Starting an accounting practice is a leap that feels equal parts exciting and intimidating. You want clients in the door quickly, but it’s easy to worry that getting noticed will cost more than you can spare. The good news? You can build momentum without burning cash. Smart, consistent marketing beats big budgets more often than you’d think.

On this page, we’ll introduce you to low-budget marketing strategies for your new accounting practice. As a business owner or certified public accountant (CPA), read on to learn how to implement digital marketing strategies for your firm on a meager budget.

How To Implement Low-Budget Marketing for Your New Accounting Firm

As a new practice, you consider the basics of your accounting workflow management. But as with any business, a critical part of the overall equation is your marketing implementation. You need to promote your firm to attract more prospects, engage with clients, and ultimately boost your long-term profits.

But how do you implement digital marketing strategies on a low budget for your new accounting practice? Here’s how:

1. Understand your target market

Before you post a single ad or draft a single email, get clear on who you’re trying to help. The accounting needs of a solo consultant differ significantly from those of a landscaping company with seasonal staff.

When you understand a client’s everyday pain points (cash flow hiccups, payroll headaches, tax anxiety, etc.), your marketing becomes obvious, and your messaging gets sharper.

Simple, free research goes a long way:

- Use a short Google Form to ask local business owners about their bookkeeping challenges and the services they wish they had.

- Lurk in LinkedIn groups and Reddit threads like r/smallbusiness (see below) to see which questions come up over and over.

- Attend a few local meetups and listen, so you can get valuable insights into marketing for accounting practices.

The best marketing insights often come from conversations, not expensive reports. Schedule coffee meetings with local business owners, join online entrepreneur groups, and listen to their accounting pain points. These free interactions tell you exactly what messaging will resonate.

Understanding what clients actually need shapes everything else, from your website copy to your social posts, even the packages you offer. It keeps you from guessing and helps you stick to work that brings results.

2. Build an online presence

These days, your website is your storefront window. If it’s clear, helpful, and easy to find, you’re already ahead.

You don’t need a custom build. Affordable platforms, such as WordPress and Wix, can produce a polished site in a weekend. Start with a simple structure of Home, Services, About, Resources, and Contact. Add a booking link, throw in some testimonials if you have them, and write short, plain-language descriptions of what you do. And that’s where search engine optimization or SEO for accountants comes in, right after!

For the uninitiated, SEO is the practice of improving your website so it appears in search engine results pages (SERPs) when potential clients look for accounting services online. For a new accounting practice, effective SEO helps the right people find you without paying for ads.

Over time, SEO drives consistent traffic from business owners who are actively searching for support. You can even use a website traffic checker to see how many visitors your site attracts and which pages generate the most interest.

That said, here’s how to implement your SEO tactics:

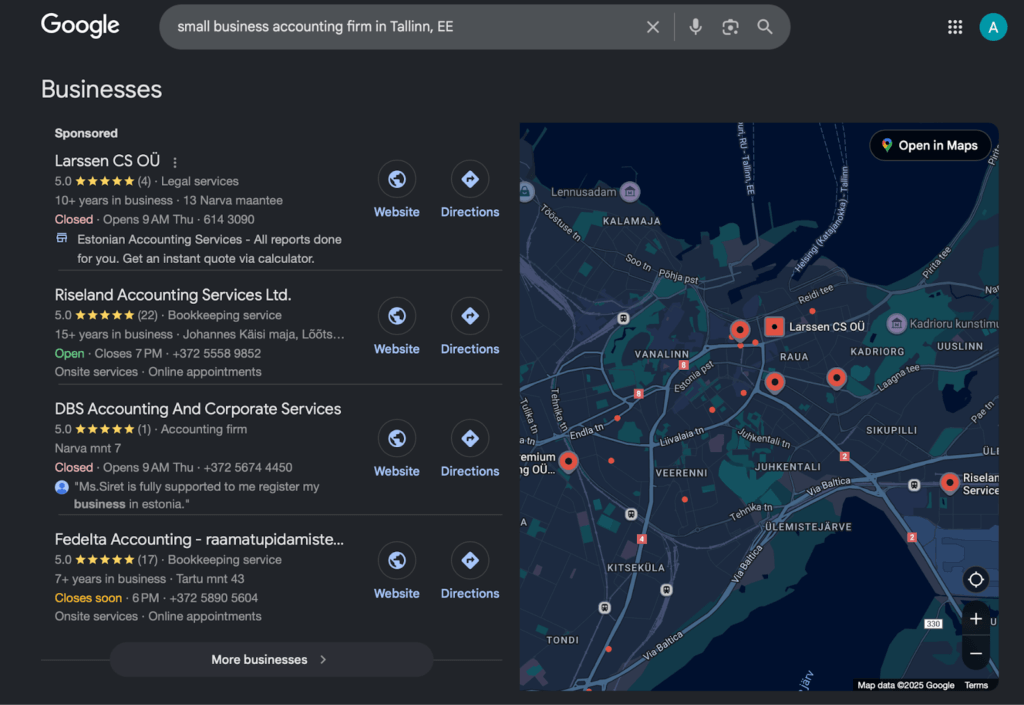

- GBM for local SEO: First things first, claim and complete your Google Business Profile so you appear in local searches and on Maps. It’s free and helps clients contact you quickly. Why is it important for your online visibility for local searches? See what comes up in the Google search engine when you look for “small business accounting firm in Tallinn, EE:

Image source: Google SERP

- SEO for search engine ranking: Write clear page titles and meta descriptions, use headings, and naturally include local keywords like “small business accountant in Denver.” Likewise, keep your contact details consistent, whether on your website footer, in your GBP, or LinkedIn.

- Social media accounts: Pick platforms your audience actually uses. Many small business owners live on LinkedIn and Facebook. Keep it simple with a consistent profile photo, a clear description of who you help, and a posting rhythm you can keep up with. Scheduling tools help you stay consistent without living online all day. Meta Business Suite is free for Facebook and Instagram, and LinkedIn now supports native scheduling.

3. Leverage social media marketing

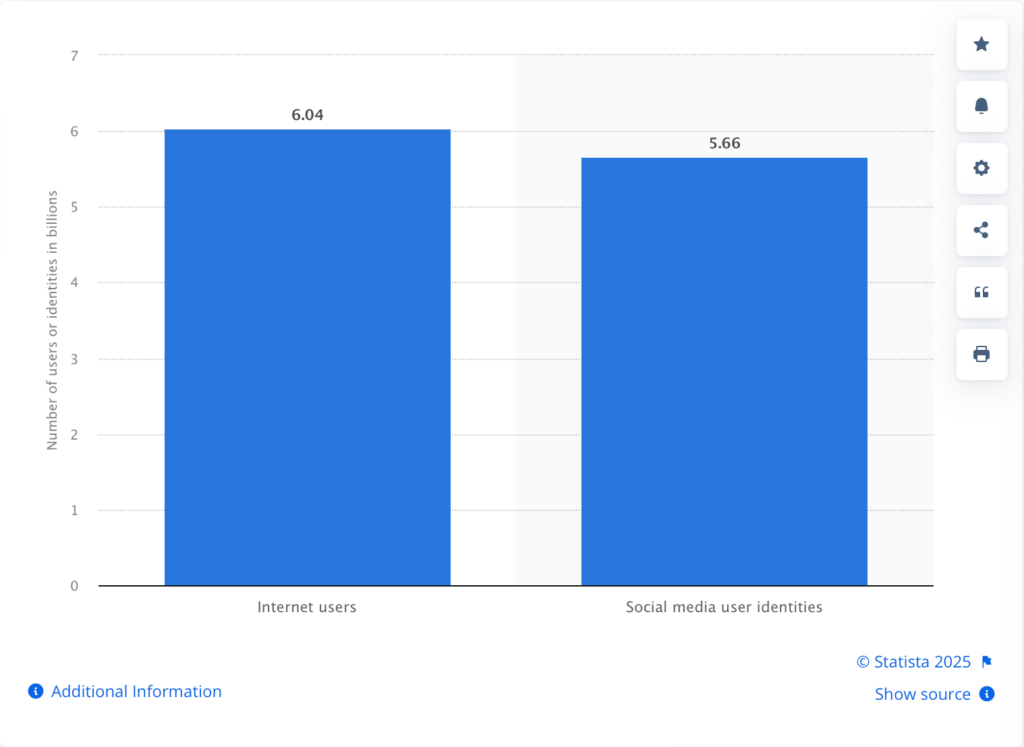

Social media can feel noisy, but it’s still one of the fastest ways to get known in your community. Not by shouting, but by showing up regularly and being useful. Why not? About 73% of the world’s population uses the internet, and nearly 69% are active on social media.

Social media success comes from being helpful, not promotional. Share tax deadline reminders, explain new regulations in plain language, and even offer quick financial tips. When you consistently provide value, potential clients start seeing you as their go-to accounting expert.

What does this look like in practice? Below are social media platforms to use for your marketing, with some accounting scenarios:

- LinkedIn: One solo CPA posts a “Friday Five” on LinkedIn with quick tips for cash flow, invoices, deductions, or other accounting ideas in general. Each post ends with a soft call to action: “If you want a checklist for this, message me.” After a month, they’ve had several direct messages and a few discovery calls. See how it works?

- Facebook/Instagram/TikTok/YouTube: Another accountant serving tradespeople records short “60-second tax tips” videos for Facebook and Instagram. They go as far as posting shorter clip versions of these on TikTok and YouTube. They use captions and simple visuals, then save every video in a website Resources page. That’s how social media marketing works!

- Social media groups: If you like community over broadcasting, join local business groups on Facebook and Slack as well as participate in online discords on other digital platforms. How? Answer questions thoughtfully and avoid pitching. It’s the same time investment as a coffee chat, but it scales because others see your answer later, too.

4. Utilize content marketing

Content marketing is just teaching in public. As an accountant, your expertise is exactly what anxious business owners are searching for at 10 p.m. If they learn from you once, they’ll remember you when it’s time to hire.

Every accounting question you answer becomes a marketing asset. Write blog posts about common bookkeeping mistakes, create tax preparation checklists, or record short videos explaining financial statements. This content works for you 24/7, attracting clients who already value your expertise.”

Below are pieces of content you can produce and publish for your new accounting firm:

- Helpful blogposts: To keep costs down, write one helpful blog post each month that answers a common question. Keep it short and plain. For example, address financial stress points by explaining concepts like debt relief programs. Outline when a business might consider them and how they impact cash flow and taxes. Educational content like this positions you as a trusted advisor while helping readers make informed decisions.

- Resource assets: Downloadable resources add long-term value with minimal effort. Consider creating a quarterly tax calendar or a bookkeeping checklist. These tools help business owners take action while subtly demonstrating their expertise. Offer them as lead magnets, then follow up with a short monthly email roundup sharing updates. Platforms like Substack make it easy to start a newsletter and build an audience:

- Content repurpose: When time is tight, reuse what you’ve already created. One blog post can become a LinkedIn thread, a short video, a checklist, or a carousel post. This approach keeps your messaging consistent and stretches a single idea across multiple channels. It also gives you a month’s worth of touchpoints without starting from scratch. Ultimately, content repurposing boosts your marketing efforts with zero to minimal costs!

5. Give promotional offers and discounts

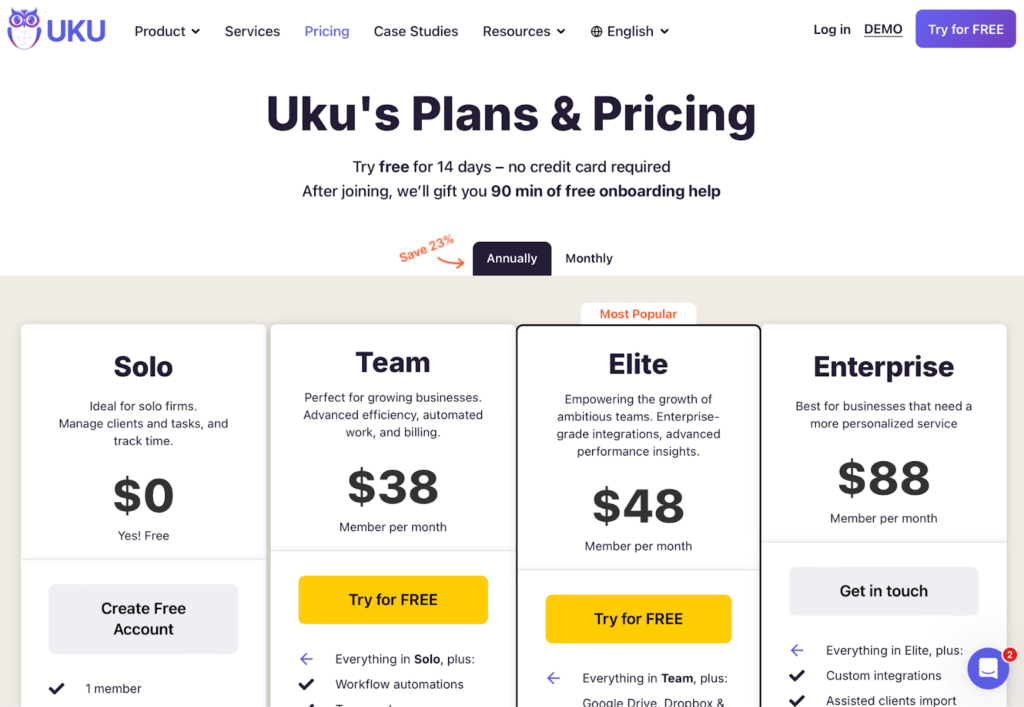

Introductory offers can nudge hesitant prospects into action, but there’s a balance to strike. Deep discounts train clients to expect low prices. Value-add packages reward action without devaluing your work. See the discount below as a perfect marketing example for an accounting practice, where you can save 23% if you get the offer annually:

Smart promotional offers focus on added value rather than reduced prices. Consider offering a free financial health assessment with the first month of services or including software setup at no extra cost.

Some firms even use thoughtful, branded touches, such as a small welcome gift or a design t-shirt collection for new clients. These gestures create a memorable onboarding experience without discounting core services. Ultimately, they reinforce professionalism and help your firm stand out while keeping pricing intact.

Here’s how to get started with offering promos/discounts:

- Set clear terms and timelines. Something like “Free QuickBooks setup with any monthly bookkeeping package signed by March 31” works well.

- Explain the “why” behind the offer. That way, this offer feels helpful, not desperate.

- Make it easy to continue. Your onboarding checklist, scheduled review calls, and clear scope of work help clients see the full value beyond month one.

Remember, clients who come for the value-add tend to stick around longer than those chasing discounts.

6. Network and build relationships

More than a few new practices get their first ten clients through relationships. People hire accountants they trust, and trust is built through real conversations. Start with what’s free and close by:

- Local chamber of commerce events

- Entrepreneur breakfasts

- Webinars from your state CPA society

- Small Business Development Center programs (visit the SBDC site below)

Your next client often comes from your existing network. Join your local chamber of commerce, attend startup meetups, or partner with business attorneys who need accounting referrals. These relationships cost nothing but time and often yield the highest-quality clients.

Think strategically about complementary services. Business attorneys, payroll providers, financial planners, and fractional CFOs all need trusted accounting partners. A quick “here’s who I serve, here’s how to refer to me, and here’s how I’ll refer you” one-pager can make partnerships easy.

You might also build a simple referral page on your site that explains who you’re best suited for, how to refer, and what new clients can expect in the first 30 days. Accounting communication using client portals is key!

Further, professional networking extends beyond direct referrals. Industry conferences, CPA retreats, and peer meetups often bring accountants and firm owners together. They even sometimes coordinate travel logistics, like performing an award flight search, to attend the same events affordably. These shared experiences create natural opportunities to exchange insights and collaborate across regions.

7. Monitor and evaluate marketing efforts

If you only track one thing, track where each new inquiry came from. “Website,” “referral,” “LinkedIn,” “event,” or “Google Business Profile” is enough to start. You can use an accounting practice management software to track and measure your marketing performance. Over a few months, you’ll see patterns and outcomes!

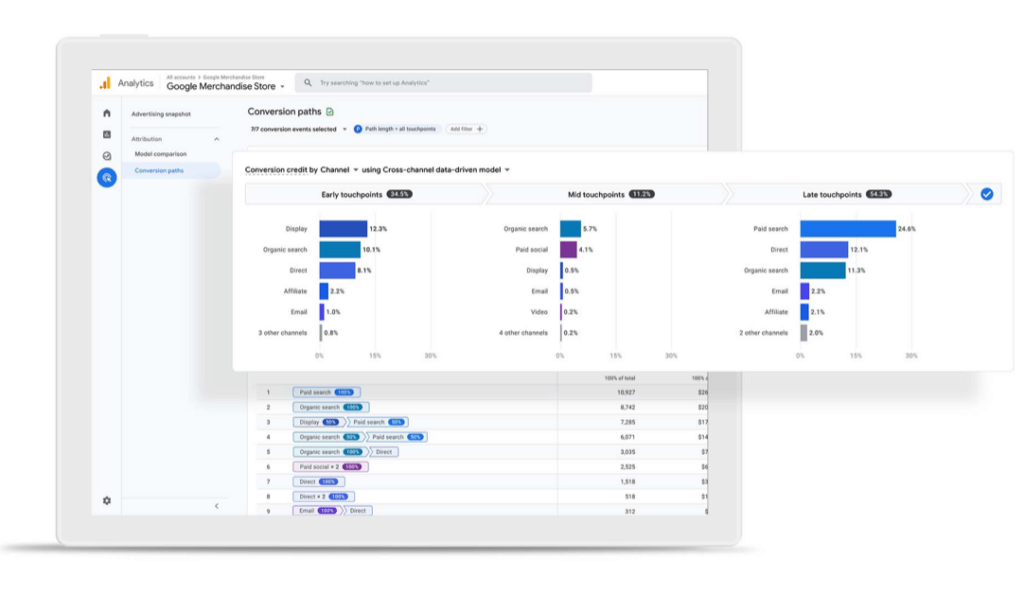

Start by tracking where each new client comes from: Was it your website, a referral, or social media? Free tools like Google Analytics show which content drives inquiries. This data helps you double down on what works and stop wasting time on what doesn’t.

Below are tools you can use for measuring your marketing performance:

- Google Analytics 4 shows which pages people visit and which pages lead to contact form submissions.

- Google Business Profile provides Insights on calls, website clicks, and searches that found you.

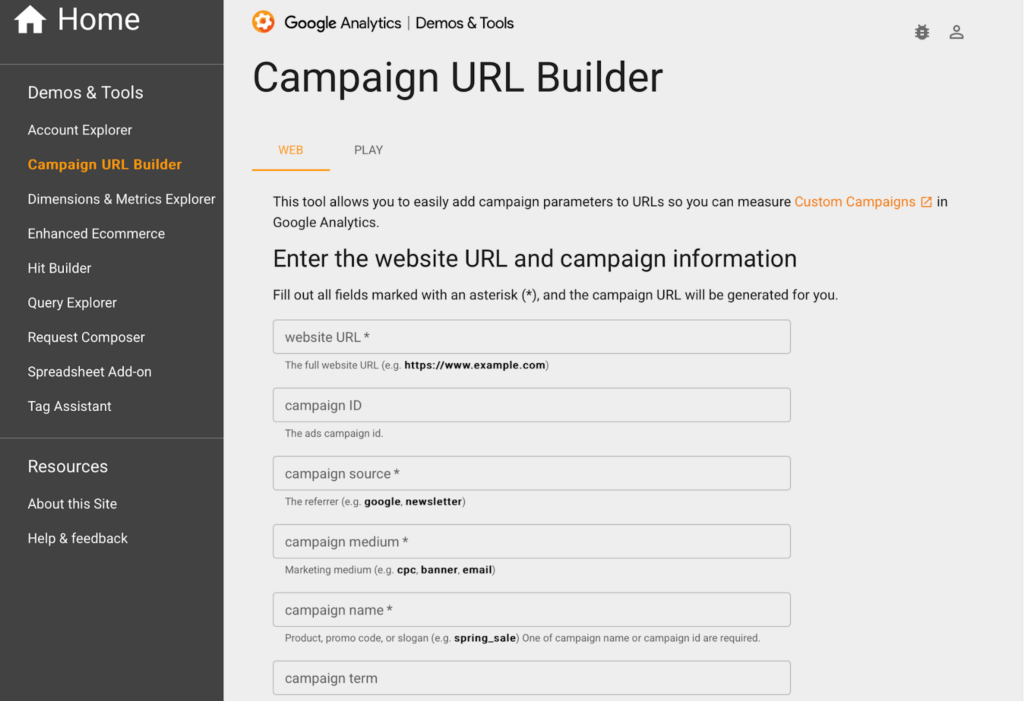

- Google’s free Campaign URL Builder lets you add UTM tags to links you share on social or email, so you can see which posts drive visits.

Further, you need to set KPIs to boost your accounting firm’s profits. That said, here are the key metrics you have to track and measure every month:

- Website – unique visitors, contact form submissions, top landing pages

- Social – profile views, link clicks, saves, direct messages

- Email – subscriber growth, open and click rates, replies

- Pipeline – number of discovery calls, proposals sent, close rate, average client value

Check your numbers monthly. If a type of post brings inquiries, do more of it. If an event produces zero conversations, try a different audience or format next time. Iteration is your best budget saver.

Final Thoughts

You don’t need a massive budget to get your first clients. You need clarity about who you help, a clean and credible online home, a steady drumbeat of useful content, and a few genuine relationships. Start small. Post once a week. Write one helpful article a month. Attend one event and meet two new people. Track what happens. Adjust.

The funny thing about marketing on a shoestring is that it forces you to be more creative and authentic. You can’t throw money at the problem, so you have to actually connect with people. And in accounting, where trust matters more than anything, that’s exactly what works.

Your early efforts compound faster than you think. One blog post might get read by ten people this month, but it’s still there next month when someone searches for that exact problem. A LinkedIn connection from a networking event might not need you today, but they’ll remember you when their cousin starts a business.

As far as your marketing is concerned, keep going, show up, be helpful. The rest takes care of itself. But if you need proper training, practice advisory, and consulting services for your new accounting practice, consider working with GetUku. Sign up today to get started for free!

For comprehensive marketing strategies beyond the startup phase, read our complete marketing for accountants guide.