For many of us, being productive is a skill that needs to be mastered. Sure, it is something we strive for, attempt to get into the habits of and pursue in the hope of achieving. So when the opportunity for a little smart digital help is presented to us, we would be fools not to consider it.

If you’re looking to boost your productivity, increase task efficiency, and make more business profit, it’s a necessary discussion you cannot avoid. After all, research has demonstrated that inefficient workflows account for a 20-30% reduction in revenue each year.

Imagine what an extra 20% revenue would do for your company.

What is workflow management in the accounting industry?

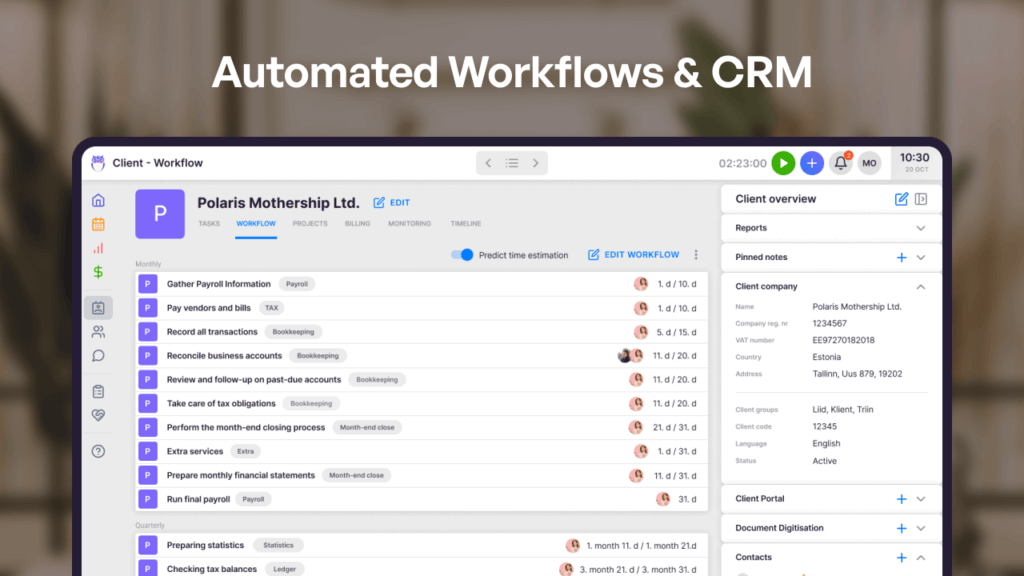

Workflows are the backbone of an accounting firm. Think of it as the ultimate work task organizer that ensures every step of the accounting process is in sync and error-free. By automating and standardizing work tasks, workflows help you avoid mistakes, save time, and maintain compliance. With such workflows, you can focus more on growing your practice and less on juggling spreadsheets. Instead, there are special accounting workflow processes that simplify software and make handling work tasks much simpler.

Streamlining workflows is essential for any accounting firm aiming to improve efficiency and maintain compliance,” says Ilda Cairns, Vice President at VCA Claims Management Software. “By integrating intuitive workflow management tools, firms can automate repetitive tasks, track progress in real time, and ensure accurate reporting. This not only reduces the risk of human error but also enhances client satisfaction by delivering faster, more reliable results.

According to research, accountants in practice work an average of 42.09 hours a week. Industry accountants work a slightly higher average of 43.05 hours a week, demonstrating that accountants work significantly longer hours than usual. To handle all of the complicated tasks and avoid burnout, it’s best to have a system or a designated workflow for accountants.

The 7 signs that your accounting firm needs better bookkeeping workflow management

1. You struggle with finding and receiving missing client information

Problems with accounting workflows tend to arise as soon as source documents are received. Firms are only aware of missing vital information when they begin the review stage. Your staff need to know what information is present because missing files cause delays and waste everyone’s time.

Tip: Keep the linear aspect of the workflow by adding optional stages after the preparation and review stages.

For example, add a notification within your accounts workflow when a client fails to supply all the necessary documentation. Workflows are paused until all materials are obtained. A client portal is an efficient way to automate this process so accountants don’t even have to worry about sending reminder emails.

Accounting practice management software like Uku has a task checklist so users know when documentation is missing. You can automate emails to send reminders created with email templates so accountants don’t have to spend time writing and sending out emails.

Accounting software like Quickbooks or Xero can assign files and tasks to those who need input if the workflow is paused.

This level of workflow control identifies suspensions in the workflow in an accounting firm and what information is needed to get the process moving again.

2. Tracking work in progress and on-demand reporting is extremely time-consuming

Accounting is demanding your resources:

- Scheduling work;

- Monitoring the status of each task;

- Keeping the staff productively moving the work forward.

A lack of knowledge of a client’s case smacks of unprofessionalism. Appearing professional is critical to both your accounting practice’s revenue and reputation. If this sounds like your firm, you add more unneeded stress to your practice. You do not need this on top of stressful periods throughout the year, such as when tax returns are due at the end of each January.

“Workflow management is vital and comes into its own when there are people working across time zones and cultures,” says Zayed Ahmed, the founder of ASL BPO, a business process outsourcing company. “Clear visibility into task status helps maintain client confidence, which keeps projects running smoothly and helps build lasting business relationships.”

Tip: Have the capability to report on work in process and the various task stages at a moment’s notice.

You will no longer have to scan information online, download a report and read it, will make. A workflow management software with CRM features helps you out. By filtering reports by drilling down into their details, you can locate the required information your client needs in their profile or dashboard.

3. Due dates cause you to panic

Accounting firms often fret about missing something when client and task due dates become closer.

- Have I included all the necessary documentation?

- Did I check all the specific boxes unique to my client?

- Should I re-read the entire process to double-check?

Any of the above questions sends shudders down an accountant’s spine. Checking and rechecking only drains further hours on your or your staff’s resources.

Tip: Ensure that your firm can perform real-time reporting.

When dealing with accounting due dates, having the ability to check en masse accountancy tasks and their workflow stages ensures staff identify when something is missing or is not completed. Uku has a comprehensive business analytics report to do the job for you.

Furthermore, staff can extend or amend due dates and, in the process, remove the panic that often comes with approaching due dates.

4. You struggle with real-time task prioritisation

Due dates are compromised when you cannot prioritise real-time tasks. A workflow for accounting should be able to handle several real-time, higher-priority task scenarios, for example:

- Higher client priority;

- The task has been dormant for a while;

- Advancing due date;

Tip: Accounting workflow software operates as a real-time source of information. You don’t need to manually check anything.

5. Your accounting workflows are not integrated with your accounting software

One critical factor inhibiting accounting workflows is the frequent search for required information or documentation in one system that is used in another. When your accountant’s workflow is not integrated into accounting software, it will force you to search for all materials needed to complete the work.

Wherever they live on your system or another, you need to examine several Excel spreadsheets to find the specified information, and searching will delay your workflow. You are ultimately forced into workarounds. Launching other programmes to search for and access required documents at that very moment when the work on a client’s file should have begun already.

Tip: Ensure your accounting workflow software is integrated and automatically linked to the task itself. When working on a client file, you have all the documentation at hand.

QuickBooks is one such accounting software that places software integrations at its core so that users do not have to search on several platforms. You will not only eliminate the added labour of tracking down documents in another software location, but you will also be faster at finishing your tasks per se.

6. You don’t have a way to monitor tax workflow stoppages

With accounting work, there will always be workflow stoppages for a variety of reasons. Through the use of accounting workflows, you can identify a systematic approach to how your accounting firm can remedy future stoppages.

Tip: Check how long tasks are kept in certain stages. By understanding the length of time-specific tasks is kept in an idle state ayou can determine the reasons why this occurs.

Thus, new solutions can be adopted, whether adding more resources or chasing up clients for information. The new workflow process can then be included, ensuring that future tasks and clients receive only the utmost efficiency.

7. Your team is working chaotically instead of organized

Maximising the use of all resources in an accountancy firm can be difficult. Overtasked staff members slow down a client’s project completion if their situation is not monitored and remedied with efficiency.

Tip: Figure out how much workload a staff member or partner has and how long it will take them to complete the tasks.

If one job requires a higher workload capacity, assign other lower-intensity tasks to others who have more time. Working out task-level budgets and their estimated completion times will make it easier to balance task workflows.

Workflow management advantages for accountants

We have discussed several reasons your accounting firm needs workflow management software. Now, let’s discuss the specific features a workflow management software for accountants provides.

Sending and receiving documents workflows

One significant advantage of workflow management is the ability to automate, simplify, and boost the speed of communication within the accounting firm and with its clients.

With a designated workflow, processes are automated, such as adding documents, files, and other digital artefacts. This saves accountants time and allows them to do more analytical or advisory tasks that software lacks intelligence for. The benefit is that work documentation is updated in one place, for example, a client portal that both the accountant and client can access without having to constantly remind each other to do things.

People working on each task, including management, can find everything they need in one place. Users access invoices, expenses, VAT letters and client messages from the same screen, no matter which stage of the task. Employees no longer need to search for paperwork that has become dispersed across the office, saving valuable time. As tasks proceed through each workflow, an employee may add extra documentation, updating the job as it ‘flows.’

The ultimate result is that tasks move from initial engagement to fulfilment much faster and more timely. Employees don’t frantically search for lost documents but focus on the work they do. Staff contact clients to get missing materials that Uku has identified as not listed. Where there are workflow delays, it becomes quicker to locate the bottleneck and take action to get back on track.

Workflows for accounting tasks, deadlines and statuses

Accounting tasks mostly appear in the same order, thanks to the precise processes that the law demands. This means that nearly every service an accountant offers has a recurrency – weekly, monthly or yearly. That is the ideal situation for creating an automated workflow.

Here’s a big bonus and a way to ensure everything is correct for accounting firm managers as well. You have the chance to enter workflow templates with the right tasks and deadlines, using project management or task management—your choice. When starting work with a new client or offering a new service, your accountants can just pick the right task template from the list, and all of their deadlines are already set. This limits the chance of missing a deadline and thus improves service quality significantly.

Preventing burnout with crafted accounting workflows

We all are good at some tasks and not so good at others. The same applies to accountants and their work tasks. As a manager, you have the power to monitor how employees perform certain tasks. Good workflow management software or accounting practice management software provides analytical tools using the data from time tracking.

Take a month or so to get a good overview of how long accountants spend on tasks or clients, have a conversation with them about why some tasks or clients might be more difficult to them than others and then delegate tasks among your team accordingly. This will boost everyone’s morale and make work more of a breeze rather than a burden.

By the way, did you know there are ways to help employees understand that time tracking is not a restricting policy but rather a way to ensure work-life balance?

How to automate daily workflows for tax pros?

Choosing the right workflow management software to make accounting faster

Each business has different task workflows. Whatever your routine, workflow management software outlines and monitors all business activity, making it easier to identify any potential delays that may arise.

As we all are aware, daily operations seldom go uninterrupted. There are delays, setbacks, and last-minute amendments.

Having an overview of each workflow helps business managers react to delays and actions more timely. Organisations that do this achieve peak efficiency on every task, providing faster and better value to their clientele.

Workflow management software helps business owners achieve peak efficiency by streamlining task activity in the workplace. It considers everything that’s involved in the daily completion of tasks:

- Client engagement

- Task setup

- Employee roles in completing tasks

- Resources needed to complete the said tasks

- Time tracking

- Automation

It should guarantee that each workflow has the necessary information to complete it, eliminating inefficiencies and boosting productivity.

The software is available on both desktop and cloud-based platforms. Most businesses opt for web-based because it is more cost-effective. (Updates are continually added.) Keeping pace with the competition in an ever-advancing digital market makes more sense.

9 proven ways workflow management increases efficiency

Once a business is using workflow management software, the next step is to train your team to become masters of productivity.

Workflow management software is itself only a tool. If used correctly and to its potential, it will result in practical and profitable benefits for your team.

These include:

- Digitising workflow management allows business owners to identify and remove any unnecessary steps. Thus reducing workflow lengths.

- Work completed is continually standardised. Everybody has ‘their’ way of doing a task. Workflow management software ensures that your standard operating procedures are always met. For example, software like Uku can make task lists that must be completed for every customer, each time.

- Guaranteeing and correctly doing work every time. The sequential nature of workflow management ensures tasks are actioned at the right time. Jobs are only forwarded when workers complete the preceding and current steps.

- No more chasing for paperwork. This means the days of misplaced documents and files and waiting on colleagues to finish their tasks are finally over. Businesses save time and reduce the need for paper documents, making it more environmentally friendly.

- Workflow management visibility is available at all times. Employees can pick up where they left a task. Plus, if clients call and ask for an update, any employee can provide a real-time update, including the time spent due to time-tracking functionality within the software.

- A holistic overview provides business owners with invaluable insights. Who can do specific tasks, or who is faster? Operating like this increases the quality of the work and reduces the time taken to complete a task. Managers identify which employees need extra task training to improve as an employees.

- Tasks can be time-tracked, so managers and employees get insight into how long each task has taken. They know how much to bill clients and customers accordingly.

- Reduced human intervention lessens the chances of human error. This saves resources and time and improves task efficiency.

- Automating manual or monotonous workflows means the tedious tasks are quickly completed. Managers and employees can focus more on business development and strategy.

For business owners who have already adopted workflow management software, do let me know in the comments which solution has helped you reap the rewards.

Always great to learn how others are doing!