Keeping track of project and client budgets can be challenging. Many scenarios exist in which one could lose money instead of earning honest pay.

Scope Creep in Advisory Services

Your client starts with a straightforward monthly bookkeeping plan, but soon, they’re reaching out for extra advice on taxes or financial forecasting.

Scope creep happens when a project’s scope or requirements gradually increase without adjustments to the budget or timeline, often leading to unexpected costs. Quick questions add unexpected hours, pushing you over the budget.

Keeping these extras in check and maintaining profitability is only possible with a formal record.

Multiple Team Members on One Project

Large projects often involve several team members tackling different tasks: one for reconciliations, another for compliance, and someone for preparing monthly reports.

Monitoring each team member’s time allocation to the project budget is necessary to stay within cost limits. Overspending can sneak in before you realize it.

Frequent Changes in Client Needs

A retail client who suddenly needs extra support around tax season or during holiday sales.

These changes lead to higher workload spikes that require resource adjustments, which, if untracked, can quickly affect your budget. When you have to pivot resources to accommodate these spikes, budgets can get blown, and it’s not always apparent until it’s too late to adjust.

Inaccurate Estimates for Complex Projects

Big projects like audits or due diligence assessments are often unpredictable, and the best you can do is estimate. Estimating project costs for complex work usually involves making an educated guess about time and resources, which can lead to overruns if the scope is larger than expected.

When the project scope turns out to be bigger than expected, the accounting team quickly surpasses the budget, impacting both your bottom line and client expectations.

A Mix of Billable and Non-Billable Work

Accounting projects involve billable and non-billable hours, like standard reporting (billable) and ongoing client communication (non-billable).

Billable hours contribute directly to revenue, while non-billable hours, though necessary, do not, which can reduce overall profitability if not closely managed. Non-billable hours add up, eating into your profit margins. Keeping an eye on the budget when both types of work intertwine is challenging.

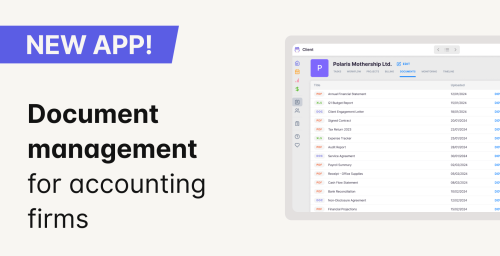

The solution is Uku’s accounting practice management software with a budgeting feature, which relieves you from the burden of manual tracking.

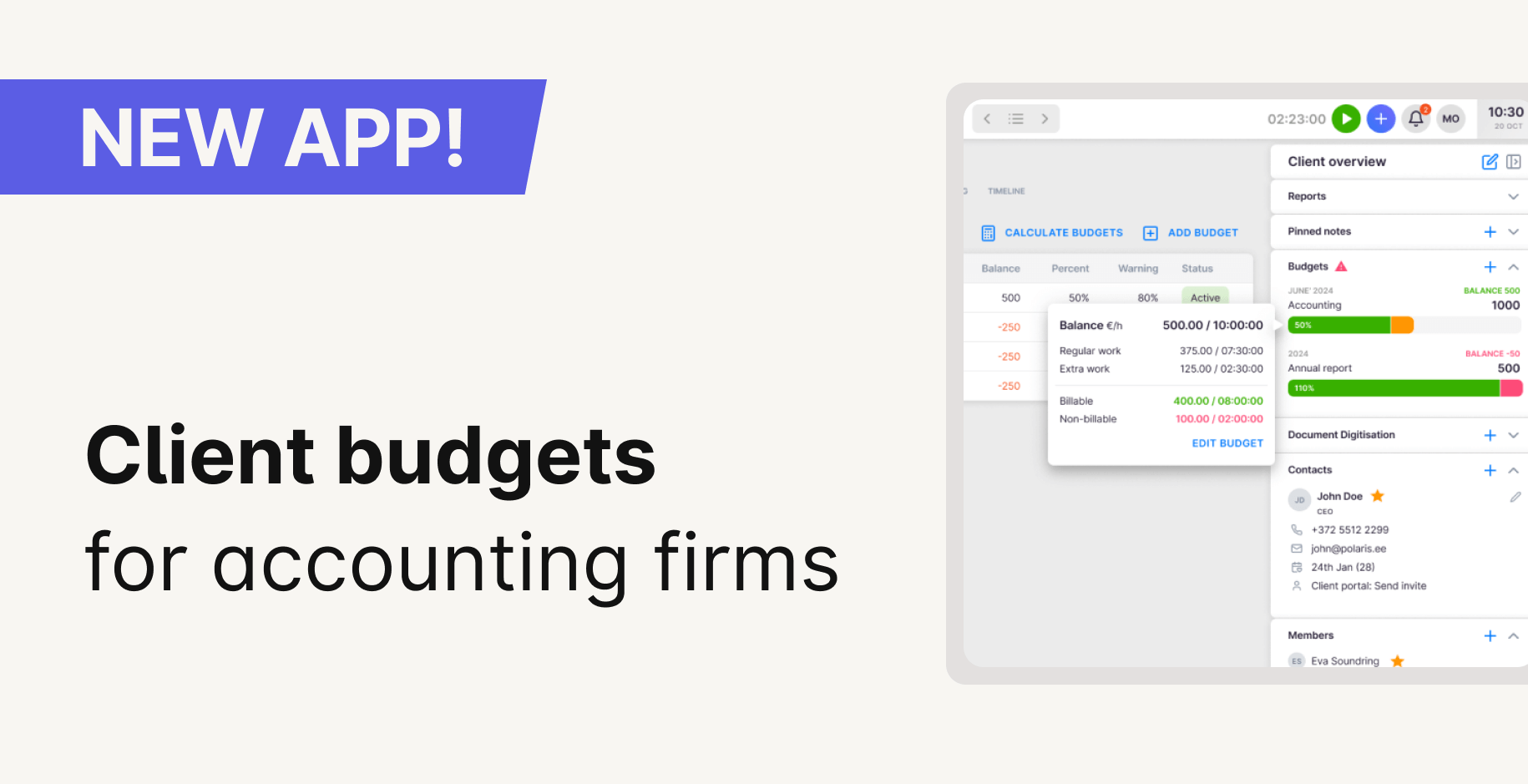

Budgets for Accounting Firms

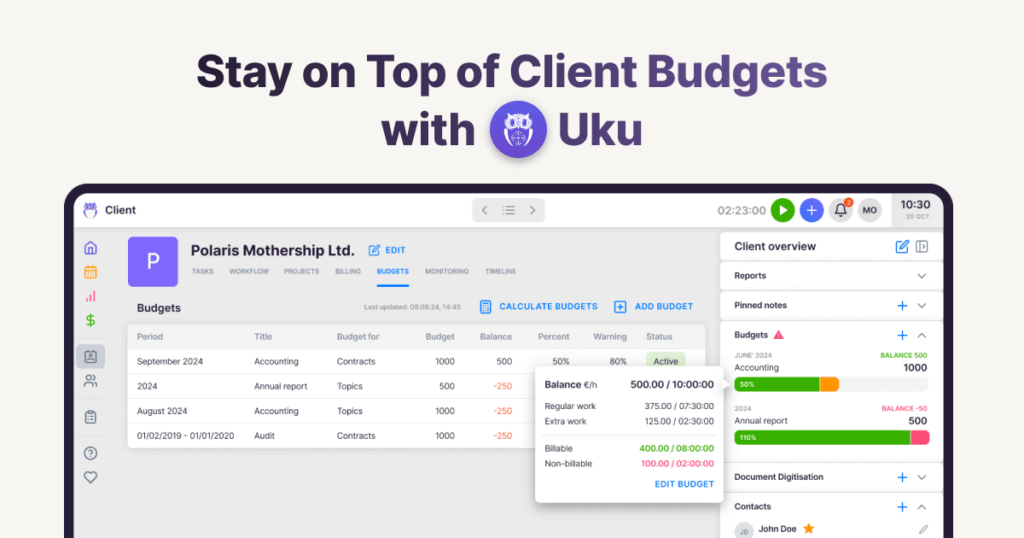

With Uku’s Budgeting feature, you can add and monitor budgets directly under your clients. View and control expenses in real time to prevent budget surprises at the end of a billing cycle.

Client’s Budgets in One Place

Uku’s budgeting feature lets you set specific budgets for clients, topics or projects to manage and monitor spending against agreed-upon limits.

Your budget for a certain client’s monthly bookkeeping is $1000, which means a certain number of your working hours. According to the billable rates you set for each employee or company-wide, Uku calculates when you’re starting to reach the limit you’ve set. Setting rates for different services (such as consulting or bookkeeping) provides a detailed view of budget usage based on actual service costs.

When viewing all of your clients at once in the client menu, you can add an extra column for budgets. This way, you’ll get an overview of every client’s budget status simultaneously. Budgeting is an excellent tool for managers to check each client’s profitability.

Budget Reaching Alerts

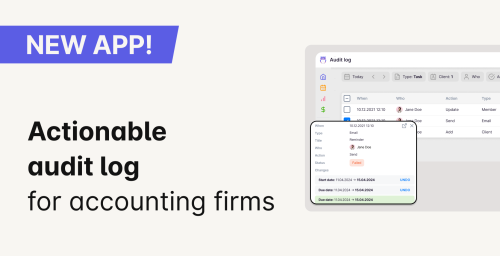

Uku sends the employee alerts in the app as notifications, on the client’s sidebar, under the task, or via email. These alerts notify you before exceeding budgets, allowing adjustments to keep costs aligned.

If any budget approaches or exceeds its limit, a red warning icon appears on your task, allowing you to take action before costs get out of hand. A red warning sign is also visible on the client profile and in the monitoring view.

Automatic Renewal and Budget History

We update your budget status automatically every midnight, but if you want an overview immediately, press the button, and statuses update magically.

Uku keeps your budgets in the archive indefinitely. This budget archive serves as a historical record, making it easy to review trends, analyze spending patterns, and provide transparency.

Flexible Budgets for Clients, Topics, or Projects

Budgets are most helpful for users of Uku’s automated billing solution for annual reports or audits. Apply budgets for these tasks for each client and have the ultimate overview of profitability.

If you haven’t set up billing in Uku, don’t worry — you can still track budgets by topic or project, so your spending stays aligned no matter how complex the service arrangement is.

Uku’s Budgets for Accounting Firms

Uku’s budgeting feature gives your accounting firm real-time control over every project and client budget, ensuring that your firm’s resources align with profitability goals. This allows you to confidently manage complex accounting projects and maintain healthy profit margins across the firm.