TaxDome has established itself as a comprehensive practice management solution serving over 10,000 firms and 30,000 professionals globally. With its all-in-one approach combining CRM, workflow automation, document management, and billing capabilities, it promises to streamline operations for accounting and tax firms of all sizes. However, as practices evaluate their options, many find themselves weighing TaxDome’s extensive features against the complexity of implementation and daily use.

To create this TaxDome review, I’ve analyzed the platform extensively. I believe it’s the ideal choice if:

- You want a truly all-in-one platform with unlimited storage and e-signatures

- You have dedicated resources for implementation and training

- You need advanced workflow automation with pipeline templates

- You’re willing to invest time in mastering a comprehensive system

- You prefer the stability of established platforms with primarily annual billing

However, TaxDome might not be the best choice if:

- You need highly flexible billing automation with complex rounding rules and quantity-based pricing

- You want more collaborative features in the client portal beyond document exchange and chat

- You prefer a modular approach where you can start simple and add features as needed

- You want flexible monthly pricing options across all plan tiers

- You need to customize workflows extensively without technical expertise

In this case, you should consider Uku: a practice management platform that combines powerful automated billing and collaborative features with an accessible interface that teams actually enjoy using. Built for accounting firms that want sophisticated functionality without sacrificing user experience, Uku offers advanced capabilities through a modular approach that adapts to your firm’s growth.

Because of that, I’ve included a detailed look at Uku later in this TaxDome review, as an alternative for firms seeking powerful automation with flexible deployment. If you’re ready to explore a more modular approach to practice management, you can start with Uku’s 14-day free trial.

Table of contents:

- What is TaxDome?

- TaxDome Pros & Cons

- TaxDome Review: How it Works & Key Features

- Where TaxDome Falls Short

- Top TaxDome Alternative for Advanced Billing & Collaboration: Uku

- TaxDome or Uku: Comparison Summary

- Final Verdict

What is TaxDome?

TaxDome was founded in March 2017 by brothers Victor and Ilya Radzinsky. The idea originated approximately eight years prior when the founders developed a custom software system for a tax practice. This system was highly successful, enabling the practice to grow from 10 to over 70 employees by automating tasks, centralizing client communication, and streamlining document management.

Realizing the potential of their solution to benefit other firms, the Radzinsky brothers decided to make their proprietary software commercially available. Their mission is to provide an intuitive, all-in-one cloud-based solution for tax practice management that helps firms of all sizes become more efficient, organized, and profitable.

Today, TaxDome serves over 10,000 firms and 30,000 professionals globally, with a significant presence in the United States, United Kingdom, and Canada. The majority of its customers are small firms with 0-9 employees. The platform positions itself as a comprehensive solution that replaces multiple disparate systems, integrating everything from client management and workflow automation to document storage and billing into a single ecosystem.

TaxDome Pros & Cons

| Pros | Cons |

|---|---|

| ✅ All-in-one platform with comprehensive features | ❌ Steep learning curve and time-consuming setup |

| ✅ Advanced workflow automation with template marketplace | ❌ Less flexible billing automation compared to specialized tools |

| ✅ Unlimited document storage and e-signatures | ❌ Primarily annual billing (limited monthly options) |

| ✅ White-labeled client portal and mobile app | ❌ Client portal focused mainly on document exchange |

| ✅ IRS integration for transcript downloads | ❌ Can become overwhelming for firms transitioning from simpler systems |

TaxDome Review: How it Works & Key Features

Workflow Automation: TaxDome’s Pipeline System

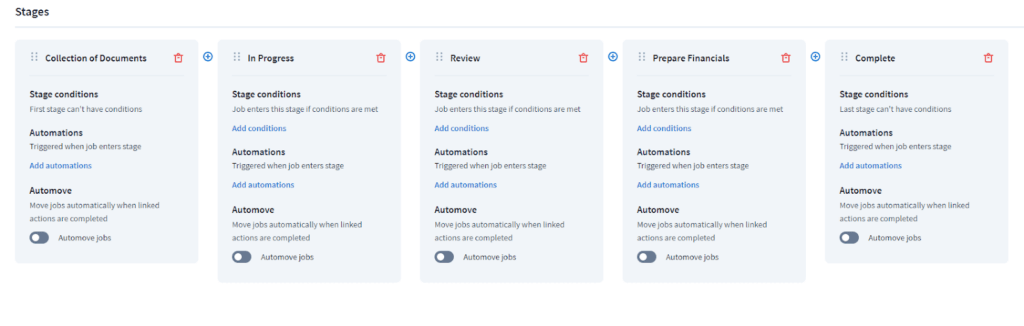

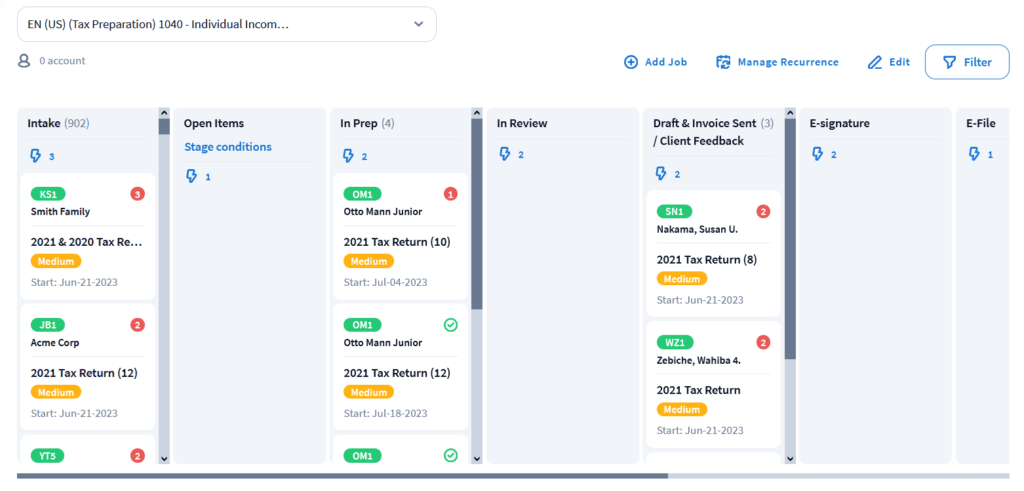

TaxDome’s workflow automation is built around the concept of “pipelines,” which are visual representations of a firm’s workflows for various services like tax preparation, bookkeeping, or client onboarding. These pipelines are broken down into stages, and as a “job” moves through these stages, pre-set automations are triggered.

The platform offers pre-built templates through its marketplace covering common accounting scenarios. Each pipeline can include automations for sending emails, creating tasks, requesting documents, sending proposals, and generating invoices. The system supports conditional logic, allowing different paths based on client attributes or behaviors.

Users can create custom pipelines from scratch or modify existing templates. The visual Kanban-style boards provide clear visibility of where each job stands, with the ability to automatically move jobs between stages when certain conditions are met.

Client Portal: Secure Communication Hub

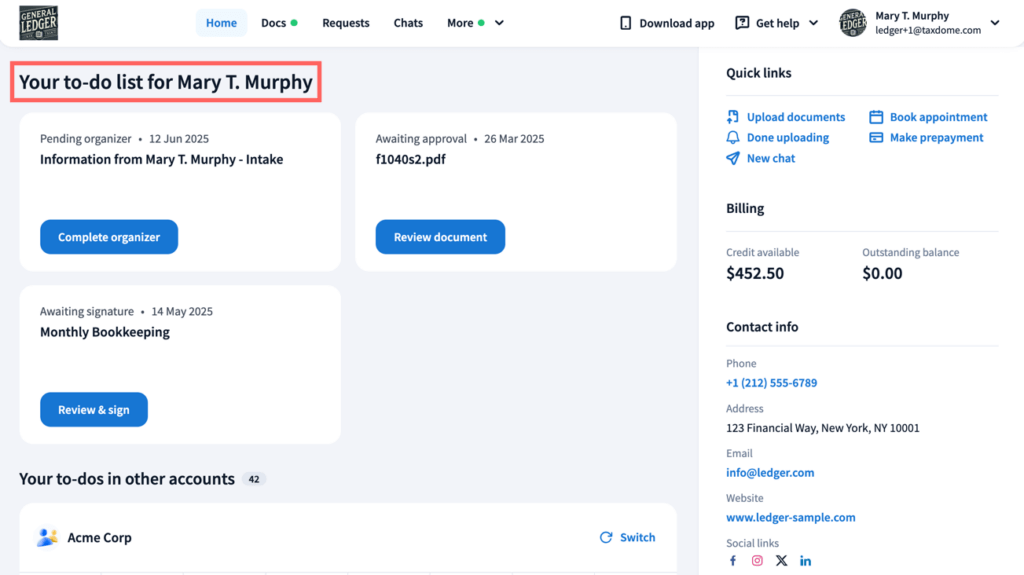

TaxDome’s client portal is a secure, white-labeled online platform accessible via desktop and a dedicated mobile app for both iOS and Android. Clients access the portal through a unique link sent to their email, which provides a dashboard showing their to-do list including unpaid invoices, pending documents, and unsigned forms.

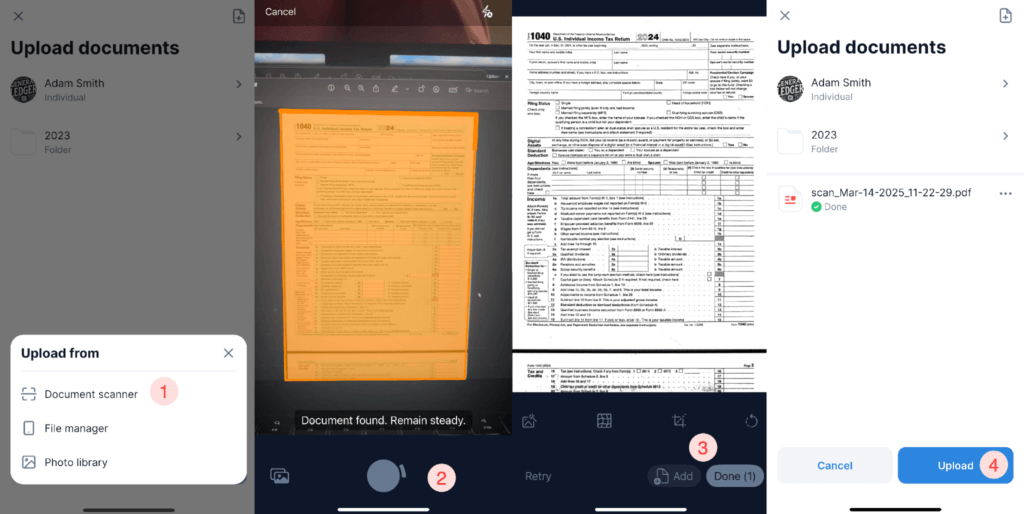

The portal allows clients to upload documents using drag-and-drop functionality or the mobile app’s built-in scanner, communicate through secure messaging, e-sign documents, and pay invoices online.

The system supports multi-language capabilities including Spanish, French, German, and several others.

Firms can customize the portal with their branding including logo, colors, and custom domain. The portal includes features like secure chat threads and client task lists, though customization options are primarily firm-wide rather than individual client-specific. All communications and document exchanges are encrypted and stored securely within the platform.

Document Management: Centralized Storage System

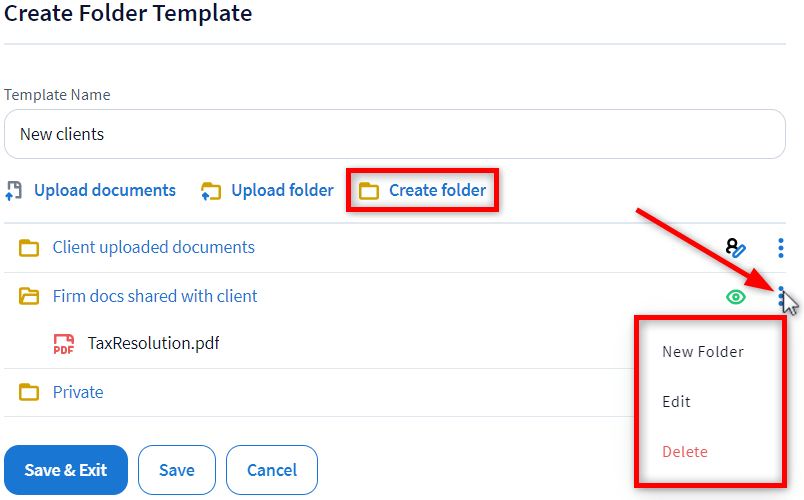

TaxDome’s document management system provides unlimited cloud storage for all firm and client documents. The platform automatically organizes files using folder templates that can be applied to ensure consistency across all clients.

Documents can be uploaded through multiple methods including drag-and-drop, direct upload from tax software, or the “Print to TaxDome” feature.

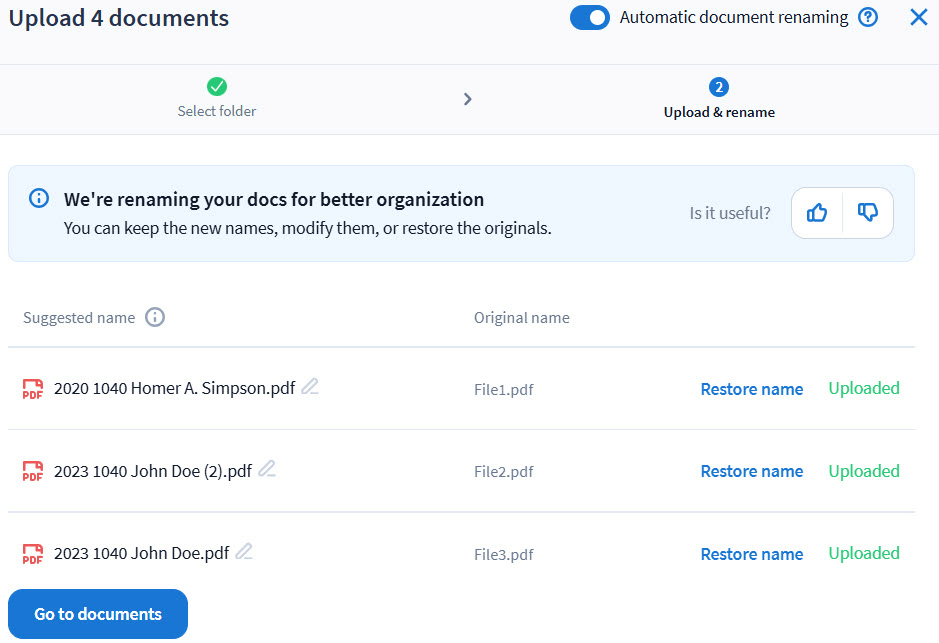

The system includes TaxDome AI, which automatically analyzes and renames client-uploaded documents, assigning relevant tags and descriptive names. For example, a file named “File1.pdf” might be automatically renamed to “2020 1040 Homer A. Simpson.pdf.”

Note that this AI feature currently only works on client-uploaded files and is limited to supported form types like U.S. tax forms, passports, and driver’s licenses. The platform maintains a comprehensive audit trail for each document, tracking uploads, views, edits, and signatures.

Note that this AI feature currently only works on client-uploaded files and is limited to supported form types like U.S. tax forms, passports, and driver’s licenses. The platform maintains a comprehensive audit trail for each document, tracking uploads, views, edits, and signatures.

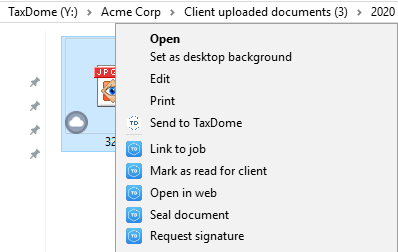

A native PDF editor allows users to merge files, add highlights, and create fillable forms directly within the platform. The TaxDome Drive feature creates a virtual drive on users’ computers, allowing them to manage documents through their file explorer while maintaining cloud synchronization.

Billing & Invoicing: Integrated Revenue Collection

TaxDome’s billing system integrates directly with the workflow automation, automatically generating invoices based on completed work and client agreements. The platform supports various pricing models including fixed fees, hourly rates, and recurring billing for ongoing services. The system also includes AI-powered reporting with profitability analysis by client, service line, or team member.

Integration with payment processors Stripe and CPACharge allows clients to pay invoices directly through the portal using credit cards, debit cards, or ACH transfers. The system includes a “payment locking” feature that restricts access to completed documents until the associated invoice is paid.

For firms using QuickBooks Online, TaxDome provides one-way synchronization, automatically creating corresponding records in QuickBooks when invoices are generated and paid. The platform can handle multi-currency billing and includes automated reminder sequences for overdue invoices.

Where TaxDome Falls Short

While TaxDome excels at providing comprehensive functionality, several limitations become apparent for certain users. These constraints reveal a platform optimized for breadth rather than depth in specific areas.

Billing Automation Flexibility: While TaxDome offers solid billing features including AI-powered profitability analysis, it lacks some of the advanced automation capabilities found in specialized billing platforms. The system doesn’t support complex rounding rules (such as automatically billing a one-minute call as 15 minutes) or sophisticated quantity-based price lists with different rates for different volume tiers.

Client Collaboration Depth: Although TaxDome includes client tasks, secure chat, and document sharing, the portal remains primarily focused on document exchange and communication rather than deep collaborative work. Firms looking for more integrated project collaboration where clients and accountants work together seamlessly on complex tasks may find the current implementation limiting.

Implementation Flexibility: TaxDome’s comprehensive nature comes with reduced modularity. While the platform offers tiered plans (Essentials, Pro, Business), firms must still adopt a significant portion of the ecosystem rather than selecting individual features. This can create challenges for firms wanting to implement gradually or those needing only specific functionality.

Pricing Flexibility: While TaxDome has introduced monthly seat options for Pro plan users, the platform still primarily operates on an annual billing model with upfront payment requirements. For a 10-person firm on the Pro plan, this means approximately $10,000 upfront, though installment plans are available for invoices exceeding $9,000. Firms preferring true month-to-month flexibility across all features may find this limiting.

These limitations aren’t failures but rather trade-offs inherent in building a comprehensive all-in-one platform. They create opportunities for alternatives that prioritize depth in specific areas while maintaining overall functionality.

Top TaxDome Alternative for Advanced Billing & Collaboration: Uku

Uku addresses specific pain points by focusing on sophisticated automation within an accessible interface. Founded in Estonia in 2017 by lifelong friends Rain Allikvee and Jaanus Lang, Uku emerged from a recognition that existing software on the market was “unhandy, impractical and unsightly.”

Where TaxDome built comprehensively, Uku built strategically, creating a platform that delivers advanced automation through a modular, accessible interface. Recommended by accounting influencer Jason Staats among his top practice management systems, Uku serves accounting firms globally, with enterprise deployments like Leinonen supporting 300 employees across 11 countries.

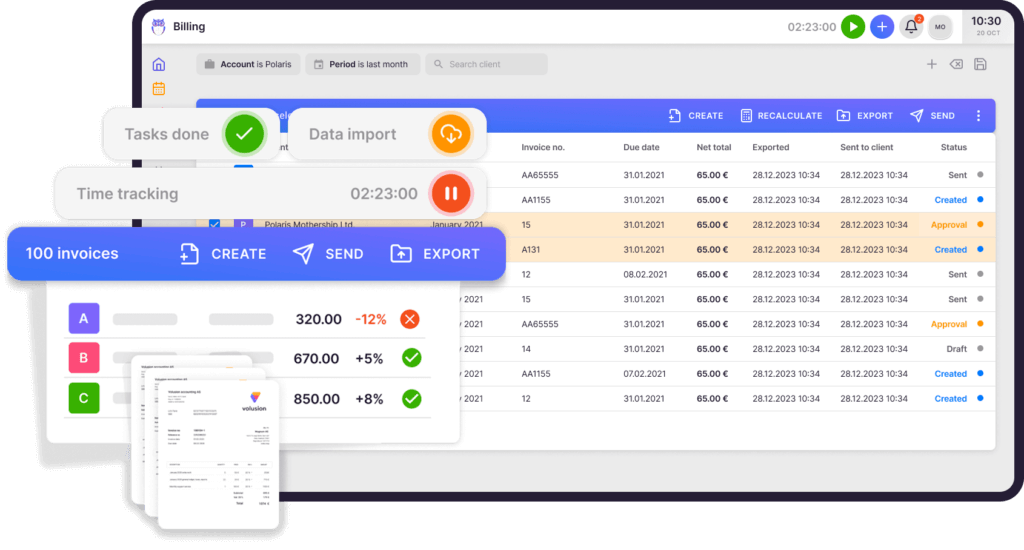

Advanced Automated Billing System

Uku’s automated billing represents a significant advancement in billing flexibility. The platform supports complex price lists based on quantity, time, and ranges with different rates for different periods.

Sophisticated rounding rules allow firms to set minimum time and rounding for services—for instance, a one-minute unplanned call can be automatically billed as 15 minutes.

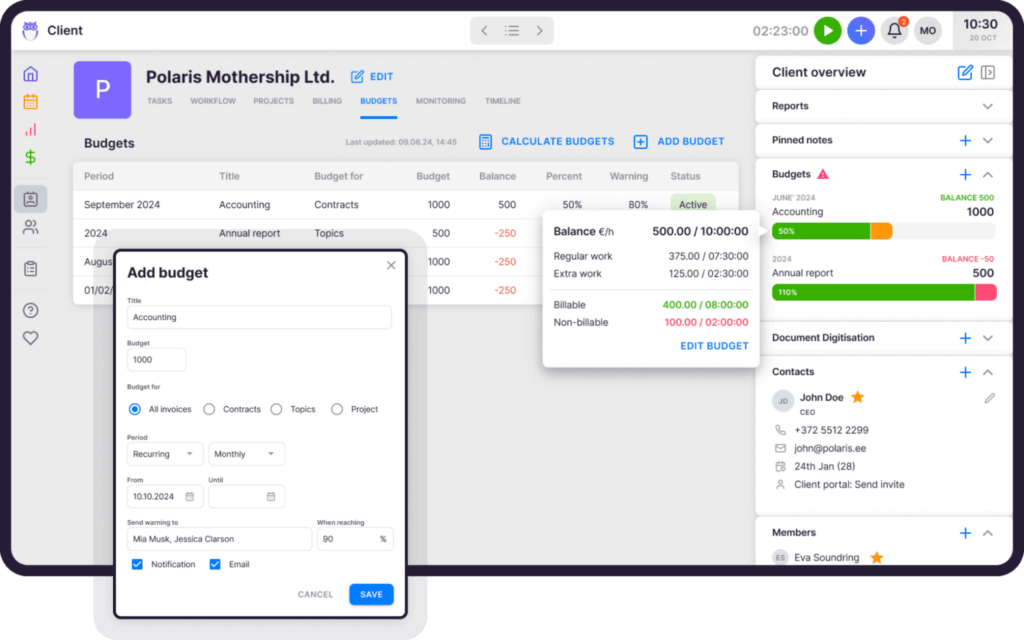

Everything operates through “contracts” where rules are configured once, then time tracking automatically calculates billable amounts in real-time. When working on tasks with budgets, users instantly see if clients are over budget, providing immediate visibility into profitability.

This automation reduces invoicing time dramatically—the platform claims invoicing 100+ clients takes just 30 minutes for confirmation.

The billing system extends into comprehensive profitability analysis by tracking both sales prices and actual cost prices. If an employee costs €30/hour but bills at €45/hour, managers can see if they’re profitable. When employees work eight hours but only six are billable, the system provides insights that help diagnose whether the issue relates to employee efficiency, client difficulty, or pricing structure. Firms using Uku’s automated pricing management see a 20% increase in profitability on average.

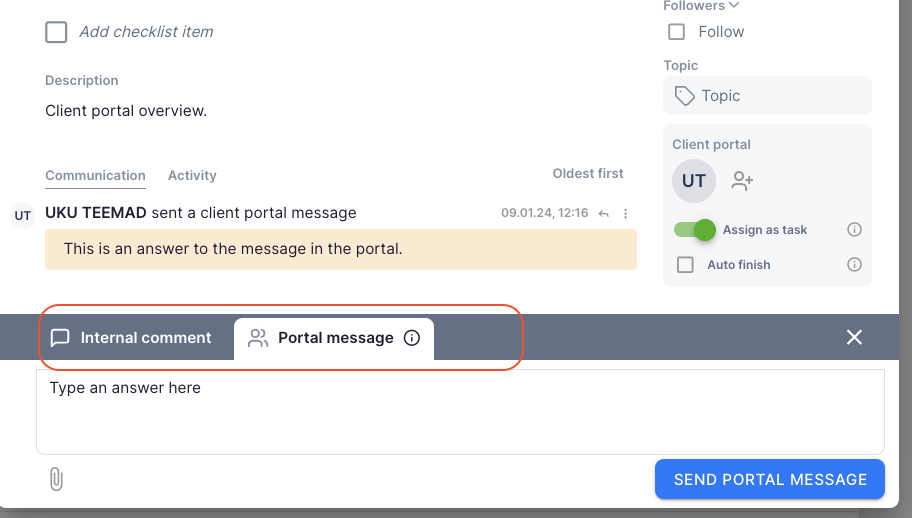

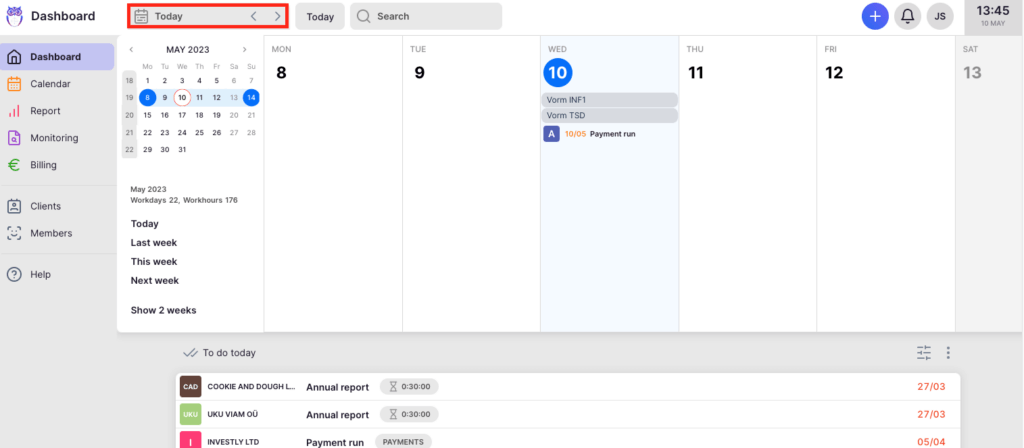

Collaborative Client Portal

The integrated client portal enhances client-accountant collaboration. Uku’s portal allows clients and accountants to work on the same task with all communication, documents, and accountant time tracking in one place.

Clients see the task checklist, files, and description just like the accountant. When clients make requests through the portal, notifications appear on the accountant’s dashboard, and they can immediately start tracking time or communicating within that same task. This solves the common problem of information being trapped in individual email accounts: when team members are absent, others can access all client communications and task history in one place.

The portal is highly customizable. Firms can create unique menus for each client, run onboarding with forms, share business insight reports, display price lists, and add custom links to external tools. This flexibility allows firms to create tailored experiences for different client segments while maintaining efficiency.

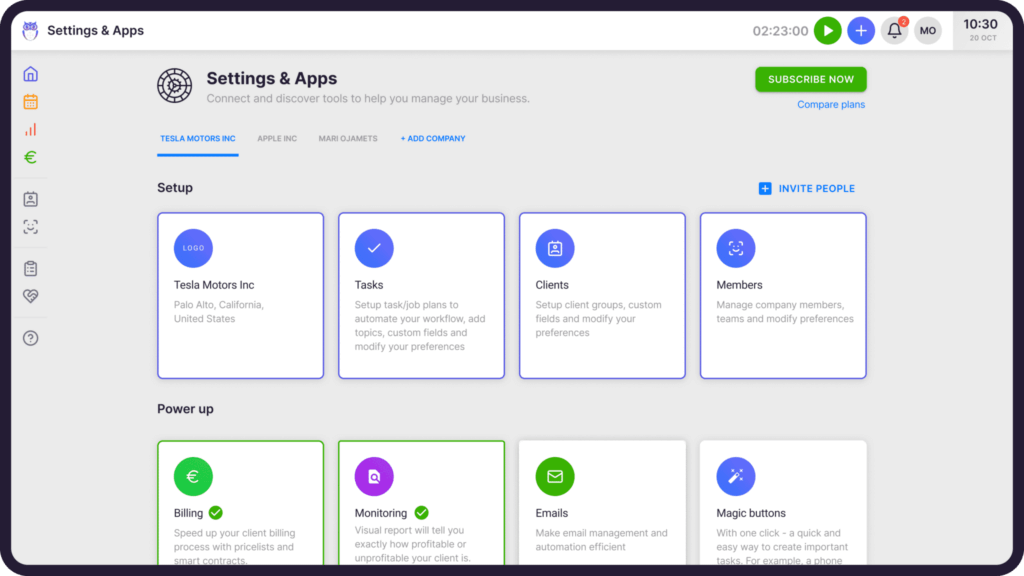

Modular Approach for Flexible Growth

Uku’s modular design philosophy addresses a critical need for accounting firms: the ability to start with core functionality and expand as needed. Like an iPhone where you start with basic functionality and add apps, users can begin with just CRM and tasks, then gradually add features through Uku’s app system or by upgrading plans.

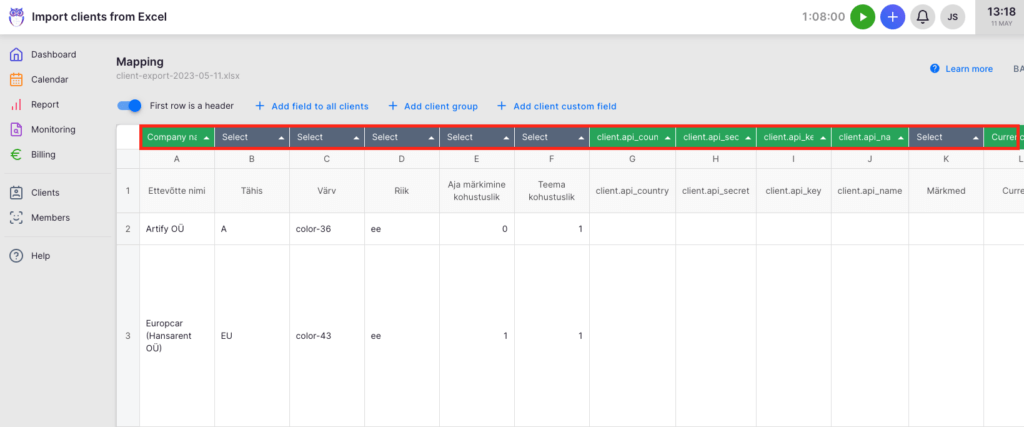

This approach is particularly valuable for firms transitioning from Excel. Uku provides comprehensive import capabilities to help firms migrate their client data and workflow templates from spreadsheets.

The gradual implementation path reduces the risk and complexity often associated with practice management software adoption.

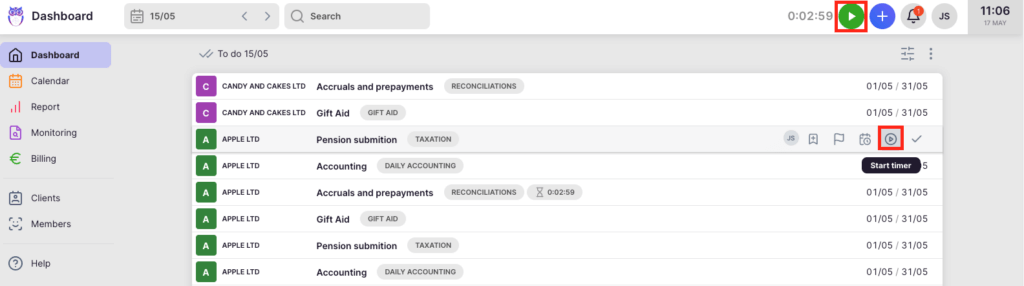

Time Tracking That Teams Actually Use

While time tracking isn’t Uku’s only strength, its implementation deserves recognition. The platform’s time tracking functionality has received positive user feedback for its intuitive design.

Users can track time through multiple methods including a stopwatch, manual entry, or bulk time allocation across multiple tasks.

The weekly calendar view allows tasks to be simply dragged and dropped for easy scheduling. Combined with the automated billing system, this creates a seamless flow from work performed to revenue collected.

Users report saving around 20% of time spent on task management and being able to serve 38% more clients after a year of using Uku.

Enterprise-Ready Scalability

Despite its accessible interface, Uku scales to support large organizations. The Leinonen deployment demonstrates this capability, supporting approximately 300 employees across 11 countries including Norway, Sweden, Finland, Estonia, Latvia, Lithuania, Poland, Ukraine, Hungary, Bulgaria, and Kazakhstan.

For enterprise clients, Uku offers custom integrations and development services.

The platform operates on SCRUM principles with weekly development sprints, allowing for rapid iteration based on user feedback. This agile approach, combined with Uku’s bootstrapped status, creates a responsive development cycle focused on user needs.

Transparent, Flexible Pricing

Uku’s pricing model reflects its commitment to accessibility and growth. Plans start at $38 per member per month for the Team plan, which includes all core features plus teamwork functionality, email integration, client portal access, and unlimited clients. The pricing scales transparently with Elite (approximately $48/month) and Enterprise (approximately $88/month) tiers adding advanced features like workforce management and custom integrations.

Critically, all plans are available on a monthly basis with no long-term commitment required. This allows firms to test and implement the platform without major upfront investments. The 90 minutes of free onboarding assistance ensures firms can leverage the platform’s capabilities from day one.

TaxDome or Uku: Comparison Summary

| Feature | TaxDome | Uku |

|---|---|---|

| Target Users | Firms wanting comprehensive all-in-one features | Firms wanting sophisticated automation with flexibility |

| Billing Capabilities | ⭐⭐⭐⭐ Fixed/hourly/recurring with AI profitability analysis | ⭐⭐⭐⭐⭐ Complex price lists, rounding rules, real-time tracking |

| Client Portal | ⭐⭐⭐⭐ Document exchange, chat, and task management | ⭐⭐⭐⭐⭐ Collaborative workspace with shared tasks |

| Implementation Approach | Comprehensive platform with tiered plans | Modular—start simple, add as needed |

| Pricing Model | Primarily annual, from $800/year (some monthly options) | Monthly or annual, from $38/month |

| Excel Migration | ⭐⭐⭐⭐⭐ Comprehensive import tools and support | ⭐⭐⭐⭐⭐ Comprehensive import capabilities |

| Time to Invoice 100+ Clients | Varies by setup and automation | ~30 minutes (per Uku claims) |

| Profitability Insights | ⭐⭐⭐⭐ AI-powered analysis by client/service/staff | ⭐⭐⭐⭐⭐ Real-time cost vs. sales analysis |

| Best For | Firms wanting established, comprehensive solutions | Firms prioritizing billing automation and flexibility |

Final Verdict

The choice between TaxDome and Uku ultimately depends on your firm’s priorities and growth trajectory.

👉 Choose TaxDome if you’re a firm that values a comprehensive, established platform handling every aspect of practice management and you have the resources to invest in proper implementation. It’s ideal for firms that want proven stability, unlimited storage, integrated features, and don’t mind primarily annual billing commitments. The platform’s AI-powered reporting, workflow automation, and established market presence make it compelling for firms ready to adopt a complete ecosystem.

Click here to get started with TaxDome.

👉 Choose Uku if you’re an accounting firm that values sophisticated billing automation with the flexibility to grow at your own pace. It’s designed for firms that understand the best software is the one your team will actually use, combining powerful features like automated billing rules and collaborative portals with an accessible interface. With its monthly pricing options, modular approach, and strong Excel import capabilities, Uku enables gradual digital transformation. For firms that measure success by billing efficiency, reduced invoicing time, and streamlined client collaboration, Uku offers an attractive balance of power and usability.

Click here to get started with Uku.

Both platforms serve their audiences well. TaxDome provides comprehensive infrastructure for firms ready to adopt an all-in-one solution. Uku enables firms to enhance their operations with sophisticated automation while maintaining flexibility. Your choice depends on whether you prioritize comprehensive coverage or specialized excellence in billing and collaboration.