Most accounting firms are not losing money because of “bad pricing.”

They’re losing it quietly in the gap between what was agreed and what actually gets done.

That gap is where revenue disappears, capacity gets eaten, and your team starts doing more work while feeling awkward about charging for it.

The pattern is always the same

A client relationship starts with a defined scope.

Then reality kicks in.

Extra reports.

Extra calls.

Extra “quick fixes.”

Extra follow-ups because documents are missing again.

None of these things feel big in the moment. They often come from good intentions: being helpful, being responsive, keeping the relationship warm.

But over time, these exceptions stop being exceptions. They become “normal service.”

And “normal service” rarely reaches the invoice.

Why this hurts more than it seems

Scope creep doesn’t just reduce revenue. It also creates two long-term problems:

1) You lose visibility into profitability.

If you can’t clearly see where time is going, you can’t confidently decide which clients need a scope reset, which need a different fee model, or which simply don’t fit anymore.

2) Your team carries more risk.

More tasks means more places for mistakes and missed deadlines. In accounting, a “small error” can quickly turn into a big client issue.

And yet many firms hesitate to correct pricing because they assume clients will leave.

In practice, that’s usually not what happens.

Clients rarely leave because you made a fair price correction based on real workload.

They leave when the service feels sloppy, late, or distant.

The simplest way to stop the leak: compare agreements vs. actual workload

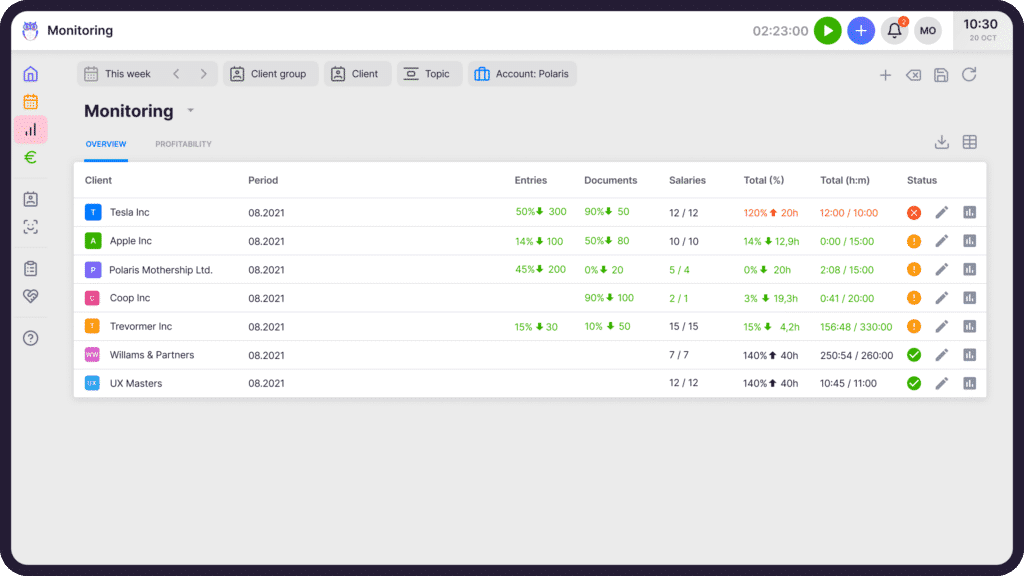

When firms move their billing into Uku and start visualizing what was agreed versus what actually gets done, something interesting happens.

They often recover around 15% of revenue.

Not by signing new clients.

Not by randomly raising hourly rates.

Simply by making sure billed work matches delivered work.

Because once the gap becomes visible, you can finally act on it.

You can fix it calmly, with data, and with the right clients.

Where I see the real opportunity in 2026

If you lead an accounting firm, these are the moves that will matter most over the next year.

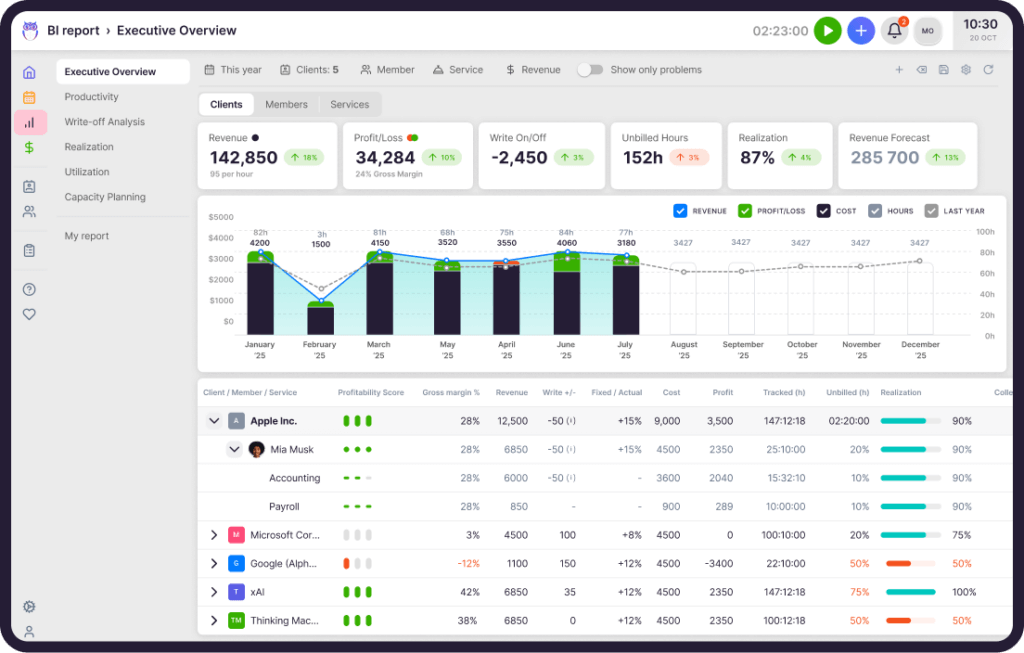

1) Make the invisible visible

You don’t need complicated analytics to start. Basic BI views can already show you:

- which clients consistently exceed scope

- where your capacity disappears

- which services are quietly “free”

- where margins are shrinking month by month

The goal is not perfect reporting. The goal is clarity you can act on.

2) Stop letting exceptions turn into free standard work

Most scope creep begins as a one-time favor.

The fix is simple, but it requires discipline:

- define what counts as “included”

- define what triggers a scope change

- make exceptions visible internally

- bill for them, or intentionally choose not to and label it clearly

If you don’t label it, you’ll forget it. If you forget it, it becomes standard.

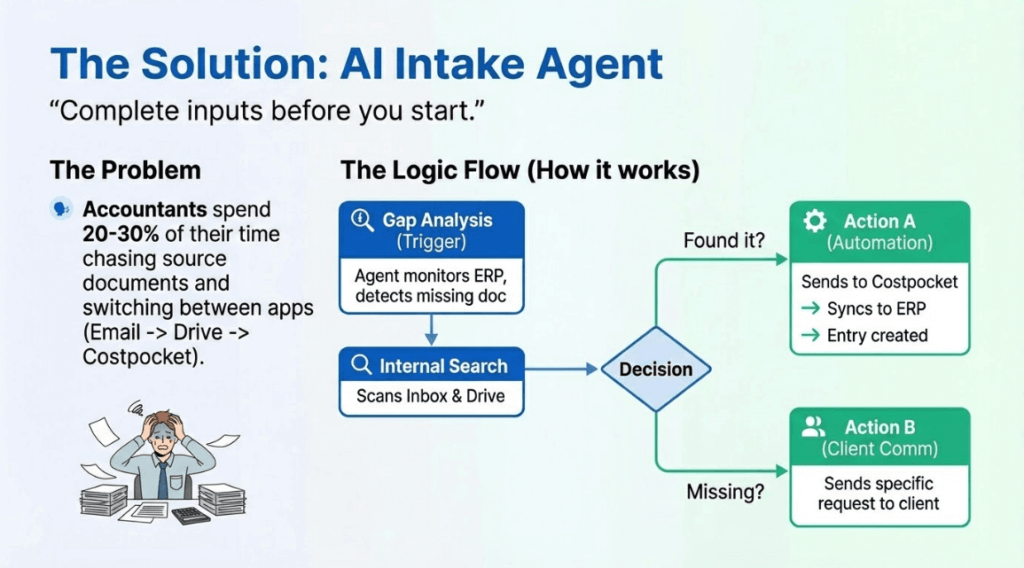

3) Automate intake and follow-ups

A lot of wasted time isn’t “real work.” It’s chasing what should have arrived in the first place.

This is exactly where AI agents can help: missing documents, reminders, follow-ups, status checks.

Not because you want to replace people.

Because you want your people doing the work clients actually value.

4) Teach people skills, not just technical skills

Even with clear data, someone still has to have the conversation.

That means helping your team learn how to:

- explain what changed

- talk about value in a grounded way

- set expectations early

- handle uncomfortable moments without making it personal

The firms that can do this well will be able to charge fairly without drama.

Do this before you promise “more for the same fee”

If you’re feeling pressure to offer more while holding prices steady, pause.

Before you commit to “more for the same fee,” do this instead:

- Audit your agreements and billing

- Identify where the gap is

- Close the leak

- Then use automation to free your team for real advisory work

That order matters.

Because if you automate messy agreements, you don’t get a healthier firm. You just get faster chaos.

PS. Raamatupidaja.ee published my full article as their cover story (in Estonian).