Accounting newsletters are rarely the things that make your coffee taste better or your inbox exciting. Most of the time, they are dusty updates that seem like someone copy-pasted a regulatory manual and hit send. That is exactly why the right accounting newsletters are precious – they make clients feel smarter than they did yesterday.

This article explores 11 accounting newsletters that deliver this exact experience. Each one shows how a simple format becomes a client favorite through voice and structure. Plus, we will also give you 6 strategies to help create your own newsletter that gets read and talked about.

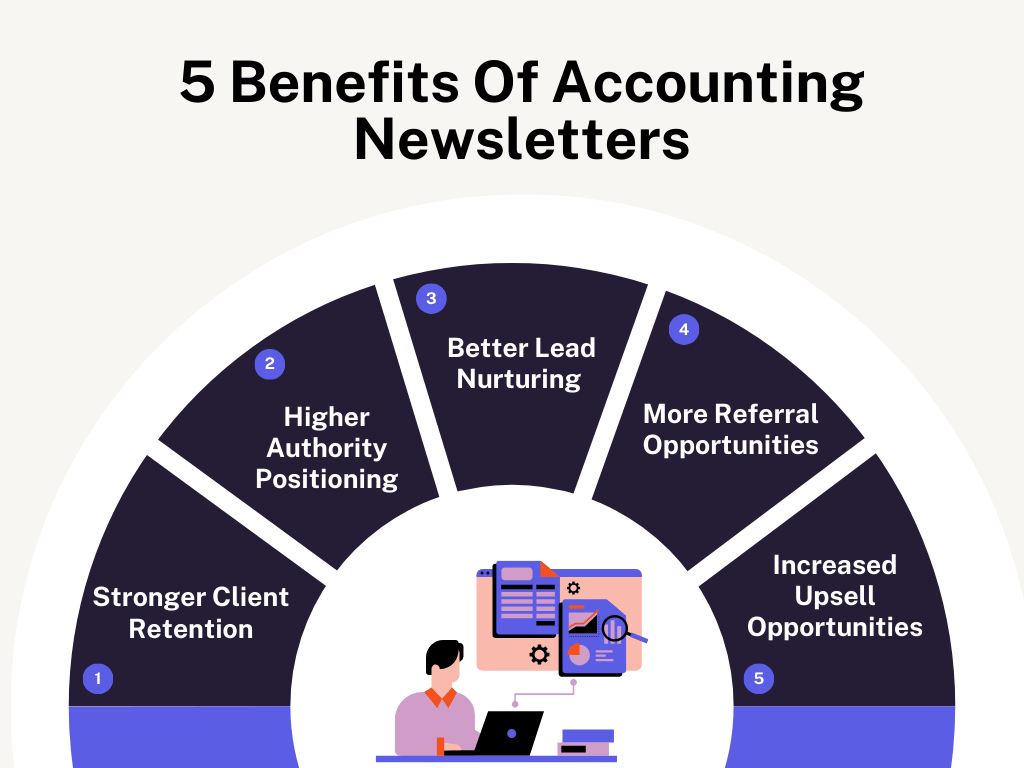

Why Accounting Newsletters Matter To Your Firm: 5 Key Benefits

Let’s get into the 5 ways accounting newsletters actually help your firm day-to-day.

1. Stronger Client Retention With Consistent Value Drops

Clients don’t stay with you because of a contract. They stick around because they feel your value every single month. Your newsletter gives them quick hits of useful info they can apply right away. A deadline shift. A small ATO change. A quick fix for a mistake they didn’t know they were making.

These drops remind them that you are paying attention even when they aren’t asking for help. That presence builds loyalty faster than any fancy retention tactic.

2. Higher Authority Positioning In Your Industry

Clients – and potential clients – take you more seriously when your insights show up before everyone else’s. A newsletter gives you the space to explain what is happening and what people should prepare for. You start sounding like someone who sees around corners, and that makes your name carry weight inside your niche.

3. Better Lead Nurturing For Prospects Still Deciding

Some prospects stay in the “thinking about it” phase for a long time. Your newsletter keeps them warm without pressure. They read your breakdowns, your little nuggets, your practical tips, and they slowly understand the way you think. When they finally want a firm that is steady, you are already in their mind.

4. More Referral Opportunities From Newsletter Sharing

People share anything that solves a problem fast. A clear breakdown of a complex rule. A reminder that saves someone a fine. A short explanation that cleans up confusion inside a team.

When your content does that, clients forward it instantly. Those forwards bring you new leads that tend to convert faster because they come with a built-in recommendation. People are already seeing your value before you even meet them.

5. Increased Upsell Opportunities Across Your Service Line

Clients only buy what they remember you offer. Your newsletter gives you an easy way to highlight services without a sales push. A short note about payroll help. A line about advisory sessions. A reminder about EOFY reviews.

Over 25% of firms that use newsletters this way have reported major profit growth, and it is easy to see why – these small mentions create natural upsell moments because clients see the right service at the right time.

11 Value-Packed Accounting Newsletters Clients Keep Coming Back To

There aren’t many accounting newsletters people actually look forward to, but these 11 somehow pull it off. Let’s take a look.

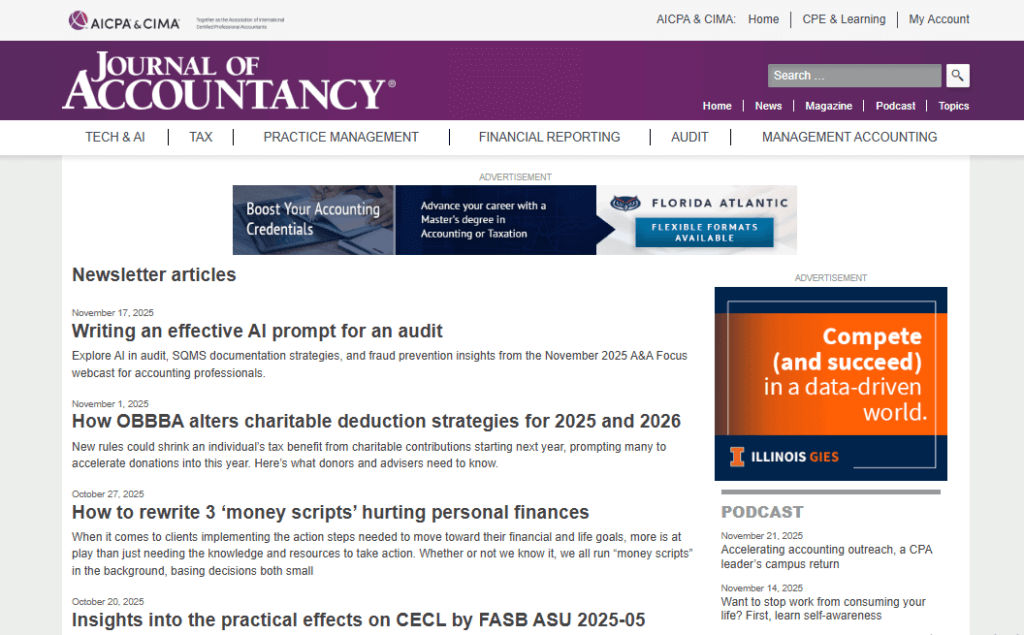

1. Journal Of Accountancy

Journal Of Accountancy is the AICPA’s flagship newsletter hub, and it is gold for deep insight into the accounting profession. Their newsletters cover everything from tax law changes to governance issues.

- You will get in‑depth analysis, not just headlines – like practical strategies for auditing or fraud prevention.

- There is also A&A (Accounting & Auditing) Focus content – webcasts, exposure draft breakdowns, emerging issues like AI in audits.

- For academics or firms working with educators, they even have a “Digital Syllabus” newsletter, which helps professors create more engaging and up-to-date course materials.

Bottom Line: This newsletter is ideal for serious accountants who want technical depth and strategic updates.

2. Accounting Today

Accounting Today is more of a fast-moving news stream – super versatile, and useful for both daily updates and niche deep dives.

- You pick your topics: technology, tax, audit, practice management – via their “Preferences” settings.

- News arrives regularly (“Daily Briefing” for weekdays), but you can also subscribe to things like “IRS Watch” or “Audit & Accounting,” depending on what matters for your clients.

- What you get: breaking news, regulatory updates, expert commentary, and analysis on how regulatory changes (like AI, M&A, tax reform) could affect CPA firms or clients’ businesses. This includes areas like S-Corp basis adjustments, 199A changes, and short-term rental cost segregation when it hits the spotlight.

Why Clients Love It: It is current and actionable – you don’t have to follow everything, just what is relevant to you.

3. Jason On Firms

Jason On Firms is a weekly newsletter by CPA and former firm‑owner Jason Staats. It delivers straight talk about running accounting firms – all written for practitioners, not theorists. The content stays sharp and actionable, nothing extra you don’t need.

- It is a full, independent comparison of top practice‑management systems (14 leading platforms, 200+ features reviewed) – great when you are picking or switching software.

- You get weekly updates (sent every Thursday) on accounting tech, automation, bookkeeping, tax, and firm strategy based on what is trending right now.

- The newsletter provides real insights from someone who ran a 40‑person firm – lessons on scaling, firm structure, avoiding common pitfalls.

Why Clients Love It: You get hard‑hitting and real‑world advice for building a firm that runs smoothly. It has everything you need when you are handling clients and growth.

4. CPA Practice Advisor

CPA Practice Advisor is all about practical tech solutions + practice management for accounting professionals. Packed with real-world advice, this newsletter shows you how to streamline processes and get more out of your software.

- Focus is heavily on technology – cloud accounting, software reviews, tools for automation

- They also run through practice management topics: how to structure your CPA firm, HR, billing, CPA firm strategy, etc.

- Regular columns (written by actual CPAs) give valuable insights into things like staffing (“Staffing & HR Advisor”) and tech adoption (“Technology IN Practice”).

Best For: Accounting firms that want to modernize or scale – clients who are less about “just tax” and more about the business of accounting.

5. Future Firm

Future Firm is a goal‑oriented newsletter from CPA and firm founder Ryan Lazanis. It sends two short emails per week to help firm owners scale smarter – with less burnout and more freedom.

- You will get tactics to systematize your firm – pricing strategies and advice on how to stop working nights and weekends while growing revenue.

- It provides guidance on building a self‑sustaining team – from hiring templates to delegation frameworks to real-life stories from other firm owners.

- You will also see marketing, automation, and workflow‑optimization tips.

Why You Need This: You get a clear, no-nonsense guide every week – packed with strategies you can actually use to grow your firm without working yourself into the ground.

6. KPMG TaxNewsFlash

If tax is your focus (or a big part of your client work), KPMG TaxNewsFlash is a must. It gives super timely alerts on legislative and regulatory developments.

- They deliver updates often – sometimes within hours of major U.S. federal or state tax changes.

- There are international and industry‑specific editions, so you can pick what matters – global tax, state tax, trade/customs, exempt organizations, and more.

- They also run a “Week in Tax” summary, which is perfect for catching up on the biggest developments without having to read every alert.

Why This Matters: Clients (or your firm) who get this can act fast on important tax changes and advise with confidence.

7. Deloitte Accounting & Financial Reporting Newsletter

Deloitte Accounting & Financial Reporting Newsletter is more heavyweight, technical + strategic. It is a collection of perspectives and deep dives on accounting and financial reporting.

- Resources include GAAP updates, IFRS, non-GAAP frameworks, financial reporting trends, and guidance on how to interpret standards.

- They usually include perspectives from Deloitte’s own thought leaders. This means these are not just news summaries but analyses with business implications.

- Their content is useful for big clients, CFOs, corporate accountants, advisory teams – anyone who needs to stay ahead of reporting risk and transparency.

For Firms: This newsletter gives your clients insight into what the top accounting advisors think, which helps them trust your advice and see that you are on the same level.

8. AICPA Tax Section Newsletter

AICPA Tax Section Newsletter is a weekly e‑newsletter just for Tax Section members, packed with seriously technical yet practical knowledge.

- You will see trending issues in tax advocacy, IRS procedure updates, and international tax shifts.

- They highlight planning strategies: how to handle big-picture tax law changes, but also how to use tools and checklists to plan smarter.

- Because it is a “Section members only” tool, the content is for real tax professionals – not generalists.

- Bonus: tax practitioners get access to CPE‑relevant webcasts through their membership.

Why Clients Appreciate It: It proves you know the nitty-gritty of tax. Share it with clients, and they will see that you are ahead.

9. AccountantsWorld Daily Newsletter

AccountantsWorld Daily Newsletter is your trusted source for everyday accounting + tax + technology news. Each day, they send the top 5 stories, plus tools and practical advice for running a firm efficiently. Tax, tech, practice management – it is all curated so you don’t waste time.

- Delivered every weekday, so it is consistent but not overwhelming.

- They select 5 major stories each day, plus a “Top 5 Most-Read” list, plus practical tools (“Tools of the Trade”), and even a light “E-break” for fun.

- They balance their own branded content and advertisements carefully.

Why Clients Love It: This is perfect when you want to give clients (or employees) a steady stream of broad yet relevant accounting news.

10. The CPA Journal Newsletter

The CPA Journal Newsletter is for the thinkers of the accounting world. It has essays and analysis that make clients feel like you are thinking bigger than just the next tax deadline.

- It leans into long-form thinking – essays, research pieces, and analysis that actually connect dots rather than repeating news already floating around LinkedIn.

- Recent themes discuss AI’s influence on audit quality and the long-arc direction of U.S. tax policy that most business owners don’t have on their radar yet.

- You will also see deep dives into topics that rarely get airtime.

Why Clients Respond to It: This newsletter signals strategic thinking – the kind clients rely on when they want to stay informed beyond tax season.

11. AccountingWEB Daily Updates

AccountingWEB Daily Updates is the all-in-one daily feed for accountants who want everything in one place. It is the kind of newsletter that makes clients feel smarter just by reading it.

- Every day, you get a mix of content – tax news, business updates, practice‑management insight, accounting technology.

- They have recently shifted away from “tax Monday, tech Thursday” structure, so each newsletter is more flexible and relevant.

- Their breaking news and “pick of the week” sections keep you updated about regulation shifts or big business‑finance stories.

- They also include timely updates for live webinars (AccountingWEB Live) plus practical AI insights every two weeks.

Why Clients Keep Reading: Because it is real and exactly what accountants and finance teams need to be sharp – not just for compliance, but for strategy and long-term growth.

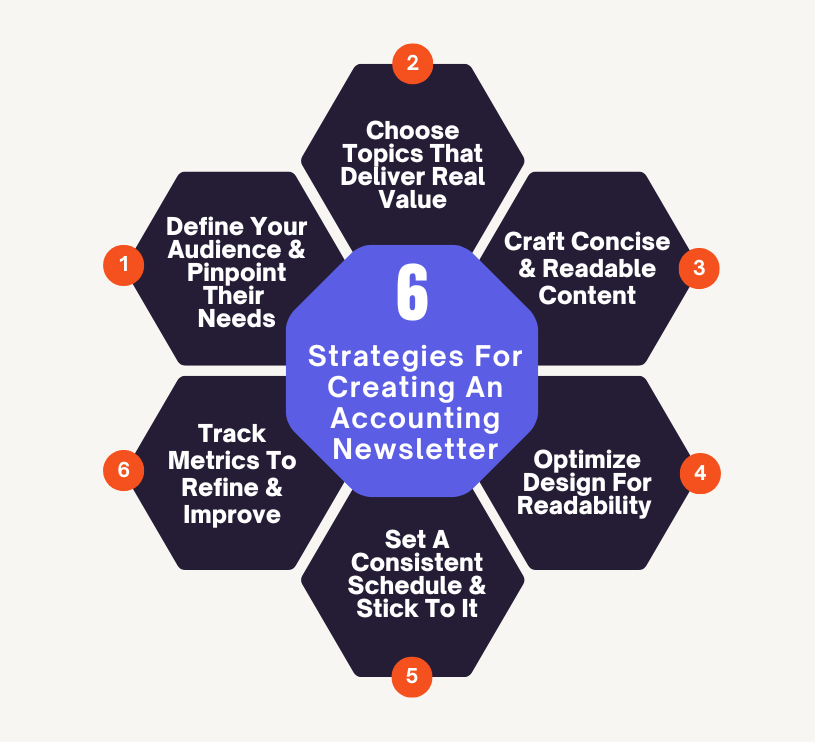

How To Create Your Own Value-Packed Accounting Newsletter: 6 Easy-To-Follow Strategies

Making a newsletter that clients actually read isn’t as hard as it sounds, but it does take a little strategy. Here are 6 simple steps to make yours worth opening every time.

1. Define Your Audience & Pinpoint Their Needs

You want to know exactly whose inbox you are showing up in. Different types of clients read newsletters in completely different ways.

A construction business owner scans for cash-flow timing and job-cost issues. They care about retention schedules and whether their project pipeline will strain next month’s liquidity. Their newsletter needs revolve around real operational pressure, not general tax chatter.

And then there is a totally different clientele, like this sewing machines e-store. They handle thousands of SKUs, and every item has its own demand pattern. Their team deals with suppliers who change lead times without warning. They often see inventory pile up in one category while another category sells out.

So their team wants clarity on clean inventory valuation and simple guidance that helps them keep margins stable without slowing operations. They need an accounting newsletter that breaks down how to classify slow-moving stock correctly, how to use real-time sales data to adjust COGS reporting, and how to forecast tax exposure when inventory swings sharply.

This contrast shows why defining your audience is the strongest starting point. People do not consume information the same way. Each type of business reads your accounting newsletter through the lens of its own pressure points. Once you know the patterns, choosing content becomes almost automatic.

What to Do:

- Build a one-page profile – industry, typical revenue, financial literacy level, and what stresses them out financially every quarter.

- Pull the last 3 months of client conversations and find the questions that repeat across calls – those become priority content buckets.

- Map out the 3 financial decisions your target reader makes every month. Write content for those decisions directly.

- Identify which regulations or filing rules affect their business type specifically, not general accounting rules.

- Call or email 3 clients and ask what they wish someone had explained more clearly. Use their exact words for your content direction.

2. Choose Topics That Deliver Real Client Value

Topics shouldn’t come from your brain – they should come from things that affect real money or real time. Personalizing content for your clients’ pain points or recent interactions can increase conversions by 25%. A good accounting newsletter makes the reader feel like “you just handed me something that saves me work” instead of “you told me something I already saw on Google.”

What to Do:

- Pick issues tied to actual triggers: an IRS update, a payroll change, a sales tax nuance.

- Break down invisible operational problems like unreviewed AP aging, sloppy expense categorization, underused deductions, or outdated bookkeeping processes.

- Add short “before vs. after” explanations showing how a change affects cash flow or compliance.

- Include one short scenario per topic – something your clients will recognize, like “If you’re paying contractors in multiple states…”

- Build a rotating content cycle: tax planning, cash-flow clarity, accounting tech, compliance reminders, and one long-term planning tip.

3. Craft Concise & Readable Content

Readable does not mean short – it means the reader is never lost. Your job is to take complex accounting information and present it like a friend explaining something over lunch. Clients should feel like they understand the point immediately. Your structure and tone matter more than word count.

What to Do:

- Break topics into short pieces – one idea per paragraph, 2-3 sentences max.

- Define technical terms in simple words (“Think of this like…” or “In plain terms, this affects…”) without using metaphors you hate.

- Add small clarity labels like “Quick Context,” “Where This Matters,” “Two Things To Do Now.”

- Lead with the outcome first. Tell them what changed or what they need to know, then explain the details.

- End every section with one takeaway. Something they can apply that same day.

4. Optimize Design For Readability & Engagement

Design affects whether someone reads the whole thing or taps out halfway. You want an email layout that is clean and predictable. Over 25% of people in your audience deal with reduced eyesight or screen-fatigue, so simple formatting helps them stay with you. When the structure is consistent, readers know exactly where to look for the most helpful bits – and they read more.

What to Do:

- Use a simple two-section structure – short update at the top, actionable items below.

- Pick a legible font size (minimum 15–16px) and consistent spacing between sections so your layout never looks cramped.

- Add small visual anchors like dividers or bolded headers to guide the eye naturally.

- Keep your CTA clean and helpful – “Need help applying this to your business? Reply, and I’ll walk you through it.”

- Use one highlight box (“Important This Month”) for high-impact items your clients can’t afford to miss.

5. Set A Consistent Schedule & Stick To It

Clients don’t trust sporadic communication. When your newsletter arrives on the same day every week or month, it becomes part of their mental rhythm. You train them to expect clarity and updates at predictable intervals. This builds familiarity, which helps retain customers.

What to Do:

- Choose a cadence you can maintain long-term – weekly for short updates, monthly for deeper issues, bi-weekly if you want a balance.

- Keep each issue roughly the same length so clients know what to expect.

- Build a 90-day content calendar with placeholders so you never look for topics.

- Set up an automated mass notification system so your firm never misses a scheduled send, especially during tax season or audit periods. Your clients see steady communication even when your bandwidth dips.

- Create a saved folder of evergreen topics for slow months or emergency weeks.

- Draft a loose outline for the next issue immediately after sending one.

6. Track Metrics To Refine & Improve Future Issues

Your newsletter gets better each month when you listen to what the numbers are telling you. Opens tell you if your subject line worked. Clicks show where the client’s curiosity is. Replies tell you which topics hit a nerve.

What to Do:

- Watch which topics earn the highest open rates – these tell you what immediately grabs attention.

- Monitor link clicks to see the concepts clients want deeper guidance on (usually tax planning, payroll, or cash flow).

- Use scroll-depth data to identify where readers drop off – then tighten that section in the next issue.

- Track replies and follow-up questions – this is the clearest indicator of what hit home.

- Review performance every 30 days and adjust your upcoming topics based on the top-performing patterns.

- Hire a financial performance analyst to interpret your data. They can spot patterns you’d miss and show you what clients actually care about. This keeps your newsletter data-driven instead of gut-driven, and helps you plan issues that align with real demand.

Conclusion

Accounting newsletters aren’t just emails you send because you “should.” Think of them as a way to show up in your clients’ lives without asking for anything in return. Take the structure and energy you saw in these 11 examples and build your own version for success.

Use the topics your clients already come to you for. Wrap everything in concise writing. Deliver it consistently. Once you do that, your accounting newsletters become something clients read and pass along – which is exactly the impact you want.

At Uku, we have built software specifically for accounting and bookkeeping firms that want to do more with less. With it, you automate billing – time tracking converts into client invoices, and you can send them out directly from your domain. Our workflow automation means your recurring tasks, checklists, and even client onboarding happen automatically.

Getting documents from clients becomes way less of a headache, too – our Client Portal lets you assign tasks, collect files, and send reminders without a million back‑and‑forth emails.

If you want to see how it works, you can take a product tour or book a free demo right now.