ Good analytics | ⭐⭐⭐⭐⭐ Real-time profit visibility |

| Best For | Small firms prioritizing simplicity | Tax-focused firms wanting everything | Growing firms transitioning from Excel |

Note: Star ratings represent our subjective assessment based on feature depth and user feedback.

The philosophical divide: Simplicity vs comprehensiveness vs modular power

The fundamental difference between these platforms isn’t features, it’s philosophy.

Financial Cents embraces radical simplicity. Founded in 2020 by Shahram Zarshenas and Abdullah Almsaeed, the platform was built for the “everyday firm” that just wants to get organized without a computer science degree.

Every feature is designed to be intuitive, from the workflow dashboard that shows all work at a glance to the password-less client portal that clients actually use. This philosophy extends to implementation, where firms can be fully operational within days to weeks depending on their complexity. However, this simplicity comes with geographic limitations—Financial Cents is only available in the US and Canada markets.

TaxDome takes the opposite approach.

Founded in 2017 by brothers Victor and Ilya Radzinsky, it aims to be the only software a firm needs. This means packing in features like CRM, workflow automation, document management, billing, e-signatures, and even a website builder. The platform can genuinely replace 5-10 separate tools, but this comprehensiveness comes with complexity.

Implementation experiences vary, with some users reporting quick setup while others invest weeks in building out their ideal workflows. This monolithic approach requires substantial upfront configuration before firms can begin using the system effectively.

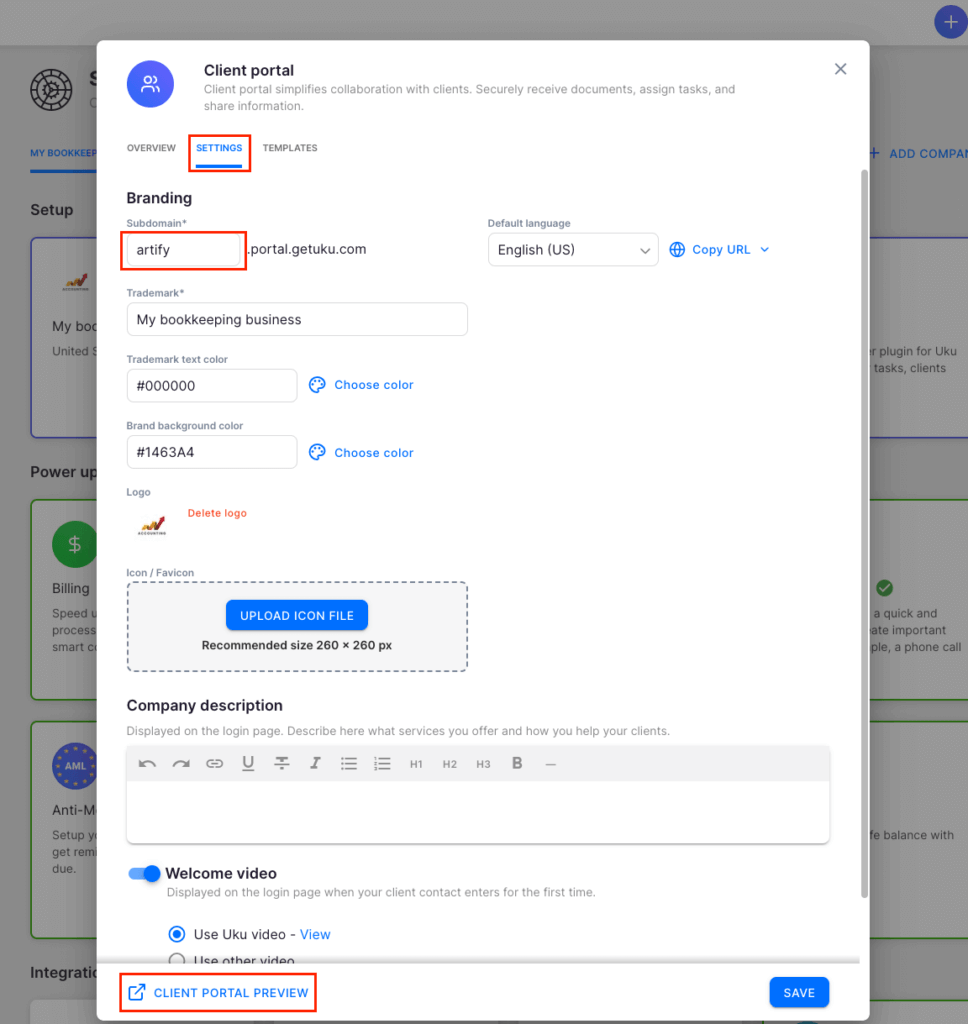

Uku was founded in 2017 in Estonia by Rain Allikvee and Jaanus Lang.

It introduces a revolutionary modular approach to accounting. Like an iPhone where you start with basic functionality and add apps as needed, firms can begin with just CRM and tasks, then gradually activate features as they grow. This flexibility is designed for small and medium-sized companies that need agility, not large corporations operating like factories.

Uku’s approach is modular, not monolithic, meaning firms can start working on day one, activating only the modules they need immediately. The platform’s core strength lies in its automated billing engine that handles complex pricing scenarios while maintaining an interface that users describe as enjoyable to use. With global availability and multi-currency support, Uku serves firms worldwide without geographic restrictions.

Automated billing: The game-changer for firm profitability

This is where the platforms reveal their true colors, and where Uku dramatically outpaces the competition.

Financial Cents provides comprehensive invoicing functionality with QuickBooks Online integration. However, firms using Xero will find no native integration available, limiting its appeal for many accounting practices.

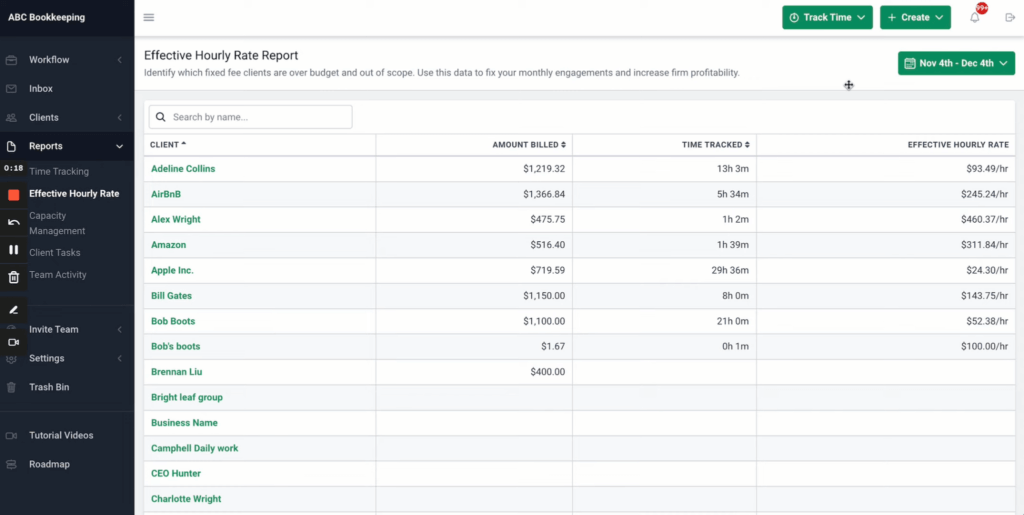

Recent updates have added automated recurring invoices, automatic payment collection, saved payment methods, and automatic client reminders. Meanwhile, the Effective Hourly Rate report helps understand profitability for fixed-fee engagements. The system integrates well with QuickBooks Online and offers solid automation for straightforward billing scenarios, though billing only works in USD, limiting its international use.

Source: Financial Cents

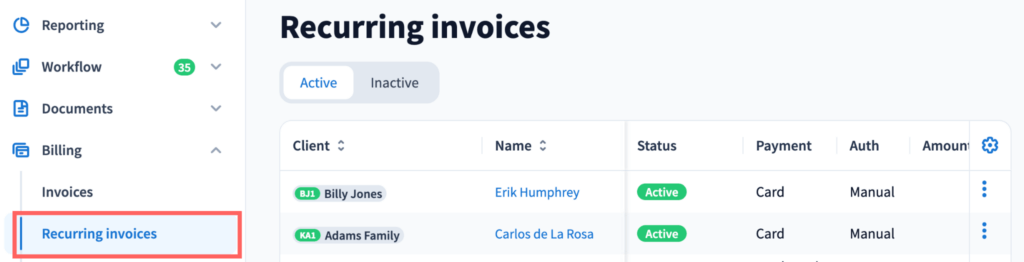

TaxDome offers more sophisticated billing features including recurring billing, automatic payment collection, and payment locking (clients can’t access documents until invoices are paid).

Source: Taxdome

The system integrates well with payment processors like Stripe and CPACharge. Time tracking feeds into invoices, and you can set up automation rules. However, firms with complex pricing scenarios may still find invoice preparation time-consuming.

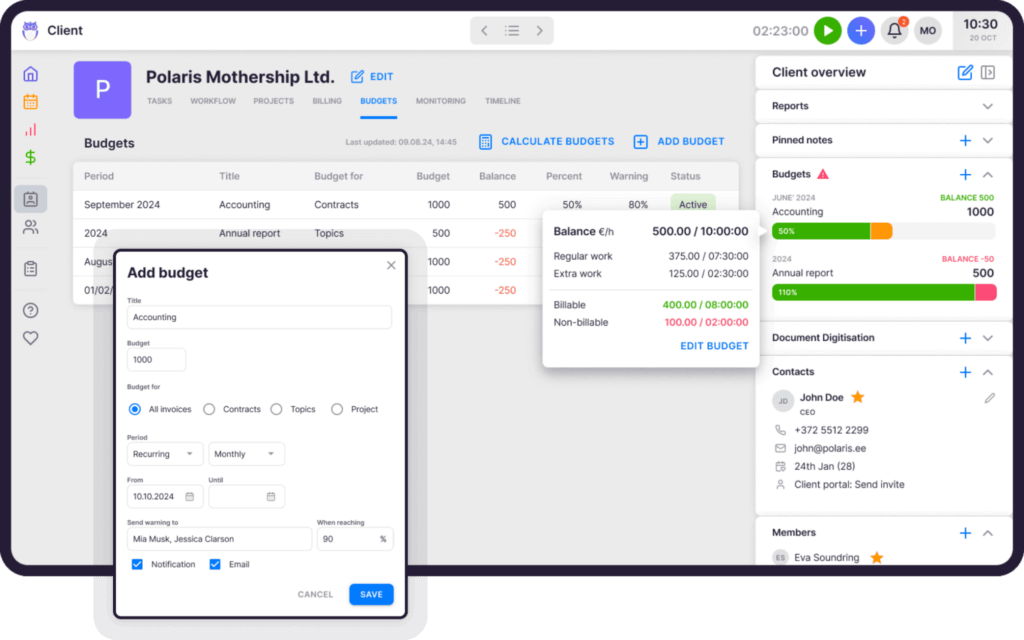

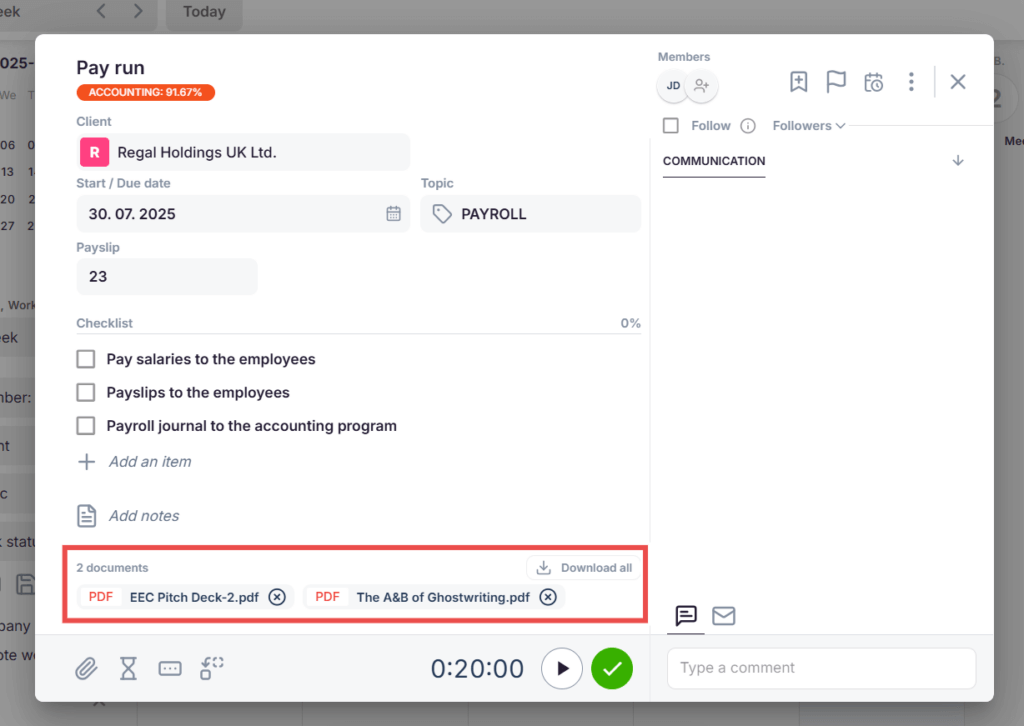

Uku turns billing from a time-consuming task into a completely streamlined process.

For 1000+ Uku clients, automated billing reduces monthly invoicing time to just 0.5 hours. Their automated billing engine supports complex price lists based on quantity, time, material, and ranges with different rates for different periods. It handles sophisticated rounding rules (a one-minute unplanned client call can automatically be billed as 15 minutes based on your firm’s policies). Everything runs through “contracts” where rules are set up once, then time tracking automatically calculates billable amounts in real-time.

With multi-currency support, Uku serves global firms without the limitations of USD-only billing.

Uku’s real power comes from profitability visibility. When working on tasks with budgets, users instantly see if clients are over budget. The system tracks time and compares it against agreements, helping firms identify outdated agreements where scope has expanded beyond original pricing.

Uku clients report an average 23% increase in profitability by identifying these pricing gaps and scope creep issues.

Client portal and communication capabilities

The client experience can make or break your practice management investment, and each platform takes a distinctly different approach.

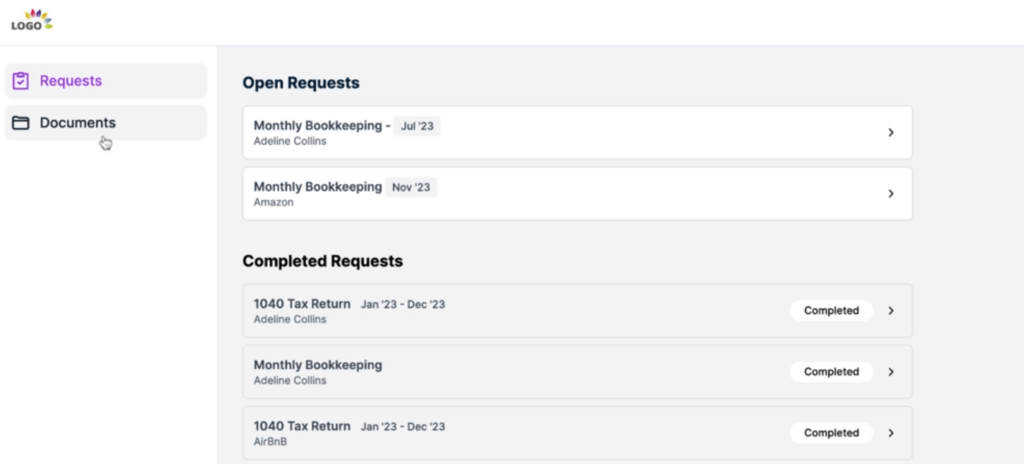

Financial Cents offers password-less access with their “magic link” technology. Clients receive an email, click the link, and they’re in. No forgotten passwords, no login frustration. The portal itself is clean and modern, allowing clients to upload documents, respond to requests, and pay invoices.

Source: Financial Cents

Meanwhile, the automated reminder system persistently but politely follows up until tasks are complete. However, a significant limitation for international firms is that the portal currently supports English only, reinforcing Financial Cents’ US/Canada-centric positioning. The portal offers basic white-labeling options including custom logos and colors.

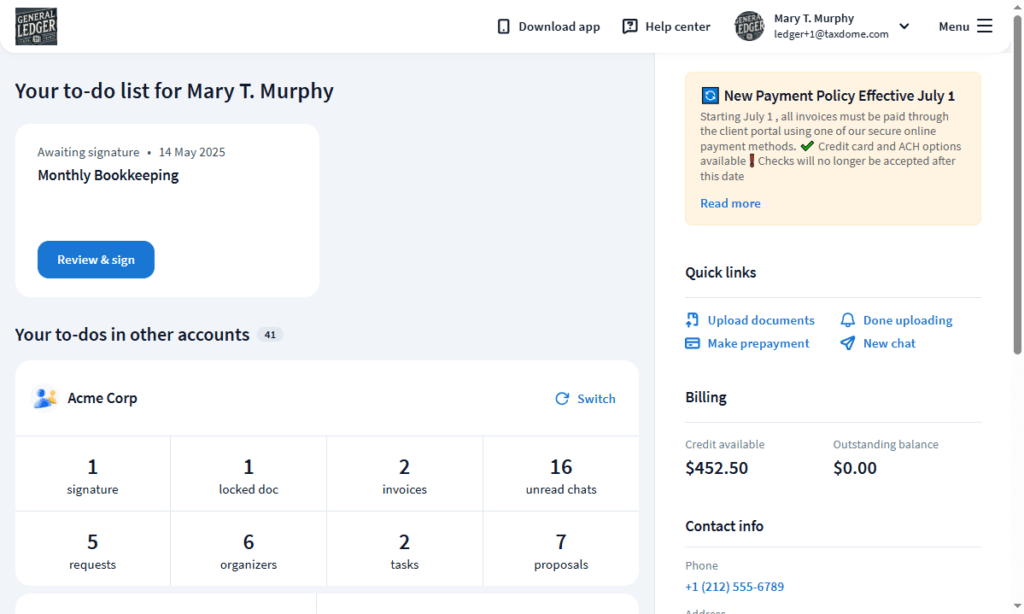

On the other hand, TaxDome‘s client portal is feature-complete.

Available in 14 languages, fully white-labeled with custom domains, and accessible via dedicated iOS and Android apps, it’s built for global firms with demanding clients. The portal includes secure messaging, document exchange, e-signatures, and even a built-in scanner for mobile uploads. Clients can access everything from tax organizers to historical documents. Some users report the extensive features can be overwhelming for clients initially.

Source: TaxDome

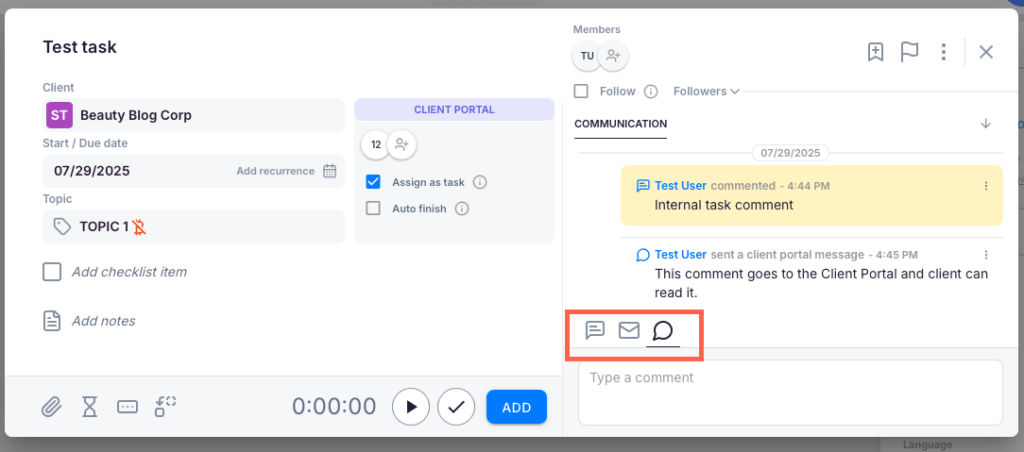

Uku‘s integrated client portal represents a fundamental rethinking of client collaboration.

Unlike traditional portals where tickets must be connected to work items, Uku’s portal mirrors the exact same task on both sides. Clients and accountants work on the same item with all communication, actions, documents, logs, and time tracking in one place. When clients make requests through the portal, notifications appear on the accountant’s dashboard, and they can immediately start tracking time or communicating within that same task.

The portal is highly customizable (firms can create unique menus for each client, run onboarding with forms, share business insight reports, display price lists, and embed custom content with simple copy-paste functionality). With multilingual capabilities, Uku serves international firms without the language barriers that limit Financial Cents.

Uku’s unified approach to client communication ensures that when team members are absent, others can access all client communications and task history in one centralized location.

Workflow automation reveals each platform’s true nature

How each platform handles workflow automation tells you everything about their approach to practice management.

Financial Cents keeps automation simple.

You can create recurring projects, automate client reminders, and set up basic task dependencies. The standout feature is their template library with community-created workflows. Instead of building from scratch, you can download proven workflows for monthly bookkeeping or tax preparation and customize them.

The automation works well for straightforward processes, focusing on ease of use over complex conditional logic.

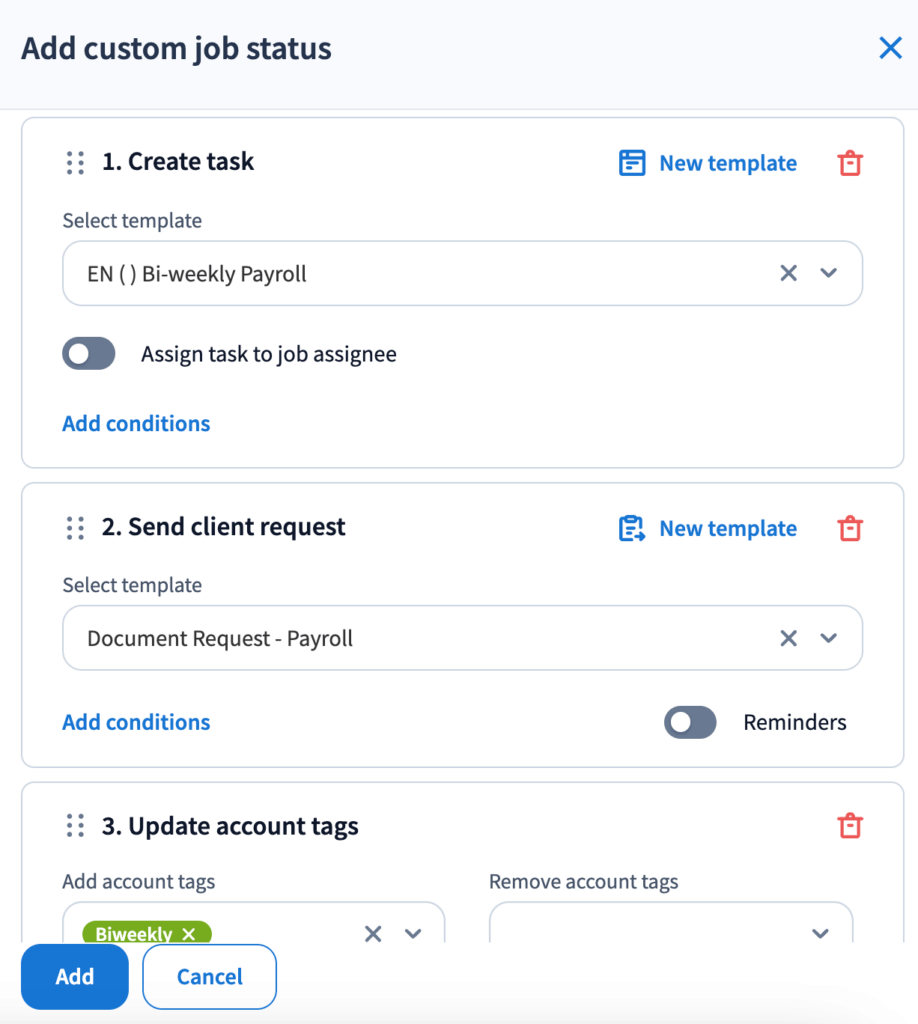

TaxDome‘s workflow automation is industrial-strength.

Their pipeline system uses Kanban-style boards with sophisticated automation at each stage. You can create conditional logic (if client has tag X, then do Y), set up complex dependencies, and automate everything from document requests to invoice generation. The system can handle intricate multi-step processes with different paths for different client types. This power requires investment in setup time and expertise.

Source: TaxDome

Uku offers powerful automation without the complexity.

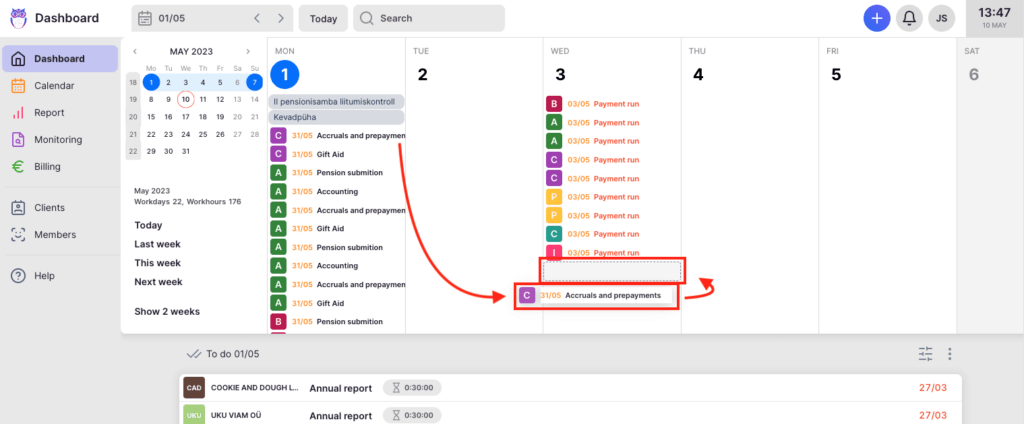

Their three-level hierarchy (task templates to client task plans to tasks) provides structure without rigidity. The system offers recurring tasks, automatic reminders, and smart dependencies. You can set tasks for specific business days of each month with automatic adjustment for holidays. Uku also features an intuitive planning calendar with a weekly view where tasks can be simply dragged and dropped.

Uku’s key differentiator is how this automation integrates seamlessly with the billing engine, ensuring every automated task is also automatically priced and tracked.

Time tracking approaches and profitability insights

Financial Cents integrates time tracking seamlessly into your daily workflows. The timer is accessible from anywhere in the app, and time entries automatically link to specific clients and projects.

Source: Financial Cents

The platform offers comprehensive profitability analysis through its Realization & Profitability reports, which calculate labor costs, gross profit, and margins. Firms can set both billing rates and labor cost rates for team members to understand true profitability. However, everyday repetitive time tracking actions can be more time-consuming compared to more streamlined alternatives.

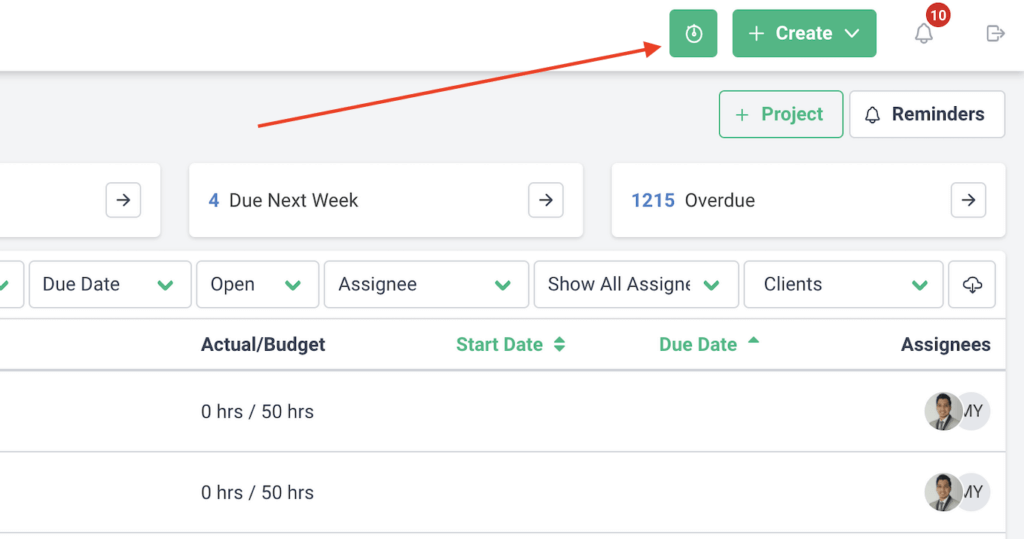

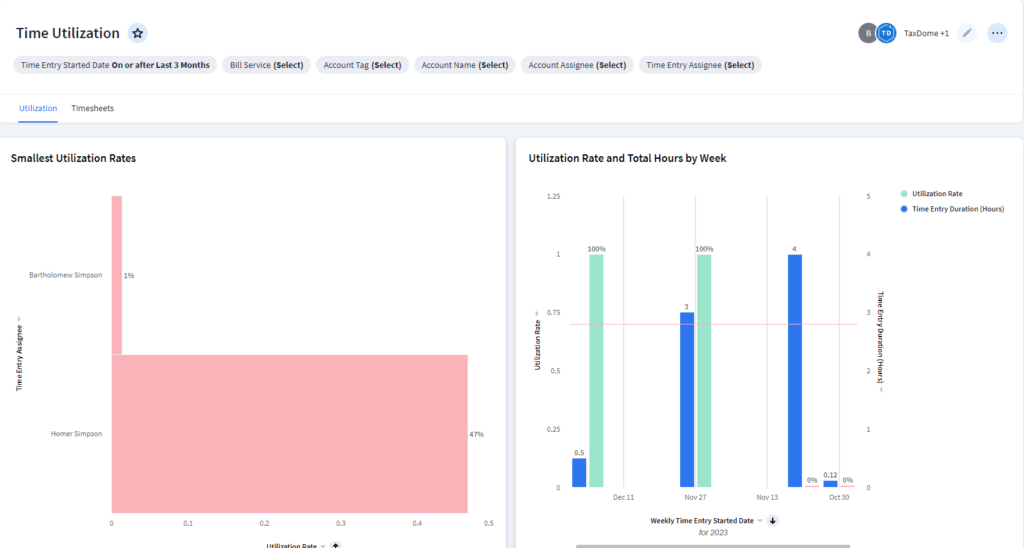

TaxDome provides comprehensive time tracking with good reporting capabilities. Time entries feed into invoices, and you can generate various utilization reports. The system tracks billable vs. non-billable time and provides analytics through AI-powered reporting features. The Time Utilization Dashboard helps firms understand how their team’s time is being used. Like Financial Cents, the interface for everyday repetitive actions can make time tracking feel more administrative than strategic.

Source: TaxDome

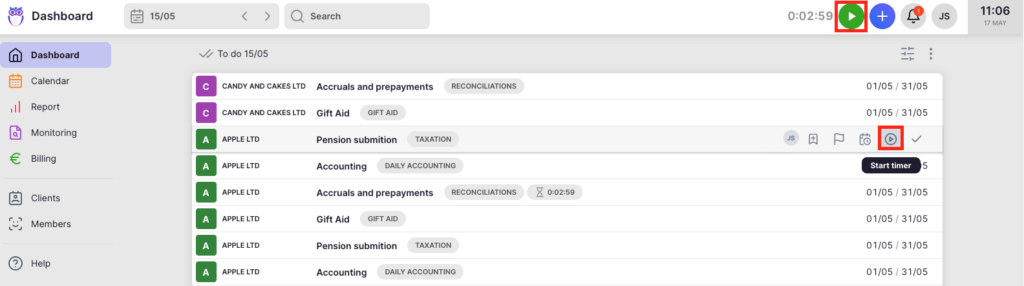

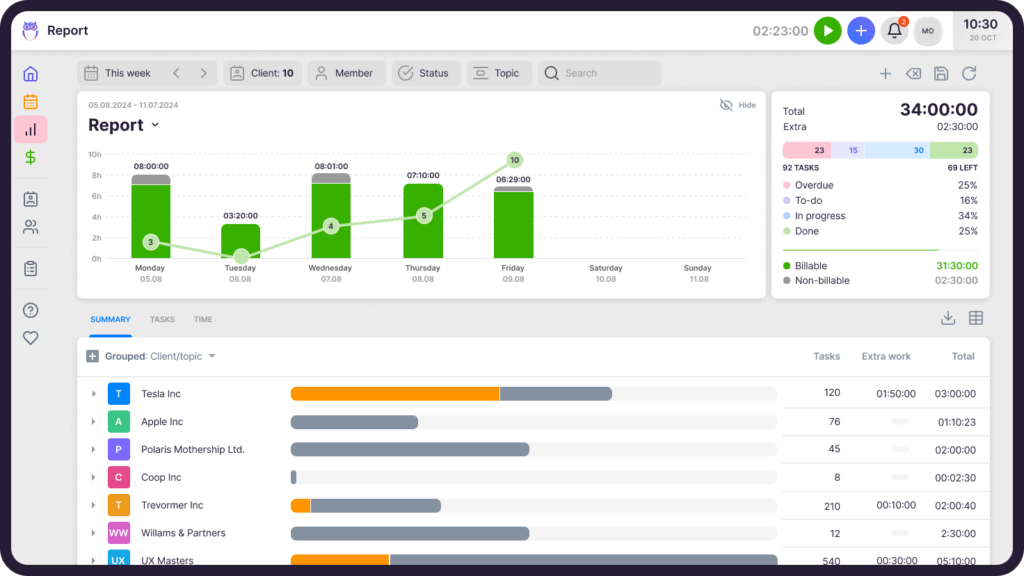

Uku‘s time tracking isn’t an administrative burden, it’s a strategic tool its users love. Users can track time through multiple methods including a stopwatch, manual entry, or bulk time allocation across multiple tasks. Uku is optimized for speed with 90% of actions being one-click, dramatically reducing daily admin tasks compared to Financial Cents and TaxDome.

Its standout capability is how time data flows into comprehensive profitability analysis. The system provides insights into client profitability and helps identify whether unprofitability stems from pricing, scope creep, or efficiency issues.

Uku is launching BI reporting features in 2026 to provide visual reports and alerts, helping firms catch profitability issues before they compound. The integration with automated billing means every minute tracked is instantly calculated against client budgets, providing immediate visibility into profitability.

The real cost of implementation: From Excel to greatness

The sticker price tells only part of the story (implementation time and complexity often determine success or failure).

Financial Cents wins on basic implementation speed but requires substantial upfront configuration.

At $49/month for teams ($588/year), it’s competitively priced. Firms can be operational quickly, though the monolithic approach means configuring all features before getting started. Most reports are set up within days to weeks, with the intuitive interface requiring minimal training. The responsive support team helps with any questions. The 14-day free trial requires no credit card. The platform includes robust import capabilities for transitioning client data from Excel or CSV files.

TaxDome‘s pricing starts at $66/month ($800/year) for the Essentials plan, requiring annual commitment upfront. No discounts. Like Financial Cents, TaxDome’s monolithic approach requires substantial upfront configuration and training.

Its implementation experiences vary widely.

While TaxDome offers intensive bootcamp programs promising setup in days, many users report spending weeks refining their pipelines, automating workflows, and training staff. The platform includes extensive training resources and the TaxDome Academy. For firms ready to invest the time, the comprehensive features can deliver significant ROI.

Uku revolutionizes implementation with its modular approach, enabling firms to start working on day one. Unlike the monolithic deployment of competitors, users can activate only needed modules and scale gradually.

Starting at $38/month ($456/year) for team plans, Uku offers monthly flexibility instead of annual commitments. The 14-day free trial gives full access to the Elite plan features, and ultra-fast onboarding means firms can import their existing client data from Excel files and begin working immediately. Crucially, Uku includes 90 minutes of free onboarding assistance, dramatically reducing the hidden costs of setup and training. This modular approach addresses accountants’ risk aversion and fear of lengthy software implementations.

Document management and security considerations

In an industry built on sensitive financial data, security and document handling matter.

Financial Cents provides comprehensive document management with unlimited storage included in all plans.

Files are stored securely with bank-level encryption (AES-256), but no Soc 2 compliance and the platform offers two-factor authentication. Integration with Google Drive, OneDrive, and SmartVault expands capabilities. They recently added AI features for checklist and email generation, though not for document organization.

TaxDome goes all-in on documents.

Unlimited storage is included in all plans, backed by SOC 2 Type II compliance. The standout document management feature is TaxDome AI, which automatically renames and organizes client-uploaded files. The TaxDome Drive feature lets you access all documents from your desktop without using local storage.

With detailed audit trails and granular permissions, TaxDome is built for firms with complex compliance requirements.

Uku provides document storage with customizable folder templates.

Unlimited storage and the platform uses AES-256 encryption, has Soc 2 compliance and hosts data in enterprise-grade German (EU) servers, appealing to privacy-conscious firms. While Uku offers cloud integrations with Google Drive, OneDrive, and SharePoint, it does not currently offer a desktop virtual drive feature.

What sets Uku apart is how documents integrate with the unified task system (all documents related to a client request are automatically organized within that task, accessible to both client and accountant).

Most importantly, Uku stands out as the only solution allowing documents to be submitted for digitalization with a single click, sending them directly into accounting software. Neither Financial Cents nor TaxDome offers this level of automation for document handling.

Reporting and insights show platform maturity

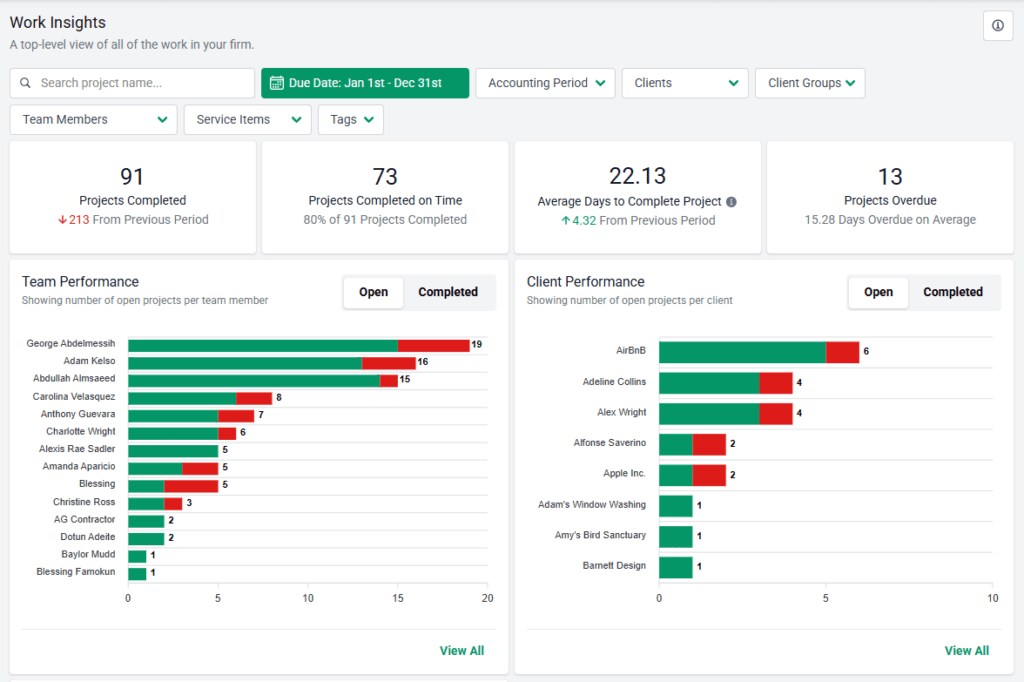

Financial Cents delivers comprehensive reports that balance depth with usability.

Its Budget Report shows which clients exceed allocated time, the Realization Report calculates true profitability including labor costs, and the Work Insights Report identifies workflow bottlenecks. These reports provide actionable insights without overwhelming users with excessive options.

Source: Financial Cents

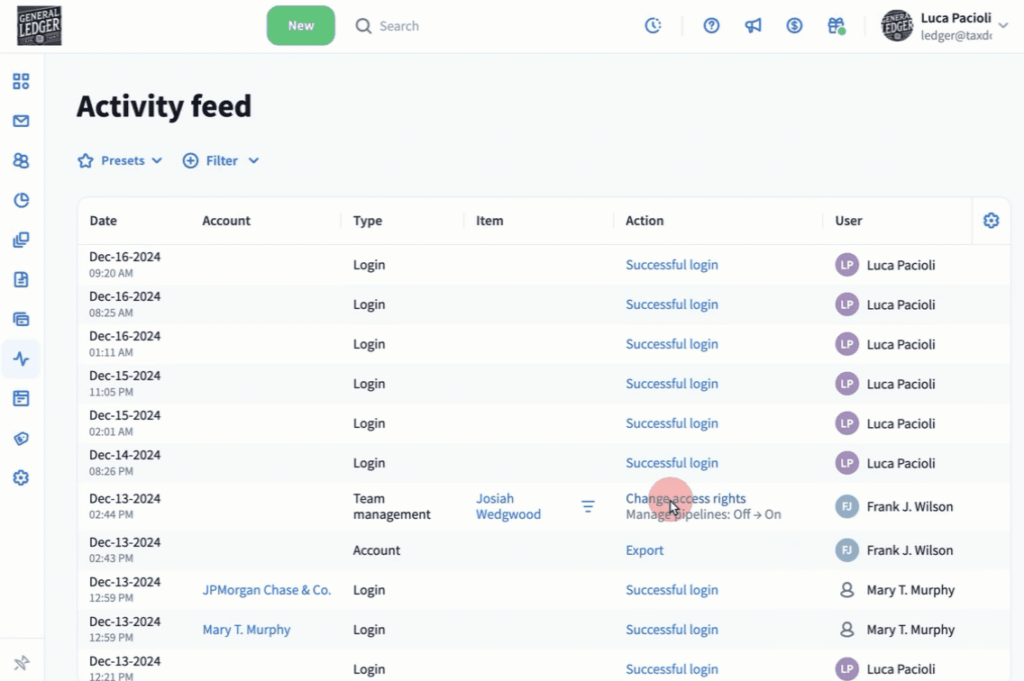

TaxDome provides extensive reporting befitting its comprehensive approach. Beyond standard time and profitability reports, it offers AI-driven analytics, capacity planning tools, and detailed audit trails. The Business plan includes a 365-day activity feed for complete historical analysis. Some users find the wealth of reporting options overwhelming initially.

Source: TaxDome

Uku turns reporting into competitive advantage through comprehensive Reporting & Analysis features.

Beyond Client Agreement Monitoring that automatically compares contracted work against actual delivery, Uku provides a more transparent and comprehensive view with deep filters, saved report templates, and three levels of depth: summary, tasks, and time. The system generates visual indicators showing when clients are over or under budget, helping firms make timely adjustments.

Users often report that Uku’s reports directly inform pricing decisions and help identify outdated agreements where profitability has eroded. The upcoming BI reporting features will provide additional visual analytics to further enhance decision-making capabilities.

Which platform should you choose?

The choice depends on your firm’s current reality and future ambitions.

Choose Financial Cents if:

- You’re a US or Canada-based firm (Financial Cents doesn’t support other markets)

- You’re a small firm prioritizing quick implementation over advanced features

- Your workflows and billing are relatively straightforward

- You value intuitive design and minimal learning curve

- Budget is a primary concern at $49/month ($588/year) for teams

- You want solid automation without overwhelming complexity

- You don’t need Xero integration (only QuickBooks Online is supported)

Start your Financial Cents journey here.

Choose TaxDome if:

- You’re ready to invest time in a comprehensive digital transformation

- You want to replace multiple tools with one platform

- Your firm has complex workflows requiring conditional logic

- You can commit to annual pricing upfront ($66/month or $800/year for Essentials)

- You need advanced features like AI document organization

Look into TaxDome’s all-in-one platform.

Choose Uku if:

- You’re a growing firm ready to transition from Excel and value ultra-fast onboarding and modular scaling

- You need sophisticated automated billing that handles complex pricing

- You want to improve profitability through better insights

- Your team values genuine ease of use with powerful features

- You prefer monthly payments and modular feature adoption

- You need a system to minimize admin time your team will actually enjoy using

- You need multilingual or multi-currency support

Experience automated billing excellence with Uku’s 14-day free trial!

The practice management landscape in 2026 offers clear choices.

Financial Cents champions simplicity and affordability with surprisingly robust features for US and Canada-based firms. TaxDome delivers comprehensive power for those willing to master its complexity. And Uku proves that sophisticated automation doesn’t require months of implementation (with their Excel import and automated billing engine, growing firms can transform their practice management quickly while discovering profit opportunities through better agreement monitoring and automated billing).