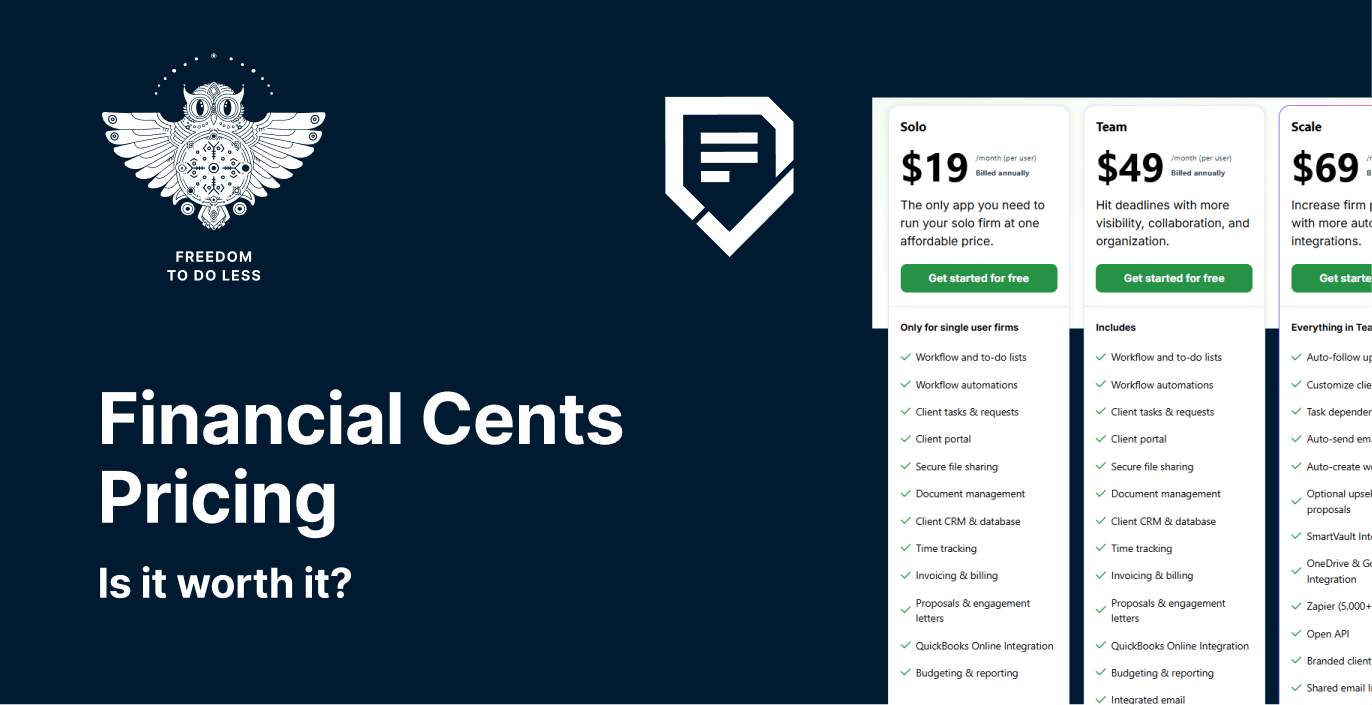

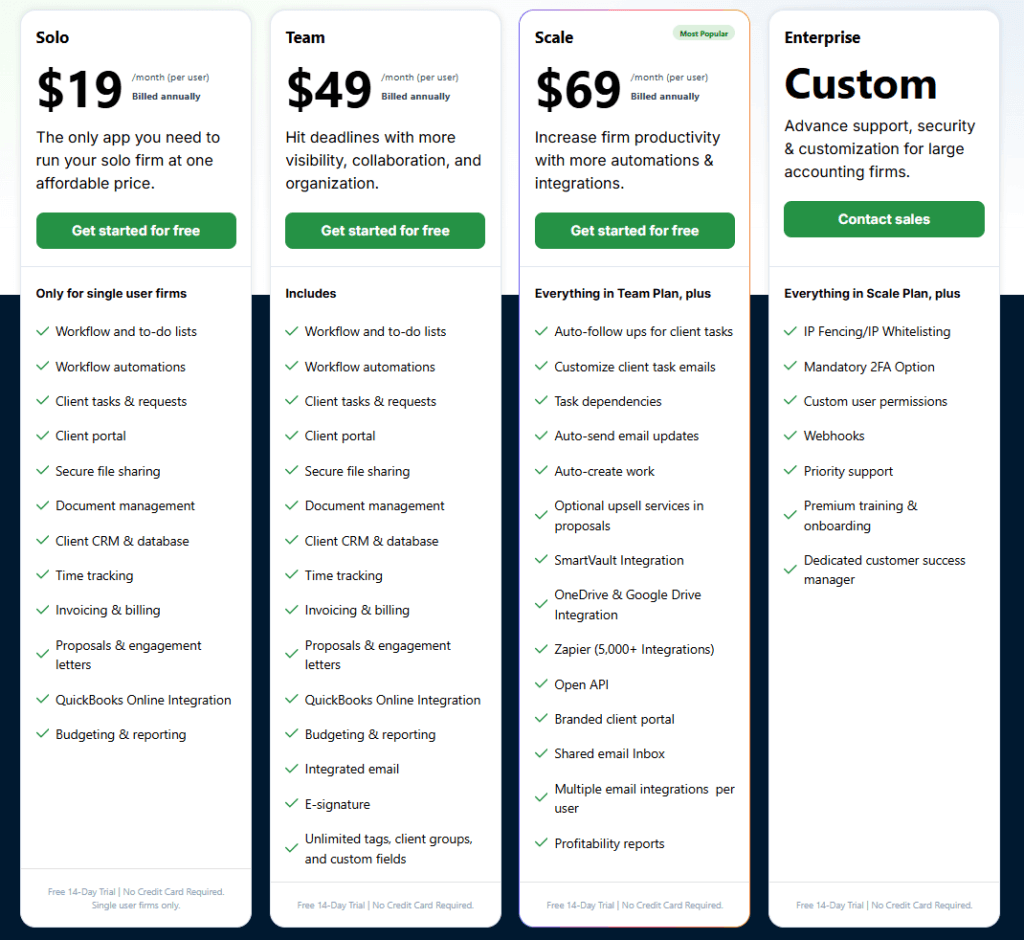

If you’ve ever navigated Financial Cents pricing tiers, calculating whether the Solo plan at $19 per user will suffice or if you need the Team plan at $49 for email integration, while wondering if the Scale plan’s automation features justify another $20 increase, you know that practice management pricing can feel like solving a puzzle where every piece costs more.

Financial Cents has established itself as a practice management solution for over 5,000 accountants globally according to the company finances, earning praise for its intuitive interface and ability to consolidate various tools into one user-friendly platform. The software streamlines operations for accounting firms, bookkeeping services, and CPAs through workflow management, time tracking, and client collaboration features.

But as Financial Cents has expanded from its founding vision of simplicity to include more advanced features across multiple pricing tiers, its cost structure has become increasingly stratified, with essential features like email integration locked behind higher price points, though basic automation is available from the Solo plan.

I’ve spent time analyzing Financial Cents’ pricing tiers, feature restrictions, and value proposition. I believe it’s the ideal choice if:

- You prioritize an extremely simple, intuitive interface above all else

- Your firm needs basic practice management without complex automation

- You want a platform that new team members can learn quickly

- Your workflows are straightforward and don’t require extensive customization

- You value having responsive customer support during implementation

However, Financial Cents’ pricing structure has limitations if:

- You’re a solo practitioner who wants to test practice management software for free indefinitely

- You need automated billing that reduces invoice preparation from days to just 30 minutes

- You want to implement practice management step by step with a modular approach

- You’re transitioning from Excel and want the easiest possible implementation

- You need flexible monthly pricing rather than annual commitments

In this case, you should consider Uku: an accounting practice management platform with a modular approach allowing firms to start working on day one. Its automated billing system reduces invoice preparation from 2-3 days to approximately 30 minutes, while firms report ~20% time savings on task management and the ability to serve ~38% more clients after implementation.

Because of that, I’ve included a detailed pricing comparison with Uku in this review, as the best choice for firms seeking a system their team will actually enjoy using.

If you’re eager to jump into the Uku pricing breakdown, go ahead and check it out here.

Table of contents

- Financial Cents Pricing Summary

- Financial Cents Pricing: In-Depth Overview

- Where Financial Cents Falls Short

- Best Financial Cents Alternative: Uku

- Financial Cents Feature Value Breakdown (vs Uku)

- Financial Cents Pricing FAQ

- Final Verdict: Financial Cents vs Uku

Financial Cents Pricing Summary

| Financial Cents | Uku | |

|---|---|---|

| Entry Plan | Solo: $19/user/month • Single user only • No email integration • Minimum 1-year purchase | Solo: $0/month • 1 user, 25 clients • Time tracking & CRM • Reporting |

| Mid-Tier | Team: $49/user/month • Email integration • E-signatures • Invoicing & billing • Proposals | Team: from $38/user/month • Email integration • Unlimited clients • Automated billing • Task dependencies |

| Advanced | Scale: $69/user/month • Auto-follow-ups • Task dependencies • OneDrive & Google Drive int. • Profitability reports | Elite: $48/user/month • Client Budgeting • E-signatures • OneDrive & Google Drive, SharePoint int. • BI Reporting |

| Best For | Firms prioritizing simplicity and ease of use with basic workflow needs | Firms wanting automated billing and modular implementation with proven efficiency gains |

Financial Cents Pricing: In-Depth Overview

Financial Cents operates on a straightforward per-user, per-month subscription model with four distinct tiers designed to serve firms from solo practitioners to large enterprises.

The platform targets accounting firms, bookkeeping services, and CPAs looking to consolidate their practice management tools into one system. However, all plans require minimum 1-year purchase commitments, and key functionalities like email integration are restricted to higher tiers, while more advanced automation features require upgrading.

Financial Cents Solo Plan: $19/user/month

| Feature | Details |

|---|---|

| Price | $19/user/month (minimum 1-year purchase) |

| Users | Single user only |

| Core Features | Workflow management, client portal, time tracking |

| Key Limitations | No email integration, no e-signatures |

The Solo plan serves as Financial Cents’ entry point for individual practitioners. At $19 per month with a minimum 1-year commitment, it includes essential practice management features: workflow management, client tasks and portal, document management, client CRM, time tracking, invoicing, proposals, and QuickBooks Online integration. It also includes basic workflow automations.

However, the absence of email integration means users must constantly switch between their email client and Financial Cents, unlike platforms with features that let you add email integration when needed.

| Solo Plan Pros | Solo Plan Cons |

|---|---|

| ✅ Access to core workflow features | ❌ No email integration |

| ✅ Client portal included | ❌ Missing e-signature capabilities |

| ✅ QuickBooks Online integration | ❌ Requires 1-year commitment |

| ✅ Time tracking and invoicing | ❌ No free option available |

| ✅ Basic workflow automations | ❌ No month-to-month billing |

The Bottom Line 👉 Solo suits individual practitioners with simple workflows who don’t mind switching between applications and can commit to a full year upfront, but the lack of email integration makes it feel incomplete for modern practice management.

Financial Cents Team Plan: $49/user/month

| Feature | Details |

|---|---|

| Price | $49/user/month (minimum 1-year purchase) |

| Users | Multiple team members |

| New Features | Email integration, e-signatures, unlimited custom fields |

| Key Addition | Gmail and Outlook integration |

The Team plan represents a significant 158% price increase from Solo but finally delivers what many consider table stakes: integrated email management. This tier adds Gmail and Outlook integration, e-signature capabilities, and unlimited tags, client groups, and custom fields.

For growing teams requiring substantial upfront configuration, these features transform Financial Cents from a task tracker into a practice management platform, though firms seeking modular implementation may find the full approach overwhelming.

| Team Plan Pros | Team Plan Cons |

|---|---|

| ✅ Email integration finally included | ❌ 158% price jump from Solo |

| ✅ E-signature capabilities | ❌ Requires 1-year minimum commitment |

| ✅ Unlimited custom fields | ❌ No task dependencies |

| ✅ Team collaboration features | ❌ Missing SmartVault integration |

| ✅ Workflow automations included | ❌ Requires upfront configuration |

The Bottom Line 👉 Team plan provides essential features that should arguably be in the base tier, requiring both a significant price increase and substantial upfront configuration and training.

Financial Cents Scale Plan: $69/user/month

| Feature | Details |

|---|---|

| Price | $69/user/month (minimum 1-year purchase) |

| Users | Multiple team members |

| New Features | Auto-follow-ups, task dependencies, SmartVault |

| Focus | Productivity and automation |

Scale introduces automation features that can significantly impact efficiency: auto-follow-ups for client tasks, task dependencies, SmartVault integration, Open API access, and a branded client portal. The 41% price increase from Team brings workflow automation that helps reduce manual follow-ups, though it still lacks the automated billing capabilities that can reduce invoice preparation from days to 30 minutes.

| Scale Plan Pros | Scale Plan Cons |

|---|---|

| ✅ Advanced automation features | ❌ $69/user becomes expensive for larger teams |

| ✅ Task dependencies for complex workflows | ❌ Still no webhooks (Enterprise only) |

| ✅ SmartVault document integration | ❌ No automated billing system |

| ✅ Branded client portal | ❌ Requires annual commitment |

| ✅ Open API access |

The Bottom Line 👉 Scale delivers meaningful automation for established firms willing to commit annually, but the per-user cost can quickly escalate for growing teams.

Financial Cents Enterprise Plan: Custom Pricing

| Feature | Details |

|---|---|

| Price | Custom pricing |

| Users | Large teams |

| New Features | IP whitelisting, webhooks, custom permissions |

| Support | Dedicated customer success manager |

Enterprise caters to large firms needing advanced security, customization, and support. Features include IP whitelisting, custom user permissions, webhooks for advanced integrations, premium training and onboarding, and a dedicated customer success manager. The custom pricing model means firms must negotiate based on their specific needs and user count.

| Enterprise Plan Pros | Enterprise Plan Cons |

|---|---|

| ✅ Advanced security features | ❌ Pricing lacks transparency |

| ✅ Dedicated support team | ❌ Requires sales negotiation |

| ✅ Custom permissions and webhooks | ❌ May be overkill for most firms |

| ✅ Premium onboarding | ❌ Implementation timeline unclear |

The Bottom Line 👉 Enterprise suits large firms with complex security requirements and integration needs, but most practices won’t need this level of customization.

Where Financial Cents Falls Short

While Financial Cents excels at providing an intuitive interface for basic practice management, several limitations become apparent when firms seek the modular approach and automated billing capabilities that can transform their practice efficiency.

The platform requires substantial upfront configuration and training, unlike modular systems where firms can start working on day one with just the features they need.

No Modular Implementation Approach

- Requires substantial upfront configuration and training before firms can start working

- Forces adoption of all features at once rather than gradual implementation

- This is specifically one of the biggest reasons why clients switch from Financial Cents to more flexible platforms

- Firms transitioning from Excel face a steep learning curve instead of gradual adoption

Limited Billing Automation

- Lacks automated billing systems that can reduce invoice preparation from 2-3 days to 30 minutes

- No advanced rounding rules or complex price lists based on quantity, time, and materials

- Missing real-time profitability analysis showing whether employees are profitable at current rates

- Invoice preparation remains a multi-day process rather than a 30-minute task

No Free Plan for Solo Practitioners

- Starting at $19/month with a minimum 1-year commitment creates a barrier for individual practitioners

- While a 14-day free trial is available, many competitors offer robust free tiers for freelancers

- Solo practitioners must commit to $228 annually with no monthly option

Feature Gating and Annual Commitments

- Essential features like email integration locked behind Team plan

- All plans require minimum 1-year purchase commitments

- No flexible monthly billing options for firms wanting to test the platform

- Forces firms to pay more for what many consider basic functionality

These limitations have led many efficiency-focused firms to explore alternatives that prioritize automated billing, modular implementation, and measurable results.

Best Financial Cents Alternative: Uku

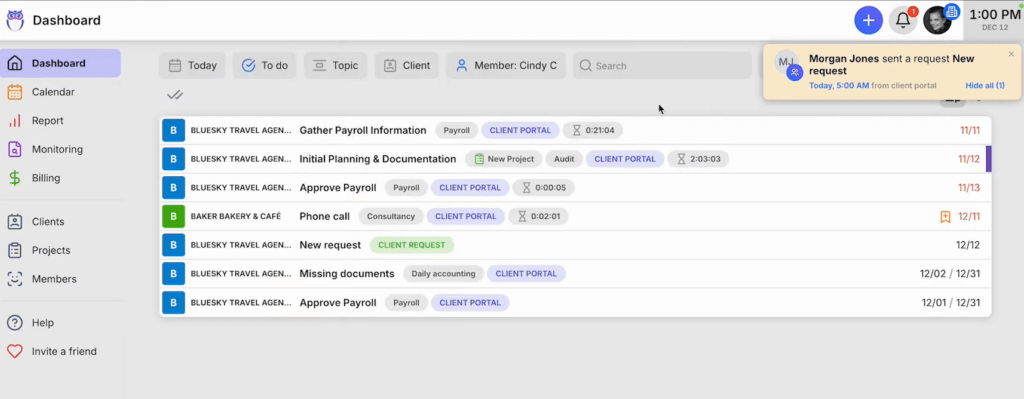

Uku brings a different approach to practice management through its modular implementation philosophy and efficient automated billing system that transforms invoice preparation from a 2-3 day ordeal into a 30-minute task.

For firms frustrated by Financial Cents’ requirement for substantial upfront configuration, lack of billing automation, and mandatory annual commitments, Uku offers compelling solutions with its step-by-step implementation approach, comprehensive automated billing, and flexible monthly or annual billing options.

The platform was created from the ground up to be international, especially for UK and US markets, supporting 12 languages and multi-currency capabilities (€, $, £).

Founded by Rain Allikvee and Jaanus Lang, Uku serves 1000+ clients globally.

The platform addresses the “from Excel to greatness” journey many firms face, making it the easiest and fastest practice management tool to onboard from spreadsheets. Firms report discovering they were billing for 8 hours but employees were doing 20 hours of work, with many increasing turnover by over 10% after adopting Uku’s automated billing system.

Uku excels as a system your team will actually enjoy using, with even resistant users aged 50+ who initially complain about tracking time becoming the highest users after a month of use. Its modular approach means firms can start working on day one, activating only the modules needed and scaling up as they grow.

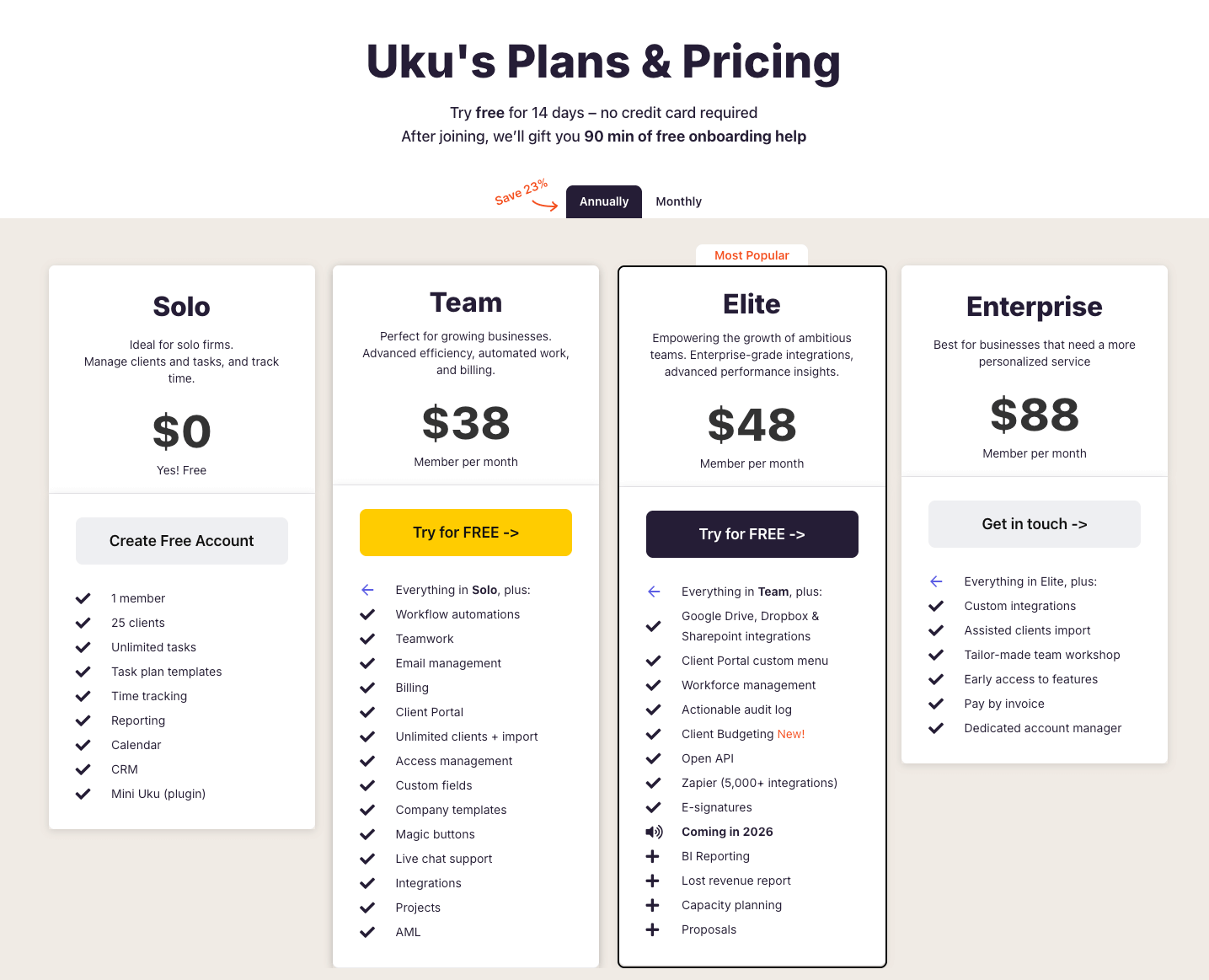

Uku Solo Plan: Free Forever

| Feature | Details |

|---|---|

| Price | $0/month |

| Users | 1 member |

| Clients | Up to 25 |

| Features | Unlimited tasks, time tracking with stopwatch, reporting, CRM |

Unlike Financial Cents’ $19 starting point with annual commitment, Uku offers a free Solo plan perfect for freelancers and individual practitioners.

This includes unlimited tasks, task plan templates, time tracking through stopwatch, manual entry, or bulk time allocation, reporting, CRM capabilities, and calendar views. The 25-client limit provides ample room for solo practitioners to grow before needing to upgrade.

| Solo Plan Pros | Solo Plan Cons |

|---|---|

| ✅ Completely free forever | ❌ Limited to 25 clients |

| ✅ All core features included | ❌ Single user only |

| ✅ No credit card required | ❌ No client portal |

| ✅ Multiple time tracking methods | ❌ No email integration |

The Bottom Line 👉 Uku’s free Solo plan lets practitioners experience real practice management without financial commitment, perfect for testing or starting a practice.

Uku Team Plan: From $38/user/month

| Feature | Details |

|---|---|

| Price | From $38/user/month (annual and monthly billing available) |

| Clients | Unlimited |

| New Features | Email integration, client portal, automated billing |

| Key Benefit | Modular implementation – start working day one |

Starting from $38 per user with flexible monthly or annual billing options, Uku’s Team plan costs less than Financial Cents’ Team tier while delivering the automated billing system that reduces invoice preparation from days to approximately 30 minutes.

This includes everything from Solo plus teamwork functionalities, email integration, integrated client portal, unlimited clients and imports, access management, custom fields, company templates, automated billing with complex price lists, live chat support, integrations, project management, and AML features. The modular approach means you can start with just CRM and tasks, then gradually add features as needed.

| Team Plan Pros | Team Plan Cons |

|---|---|

| ✅ Lower starting price than FC Team | ❌ Learning curve for automation setup |

| ✅ Automated billing saves days of work | ❌ More complex than basic tools |

| ✅ Modular – implement step by step | ❌ BI Reporting in Elite tier |

| ✅ Monthly or annual billing options | |

| ✅ 90% of actions are one-click |

The Bottom Line 👉 Team plan delivers exceptional value with automated billing that transforms a 2-3 day process into 30 minutes, all while costing less than Financial Cents.

Uku Elite Plan: $48/user/month

| Feature | Details |

|---|---|

| Price | $48/user/month (annual and monthly billing available) |

| New Features | BI Reporting, Client Budgeting, Document Management |

| Included | E-signatures, workforce management, audit log |

Elite at $48 per month costs less than Financial Cents’ Scale plan while offering comprehensive features including BI Reporting with deep filters and saved templates, Client Budgeting capabilities, Document Management with one-click digitalization, Google Drive, Dropbox and Sharepoint integrations, customizable client portal menu, workforce management, actionable audit log, and e-signatures (included but not a primary differentiator).

The business analytics reports provide detailed performance metrics with real-time insights into profitability and budget status.

| Elite Plan Pros | Elite Plan Cons |

|---|---|

| ✅ $48 price beats FC Scale at $69 | ❌ More than basic firms need |

| ✅ BI Reporting included | ❌ Requires platform commitment |

| ✅ Document Management automation | ❌ Annual billing for best rate |

| ✅ Client Budgeting capabilities | |

| ✅ Real-time profitability analysis |

The Bottom Line 👉 Elite provides enterprise-grade features at $48 per month, delivering powerful BI Reporting and automation for ambitious firms.

Uku Enterprise Plan: From $88/user/month

| Feature | Details |

|---|---|

| Price | From $88/user/month |

| Features | Custom integrations, Special onboarding included, Priority support |

| Benefits | Early feature access, invoice billing, Dedicated account manager |

Uku’s Enterprise plan starts from $88 per month and includes all Elite features plus custom integrations for 50+ user firms, country-specific features like local e-invoice formats, assisted client import, tailor-made team workshop, early access to new features, invoice payment options, and a dedicated account manager.

The in-house development team can create custom software and integrations, including features that larger competitors refuse to build for smaller markets.

| Enterprise Plan Pros | Enterprise Plan Cons |

|---|---|

| ✅ Transparent pricing from $88 | ❌ Higher cost for smaller firms |

| ✅ Custom country-specific features | ❌ May exceed many needs |

| ✅ Dedicated account manager | ❌ Best for 50+ users |

| ✅ Tailor-made workshop included |

The Bottom Line 👉 Enterprise delivers white-glove service and customization for established firms ready to maximize their practice management investment with transparent pricing.

Financial Cents Feature Value Breakdown (vs Uku)

Modular Implementation vs All-at-Once Configuration

Financial Cents’ Approach: Financial Cents requires substantial upfront configuration and training before firms can start working effectively. Teams must learn all features simultaneously, implement complete workflows from the start, and adapt their processes to the platform’s structure. This comprehensive approach can take days or weeks before firms see productivity gains.

Uku’s Approach: Uku’s modular approach (like an iPhone where you start with basic functionality and add apps as needed) lets firms begin with just CRM and tasks, then gradually add features. Firms can start working on day one, implement the software step by step, and scale up as they grow. This flexibility is specifically one of the biggest reasons why clients switch from Financial Cents to Uku.

Source: Uku

Value Verdict: Uku is better for firms wanting immediate productivity and gradual implementation, especially those transitioning from Excel who fear lengthy software implementations.

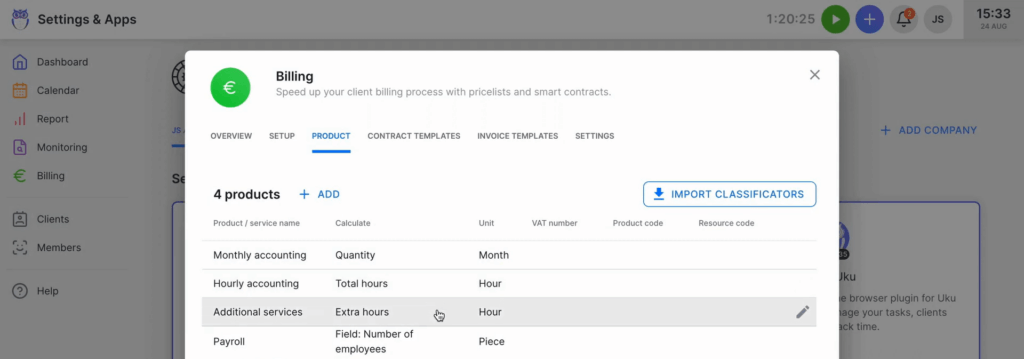

Automated Billing Capabilities

Financial Cents’ Approach: Financial Cents includes basic invoicing and time tracking but lacks comprehensive automated billing. Invoice preparation remains a manual, multi-day process. The platform doesn’t offer complex price lists based on quantity, time, and materials, or advanced rounding rules that properly bill for interruptions and unplanned work.

Uku’s Approach: Uku’s automated billing system reduces invoice preparation from 2-3 days to approximately 30 minutes and automatically sends invoice reminders. The system handles complex price lists, advanced rounding rules (a one-minute unplanned call can be automatically billed as 15 minutes), and tracks both sales prices and actual cost prices. Firms report discovering outdated agreements and increasing turnover by over 10% after implementation.

Source: Uku

Value Verdict: Uku is dramatically better for firms prioritizing billing efficiency, delivering automated systems that save days of work each month.

Pricing Flexibility and Commitment

Financial Cents’ Approach: All plans require minimum 1-year purchase commitments with no monthly billing options. Solo practitioners must commit $228 upfront. The significant price jumps between tiers (158% from Solo to Team) force firms to make substantial financial commitments to access essential features like email integration.

Uku’s Approach: Uku offers both monthly and annual billing options across all paid plans, with a permanently free Solo plan removing all barriers for individual practitioners. Clients prefer paying approximately $38 monthly to test the system rather than large upfront annual commitments. The pricing structure provides more features for less money at comparable levels.

Value Verdict: Uku is better for cost-conscious firms and those wanting flexibility, offering a free start and monthly billing options versus Financial Cents’ mandatory annual commitments.

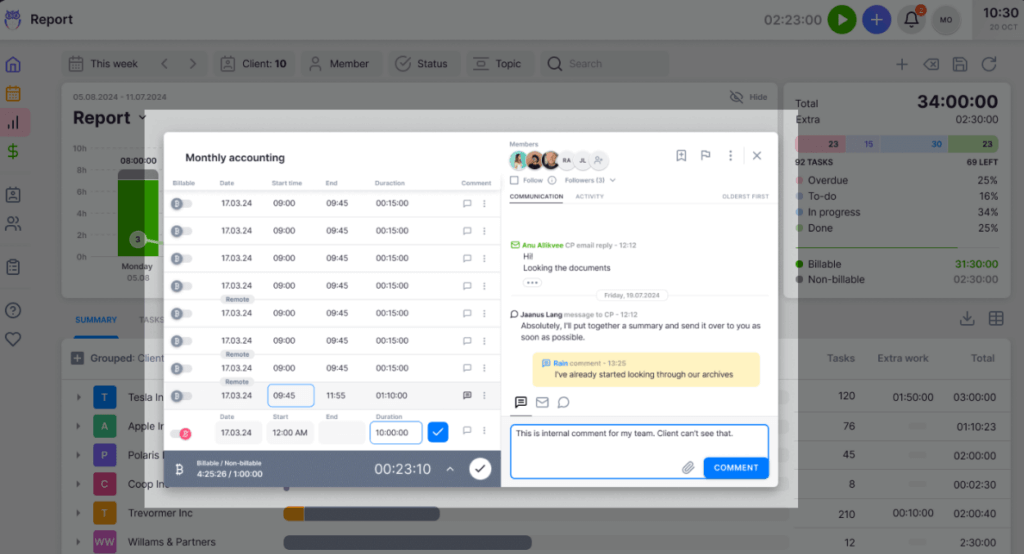

Time Tracking and Efficiency Reporting

Financial Cents’ Approach: Financial Cents includes time tracking across all plans with integration to QuickBooks Online. The platform reports that firms save an average of 56 hours per month and $19,200 annually. It offers various reports including profitability analysis and efficiency metrics.

Source: Financial Cents

Uku’s Approach: Uku’s time tracking offers multiple methods including stopwatch, manual entry, and bulk time allocation across multiple tasks. With 90% of actions being one-click, the system maximizes speed for day-to-day admin tasks. Combined with BI Reporting showing real-time profitability per client, firms report ~20% reduction in task management time and ability to serve ~38% more clients.

Value Verdict: Both platforms offer solid time tracking, but Uku’s one-click efficiency and real-time profitability analysis provide more actionable insights for growth.

Client Portal and International Capabilities

Financial Cents’ Approach: The client portal is included from the Solo plan but branded portals require the $69 Scale tier. Financial Cents is exclusively US/Canada-centric with no multilingual support and billing only in USD. The platform lacks native Xero integration.

Source: Financial Cents

Uku’s Approach: Uku’s integrated client portal mirrors the exact same task on both sides. Clients and accountants work on the same item with all communication, actions, documents, and time tracking in one place. Created from the ground up to be international, Uku supports 12 languages, multi-currency capabilities (€, $, £), and includes native Xero integration.

Source: Uku

Value Verdict: Uku is better for international firms or those with global ambitions, offering true multi-language and multi-currency support versus Financial Cents’ North American focus.

Financial Cents Pricing FAQ

Is Financial Cents free to use?

No, Financial Cents doesn’t offer a free plan. The platform provides a 14-day free trial with no credit card required. The cheapest option is the Solo plan at $19 per user per month with a minimum 1-year purchase requirement. This contrasts with Uku’s permanently free Solo plan for individual practitioners.

What’s the minimum cost for Financial Cents?

The absolute minimum is $228 per year ($19 per month) for a single user on the Solo plan with mandatory annual billing. For teams needing email integration, the minimum jumps to $588 per year ($49 per month) per user, making Financial Cents one of the pricier entry points requiring upfront annual commitments.

Does Financial Cents pricing include email integration?

Email integration is not included in the $19 Solo plan. You must upgrade to the Team plan at $49 per user per month (minimum 1-year commitment) to get Gmail and Outlook integration. Many users find this surprising since email integration is considered a basic feature in most modern practice management platforms.

How does Financial Cents compare to Uku for implementation speed?

Financial Cents requires substantial upfront configuration and training before firms can start working effectively. Uku’s modular approach allows firms to start working on day one with just the modules they need, implementing step by step. This is specifically one of the biggest reasons why clients switch from Financial Cents to Uku.

Can I switch between Financial Cents pricing plans?

Yes, you can upgrade or downgrade Financial Cents plans. However, downgrading may result in loss of features if you exceed the limits of the lower tier. Since all plans require annual commitments, refunds or credits when switching mid-cycle may be limited.

Which offers better value: Financial Cents or Uku?

For pure simplicity with basic workflows, Financial Cents may justify its pricing. However, Uku offers superior overall value with its free Solo plan, modular implementation approach, automated billing that saves days of work, and flexible monthly billing options. Uku’s ability to reduce invoice preparation from 2-3 days to 30 minutes alone can justify the investment.

Final Verdict: Financial Cents vs Uku

The choice between Financial Cents and Uku depends on your firm’s priorities and implementation preferences.

👍 Financial Cents is a practice management platform designed for accounting firms that value simplicity and can commit to annual pricing from $19 to $69 per user per month.

It enables firms to organize their workflows in an intuitive interface that new team members can learn through comprehensive upfront training. This all-at-once approach works best for firms with straightforward workflows who can afford substantial configuration time, practices where annual financial commitments aren’t a concern, and teams that prefer learning everything upfront rather than gradual adoption.

Get started with Financial Cents here

👉 Uku is a practice management platform built on the principle that firms should be able to start working on day one and implement features step by step.

With pricing from free to $88 per user per month and flexible monthly or annual billing, it enables firms to reduce invoice preparation from 2-3 days to approximately 30 minutes through automated billing. This modular approach combined with proven results (~20% time savings, ~38% more clients served) makes it ideal for firms transitioning from Excel, growth-oriented practices wanting measurable efficiency gains, teams that prefer testing with monthly billing before committing, and any practice that values starting immediately over lengthy implementations.

The key difference is implementation philosophy: While Financial Cents asks “How can we train your team on our complete system?”, Uku asks “How can you start working productively today and scale as you grow?”