In an accounting firm, the main focus is on providing accounting services. Client management and client-related procedures are essential but distract from the tasks that accountants do best. Even though accountant CRM is not the most popular idea, accounting firms can benefit highly from adopting accounting CRM software. How to use CRM as a bookkeeper? Let’s find out.

Why should you start using CRM?

- All of your client data is in one place.

- Save time by automating emails.

- Your clients feel valued.

- You can see exactly whether the actual volume of work corresponds to the contract concluded with the client.

What is CRM?

CRM is short for Customer Relationship Management. Companies primarily use it to improve customer experience and increase sales. CRM helps the company to be more organised and efficient, manage working time, and serve customers more conveniently.

Most CRM programs allow users to differentiate between clients and potential clients or leads, organise client communication (calls, agreements, emails), automate recurring tasks, and analyse collected data.

Many businesses use spreadsheets, databases, and apps when they could be using combined accounting CRM software instead.

Who uses CRM software?

Customer relationship management software is primarily intended for companies that offer business-to-business (B2B) services with a long sales process, such as real estate or accounting firms. It’s also become essential for service-focused teams, where a CRM for agencies helps streamline projects, track clients, and keep communication organized. A collective client base is also beneficial for companies offering remote work opportunities.

CRM functions offer the most value to a business’s sales department. That’s why many forward-thinking firms now rely on AI research tools used by marketing and procurement teams. To get ahead, AI business sourcing tools can sift through endless data to find your ideal clients, making your outreach efforts smarter and more successful from day one.

CEO or manager

The duties of a manager are wide-ranging. However, being a specialist in every field is challenging. This is where various software comes in handy, which helps the manager manage his company and employees better. CRM software with a convenient and practical design helps explain its content with visuals created from data, providing an overview of the team’s work.

An employee

As mentioned, CRM is a handy tool for a salesperson. However, CRM software for accountants is essential in an accounting firm. For example, accountants can add specific data to each client, such as which bank the client uses or who to contact if documents are missing.

In a bookkeeping CRM, you can add all kinds of information to the client profile, which helps communicate with the client. For example, mark down the client’s birthday in their profile. In this way, the accountant never forgets a client’s personal information, and the client feels like a king when talking to the accountant.

Accounting firm CRM, is it necessary?

Usually, accountants have their own ‘systems’ of dealing with clients who have served them well over the years. This ‘system’ can be in emails, an Excel spreadsheet, or even on paper stored in the office. Most probably use some form of accounting software. Accountants do not see themselves as ‘sales’ but recognise the need to sell their services to remain profitable and sustainable.

CRM for accounting practice should be a combination of people and technology

Most CRM software requires accountancy practices to be process-oriented. In other words, it concerns documentation accountants use to react to client engagement. Using CRM for an accounting practice to smoothen workflows is important.

The key to ensuring end-user adoption is to focus on what would make their life more comfortable to do their job and serve their customers better. Because if tasks are done on time, the customer is happy. From the outset, this fosters a positive relationship, discussing and selling more of a ‘client offering’ than directly selling.

The complexity of customer management depends on the size of the company. A small business with five clients can keep its data in a notebook and easily find it when needed. However, large companies have a much more complicated situation. The data of several hundred or even thousands of clients would require a library to store, and finding the correct data is a lot of work.

A detailed client database is why CRM for accounting firms gives extra value.

Keeping client data in one system when working with a team is very practical. This way, everyone can access essential data, even if an employee serving a customer goes on vacation or is not at the office.

CRM holds all client data that is always available for the whole accounting firm and keeps employees from puzzling.

With the help of CRM, accountants can spend valuable time working rather than on customer management. Saving time comes from automating recurring accounting tasks. With the help of recurring tasks, you can create a workflow for client communication.

Avoiding human errors is also a bonus of the software. If the recurring task is well planned, it starts an efficient process. The correct recurring task will reappear on the desktop every month.

How to use CRM as an accountant?

Accounting CRM software provides value in several different ways. Client management starts even before the contract is signed. The first step is to win over the client. For this, it is necessary to carry out several processes, like negotiating with the client and conducting a background investigation.

Once you have entered existing and potential clients into the system, you can gather all their information using CRM software. This way, when employees get ill or go on vacation, a situation where an employee does not have information about a specific client will not arise. Using all the data, the accountant leaves the client feeling like they are their only client.

A personalised approach is the basis of a long-term customer relationship.

Is it necessary to use separate CRM and accounting software?

One of the most popular CRM software in the world is Pipedrive. This CRM software lets you manage all client communication from one place, monitor how many letters sent have been opened, how far a client is in the sales process, and much more. Here is a list of the best CRM for accounting firms: Uku, Firmao, Zoho CRM, Freshsales, HubSpot CRM, Bitrix24, Capsule CRM and Creatio CRM software.

The more advanced the software, the longer it will take to set up and deploy.

At this point, it is worth thoroughly evaluating whether the time spent learning new software is worth it. If the accounting office plans to dominate the world’s markets, it is okay to introduce a new separate CRM for accountants.

CRM capabilities are also often added to work management software, which one could also call CRM accounting software. For example, work management software Uku has a simple, convenient design and includes CRM, task management, and invoicing automation.

How to use Uku as CRM accountants and bookkeepers can benefit from?

We at Uku base our CRM for accounting practices on a customer-focused approach. Naturally, we have workflow processes that you’d expect from all CRM software. Yet ours includes time tracking, so it is even easier to track all billable hours to determine how profitable a client is.

Every accountant using Uku can observe recorded transactional data and billed hours and how the customer wishes to interact, making it an invaluable tool for understanding what type of client you are dealing with and how you can improve customer satisfaction.

Finally, Uku’s powerful reporting will permit users to analyse the entire practice and determine which services sell more (or not), bring in more revenue, or take up more employee hours.

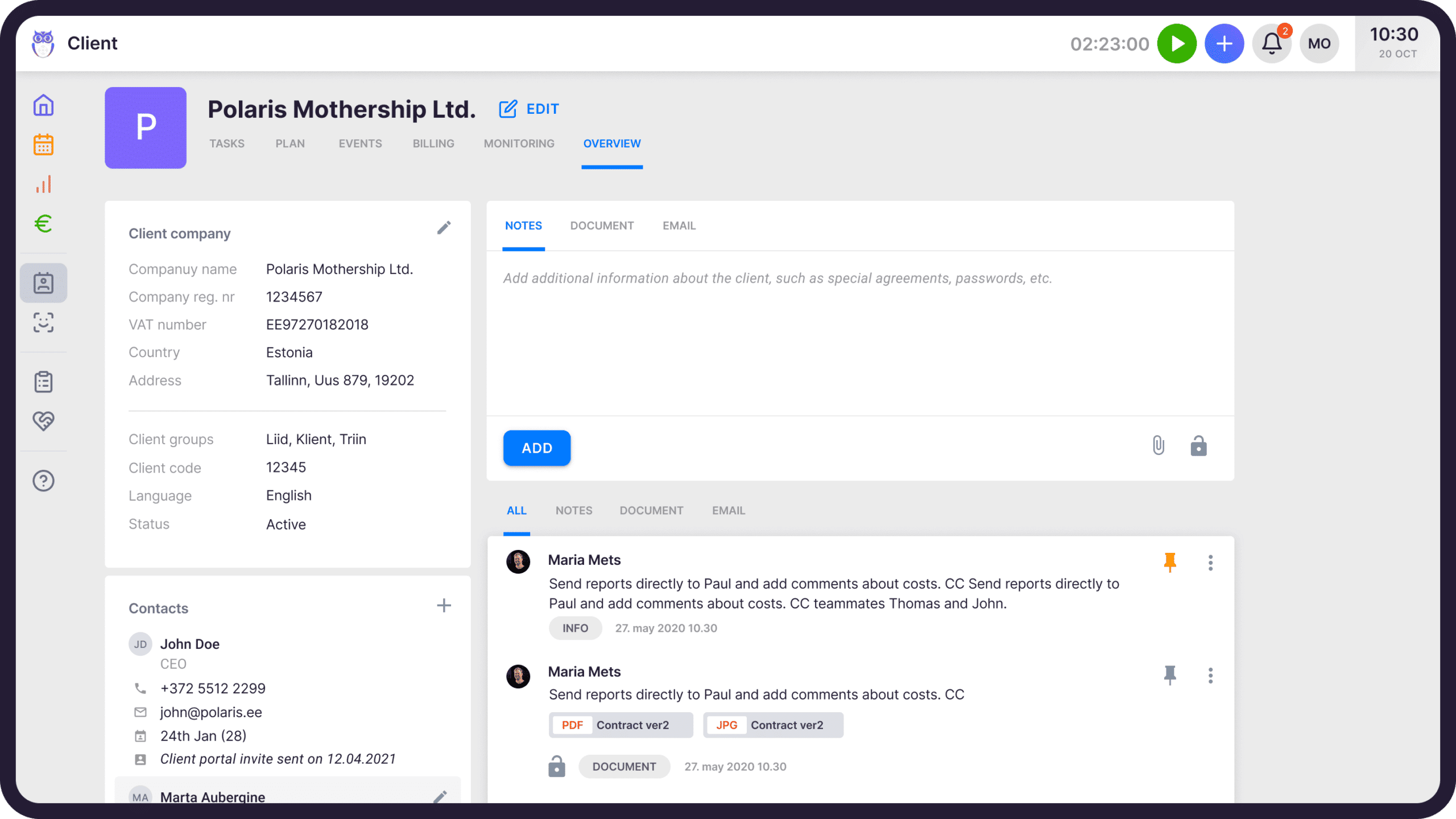

Customer profile

When you add clients to Uku, you have already started the process. Thoroughly add all necessary information about the customer to the client profile. In Uku, in addition to the mandatory fields, you can create custom fields based on your needs and add attachments, notes, and correspondence. We recommend taking advantage of all possibilities to prevent employees from having to look for information about the client elsewhere than in the software.

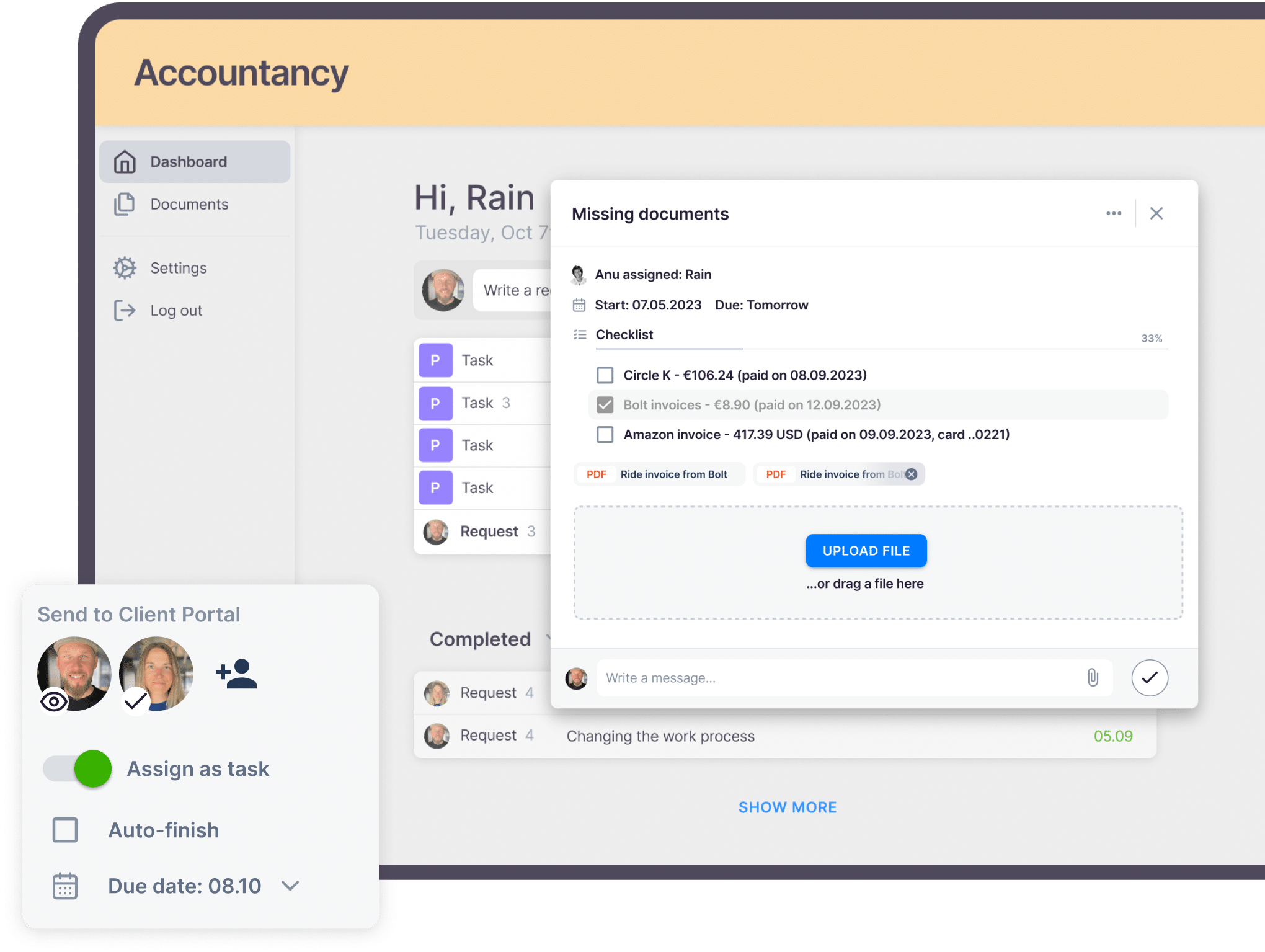

Client communication with an accounting client portal

Uku’s accounting Client Portal is the place to communicate with clients. A beautiful platform to show your clients gives your accounting firm a competitive edge by offering your innovative outlook.

Uku’s Client Portals features include:

- Adding tasks and sending inquiries or questions to the client.

- Adding public messages and internal comments to tasks.

- Receiving missing items, e.g. invoices, documents, etc, from clients faster.

- Personalising the appearance of the portal.

Sales process

In Uku, we recommend the following process for potential customers or leads to becoming real customers.

- Add all potential clients to Uku and create a client profile.

- Create a “Leads” client group of potential clients.

- Create a template with the tasks you do as a sales process.

- Since winning over clients is often not a linear process, it is good to use the option of dependent tasks. With them, you create a smooth workflow—when one task is marked as done, the next appears on the desktop.

- If you have signed a contract with a client, move them to the client group of active clients.

Email automation unites tasks and CRM for bookkeepers

The majority of customer communication is generally done by email. It is also possible to send emails from Uku thanks to Uku’s Emails app.

Letters are often recurring – both in terms of time and clients. Email templates are a great way to make client communication more efficient. Compose the letters you frequently use and automate sending them. To make the process even more convenient, we have composed 11 must-have email templates for accounting practices, which you can adapt according to the data of your accounting firm.

Integrations with accounting software to make the ultimate accounting CRM system

To reduce manual work, Uku has integrations with several accounting software to help you create the ultimate accounting CRM system. Instead of manually collecting data about clients, entries, records, documents, etc., conveniently import the data into Uku. You can also import members added to the client with permissions and much more.

As firms adopt more cloud-based tools and integrations, using an Infrastructure as Code platform can help ensure that the systems behind these workflows remain secure, consistent, and easy to maintain.

Uku integrates with Xero, Quickbooks, and many more to come.

Analysing real-time data

The Monitoring feature in Uku shows whether the work employees have done corresponds to the amount of work agreed upon by the client. This way, you can continuously monitor the fulfilment of the workload and inform the client before the workload has increased.

The Report feature turns Uku from ordinary work management software to accountants’ best work management software.

Why track time, mark a topic for a task, and collect information about clients if you can’t analyse it?

The report shows how efficiently your team works, how much time they spend on clients, and how well the firm is doing. Uku even automatically creates invoices based on the data from the report.

CRM for accounting practice should be a combination of people and technology

Successful CRM implementation requires the firm’s partners and practice managers’ commitment to CRM and leadership.

To summarise, a successful CRM for accounting practice needs:

Allocating financial resources. Practice managers must invest in the right technology that is easy to adopt within their practices.

Enthusiasm. Practice managers must be enthusiastic and confident when using CRM. If not, their accountants will likely not get staff buy-in.

Adoption. Practice managers must be committed to using it and sharing the knowledge obtained with staff. So all can understand the value it brings.

Patience. CRM strategy will take time to learn and practice but keep going, the rewards will be worth it in the long term.

Remain focussed. Despite how busy accounting periods become, accounting firms must continue to use CRM.

To achieve CRM success, discuss with everyone concerned what is required and the aims of implementing it. Ensure all are updated, who will be impacted, and when and how changes will occur.

Learn more about CRM accounting software and try it out for yourself; book a 30-minute personal Uku demo or create a free Uku account.