Marketing in the finance and accounting industry has traditionally been done in silos.

A finance firm runs ads. An accounting brand publishes content. Each pushes its own message, budgets, and channels, hoping to reach the same audience at different moments. However, that approach is showing its limits.

Accounting firms now serve clients whose needs overlap across payroll, tax, compliance, advisory, software, and finance operations. Clients do not experience these as separate problems. They experience them as one workflow.

And that’s why partnership marketing is now more important than ever.

Instead of competing for attention in isolation, you need to collaborate with adjacent providers to reach the same client at the right stage. This results in shared growth, a financial boost, and reduced expenses.

Let’s break down how partnership marketing works, what your brand gains, and how to implement it in this article.

What is Partnership Marketing?

Partnership marketing is when your business teams up with another business to reach new audiences. The outcome? Create shared value and grow faster than you could on your own. This is different from a sponsorship or a simple referral now and then.

Instead, it’s a structured, ongoing collaboration to co-create services, content, events, and a steady flow of value within your target market.

For accounting firms, partnerships make sense because clients rarely have a single money question. They need tax help, yes, but also estate planning, bookkeeping, wealth management, payroll, benefits, legal structure, lending, ERP selection, and better financial operations.

You can’t be everything to everyone, but you can assemble a trusted circle of experts to consistently cover all your clients’ and customers’ needs. In turn, that consistency and availability as a go-to roundabout solution enhance customer trust and loyalty in your brand.

What is the Value of Partnerships in Accounting?

Partnership marketing in accounting offers a credibility boost, saves costs, andleads to financial growth.

- Credibility

When a respected law firm, bank, or SaaS provider trusts your team enough to co-create content or refer clients, that trust transfers. It shortens the time it takes a prospect to believe you can help. It also expands your client base through introductions you wouldn’t get on your own, and it lets you enhance your services without hiring a dozen specialists.

- Cost saving

Strategic partnerships let accounting firms offer more comprehensive solutions without overextending resources. Let’s say you partnered with a financial planning firm. Your clients gain access to wealth management services while you focus on your core tax expertise. This increases client retention and opens doors to new referral streams.

- Financial growth

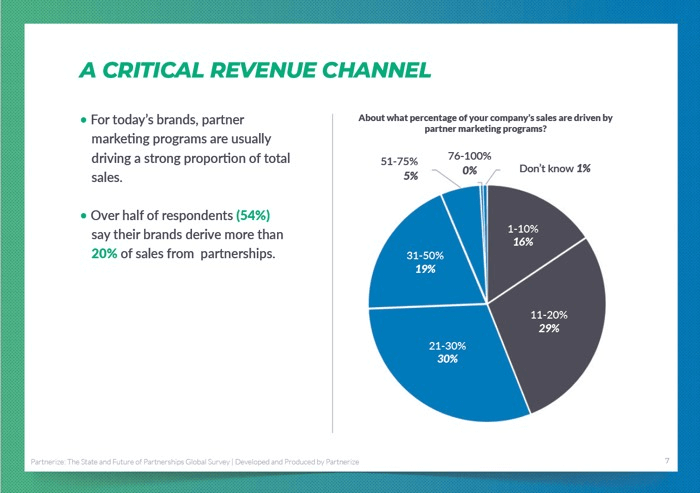

Growth is expensive when you are doing it alone. According to a Partnerize report, 54% of brands say partnerships with other companies account for 20% of their annual revenue. This proves investment in partnerships can significantly lower your acquisition cost per lead and ultimately increase your ROI per marketing budget. Also, this helps you tap into an existing market and an audience that needs the solutions you provide. The result? Less time hunting for prospects and more time serving them.

Common Partnerships That Make Sense To Clients

Examples of partnerships that make sense to your clients and can truly boost your accounting firm include:

- Estate planning attorneys for coordinated tax and trust strategies

- Fractional CFO or FP&A firms for forecasting, cash flow, and dashboards

- Payroll, HR, and benefits providers for people-heavy businesses

- Banks and alternative lenders for capital planning

- ERP and accounting software vendors for modernization

- Startup accelerators and VC firms for founder-focused advisory

- Insurance brokers for risk management and benefits design

- IT security consultants for cybersecurity and compliance

- Business valuation specialists for M&A and succession planning

You’re on the right track if the combination helps your client get from problem to result with fewer steps.

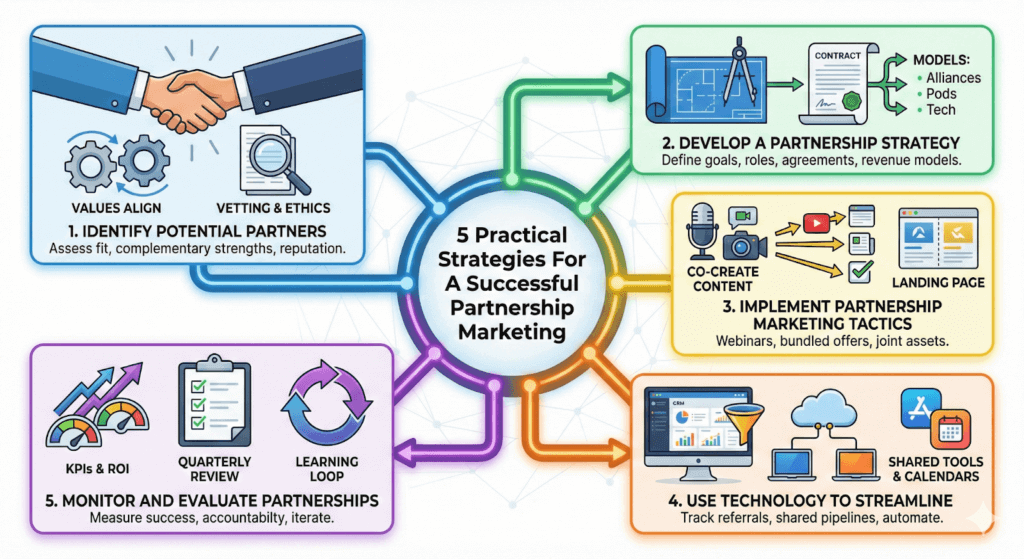

5 Practical Strategies For A Successful Partnership Marketing

Partnership marketing can scale your business and help grow revenue faster, but you need to do it right if you want results. Here’s how:

Generated by the author

- Identify Potential Partners

The most successful partnerships happen when values and work cultures align. You need to evaluate potential partners based on their client service standards, communication styles, and long-term vision.

Take your time upfront to assess:

- Client overlap with minimal service conflicts

- Strong reputation and clear ethical standards

- Complementary strengths. Ensure you fill each other’s gaps

- Operational compatibility matters. Look for responsiveness, documentation, and security

- Willingness to invest valuable time

Also, review case studies about the brand and schedule an interview with shared clients, of course, with their permission.

- Ask about data security practices, incident response, and certifications when relevant

- Check that the partner’s advice won’t jeopardize independence requirements if you perform attest services

The same thing goes for you. Your potential partners are evaluating you just as you are doing that, too.

You can offer to appear as a guest on their webinar with genuinely helpful insights. Share a short, value-led one-pager that clarifies who you help, how you work, and when to loop you in. It’s easier for partners to refer when you make the ask simple.

- Develop a Partnership Strategy

Start with clear objectives and objective-led questions.

- Are you aiming to create new logos for a single niche?

- Better retention for existing clients through a bundled service?

- A thought leadership footprint that draws inbound leads?

Whatever it is, write it down. Then map how a partner helps you reach that goal. This includes:

- Defining roles, handoffs, and client experience standards

- Creating a lightweight but formal agreement that covers scope, data sharing, branding, disclosures, and how you’ll measure success

If revenue sharing is involved, make sure it aligns with professional standards and state board rules.

You should also draft a structure for review meetings, define specific revenue targets, and create clear protocols for client handoffs. This keeps both parties accountable and ensures your partnership delivers real value.

Models are also very important. A few strategy models that work for accounting firms like yours include:

- Centers of influence: reciprocal referrals with attorneys, bankers, and consultants

- Co-delivery alliances: jointly deliver bundled services. An example is tax plus estate planning

- Content consortiums: publish research, guides, or a webinar series together

- Industry pods: a small circle of specialists serving one niche deeply

- Technology alliances: advisory plus implementation with a vetted software partner

Start with one model, pilot it, and iterate. If it works, you can add another model to the stack and scale gradually.

- Implement Partnership Marketing Tactics

Once the strategy is set, bring it to life with simple, repeatable tactics.

- Build a monthly webinar series with a partner and rotate topics around tax, cash flow, entity structure, succession, or industry-specific issues

- Record everything, transcribe it, and repurpose it into blog posts, checklists, and short videos

- Create a single co-branded landing page and track registrations by source so you can see which partner promotions drive attendance

For instance, you could co-create a tax planning series with an estate planning firm. The content attracts qualified leads for both practices and establishes you as the go-to resource for comprehensive financial guidance.

Other moves that work:

- Offer bundled assessments, for example, tax readiness plus cash flow review

- Cross-feature each other’s experts in newsletters and podcasts

- Co-host small roundtables for CFOs or founders and keep them invite-only

- Swap educational resources inside the client onboarding kits

- Run a shared office hours session once a month for live Q&A

Keep the bar low at first. Nail the basics, then scale.

Note that partnerships often come to life during physical touchpoints such as workshops, closed-door CFO sessions, community meetups, and co-hosted conferences. As such, a strong visual consistency matters here. Use shared branding elements via customized wears, cobranded magazines, and owned wall banners to reinforce the partnership identity during these live engagements.

- Use Technology to Streamline Partnership

Technology turns partnership management from guesswork into a system when used correctly.

- Use your CRM to track referrals, sources, win rates, and revenue by partner

- Build a shared pipeline dashboard so both firms can see progress without endless emails

- Align with a contract management software to track and process your collaborative agreements and maintain clean documentation for audits or renewals

- If you’re managing a larger network, a partner relationship or ecosystem platform like Crossbeam can help with account mapping and co-selling opportunities

On the collaboration side, stick to simple tools your teams already use, such as shared calendars, Getuku’s team collaboration platform for accounting firms, Slack or Microsoft Teams channels, and a common folder structure for co-branded assets.

For events, keep a standard webinar kit with templates, landing pages, and follow-up emails. Templates help you ship your campaigns faster and error-free. It also allows for consistency.

- Monitor and Evaluate Partnerships

Tom Bukevicius, Principal at Scube Marketing, whose work focuses on performance marketing, conversion optimization, and revenue attribution for B2B and professional services brands, says accounting firms should view partnerships through a growth lens.

“If a partnership does not change how demand is generated, tracked, or converted, it is not a growth lever. You should see the impact on pipeline quality, conversion rates, or deal velocity. Anything else is a branding exercise with no accountability. Partnerships work when they influence buying decisions, not just visibility.”

A good way to know whether the partnership is driving growth is to agree on the KPIs you’ll review together and how often you’ll review them. Common ones include:

- Number and quality of introductions

- Opportunity-to-win rate for partner-sourced deals

- Revenue and margin attributed to the partnership

- Time-to-close and average deal size

- Client retention and expansion within shared accounts

- Event and content metrics (registrations, attendance, downloads)

- Cost per lead and ROI by campaign

Build a simple scorecard and meet quarterly to discuss what’s working and what to fix. Treat the review as a learning loop, not a grading session.

Also, as your partnerships expand, administrative work grows quickly across scheduling, follow-ups, documentation, and coordination between firms. You can extend capacity by working with a virtual assistant agency to support partner campaigns, manage shared calendars, handle webinar logistics, and maintain operational continuity without hiring internally.

Conclusion

Partnership marketing is the next gold for growth and scalability. And you know why? Because it’s built on shared value, trust, and measurable outcomes. Of course, results are only plausible if you do it right. Otherwise, you might end up getting siphoned while the other business thrives as yours goes bearish.

To avoid that, ensure you’re picking a partner that understands how the dice rolls and is interested in shared value as much as you. Most importantly, they must contribute equal value and have the reputation plus resources to do that. That’s why vetting is essential before you sign the agreement.

The next step is to develop a partnership framework and strategy to guide your operations, implement your tactics using a pilot model to start, and gradually iterate before scaling with two or more models.

Lastly, use technology and tools such as CRMs, ERPs, and other integration platforms to bridge the gap between the two brands. Simple collaborative tools like Google Calendar or Calendly for meeting scheduling and Google planners or Trello can save costs. Don’t forget to monitor and evaluate as you progress.