We’d all like to make our lives easier. Tools are the best way to make work easier when talking about working. Imagine trying to build a house without a hammer — sounds frustrating, right? But this article is not about building. We are here to talk about the day-to-day tasks accountants face.

Handling client information, keeping track of invoices, and ensuring you’re on time can feel like constantly putting out fires. What if you had a tool that could handle all that background noise, giving you more time to focus on what matters? That’s invoicing and accounting software.

This article will give you a detailed overview of the top billing software for accounting firms, focusing on features, pricing, and usability. We’ll discuss the importance of having reliable invoice and accounting software for small businesses and offer recommendations tailored to different business needs. The article includes examples, statistics, and user reviews to support our picks.

Why Small Businesses Need Invoice and Accounting Software?

Invoicing is an administrative job that should work as precisely and automatically as possible. With the right billing software for accounting firms, accountants can invest their time in more value-creating activities like advising clients.

Many small businesses benefit from using free invoice template by Invoice Simple to streamline their invoicing process. With a range of downloadable invoice templates, companies can easily find a format that aligns with their brand and billing needs. This variety aids in maintaining consistency and professionalism, which can enhance clients’ trust.

Top Benefits of Invoicing Software:

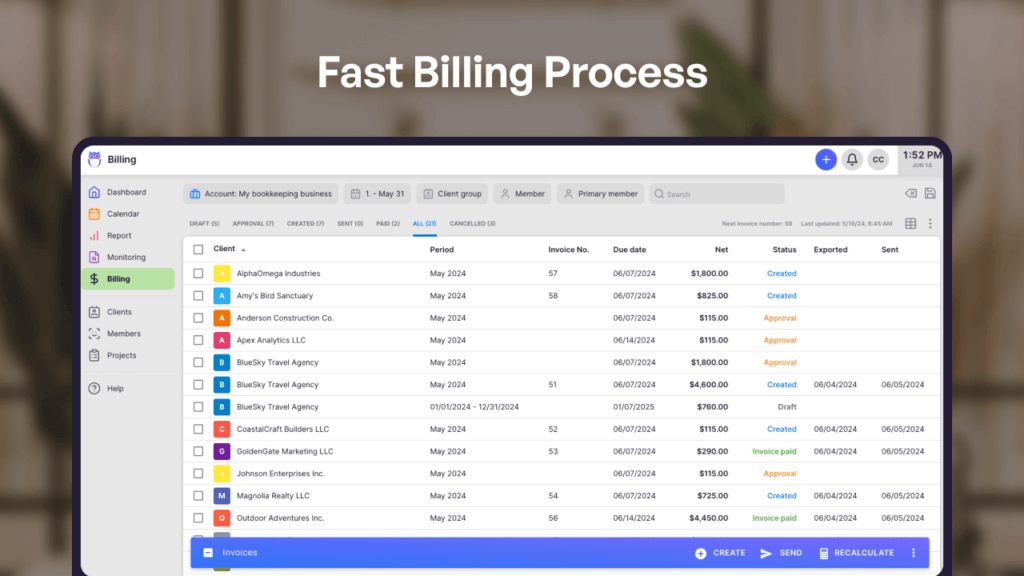

- Faster billing process (30 minutes per month)

- Reduce human errors by automating data collection

- Systematic product and price management (templates)

- Different pricing strategies like time, volume, fixed, recurring or mix on them

- Better profit through insight and analysis

A fast and reliable invoicing solution ensures the efficiency of the accounting firm, which is an essential part of growth, and this can be achieved through high-quality billing software for accounting firms.

“My favourite Uku funcion is billing, it will streamline our invoicing process significantly.”

– Review from G2

Features to Look for in Billing Software

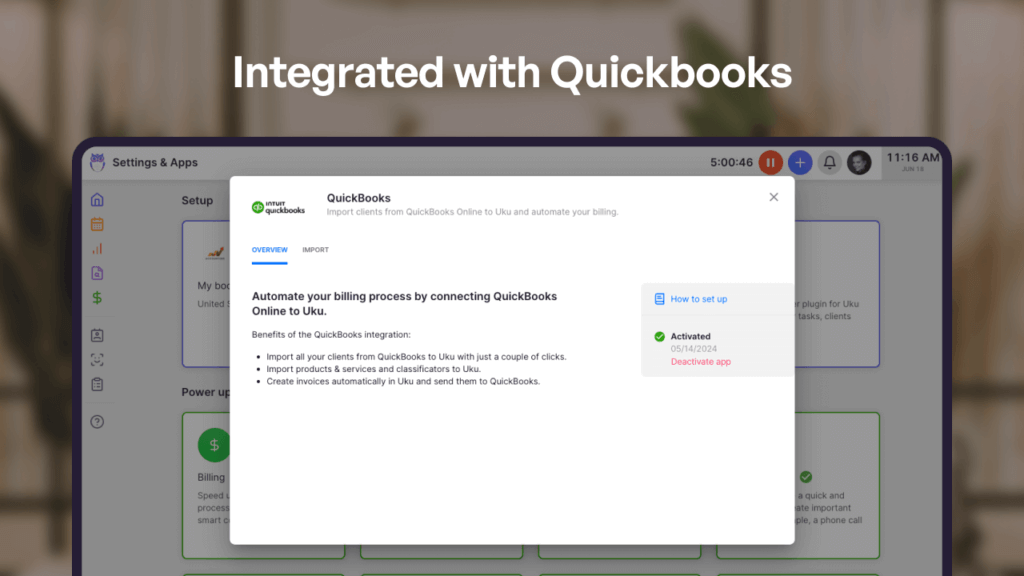

When selecting billing software for accounting firms, you need to choose the software with the right features. Look for tools that automate data collection and integrate with accounting software. Integrating with accounting software such as Xero, Quickbooks, Sage AI accounting software, or any other accounting software is necessary, as invoices are synchronized with invoice statuses.

- Integration with accounting software ensures that all possible classifiers (tax rates, products, etc.) are unified.

- Monitoring to get a quick overview of whether client workloads are within agreed limits, enabling timely negotiations with clients, for example, price increases due to increased workload.

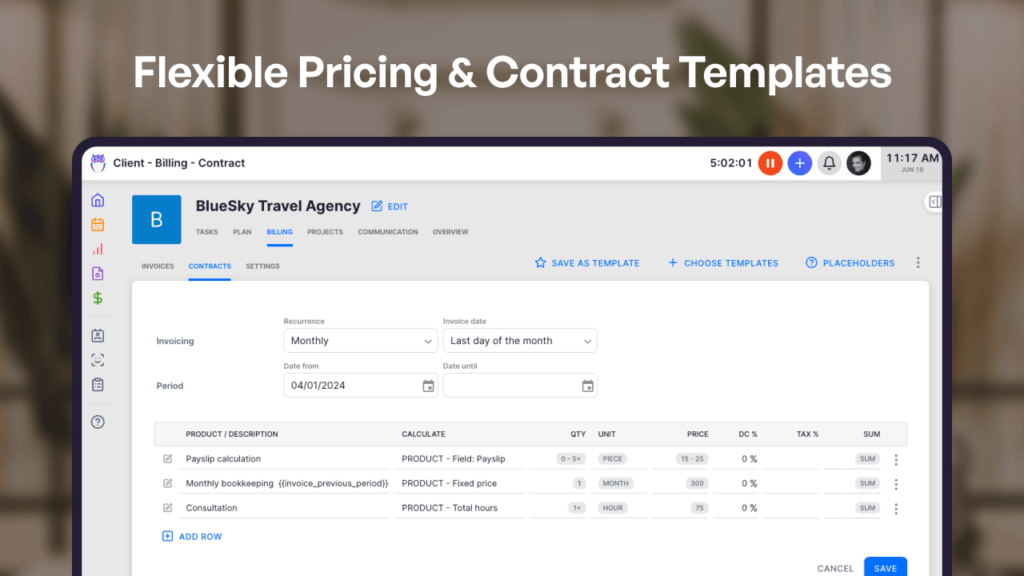

- Pricing contract templates for quick onboarding of new clients and making modifications, with good input for analysis.

- Client custom rates help create individual agreements for each client while maintaining system integrity.

- Invoicing automation to generate invoices according to contracts, confirm, mass export, and send to clients.

- Time, volume, fixed, and recurring billing – setting up pricing separately or in combination.

- Price ranges with levels – Reduce the price on larger volumes, do it in levels and use cumulative summation or pricing periods.

- Set minimum time and rounding—Increase the profitability of your accounting firm by setting minimum time requirements and applying rounding rules to your services.

- Placeholders – Like invoice period, next or previous period, client primary member, quantity as number, time or time in number format.

Advanced Features a Modern Accounting Firm Needs

Modern accounting firms require billing software for accounting firms that can handle split revenue and business intelligence reporting and integrates with other systems, like accounting software.

- Fast & reliable billing process — send out invoices in half an hour, not half a day.

- Split revenue —Add one or several people to one resource and divide their share. Pay bonuses or just track who contributed to which invoices/services/clients.

- Bill parent company — Subsidiary invoices can now be charged to their parent company, and you can either separate invoices per subsidiary or merge all invoices.

- Bill later – Ability to define when the work will be billed, for example on the month the work is done or when the work is finished.

- Find unbilled work — Ability to find all unpaid work and adjust invoicing rules for automation.

- Business Intelligence Reporting (BI) — to get insight for better pricing, like changing the pricing range with levels.

- API — the ability to exchange data automatically with whatever systems, such as sales systems like Pipedrive, HubSpot, Salesforce, or Zapier, for all use cases.

Your Accounting Firm’s Billing Process Should Be Fast and Easy

With the right billing software for accounting firms, the billing process can be simple and fast, enabling firms to send out invoices in a fraction of the time.

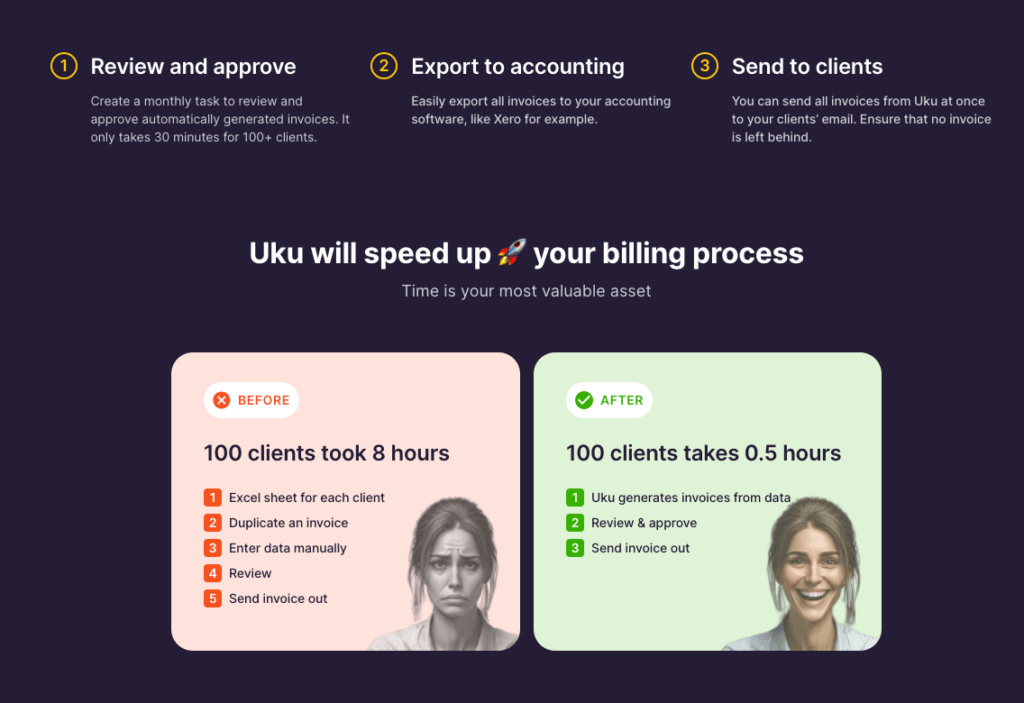

1. Review and approve

97% of accounting firms approve invoices once a month. The invoice system must automatically create draft invoices daily according to the clients’ contracts to give an overview of the sums and confirm the invoice exactly when needed.

2. Export to accounting software

Easily export all invoices to your accounting software, such as Xero or Quickbooks. The invoice numbers update according to the settings, and the invoice payment statuses update to send reminders about unpaid invoices if necessary.

3. Send to clients

Ideally, all invoices should be sent out in bulk and with a good overview so no invoice is left behind. Successful accounting firms send out their clients’ invoices in an average of an hour.

Billing is only one part of automating the accountant’s work. Research shows that with the right technology, 40% of accounting functions are fully automated.

Top Picks for Billing Software for Accounting Firms

Uku

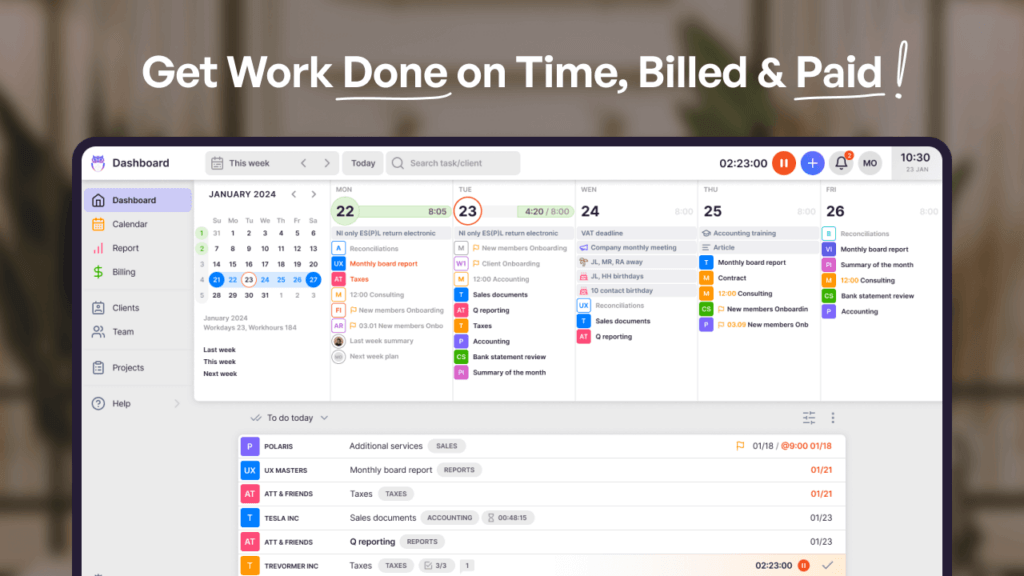

Uku is the accounting practice management software built to get accounting work done, billed, and paid at the right time.

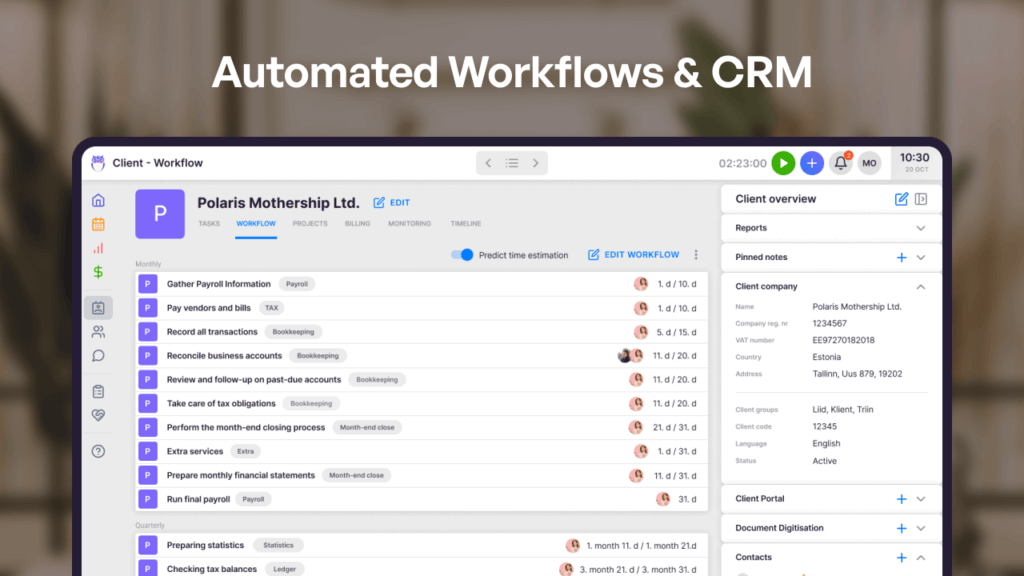

It provides accounting firms automated workflows and a customizable CRM. These apps help boost your accounting firm, increase visibility, and improve your billing process.

Uku was founded in 2017 and is used by accountants from over 25 European countries. Uku is the number one time and billing software choice among small to medium-sized Scandinavian accounting firms. The practice management software also serves UK, USA, Canada, Australia, and New Zealand accounting firms.

The founders, Rain Allikvee and Jaanus Lang are product designers and builders with over 25 years of experience.

They are big fans of user experience and business-critical problems. Uku’s long-term vision is to build a smart AI-powered assistant for accountants that helps them take their careers to the next level with modern tools and gives accountants and bookkeepers the freedom to do less.

Billing software for accounting firms like Uku can be a game-changer for those looking to enhance their billing processes.

If you want to change something, you have to go big. Knowing our accountant mothers, we need to put in a lot of effort and play the long game to earn their professional trust. We’re running a marathon!

Rain Allikvee / Co-founder of Uku

Other Core Features of Uku

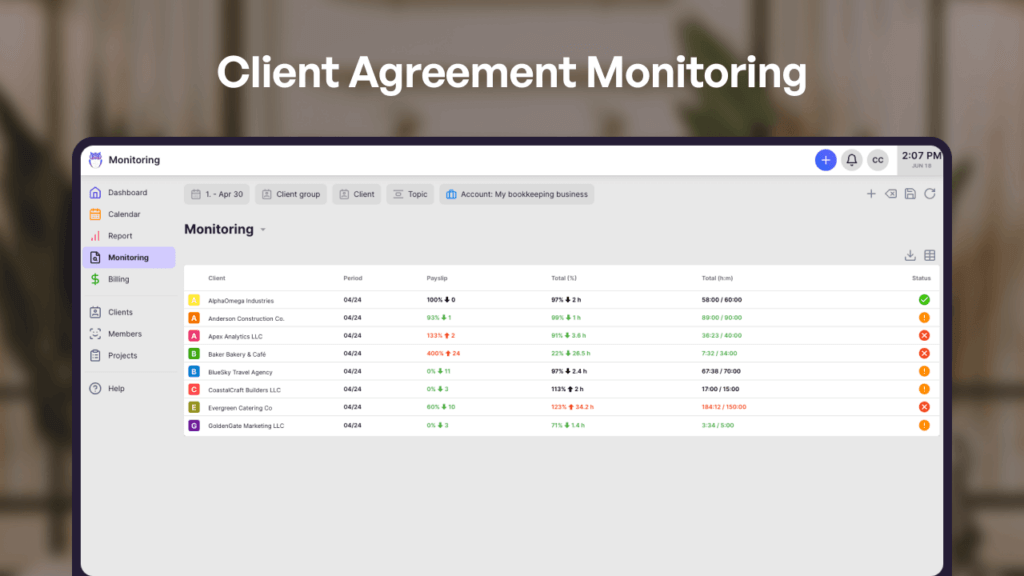

Uku offers several features that make it stand out as a top billing software for accounting firms, including client agreement monitoring and workflow management.

Client Agreement Monitoring: Ensure clients are billed accurately and on time, with tools to track contracts and engagements so you won’t overlook any details.

Workflow and Task Management with Templates: Manage tasks efficiently with daily, weekly, monthly, and yearly templates. Create workflows from scratch or use templates based on US accounting standards.

Time Tracking and Billing: Use a stopwatch or log time manually. Automatically generate invoices based on tracked time, distinguishing between billable and non-billable hours for precise invoicing.

Team Collaboration: Delegate, share, and track tasks seamlessly. Reassign tasks quickly when team members are unavailable. The Flextime app helps HR manage vacations, sick days, and overtime.

Business Insights and Reporting: Gain detailed insights into time expenses, task completion, and client agreements, aiding informed business decisions and productivity improvements.

CRM and Customizable Client Portal: Access critical client information through Uku’s CRM. The customizable client portal enhances client communication with document sharing, task delegation, and automated reminders.

Uku’s Pricing

Solo plan: Free

Team plan: from $38/month per user

Elite plan: from $48/month per user

Enterprise plan: from $88/month per user

Onboarding packages: Starting from $700

Other Time and Billing Software Options for Accounting Firms

This is based on quick survey by Uku in Nov 2025 of European, UK, US, and Canadian accounting firms. This is not absolute truth, but can give you some ideas. Clients have written critical feedback about these software solutions because real life is often not as great as it’s made out to be.

- Uku – G2 rating: 4.7

”Uku offers seamless time tracking, extensive reports, and billing. What I love most is its constant innovation, introducing features users didn’t know they needed. The hands-on support makes every customer feel appreciated and well cared for! <3”

Read more reviews from G2 - Karbon – G2 rating: 4.8

“The billing platform can also improve in the sense that you should be able to create billing runs for different types of work and you should be able to see billing history per client, per work.”

Read more reviews from G2 - Taxdome – G2 rating: 4.8

”At the moment, the billing and invoicing feature is what I like best. Integrated processing solutions include ACH for bank draft (from checking or savings, without a debit card). Being able to lock client documents with an invoice is also convenient and helps with collection.”

”The only thing that I think needs imporvement is the billing.”

Read more reviews from G2

Simpler Time and Billing Software for Accounting Firms

- Toggl Track – G2 rating: 4.2

”Toggl Track is so easy to use, and it has every feature I could possibly want to ensure I’m accounting for and billing for every bit of my time appropriately.”

Read more reviews from G2 - Harvest – G2 rating: 4.3

”Very easy to use. Great for professional services organizations that employ different billing models. Reliable – uptime is high. Integrated timesheet and estimate approval and invoicing.”

Read more reviews from G2 - FreshBooks – G2 rating 4.5

”Love the interface very easy to navigate. Intuitive and the support I had been stellar. I have to go though a lot of steps and re-verification when doing billing. The application refuses to fix taxed entries as a static field if I don’t check taxes might be omitted.”

Read more reviews from G2

If you are more interested in learning more about different time tracking and billing software for accountants, then here are top 5 time and billing software for accountants in 2026