Financial Cents has established itself as a comprehensive practice management solution for accounting firms, with the company reporting over 10,000 accountants worldwide using its platform to streamline workflows and improve collaboration. Its intuitive interface and comprehensive feature set have made it a common choice for firms transitioning from spreadsheets and disconnected systems to centralized practice management.

To create this Financial Cents review, I’ve analyzed the platform extensively. I believe it’s the ideal choice if:

- You value a large community of users sharing workflow templates and best practices

- You need deep email integration to manage client communications

- You want visual capacity management to prevent team overload

- You appreciate built-in proposals and engagement letters

- You prefer extensive onboarding support and resources

However, Financial Cents might not be the best choice if:

- You want a permanently free option beyond a 14-day trial

- You need automated billing that reduces invoice preparation from days to 30 minutes

- You require native Xero integration for seamless accounting workflows

- You need global capabilities with multi-currency and multilingual support

- You want flexible monthly pricing instead of a minimum 1-year commitment

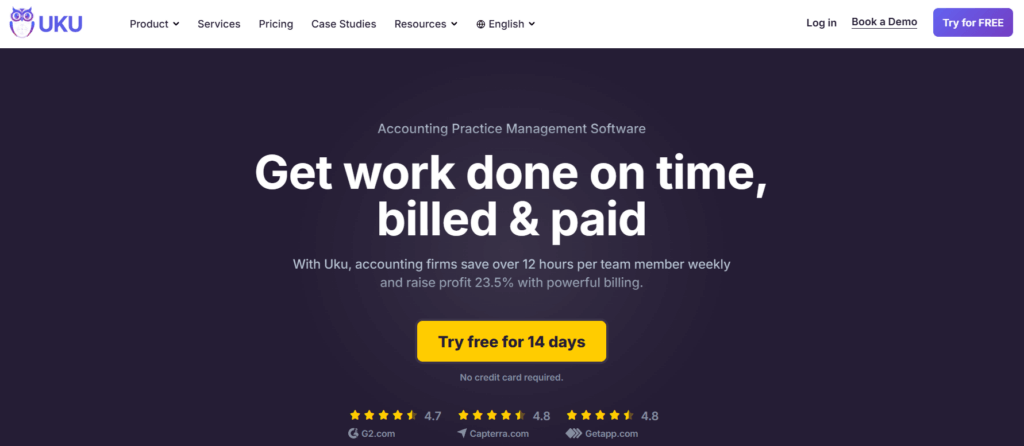

In this case, you should consider Uku: a practice management platform that takes a modular approach, allowing firms to start working on day one with just the features they need. With its automated billing system that reduces invoicing from 2-3 days to just 30 minutes and an integrated client portal that mirrors tasks on both sides, Uku helps firms discover outdated agreements and increase turnover by over 10%.

Because of that, I’ve included a detailed look at Uku later in this Financial Cents review, as the best alternative for firms prioritizing automated billing efficiency and flexible implementation.

If you’re ready to explore this approach, you can start with Uku’s free plan for solo practitioners.

Table of contents:

- What is Financial Cents?

- Financial Cents Pros & Cons

- Financial Cents Review: How it Works & Key Features

- Where Financial Cents Falls Short

- Top Financial Cents Alternative: Uku

- Financial Cents or Uku: Comparison Summary

- Final Verdict

What is Financial Cents?

Financial Cents was launched in 2020 by Shahram Zarshenas and Abdullah Almsaeed, who identified a gap in the market for practice management software that was both powerful and accessible.

The founders aimed to create an intuitive platform for the “everyday firm” that simplifies how work gets done, observing that many existing solutions were either too complex or too expensive for solo practitioners and small firms.

Today, Financial Cents serves as an all-in-one accounting practice management platform that brings teams, clients, and data into a single place. The software reports serving over 10,000 accountants globally and has grown steadily since its launch.

The platform encompasses workflow management, client relationship management, time tracking, automated billing, document management, and client collaboration through a secure portal. Its core value proposition centers on simplicity and efficiency, helping firms track client work, meet deadlines, and organize operations without the steep learning curve of enterprise solutions.

Financial Cents primarily targets small to mid-sized accounting and bookkeeping firms, including solo practitioners, who are looking to move beyond spreadsheets and manual processes. The ideal user values ease of use, quick implementation, and having a single source of truth for all client and project information.

Financial Cents Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Intuitive interface accessible to non-technical users | ❌ No permanent free plan (14-day trial only) |

| ✅ Community-driven template library with 100+ workflows | ❌ Requires minimum 1-year purchase commitment |

| ✅ Comprehensive email integration with focused client inbox | ❌ Limited to US/Canada markets (no multilingual support) |

| ✅ Visual capacity management and workload tracking | ❌ No native Xero integration |

| ✅ Built-in proposals and engagement letters | ❌ Lacks one-click document digitalization to accounting software |

| ✅ Strong QuickBooks Online integration | ❌ Limited bulk operations for file management |

Financial Cents Review: How it Works & Key Features

Workflow Management with Community Templates

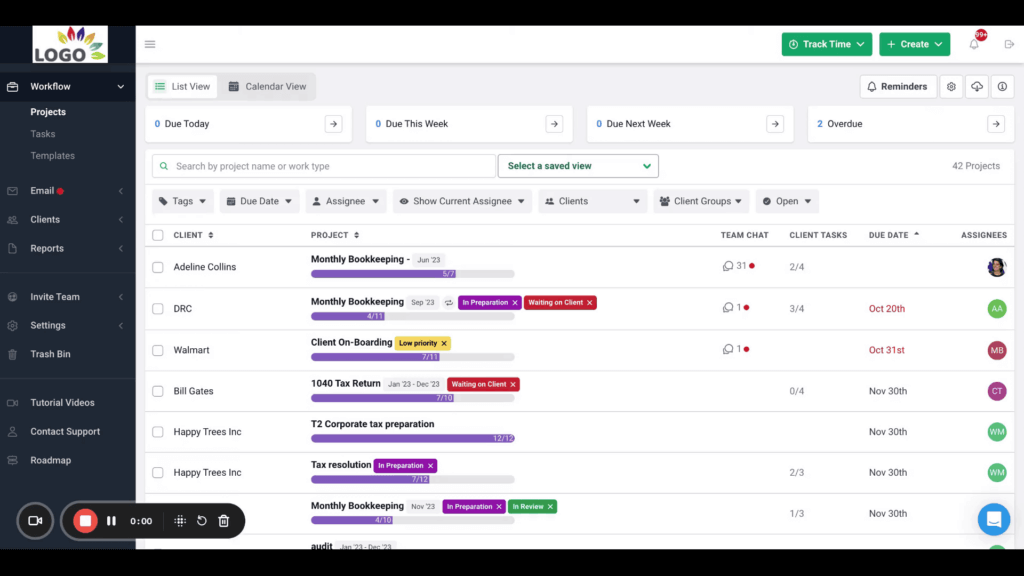

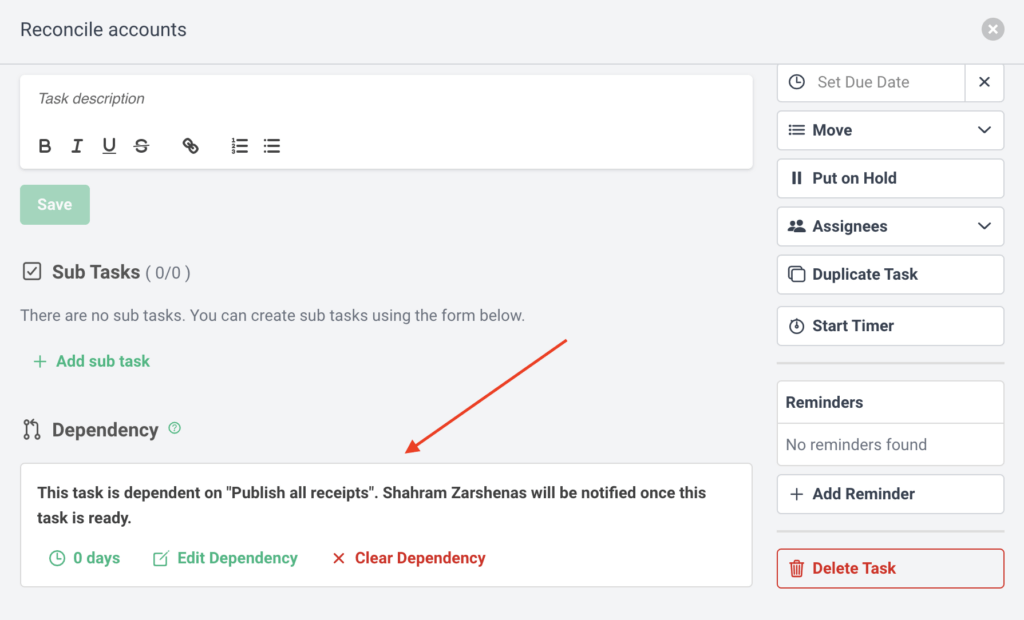

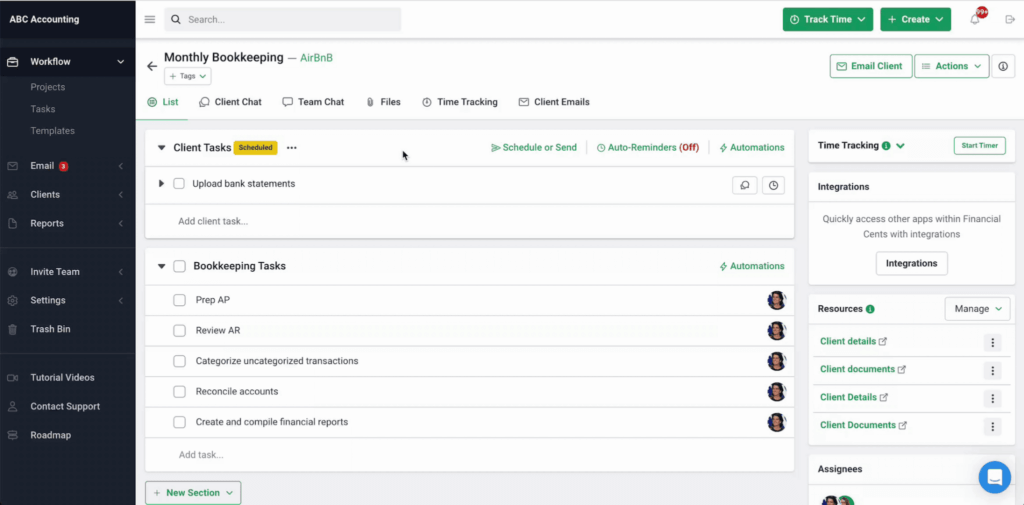

Financial Cents structures workflow management through a three-level hierarchy: templates, projects (client-specific work plans), and individual tasks.

The platform provides access to over 100 pre-built workflow templates created and shared by other accounting professionals in the community. These templates cover common services like monthly bookkeeping, payroll processing, and tax preparation.

Users can browse the template library and download relevant workflows, then customize them to match their firm’s specific processes. Once templates are set up, they’re applied to individual clients to create customized work plans. The system then automatically generates tasks based on recurrence settings, streamlining recurring work.

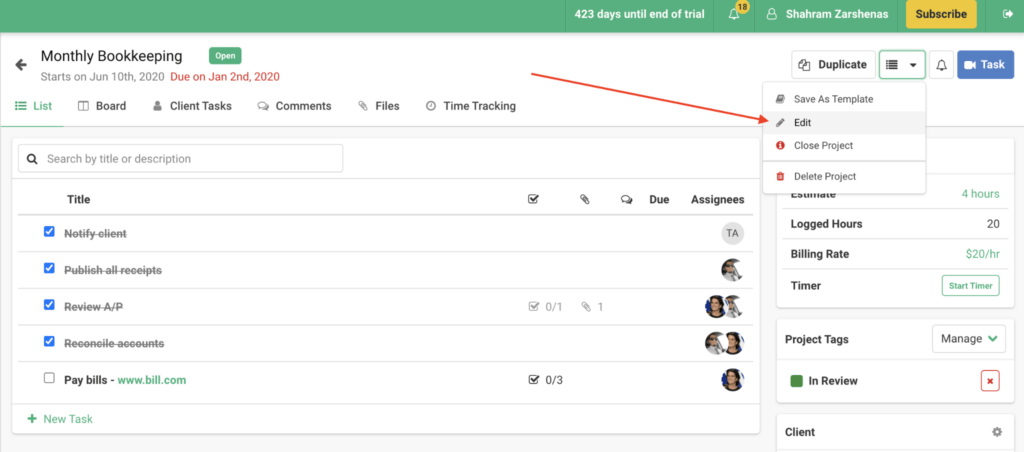

The workflow dashboard provides a real-time overview showing task statuses, assignments, and deadlines. Tasks can include subtask checklists, attachments, and notes. The platform also supports custom fields at the client level for tracking specific information like invoice counts or employee numbers. Task dependencies ensure certain tasks cannot start until prerequisites are completed.

Source: Financial Cents

Client Portal and Communication Hub

The client portal serves as a centralized platform for client interaction and document exchange.

Source: Financial Cents

Clients access the portal through secure email links and can view their assigned tasks, upload requested documents, and communicate with their accounting team. The portal can be customized with the firm’s branding, including logo, colors, and domain name.

Document requests are automated through the portal, with the system sending reminders to clients about outstanding items until they’re completed. This automation addresses the common problem of accountants spending hours chasing clients for information. All documents uploaded through the portal are automatically organized within the relevant project.

The portal integrates with document management systems including SmartVault (in beta), Google Drive, and OneDrive. Clients can also sign engagement letters and proposals electronically through Adobe eSignature integration, streamlining the onboarding process.

Source: Financial Cents

Time Tracking and Billing

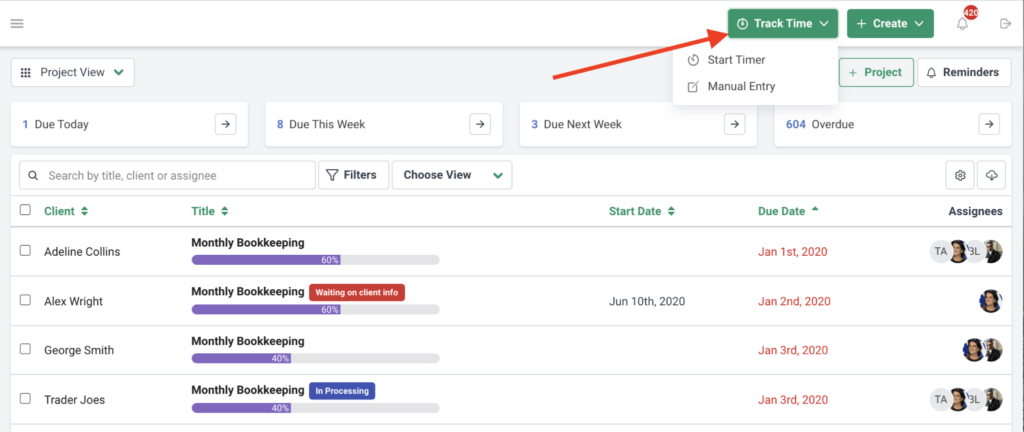

Financial Cents offers multiple time tracking methods to accommodate different working styles.

Users can track time using a running timer or enter time manually. The platform distinguishes between billable and non-billable hours, with all time entries flowing directly into reporting and billing modules.

Source: Financial Cents

The billing system generates invoices based on tracked time. It supports various pricing models including hourly rates and fixed fees. The platform integrates with QuickBooks Online for two-way time sync and one-way invoice sync, ensuring financial records stay updated.

An Effective Hourly Rate Report helps firms analyze profitability by comparing billed amounts against time spent, particularly valuable for fixed-fee engagements. This report identifies which clients may be consuming more resources than their fees justify, enabling data-driven pricing decisions.

Email Integration and Focused Inbox

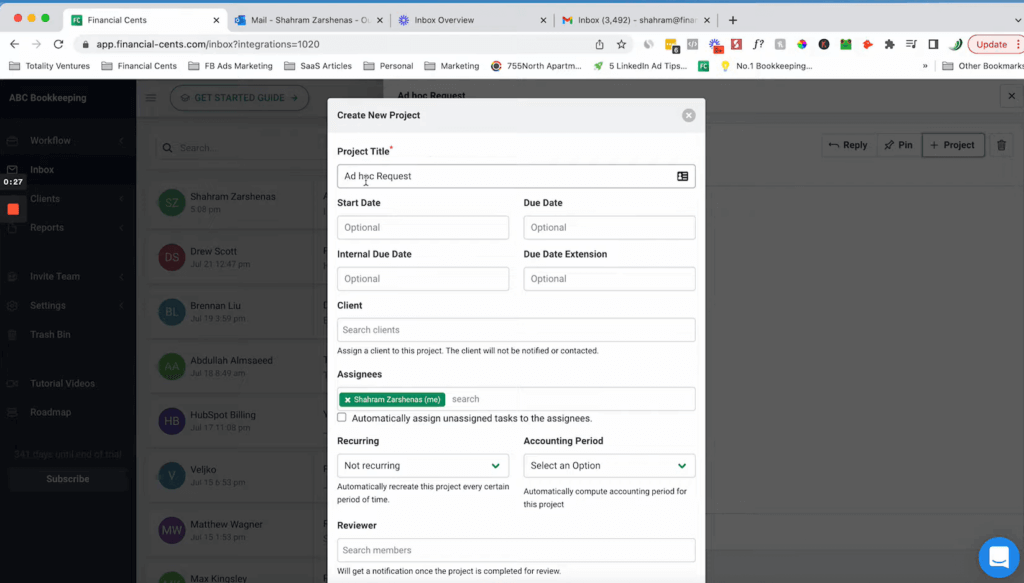

Financial Cents integrates directly with Gmail and Outlook to create a unified communication system.

Once connected, emails sync bidirectionally, meaning actions taken in Financial Cents reflect in the native email client and vice versa. The platform automatically creates a “Focused Client Inbox” that filters to show only emails from clients in the firm’s database, reducing inbox clutter.

Users can convert emails directly into projects or tasks, ensuring ad-hoc client requests don’t get lost in email threads. Emails can also be “pinned” to existing projects, making them accessible to all team members working on that client. An email audit trail tracks all communication between the firm and each client, providing transparency into who communicated what and when.

Source: Financial Cents

The platform allows integration of multiple email addresses, consolidating client communications from various accounts into a single view. This centralization helps prevent important messages from being overlooked when team members use different email addresses for client communication.

Where Financial Cents Falls Short

While Financial Cents is great at workflow automation and team collaboration, several limitations become apparent for firms with specific needs. These constraints reveal a platform optimized for US/Canada markets rather than global practice management.

Minimum 1-Year Commitment Required: Unlike competitors offering flexible monthly billing, Financial Cents requires a minimum 1-year purchase commitment. This upfront commitment can deter firms wanting to test the platform thoroughly before making a long-term financial decision. For firms transitioning from Excel or other systems, this represents a significant risk without the option for month-to-month flexibility.

Limited to US/Canada Markets: Financial Cents is exclusively US/Canada-centric with no multilingual support and billing only in USD. This geographic limitation excludes international firms or those with clients across multiple countries. The lack of multi-currency capabilities and language options makes it unsuitable for firms operating in global markets.

No Native Xero Integration: While Financial Cents offers strong QuickBooks Online integration, it lacks native Xero integration. For firms using Xero as their primary accounting software, this creates workflow inefficiencies and requires manual data transfer or third-party workarounds.

Source: Financial Cents

Manual Document Processing: Financial Cents lacks one-click document digitalization to accounting software. Unlike platforms that allow instant submission of documents for digitalization with a single click, Financial Cents requires more manual document handling processes. This limitation impacts efficiency, particularly for firms processing high volumes of client documents.

Substantial Upfront Configuration: While the platform offers extensive templates and features, implementing Financial Cents requires substantial upfront configuration and training. Firms cannot start working immediately with just the modules they need, instead requiring comprehensive setup before becoming productive. This approach conflicts with the needs of smaller firms wanting to implement software step by step.

These limitations aren’t failures but rather reflect Financial Cents’ focus on the North American market with comprehensive but rigid implementation requirements. However, they create opportunities for alternatives that prioritize global capabilities, flexible deployment, and automated efficiency.

Top Financial Cents Alternative: Uku

Uku addresses Financial Cents’ gaps by providing a practice management platform created from the ground up to be international, especially for UK and US markets.

With its modular approach and automated billing system, Uku enables the “from Excel to greatness” transformation that accounting firms seek.

True Free Plan and Flexible Monthly Pricing

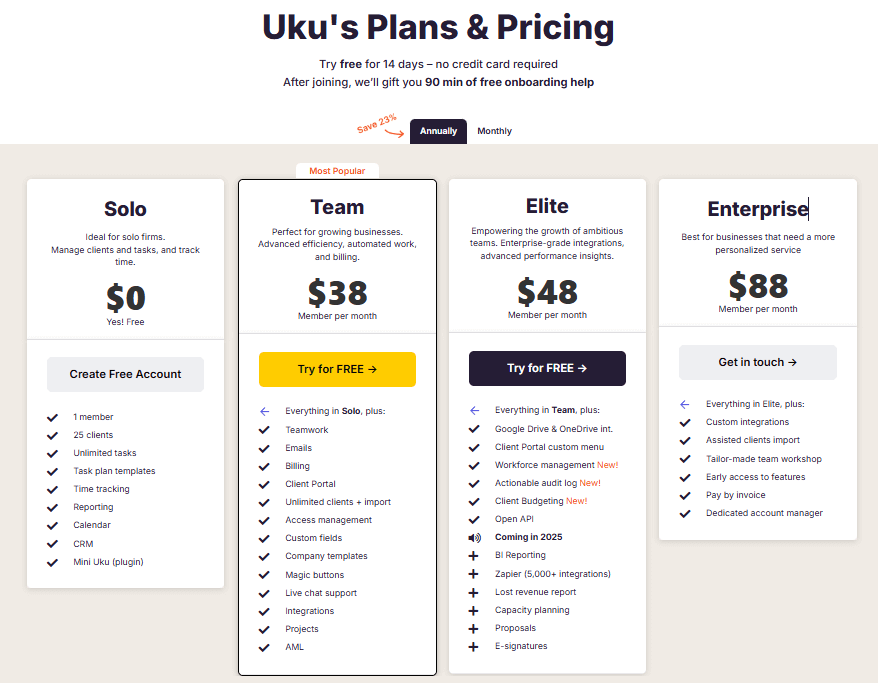

Where Financial Cents requires a minimum 1-year commitment after a 14-day trial, Uku offers a permanently free Solo plan supporting one user and up to 25 clients.

This includes unlimited tasks, time tracking, reporting, CRM functionality, and the Mini Uku browser plugin. For growing firms, the Team plan starts from $38/member/month with flexible monthly billing, and no annual commitment required.

Pricing is available in multiple currencies (€, $, £) to serve international markets. The Elite plan at $48/month adds advanced features like Client Budgeting, Document Management, and E-signatures. Both annual and monthly billing options are available, giving firms the flexibility to choose what works best for their cash flow.

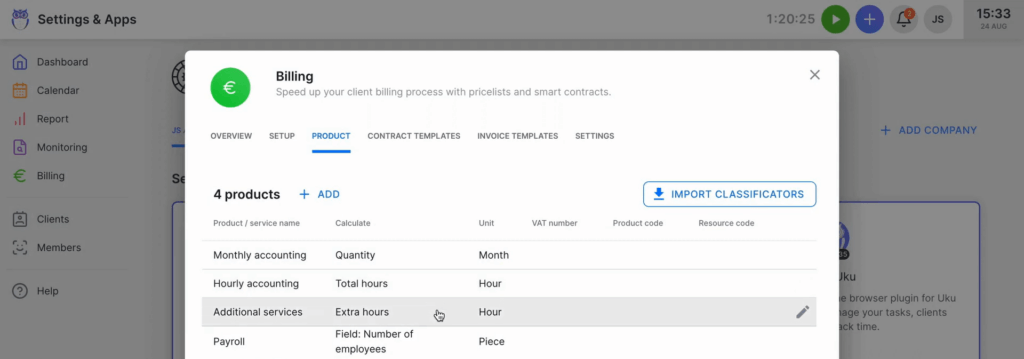

Automated Billing: From 2-3 Days to 30 Minutes

Uku’s automated billing system is the platform’s primary competitive advantage.

The system supports complex price lists based on quantity, time, material, and ranges with different rates for different periods. Advanced rounding rules based on entry, team, client, or month allow firms to properly bill for interruptions. For instance, a one-minute unplanned call can be automatically billed as 15 minutes.

Source: Uku

Everything is automated through ‘contracts’ where rules are set up once, then time tracking automatically calculates billable amounts in real-time. What normally takes 2-3 days of invoice preparation is reduced to approximately 30 minutes. The system tracks both sales prices and actual cost prices, so if an employee costs €30/hour but bills at €45/hour, managers can see profitability instantly.

Many customers report seeing up to ~20% more profit by discovering outdated agreements where they were billing for eight hours but employees were doing 20 hours of work. The BI Reporting provides real-time visual reports and alerts, preventing firms from discovering losses 30 days too late.

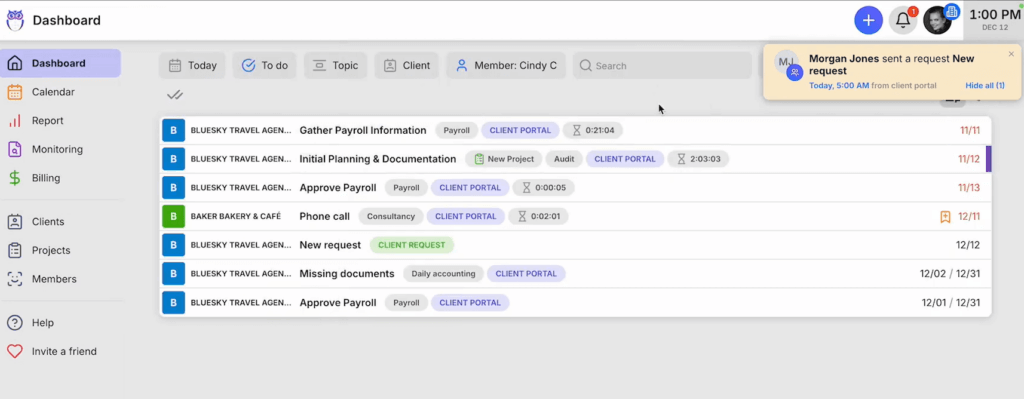

Integrated Client Portal That Mirrors Tasks

Unlike traditional portals where tickets must be connected to work items, Uku’s portal mirrors the exact same task on both sides.

Source: Uku

Clients and accountants work on the same item with all communication, actions, documents, logs, and time tracking in one place. When clients make requests through the portal, notifications appear on the accountant’s dashboard, and they can immediately start tracking time within that same task.

The portal uses a “magic link” system that eliminates passwords entirely. Clients receive an email with a secure link providing instant access. The portal is highly customizable. Firms can create unique menus for each client, run onboarding with forms, share business insight reports, display price lists, and embed custom content with simple copy-paste functionality.

Global Capabilities and Native Integrations

Supporting 12 languages and multi-currency capabilities, Uku serves 1000+ clients globally across the UK, USA, and Scandinavia.

The platform offers native Xero integration alongside other accounting software connections, addressing a critical gap in Financial Cents’ offerings.

Documents can be submitted for digitalization with a single click, sending them directly into accounting software. This level of automation for document handling is unique in the practice management space and significantly reduces manual data entry.

Modular Approach: Start Working Day One

Like an iPhone where you start with basic functionality and add apps as needed, users can begin with just CRM and tasks, then gradually add features. This flexibility is designed for small and medium-sized companies that need agility. Firms can start working on day one, activating only the modules needed and scaling up as they grow.

This modular deployment represents one of the biggest reasons why clients switch from competitors to Uku, as it eliminates the need for substantial upfront configuration and training. Users can work with their Excel file for an hour, import it into Uku, and have automated plans ready to go, thereby achieving the “from Excel to greatness” transformation.

Financial Cents or Uku: Comparison Summary

| Feature | Financial Cents | Uku |

|---|---|---|

| Starting Price | $19/month Solo plan (1-year minimum) | Free Solo plan (up to 25 clients) |

| Team Pricing | $49/member/month (annual commitment) | From $38/member/month (flexible monthly) |

| Premium Tier | $69/month (Scale) | $48/month (Elite) |

| Billing Flexibility | Minimum 1-year commitment required | Monthly or annual options available |

| Invoice Preparation Time | Standard manual process | ~30 minutes (from 2-3 days) |

| Global Capabilities | US/Canada only, USD billing | 12 languages, multi-currency (€, $, £) |

| Xero Integration | Not available | Native integration |

| Document Processing | Manual handling | One-click digitalization to accounting software |

| Implementation Speed | Substantial upfront configuration | Start working day one with modular approach |

| Client Portal | Password-protected access | Passwordless magic link with task mirroring |

Final Verdict

The choice between Financial Cents and Uku ultimately depends on your firm’s geographic scope, implementation preferences, and billing efficiency needs.

Choose Financial Cents if your firm operates exclusively in the US or Canada and values community resources through shared templates.

It’s ideal for practices that heavily rely on QuickBooks Online integration and need advanced mail inbox management. The platform suits teams willing to commit to a full year upfront and invest time in comprehensive initial configuration for long-term benefits.

Get started with Financial Cents here.

Choose Uku if you want to minimize your team’s admin time with automated billing that reduces invoice preparation from days to 30 minutes.

It’s perfect if you value ultra-fast onboarding and modular scaling, allowing you to start with just the features you need. The platform excels for firms needing multilingual or multi-currency support, those transitioning from Excel wanting the easiest implementation, and teams preferring flexible monthly pricing rather than annual commitments. With native Xero integration and one-click document digitalization, Uku provides “a system your team will actually enjoy using.”

Both platforms deliver on the promise of streamlining accounting practice management. Financial Cents excels at community-driven efficiency within North American markets, while Uku stands out for its automated billing efficiency, global capabilities, and modular approach that lets firms implement software step by step. Your choice depends on whether you prioritize community resources with annual commitment or automated efficiency with flexible, immediate implementation.