To stay competitive among the rough competition in the ever-evolving accounting business, being more efficient than your competitors is the key. As clients demand growth and regulatory requirements become more complex, CPA firms must leverage every tool to simplify operations and boost profits. Advanced time-tracking software for accountants and billing solutions are two of the most powerful tools in a modern accountant’s arsenal.

While accounting, time tracking has become essential across industries, each sector adapting it to meet its unique operational needs. In construction, GPS-based tracking ensures employees’ hours and locations across multiple sites are accurately recorded. Retail and manufacturing rely on employee time clocks to manage hourly shifts and productivity.

For remote or distributed teams, task-tracking tools help monitor progress and maintain accountability without micromanaging. Service-oriented industries also rely on specialized tools to reduce administrative strain. For example, salons use platforms like Time Tailor to streamline appointment scheduling and eliminate manual tracking. These diverse applications demonstrate how time-tracking software can improve efficiency, resource allocation, and profitability across various fields.

Let’s dive deep into how these technologies can transform your CPA firm’s operations.

Innovating Pricing Models in Accounting Firms

Modern accounting firms have moved beyond the traditional one-size-fits-all approach to pricing. Today, successful firms employ various pricing strategies to meet diverse client needs. This strategy helps accounting firms maximize revenue.

Let’s examine the three most common approaches and explore how they can be effectively implemented with the right accounting firm time and billing software.

- Hourly and volume-based pricing models

- Package-based pricing models

- Hybrid pricing models

1. Hourly and Volume-Based Pricing Model for Accountants and Bookkeepers

Hourly and Volume-based pricing are traditional models that remain popular due to their simplicity and direct correlation between work performed and revenue earned. With this system, firms charge based on the time spent or the volume of work completed.

Examples of hourly and volume-based pricing options:

- Virtual CFO services: $125/hour

- Bookkeeping services: $60/hour

- Payroll processing: $75/hour

- Financial consulting: $150/hour

- Payroll calculations: $15 per employee

- Accounting entries: $0.8 per entry (for 100-150 entries)

While straightforward, this model can be enhanced with tiered pricing to incentivize larger volumes of work:

- 1-10 hours: $60/hour

- 11-20 hours: $55/hour

- 21+ hours: $50/hour

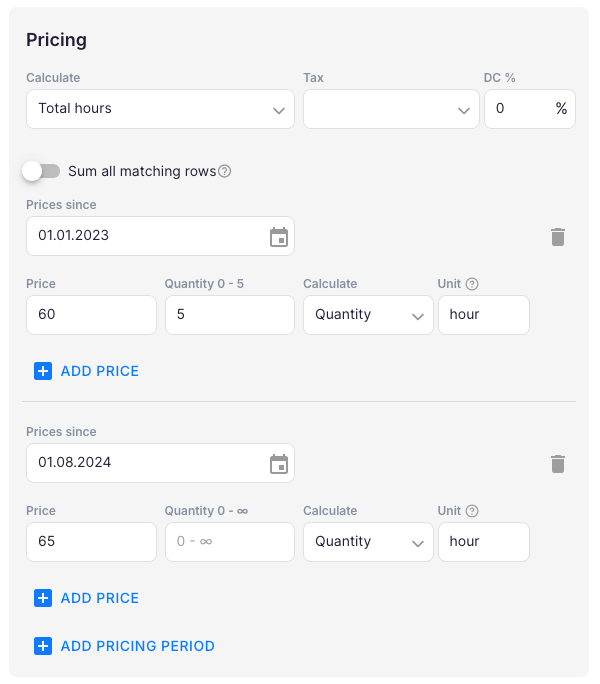

“Implementing this tiered system in your time tracking software for accountants can automatically apply the appropriate rates, ensuring accurate billing without additional administrative overhead.”

2. Package-Based Pricing Model for Accountants and Bookkeepers

Package-based pricing model offers tiered accounting service packages tailored to clients with unique needs and multiple sizes. It provides clients with predictable costs and can simplify billing for CPA firms.

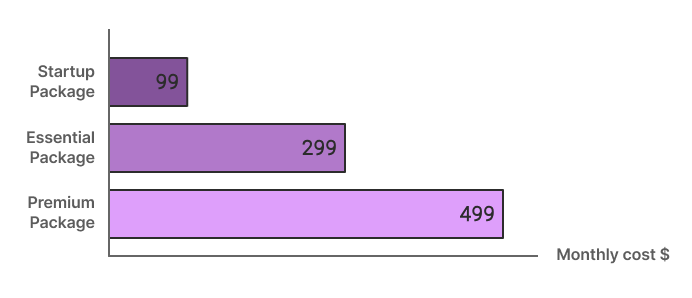

Example of how package-based pricing might be structured:

- Startup Package: $99/month

Includes: Basic bookkeeping, tax filings, 1 hour of consultation, quarterly financial statements, access to accounting software (e.g., Xero or QuickBooks), document collection with Envoice or CostPocket, and payroll for up to 5 employees. - Essential Package: $299/month

Includes: Dedicated bookkeeping expert, monthly financial statements, year-end tax preparation, P&L and balance sheet reporting, 1099 reporting, and unlimited communication with your bookkeeper. - Premium Package: $499/month

Includes: All Essential features plus a dedicated team of licensed tax professionals, annual income tax filing for businesses (partnerships, S corps, C corps) and individuals (sole proprietors, contractors).

With powerful Uku time and billing software for CPA firms, you can easily set up these packages and automatically apply them to client invoices, speeding up your billing process.

“It now takes 15 minutes instead of 1-2 days to create invoices.”

Annika Lattik, CEO of Aaron’s Accounting Services. Read the case study >

3. Hybrid Pricing (Package + Hourly) Model for Accountants and Bookkeepers

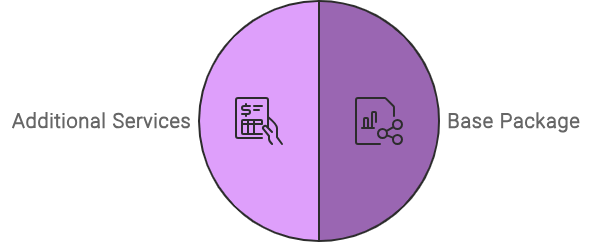

The flexible hybrid pricing model approach combines a base package with hourly billing for additional services, offering the best of both worlds. It provides a predictable base cost for clients while allowing CPA firms to charge for unexpected or out-of-scope work.

Example of a CPA hybrid pricing model

- Base package: $100/month

Includes: 0.5 hours of consultation, monthly financial statements, access to accounting software, and document collection with Envoice or CostPocket. - Additional services: $60/hour

Covers all extra work such as additional bookkeeping, tax preparation, financial analysis, or extended consultations.

“The hybrid pricing model offers the perfect balance of predictability for clients and flexibility for CPA firms. It’s become increasingly popular among forward-thinking accounting practices.”

Implementing this model with advanced time tracking software for accountants allows you to automatically track and bill for additional services, ensuring no billable time goes unaccounted for.

Popular Examples of Client Accounting Services (CAS)

Client Accounting Services (CAS) empowers accounting firms to overcome growth and pricing challenges by diversifying their service offerings, adopting value-based pricing models, and enhancing operational efficiency. By delivering high-value, specialized services, firms can attract and retain clients, optimize their operations, and position themselves for sustainable growth and profitability.

Tax Services

- Tax Planning

- Sales Tax Filing

Financial Management Services

- Virtual CFO Services

- Virtual Controller Services

- Management Reporting

- Cash Flow Forecasting

- Budgeting

- Financial Statement Preparation

Advisory Services

- Business Performance Reviews

- Advisory and Consulting Services

- Wealth Management

Risk and Compliance Services

- Internal Control Implementation

- Financial Risk Assessment

Analysis Services

- Cost Analysis

- Industry Benchmarking

Challenges of Implementing Flexible Billing Models

While flexible pricing models offer numerous advantages, they come with their own set of challenges that CPA firms must navigate:

- Complex billing

- Time-consuming processes

- Pricing changes are difficult

Billing is Complex

As pricing models become more sophisticated, they also become more complex to manage. Without the right tools, firms may struggle to accurately track time, apply the correct rates, and generate invoices that reflect their intricate pricing structures.

Billing is Time-Consuming

Creating accurate invoices in CPA firms with large client bases can be a monumental task. Many firms report spending 3-5 days each month on invoice preparation, taking valuable time away from billable work.

Difficulty in Implementing Pricing Changes

As your accounting firm grows and costs change, you’ll need to adjust your pricing. However, rolling out these changes across a large client base can be challenging and time-consuming, often taking up to 6 months to fully implement.

These challenges underscore the need for robust CPA firm time and billing software that can automate complex processes and adapt to changing pricing structures.

The Power of Time and Billing Software

Implementing advanced time-tracking software for accountants can address these challenges and unlock numerous benefits. Let’s explore how the right software solution can transform your firm’s operations:

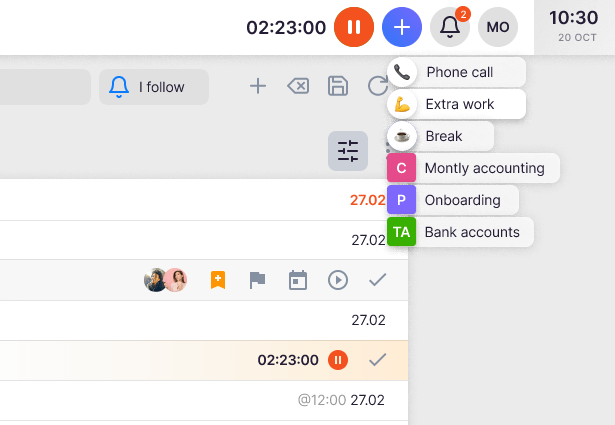

Fast, Easy, and Reliable Time Tracking

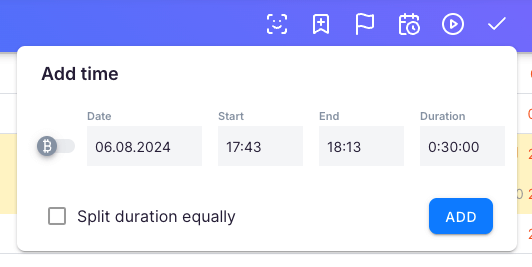

With one-click time entry and the ability to simultaneously track time across multiple clients, accountants can easily and accurately record all billable hours. For example, if a CPA spends 30 minutes processing bank transactions for 10 clients, they can allocate this time with just a couple of clicks.

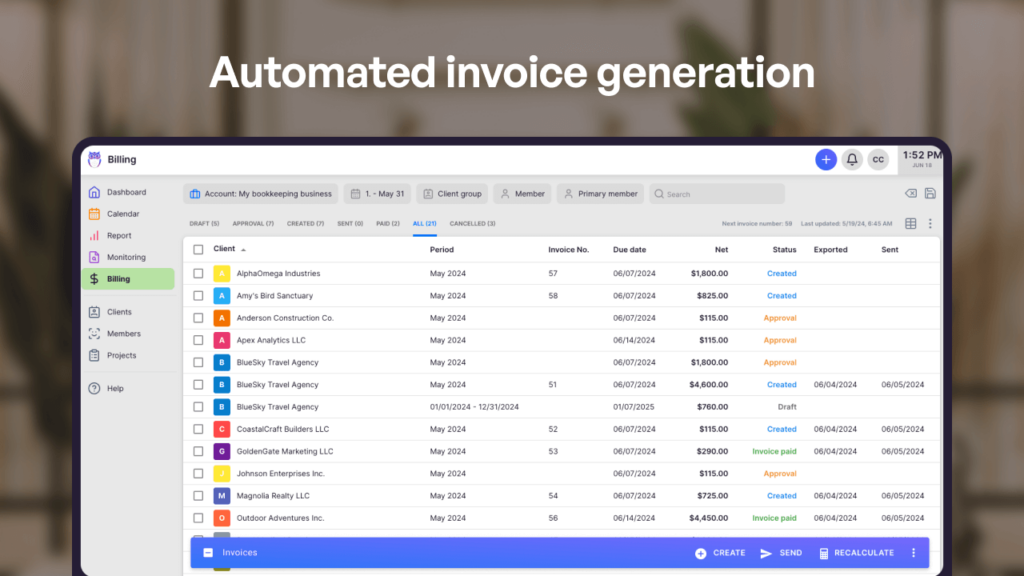

Automated Invoice Generation

Invoices can be generated automatically by integrating time tracking with your pricing models, drastically reducing the time spent on billing. Some firms have reported reducing their invoice preparation time from 5 days to just 30 minutes for a 380+ client base.

Easy Accounting Pricing Model Adjustments

Advanced software allows you to update pricing models across your entire client base with ease. This means you can implement changes quickly and ensure all new work is billed at the correct rates.

CPA firms using advanced time and billing software report up to 34% increase in revenue within six months of implementation.

This boost comes from more accurate time tracking, efficient billing, and the ability to quickly adapt pricing models.

Essential Features of Time Tracking Software for Accountants and Bookkeepers

When choosing a CPA firm time and billing software, look for these key features that can dramatically improve your firm’s efficiency and profitability:

- User friendly time tracking

- Dynamic product and service management

- Flexible client agreement management

- Automated billing and invoicing

1. User-Friendly Time Tracking

- One-click time entry – Employees should be able to start tracking time for predefined tasks with a single click. Ideally, 90% of common tasks should be readily available on the user’s dashboard.

- Bulk time entry – The ability to allocate time across multiple clients or projects simultaneously can save hours of administrative work each week.

- Quick call logging – Client calls should be easy to log, ideally with no more than three clicks.

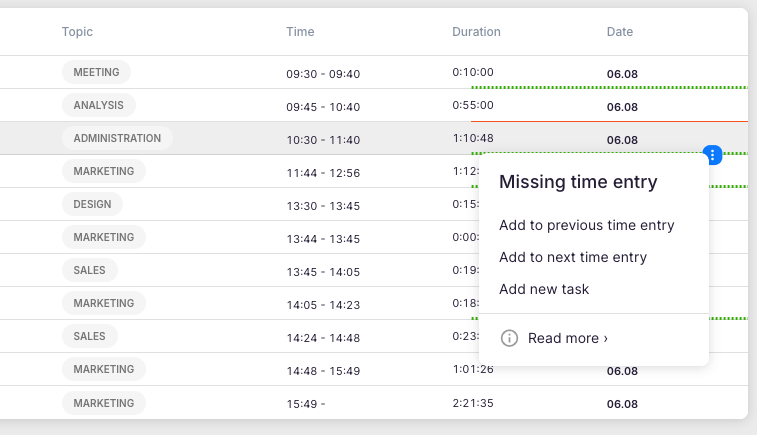

- Time entry verification – Look for features that help identify missed time entries or potential errors, such as overlapping time entries.

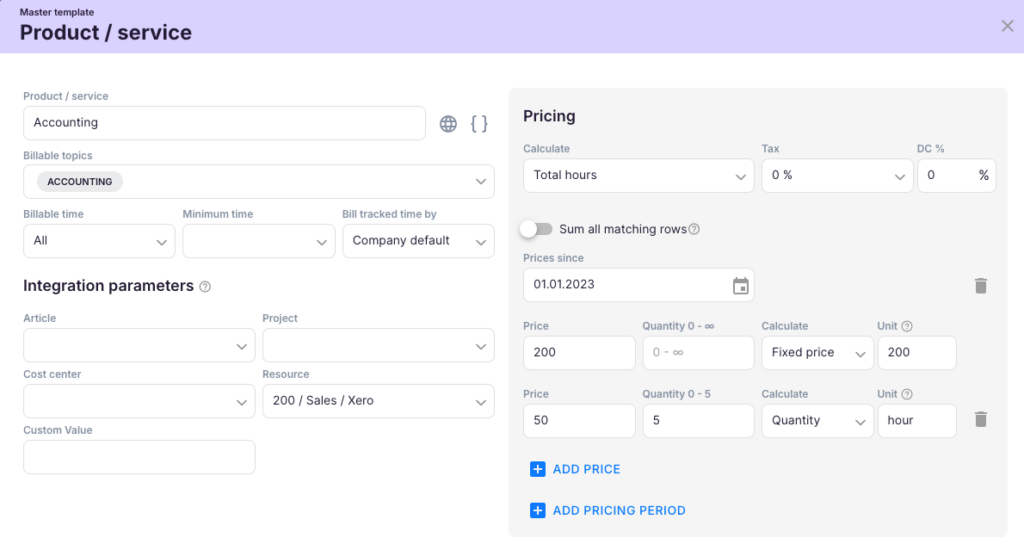

2. Dynamic Product and Service Management

- Customizable service packages – The software should allow you to create and modify service packages easily, enabling you to tailor your offerings to different client segments.

- Tiered pricing options – Implement volume-based discounts or tiered pricing structures effortlessly.

- Integration with accounting software – Seamless integration with popular accounting platforms like Xero or QuickBooks ensures consistency across your financial systems.

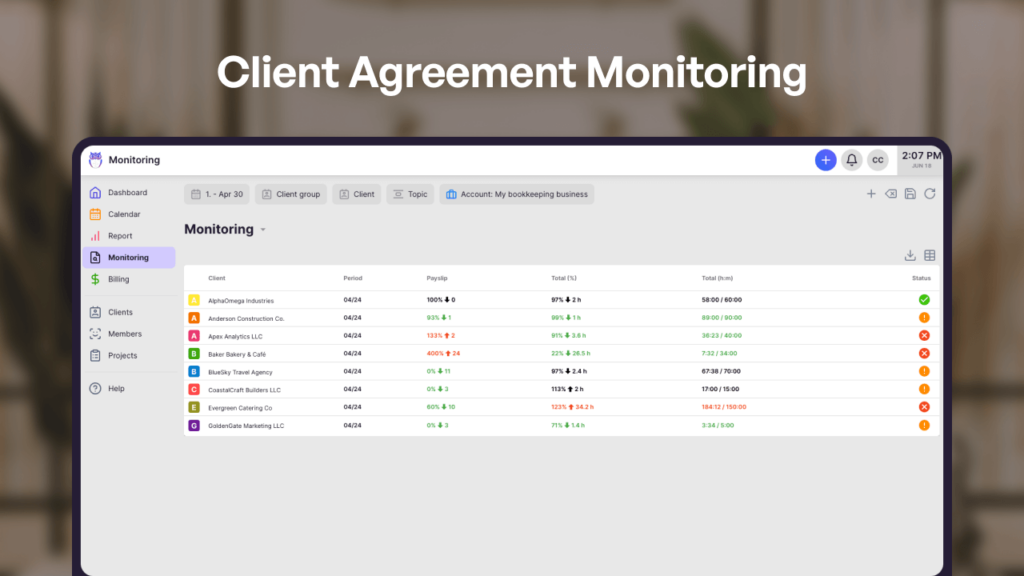

3. Flexible Client Agreement Management

- Customizable contract templates – Create templates for different service levels or client types to streamline the onboarding process.

- Multi-contract support per client– Some clients may require multiple service agreements. Your software should be able to handle this complexity.

- Easy agreement monitoring and adjustment – The system should alert you when client usage patterns change, indicating it might be time to adjust their service agreement.

4. Automated Billing and Invoicing

- Automatic invoice generation – Invoices should be created automatically based on tracked time and client agreements.

- Integration with accounting software – Ensure invoices are automatically recorded in your accounting system to maintain accurate financial records.

- Automated payment reminders – Reduce late payments with automatic reminders for overdue invoices.

“Automated billing reduced invoicing from 5 days to just 30 minutes for a 380+ client base. Getting invoices out faster saves time and improves cash flow.”

Maximizing ROI with Time Tracking Software for Accountants and Bookkeepers

What is ROI?

Return on investment (ROI) measures how effectively an investment generates profit or value. It’s a straightforward way to compare the performance of different investments by calculating the return relative to the cost. Several factors impact ROI, such as the initial investment amount, ongoing fees, and the revenue or cash flow the investment brings in.

To calculate ROI, you divide the investment’s return by cost, then express the result as a percentage or ratio. This gives you a clear picture of the investment’s efficiency.

How do you get the most out of your CPA firm’s time tracking software?

Consider implementing these strategies:

- Implement a hybrid pricing model (package + hourly) for maximum flexibility and profitability. This allows you to secure a base revenue while still capturing additional value from extra services.

- Regularly review and adjust client agreements based on actual time tracked. Use your software’s reporting features to identify clients who consistently go over their allotted hours and adjust their packages accordingly.

- Use automation to minimize administrative work and focus on client work and communication. The time saved on billing and administrative tasks can be redirected to client advisory services or business development.

- Leverage data insights from your time tracking software to optimize your service offerings. Identify your most profitable services and clients to inform your business strategy.

CPA firms that actively manage their pricing and leverage automation can see a 20% increase in profitability on average.

This comes from a combination of more accurate billing, reduced administrative costs, and the ability to focus on high-value services.

Real Accounting Firm Success Stories

Let’s look at some real examples of how CPA firms have benefited from implementing advanced time tracking and billing software:

A firm with 620 clients switched to a hybrid pricing model (package + tiered hourly rates) and saw a 34% increase in revenue within 6 months of implementation.

Another firm with 380 clients automated its billing system, reducing its monthly invoicing process from 5 full working days to just 30 minutes.

By automating time tracking and reducing human errors in data entry, one firm saved approximately 5% of their profit and significantly improved client relationships due to more accurate and transparent billing.

Conclusion: The Future of Accounting Firm Management

In today’s competitive landscape, efficient time tracking and billing are no longer optional for CPA firms – they’re essential for survival and growth. By implementing time tracking software for accountants, firms can:

- Price services in Hybrid Pricing (Package + Hourly) and transfer as many clients as possible to this model. You’ll definitely earn more this way!

- Systematize products and services across the company

- Create contract templates to use across the client base, with which you can effectively implement price changes in the future

- Set up invoice reminders if an invoice should go past due

- Set up client agreement monitoring to price fairly and maintain good relationships with clients

There are several time and billing software for accountants, but as Jason Staats has said, no one else has solved it as thoroughly and capably as Uku, the accounting practice management software.

“The right CPA firm time and billing software doesn’t just save time and increase accuracy – it can be a transformative tool that allows your firm to scale efficiently and provide more value to clients.”

Are you ready to transform your CPA firm’s time-tracking and billing processes?

Consider exploring Uku, a leading solution, to see how it can benefit your practice. With its large feature set and user-friendly interface, Uku has helped numerous accounting firms with their operations.

Book a demo with Uku today and take the first step towards optimizing your accounting firm operations

With this demo, you’ll discover how the right time-tracking software for accountants can propel your firm into a more efficient and profitable future.