Starting a bookkeeping business is one of the hottest tickets in the small biz world right now. It’s not hype. Professional bookkeepers pull in $40,000+ a month with over 80 recurring clients, each paying roughly $500/month.

You’re probably interested in the guide on how to start a bookkeeping business because it can be wildly profitable. But it is also like signing up to run a marathon on a treadmill that sometimes changes speed without warning. The bookkeeping means you’re deep in numbers, tax codes, and reconciling accounts while your friends might be at happy hour.

Typical speed bumps?

- Many folks are trying to find their first potential clients without a clear business plan.

- They struggle to pick a niche or specialty.

- Get so buried in spreadsheets they forget marketing and selling their services.

- And let’s not forget deep tech stuff that’ll be your daily bread.

Inside this guide on how to make money on bookkeeping you’ll find: what bookkeepers actually do, how to launch smart, plus the best tools to build a thriving practice.

Let’s check if we’re on the same page about the definition👇

What Does a Bookkeeper Do?

Picture this: You’re knee-deep in a client’s tangled dashboard — 10,000 uncategorized transactions blinking like needy toddlers. The real heart of bookkeeping experience is turning spaghetti-coded statements into crystal-clear cash flow stories that drive every smart business decision.

A pro bookkeeper’s typical day?

- Automating transaction imports with a killer tech stack,

- reconciling accounts so the numbers play nice,

- chasing overdue invoices like a silent bounty hunter,

- preparing income statements and balance sheets so owners can sleep,

- and catching subtle errors that would nuke profit margins if left unchecked.

Whether you’re an in-house legend or a public bookkeeper with a portfolio of small biz clients, you’re offering life-saving services that keep the business from accidentally steering off a cliff. You’re also prepping neat packages for the accounting team to do their tax wizardry.

What nobody tells you? If you want to start your own bookkeeping business, these daily rhythms matter big time. They’re how you impress potential clients, showing them you’re the gatekeeper of their financial health.

What is a Bookkeeping Business?

A bookkeeping business is where you build systems to handle the messy money side of other people’s businesses, then sell that clarity as your core service.

Simple, right? But here’s where the magic — and your future profits — actually happens.

When bookkeepers onboard a new ecommerce client, their first hour is pure tech triage. They hook up Stripe, Alidrop, Shopify, PayPal directly into bookkeeper software and spin up custom bank feed rules to auto-tag ad spend, merchant fees, and fulfillment costs. Then, they plug in Dext to scrape invoices straight from their inbox.

These automated, bulletproof flows mean every client knows exactly if they can afford a new hire today, and I don’t spend weekends fixing doubled Stripe payouts.

When you start your own bookkeeping business, this is the foundation. You’re not just pushing numbers around — you’re their CFO-level calm in the storm. You’ll use your accounting know-how and smart tools to catch hidden cash leaks before they sink the ship.

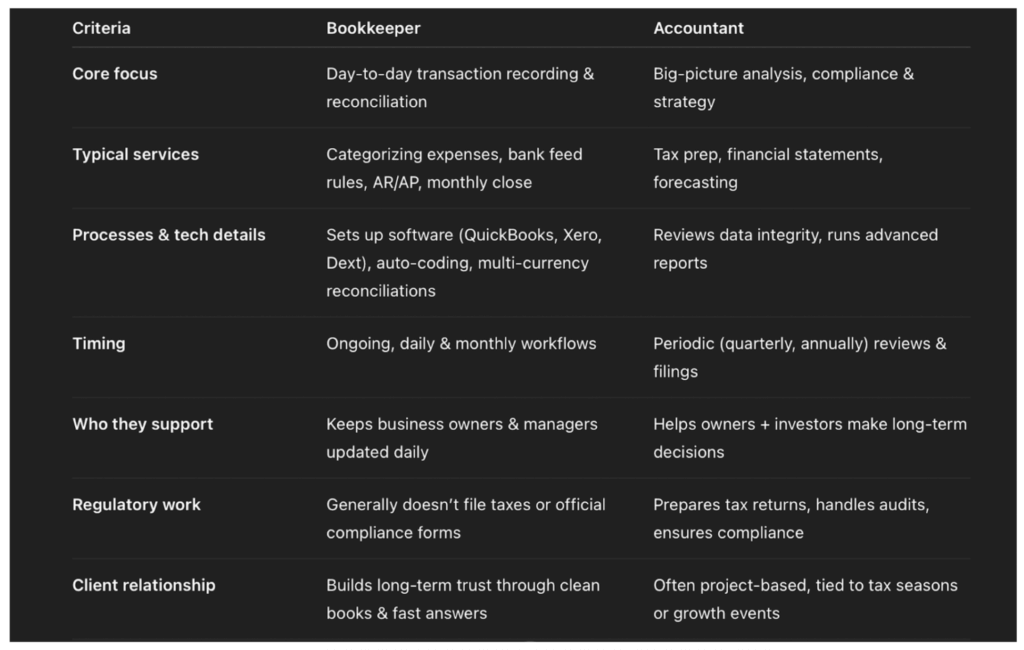

How a bookkeeper is different from an accountant

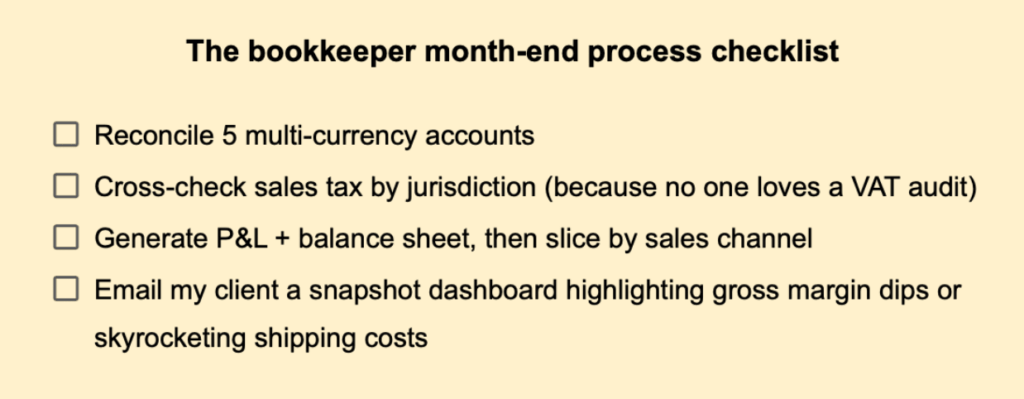

Bookkeeping and accounting play in the same sandbox, but a bookkeeper’s job is to build flawless records: reconciling multi-currency accounts, automating invoice capture in Dext, and running clean month-end closes. That’s the service backbone your client counts on.

Public accountants? They swoop in after to interpret the story — advising on business tax strategy or complex compliance.

When you start your bookkeeping business, your superpower is crafting bulletproof financial data. That means drilling into software rules, spotting duplicate Stripe feeds, and preparing dashboards so an accountant can file taxes without hunting down mysteries.

It’s all laid out in this guide I wish I’d had — because smart customers buying peace of mind that their business runs lean, with zero surprises.

How to Start a Bookkeeping Business in 9 Steps

This guide is stitched together from the trenches by absolute pros like Ben Robinson, BILL’s team strategists. Whether you’re dreaming of a sole proprietorship or building a slick virtual bookkeeping business empire, we’ll break down real workflows 👇

Choose Your Niche and Define Your Target Market

The bookkeeping business begins with carving out your slice of the world so you’re not just another invoice chaser.

Want SaaS startups with complex deferred revenue? Construction business buried in job costing chaos? Shopify stores desperate for real-time COGS? Each niche has unique accounting landmines — and you’ll tweak your software, workflow automations, and service deliverables to solve them.

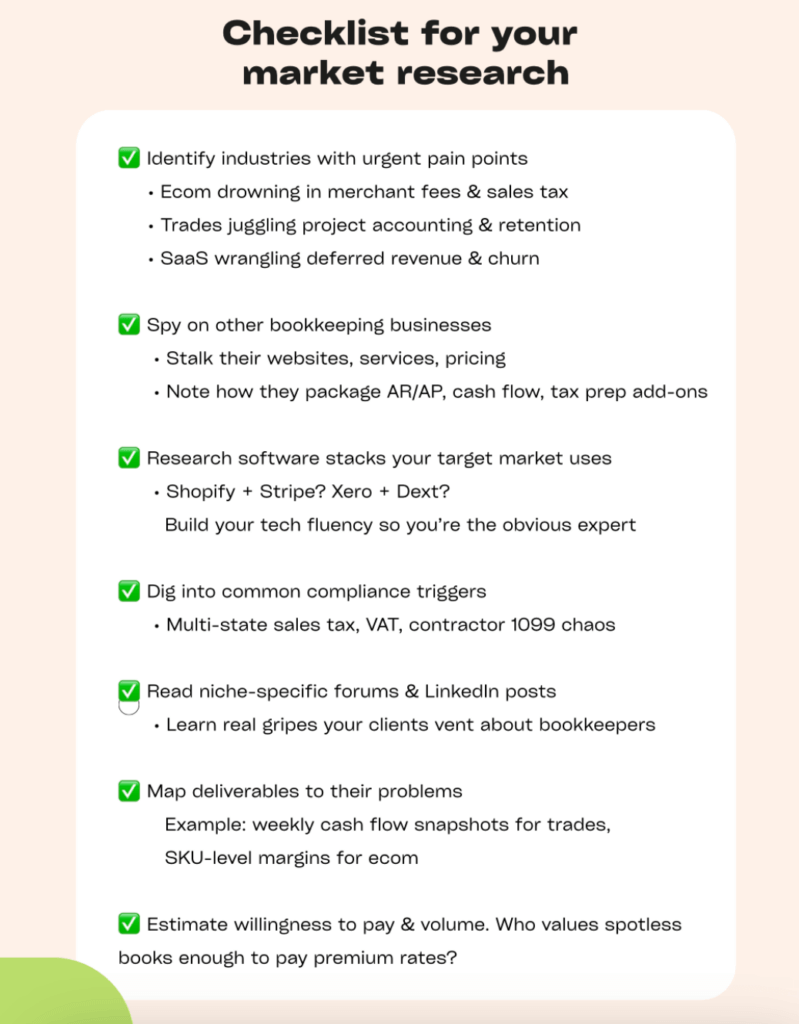

A guide to other bookkeeping businesses market research.

Dial in who your clients are, what services they’d kill for, and how your dashboard snapshots will give their clients spotless experiences. It’s how you’ll start strong, skip the price wars, and build long-term trust that keeps your business growing.

Create a Solid Business Plan

A sharp business plan is non-negotiable. It’s how you stop winging it and start building a practice that grows without devouring your nights.

Sketch out the services you’ll deliver. Are you offering tight AR cleanups, payroll oversight, multi-entity month-end closes? How often will you provide custom business dashboards — weekly operating cash, aged AR, gross margin by SKU? Map these into packages tied to real business outcomes, not generic hours.

Then build forecasts. List your target MRR, average ticket size, client onboarding timelines, plus what tech you’ll rely on to handle the load.

It is your blueprint, so when you lock in your business structure next, it all clicks into place. That’s how you design a bookkeeping life you actually want to live.

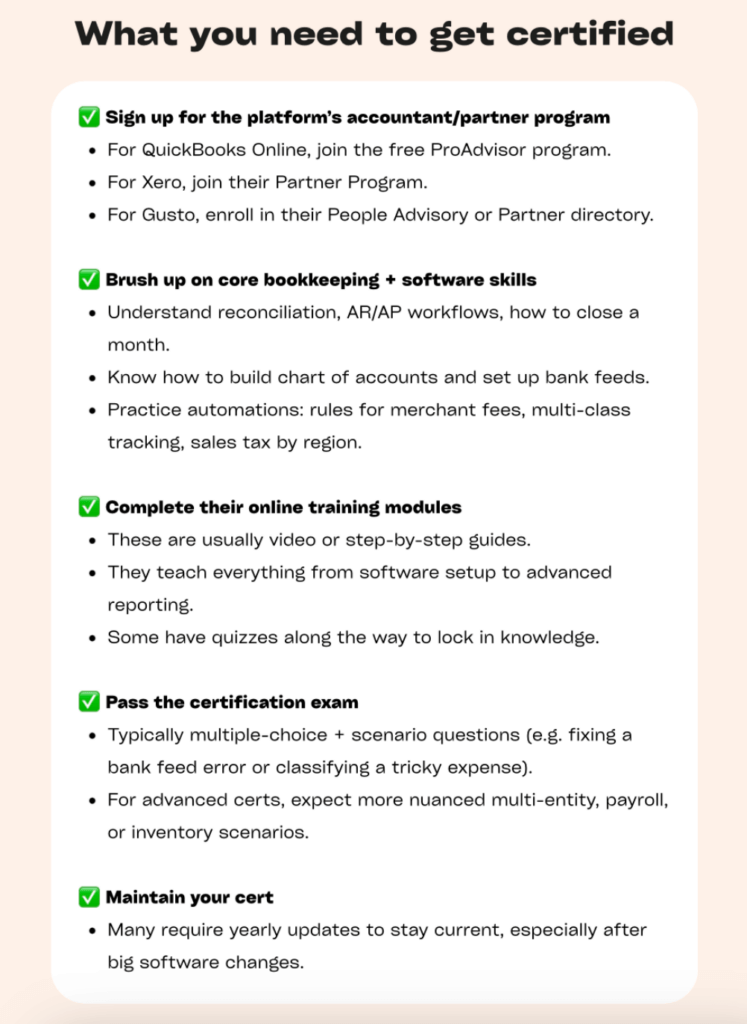

Get Certification for Your Bookkeeping Business

Certification is how serious clients decide you’re the pro to trust when their business working capital movements on the line.

Want ecom brands? Go all-in on QBO Advanced + A2X business certificate so you can auto-reconcile hundreds of daily payouts without breaking a sweat. Serving multiple contractors or agencies? Stack up Xero Advisor plus Hubdoc certs to build bulletproof digital audit trails.

A quick checklist on getting a certificate for your bookkeeping business.

Without it? You’ll burn time (and client patience) Googling chart setups or undoing broken bank feeds.

So pick your tools, block two weeks, and start. If you plan to serve charities or foundations, brushing up on nonprofit bookkeeping best practices can give you an edge with impact-driven clients. Then plaster your certs under your business name on every proposal. It’ll justify premium pricing and show you’re not just offering bookkeeping services — you’re safeguarding their entire accounting universe.

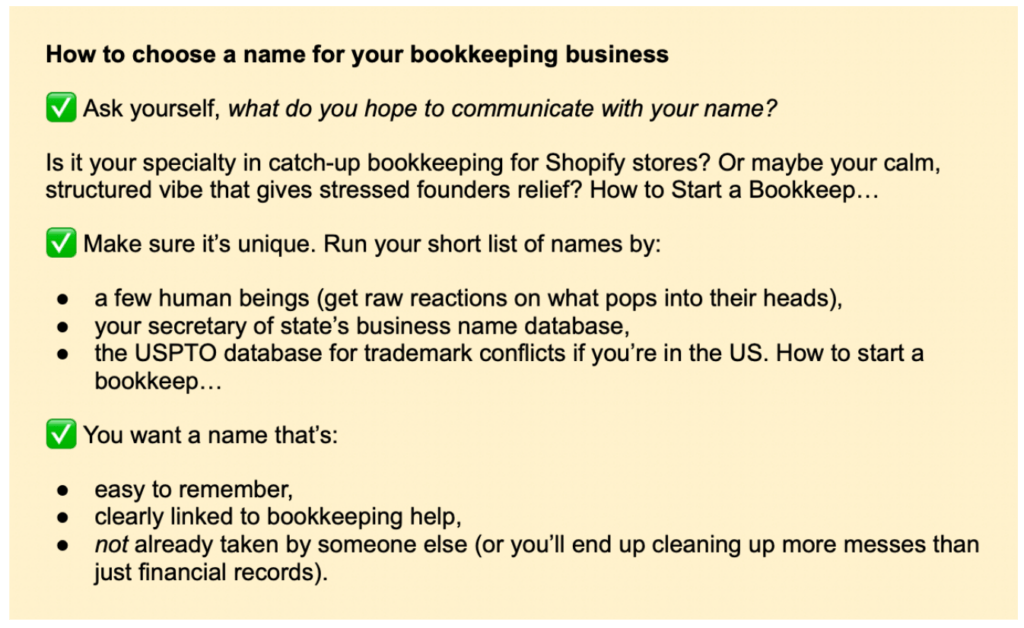

Pick a Business Name and Structure

Make it crystal. Use words that small business owners link with trust and smart tech — think “Precision,” “Cloud,” “Ledger,” or “Virtual.” Check business domain availability, social handles, and run it through your local registry so you’re not slapped with a rebrand right when your AR cleanup packages start flying off the shelf.

Your business structure? If you’re testing the waters, a sole prop gets you to live fast. But if you want to protect personal assets, score tax flexibility, or hire subcontractors for onboarding surge months, an LLC is your move.

Register Your Business and Get Insured

Register your bookkeeping business with your state so your contracts, EIN, and payment processors stay squeaky clean. That EIN unlocks QuickBooks wholesale pricing, direct business payouts, and lets you onboard clients who demand vendor W-9s on file.

Next, lock down liability insurance. Even the slickest successful business can face a nightmare if a missed AR discrepancy tanks a client’s money movement. Look for professional liability (E&O) that covers data entry slip-ups or reconciliation misses.

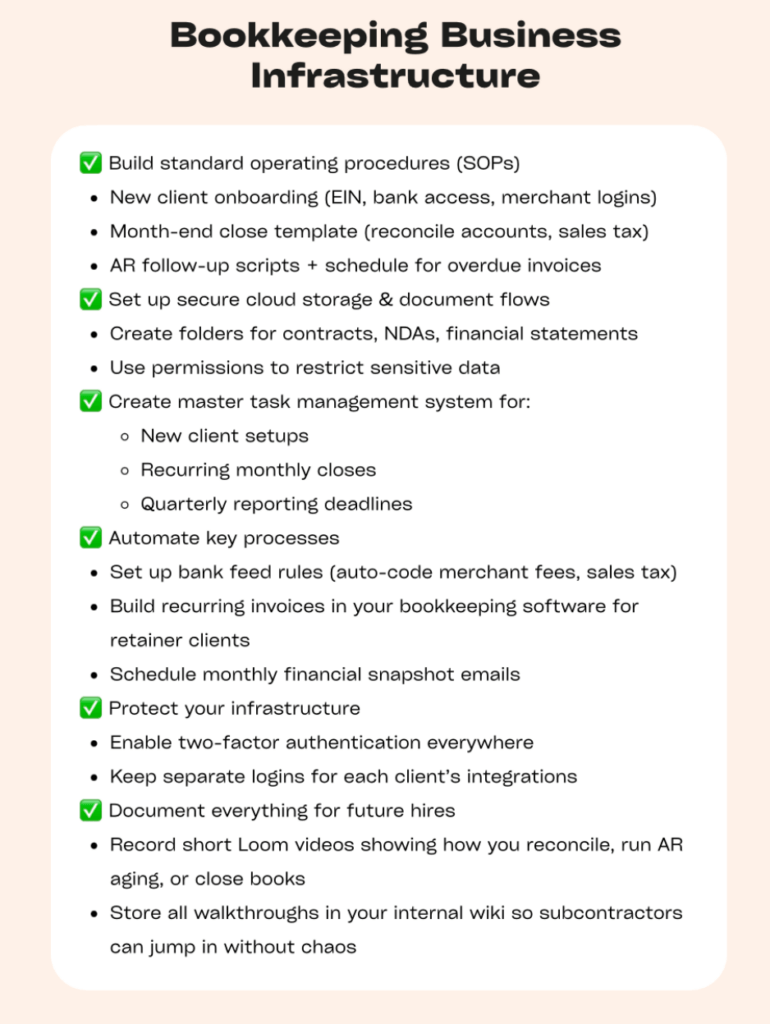

Work on Your Business Infrastructure

Dial in your tech stack first. Are you serving ecommerce? Then integrate QuickBook Online with A2X for auto-coding payouts and Gusto for hands-free payroll. Contractors or creatives? Xero plus Dext to suck receipts straight from inboxes.

Set up a secure cloud doc hub for signed agreements, an SOP for AR follow-ups, month-end close templates, and a master task board in ClickUp or Notion so you never miss reconciling a merchant fee.

Price Your Services

Are you reconciling five bank accounts, running multi-location inventory roll-ups, building AR aging for each entity? That’s a premium. Light cash-based startups with one checking account? Lower tier.

Use your bookkeeping tech to help. Xero or QBO let you pull historic transaction volume so you don’t quote blindly. If you see 3,000 transactions a month, that’s a different ballgame than 200.

Then package it: flat monthly rates tied to clear deliverables. Example:

- Bronze: monthly reconciliations + standard P&L

- Silver: plus financial inflows and outflows forecasting + AR management

- Gold: add inventory tracking + weekly margin insights

Market Your Bookkeeping Business

Build a professional website that highlights your tech edge. List how you clean up multi-currency Xero accounts, automate Shopify payouts in QBO, or run tight AR workflows that cut aging in half.

Here are some top ideas for your marketing plan.

The best marketing strategy hypothesis on how and where to attract new clients:

Think Over Funding Options for Your Bookkeeping Business

Business finances matter just as much as your tech chops.

Many bookkeepers bootstrap — using personal savings to snag a dual monitor setup, a QBO wholesale plan, and a secure cloud stack for your docs. But if your runway’s short or you plan to scale service fast, look at small business loans or micro lines to smooth early financial inflows and outflows.

Next: open a business bank account right now. It keeps your books clean, locks down deductions, and builds credibility for when you go for business credit lines later.

Essential Bookkeeping Software & Services

The right software choice is the base for how you streamline reconciliations, automate AP approvals, and hand your clients crystal-clear finances without burning your weekends. Below are the tools you need to structure bulletproof services that small businesses pay top dollar for.

Bookkeeping Software: Your Daily Workspace

This is the cockpit of your bookkeeping business, where you’ll spend hours fine-tuning financial reports, reconciling accounts, and spotting tiny discrepancies before they torch a client’s incoming and outgoing funds. Your accounting software handles all those essential bookkeeping tasks: pulling in multi-currency bank feeds, auto-matching finances invoices, calculating sales tax across states, and tracking aged AR so no invoice slips into oblivion.

Top contenders in the market are QuickBooks Online, Xero, and FreshBooks.

Communication and Document Sharing with Сustomers

These business tools handle your communication services: secure portals where clients upload invoices, direct messaging threads for quick AR questions, and e-signature steps that keep every authorization on record.

And don’t skip building a centralized knowledge base — it can be a specialized platform or even a Notion hub or private Google Site — with a short “how-to” on uploading statements, or your month-end steps. It stops endless “how do I send this?” emails that burn your mornings.

Deep tech tip: pair your doc hub with bank-level encryption portals so no P&L or payroll file floats through unsecured inboxes.

Practice Management & Workflow Tools

Tools like UKU run your client database management — tracking who needs a bank feed fix, who’s overdue on sending payroll hours, and who you promised a new incoming and outgoing funds forecast by Friday.

UKU dashboard with a list of consumers data for pro bookkeeping experts.

They’re also how you standardize repeatable tasks: like popping up a reminder to chase AR aging over 60 days.

Real magic? They let you systematize your entire tasks — mapping out reconciliation sign-offs, quarterly tax-ready package deadlines, even prepping doc requests before year-end chaos hits.

Your Website and Online Presence

Website shows exactly what bookkeeping services you offer, the software you master, and filters leads so you only talk to serious consumers.

Your site’s intake forms gather transaction volumes and payroll needs upfront — so you spot if it’s a quick cleanup or a deep rebuild before the first call.

Optimize pages for niche searches like “multi-entity working capital movements bookkeeping” to pull in business owners ready to pay. It’s how your business starts attracting the right work on autopilot.

Payment and Invoicing Tools

This solution automates recurring invoices, chases late payers with polite nudges, and drops cleared payments right into your business bank account — no manual cross-checks needed.

Inside your financial accounting software, you’ll sync these payments so your P&L stays spotless without hand-reconciling Stripe or PayPal every Friday night. Smart business invoicing platforms let you attach e-sign contracts and break out multi-service lines, so businesses see exactly what they’re paying for.

Banking & Budgeting Tools

These beauties give you live visibility over your own financial records, so you’re not blindsided by quarterly tax estimates or the real cost of that fancy tech bundle. You’ll track every dollar flowing through your ops, spot when margins tighten, and build reserves for lean months.

The smart ones sync directly to your business stack, auto-classifying expenses and even forecasting cash runway.

Using all of those tools and apps requires a lot of space on your device. With software like MacKeeper, you can declutter your macOS device, remove unused apps, get rid of adware and viruses, and, therefore, make your system run smoothly.

To summarize

Want to make money in this niche? Start with building your business plan, nailing workflows, and choosing the accounting software that matches the audience you want. This guide has unpacked exactly how to start a bookkeeping business that runs on clean systems, automates your service, and keeps your cash flowing. Whether it’s setting up your first dashboard or onboarding new clients, remember — the right tech stack plus a solid business foundation will scale your books and your confidence.