Choosing between Financial Cents and Karbon for your accounting practice management needs often comes down to these critical questions:

- Do you need a simple, straightforward tool that works out of the box, or are you willing to invest time learning a more complex platform for advanced capabilities?

- Is your firm focused on standardizing basic workflows, or do you need sophisticated automation and AI-driven insights?

- Are you a solo practitioner or small firm watching every dollar, or an established practice ready to invest in premium tools?

- Do you prioritize ease of use and quick implementation, or are you looking for deep collaboration features and enterprise-grade functionality?

- Would you rather have everything in one unified platform, or are you comfortable with a simpler tool that might require additional software?

In short, here’s what we recommend:

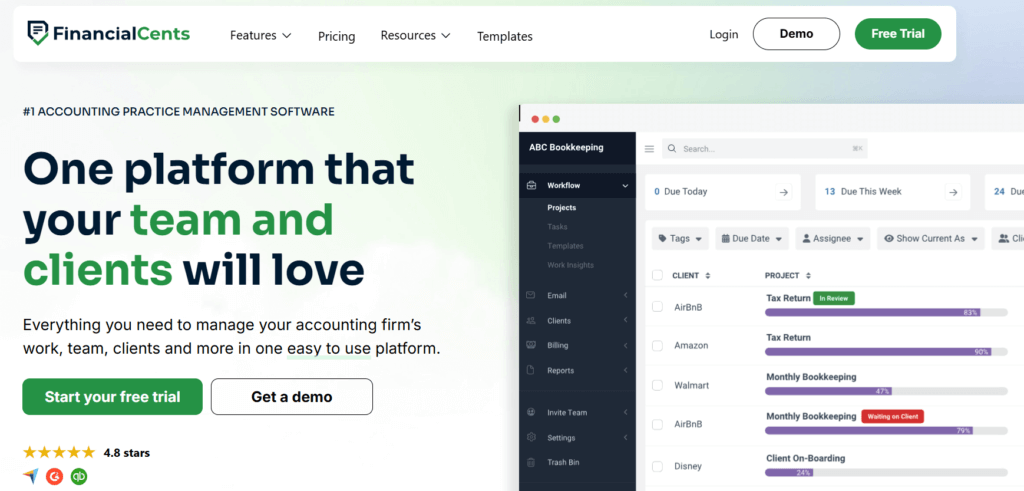

👉 Financial Cents is the go-to choice for small to mid-sized accounting firms seeking simplicity without sacrificing functionality. With its intuitive interface and quick implementation, firms can organize their workflows, track client work, and manage deadlines from day one. The platform excels at making practice management accessible, with features like automated client reminders, integrated email, and a client portal that actually gets used. While Financial Cents delivers excellent value (starting at $288/year for solo practitioners), it may lack the depth needed for larger firms with complex workflows or those seeking advanced automation and reporting capabilities.

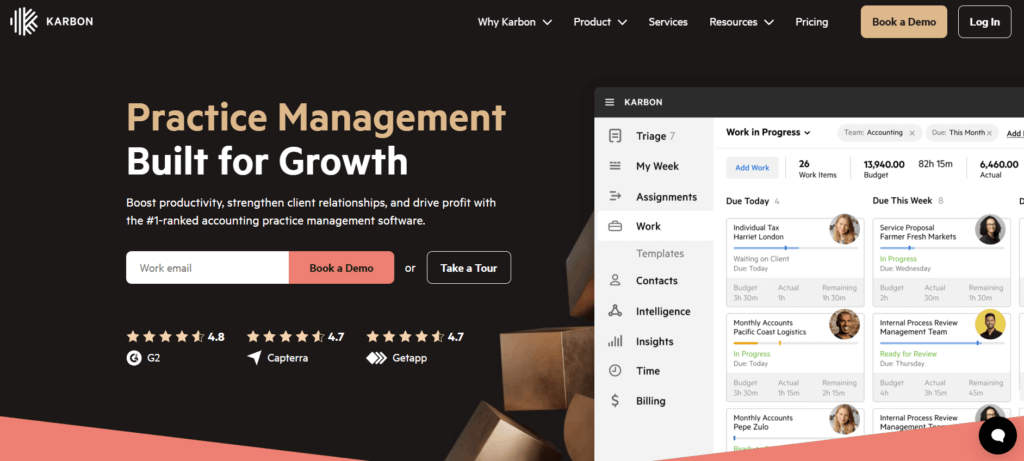

👉 Karbon positions itself as the premium solution for growth-oriented firms that prioritize collaboration and comprehensive practice intelligence. Its unique Triage email system transforms how teams handle client communication, while the Practice Intelligence feature provides AI-driven insights for strategic decision-making. With deep workflow automation, sophisticated reporting, and enterprise-grade security, Karbon justifies its higher price point ($59-89/user/month). However, the platform’s complexity means a steeper learning curve, and smaller firms might find themselves paying for features they’ll never fully utilize.

Both platforms have earned their reputations and loyal user bases. But while everyone compares these two household names, there’s a third player that’s been quietly revolutionizing practice management for over 5,000 daily users across 25 countries.

👉 Uku represents a different philosophy: powerful automation wrapped in beautiful, intuitive design. This platform delivers sophisticated workflow automation while maintaining the simplicity that makes team adoption effortless. With features like dynamic due dates, comprehensive billing automation, and a client portal that clients actually enjoy using, Uku delivers enterprise-level capabilities without enterprise-level complexity. The platform’s bootstrapped growth (120% yearly) proves that firms are discovering what many reviews confirm: Uku offers the perfect balance of sophistication and simplicity at a price point that makes sense (from $38/user/month or $456/user/year, with a free plan for solo practitioners).

If you’re looking for a platform that combines Financial Cents’ ease of use with Karbon’s powerful features, see why accounting firms are making the switch to Uku.

Table of contents:

- Financial Cents vs Karbon vs Uku at a glance

- The fundamental divide: Simplicity vs power vs balance

- Workflow management reveals each platform’s DNA

- Email integration and collaboration approaches

- Client portal capabilities show different philosophies

- Time tracking and billing automation

- Reporting and analytics depth

- Pricing models and value propositions

- Which platform should you choose?

Financial Cents vs Karbon vs Uku at a glance

| Financial Cents | Karbon | Uku | |

|---|---|---|---|

| Target Market | Small to mid-sized firms, solo practitioners | Growth-oriented firms, small to enterprise | Ambitious firms, freelancers to enterprise |

| Ease of Use | ⭐⭐⭐⭐⭐ Very intuitive |

⭐⭐⭐ Steep learning curve |

⭐⭐⭐⭐⭐ Beautiful and intuitive |

| Workflow Automation | ⭐⭐⭐ Good basics |

⭐⭐⭐⭐⭐ Deep automation |

⭐⭐⭐⭐⭐ Advanced automation |

| Email Integration | ⭐⭐⭐⭐ Gmail/Outlook sync |

⭐⭐⭐⭐⭐ Advanced Triage system |

⭐⭐⭐⭐ Email integration included |

| Client Portal | ⭐⭐⭐⭐ User-friendly |

⭐⭐⭐⭐ Full-featured |

⭐⭐⭐⭐⭐ Highly customizable |

| Time Tracking | ⭐⭐⭐⭐ Simple |

⭐⭐⭐⭐ Simple |

⭐⭐⭐⭐⭐ Multiple methods |

| Billing & Invoicing | ⭐⭐⭐ Basic features |

⭐⭐⭐⭐ Comprehensive |

⭐⭐⭐⭐⭐ Advanced automation |

| Reporting | ⭐⭐⭐ Limited but improving |

⭐⭐⭐⭐⭐ Practice Intelligence |

⭐⭐⭐⭐ Advanced reports (BI coming 2026) |

| Mobile App | ❌ None |

⭐⭐⭐ iOS/Android apps |

⭐⭐⭐⭐ Mobile-responsive portal |

| Standard Price | $49/user/month | $59/user/month | $38/user/month |

| Best For | Firms wanting simplicity | Firms needing advanced features | Firms wanting power + simplicity |

The fundamental divide: Simplicity vs power vs balance

The philosophical differences between these platforms become clear the moment you log in.

Financial Cents embraces simplicity. The platform focuses on solving the everyday challenges of practice management without overwhelming complexity. Every feature reflects this mission. The dashboard immediately shows you what needs attention today. Creating a workflow takes minimal setup time. Even the pricing structure is straightforward, with clear tiers and transparent features.

Karbon takes a comprehensive approach, positioning itself as a “Practice Intelligence” platform. The depth is impressive, offering powerful capabilities for firms ready to invest in learning the system. The Triage email system requires teams to adopt new communication workflows. The Kanban boards, My Week views, and Practice Intelligence dashboards offer powerful insights for those who commit to mastering the platform.

Uku found a third way. The founders, coming from a design and development background, built a platform that handles complex automation while maintaining an interface that users consistently praise for its ease of navigation. The system offers sophisticated recurring task schedules, dynamic workflows, and comprehensive automation capabilities, all wrapped in a clean, approachable design.

Workflow management reveals each platform’s DNA

How each platform handles workflow management tells you everything about their approach to practice management.

Financial Cents keeps it simple with a three-level hierarchy:

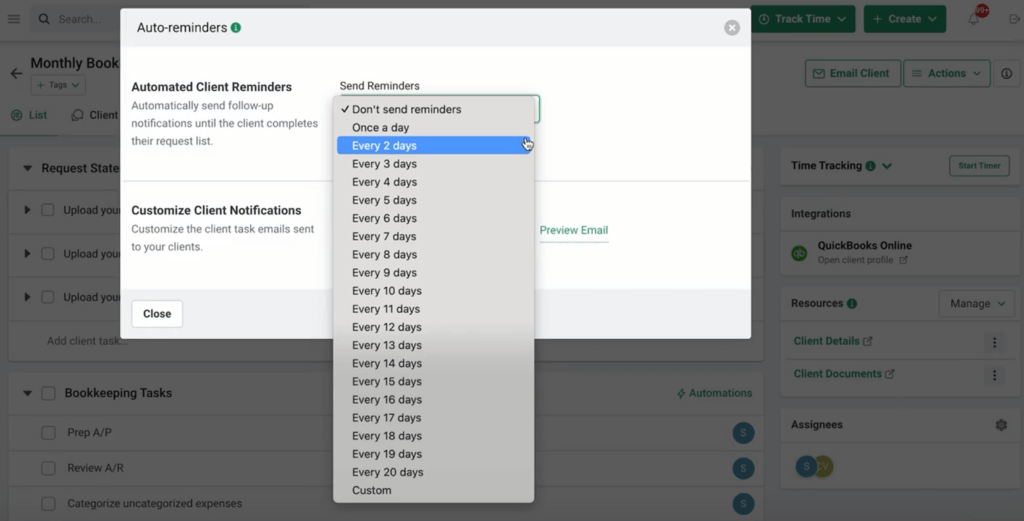

- workflow templates

- client-specific workflows

- individual tasks You can set up recurring work, track deadlines, and ensure nothing falls through the cracks. The strength lies in its accessibility. Any team member can understand and use the system with minimal training. The workflow automation handles the basics well, sending automated client reminders and creating recurring tasks. However, firms needing complex dependencies or advanced automation might find certain features limited to higher-tier plans.

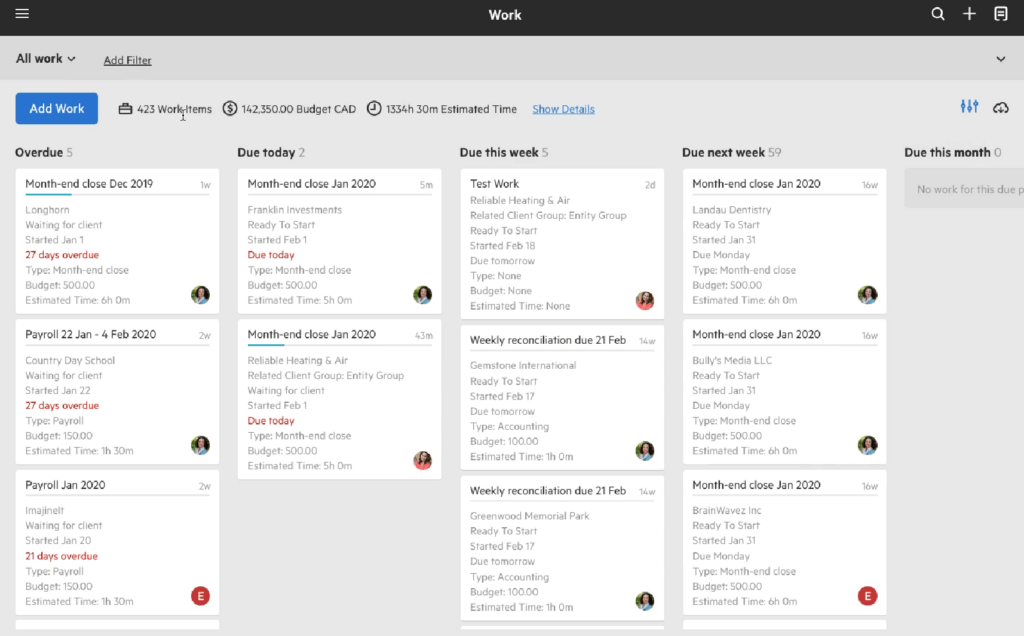

Source: Financial Cents

Karbon‘s Work Management is comprehensive and powerful. Work items serve as central hubs containing everything related to a job: emails, tasks, documents, and communication. The platform’s strength lies in standardization through detailed work templates and the Work Scheduler for recurring jobs.

The Kanban view provides visual workflow management that larger teams particularly appreciate. This power requires significant upfront investment in planning and configuration to optimize workflows.

Source: Karbon

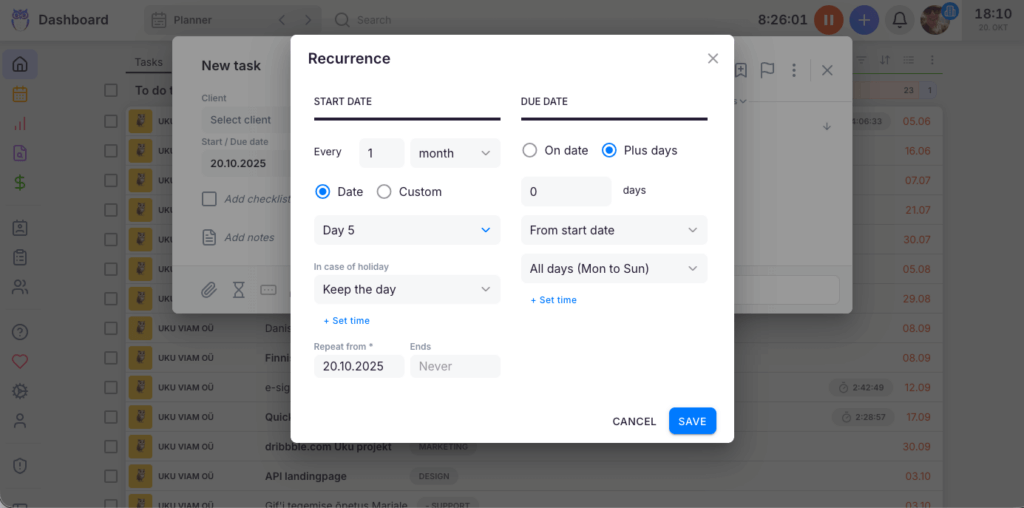

Uku‘s approach to workflow management is where the platform truly shines. The system provides sophisticated automation through advanced recurring task schedules that go beyond simple calendar repetition. You can set dynamic due dates (like “the 6th working day of the month”), create task dependencies, and even automate client communication. Yet despite this power, the interface remains clean and approachable. Custom fields and checklists ensure consistency without overwhelming users with options.

Email integration and collaboration approaches

Email management often makes or breaks practice management adoption, and each platform takes a distinct approach.

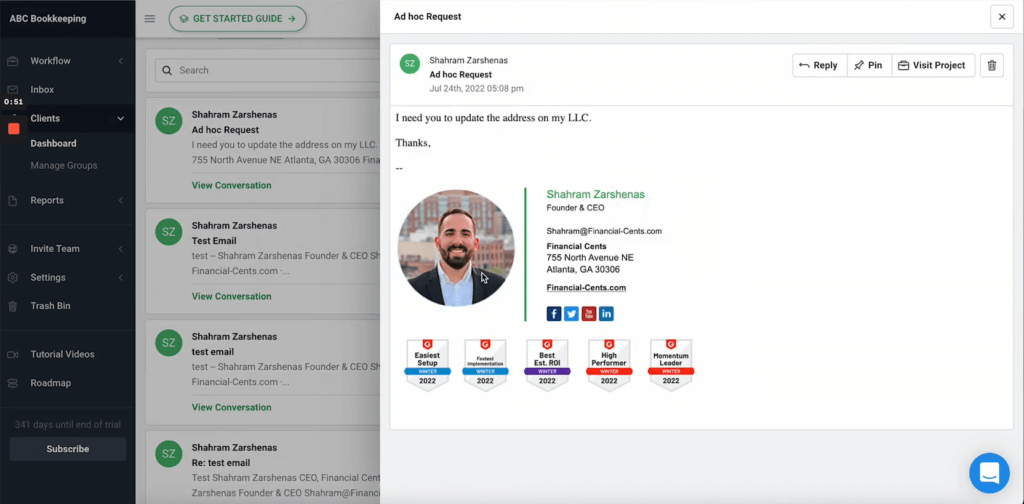

Financial Cents offers straightforward email integration with Gmail and Outlook. Emails sync to create a complete audit trail for each client, and you can pin important messages to specific projects. The Focused Client Inbox filters out non-client emails, helping you concentrate on what matters. It’s functional and sufficient for most firms looking for reliable email management.

Source: Financial Cents

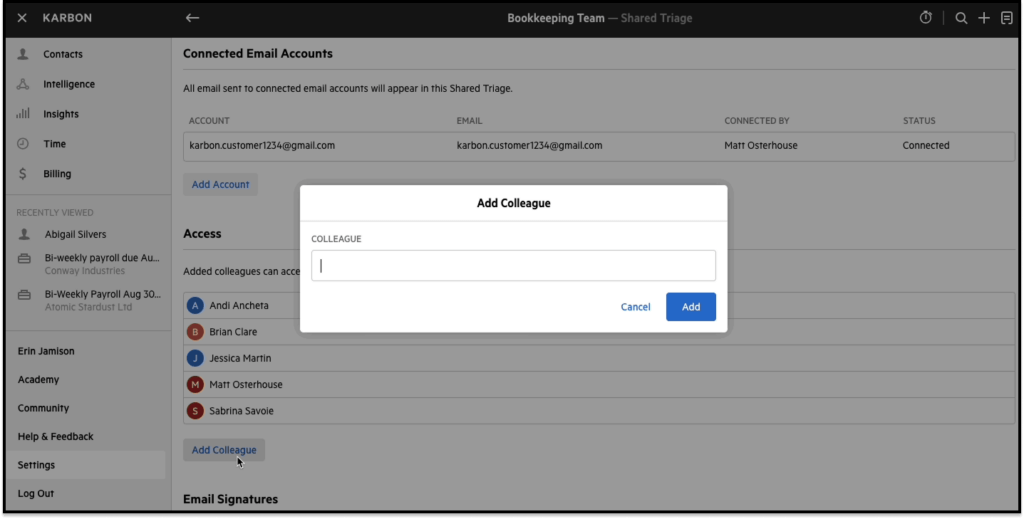

Karbon‘s Triage system represents a comprehensive approach to email for accounting firms. Through personal and shared Triage inboxes, emails become actionable items that can be assigned, tracked, and managed collaboratively. You can assign emails to colleagues, comment internally without forwarding, and ensure nothing gets missed. For firms ready to embrace this methodology, it can transform communication workflows. The system requires team-wide adoption and represents a significant shift from traditional email handling.

Uku takes a balanced approach with integrated email that enhances rather than replaces your existing workflow. Emails connect to tasks and clients, creating a complete communication history without forcing a new paradigm on your team. The platform also includes team collaboration features like comments and notifications within tasks, keeping discussions contextual and organized. Easy and quick to use.

Client portal capabilities show different philosophies

The client portal often determines whether clients actually engage with your practice management system.

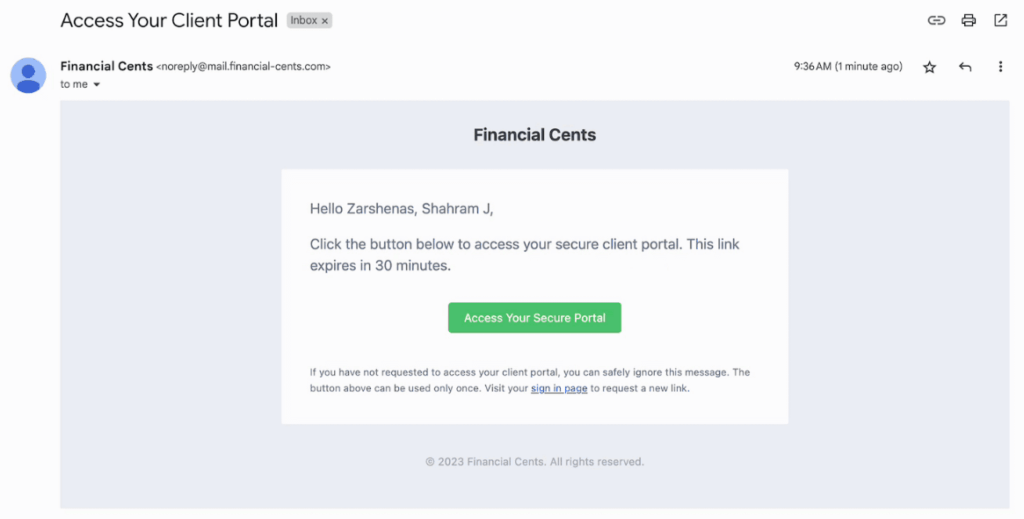

Financial Cents delivers a solid client portal with a unique “magic link” approach. Clients don’t need to remember passwords; they simply click a link in their email to access the portal. The system handles document requests, task assignments, and basic communication effectively. The portal is functional and user-friendly, with white-labeling options for branding, though deeper customization options are limited.

Source: Financial Cents

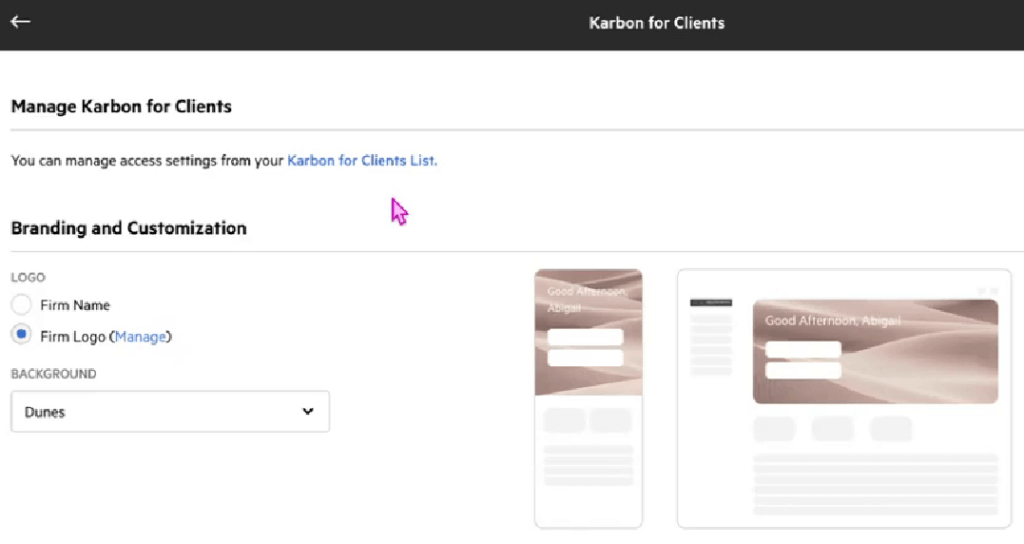

Karbon launched “Karbon for Clients” in July 2026, significantly upgrading their client portal capabilities. The new portal offers comprehensive features including branded experiences, document management, and mobile access. This addresses earlier user feedback requesting more advanced portal functionality, bringing Karbon’s client experience more in line with the platform’s other sophisticated features.

Source: Karbon

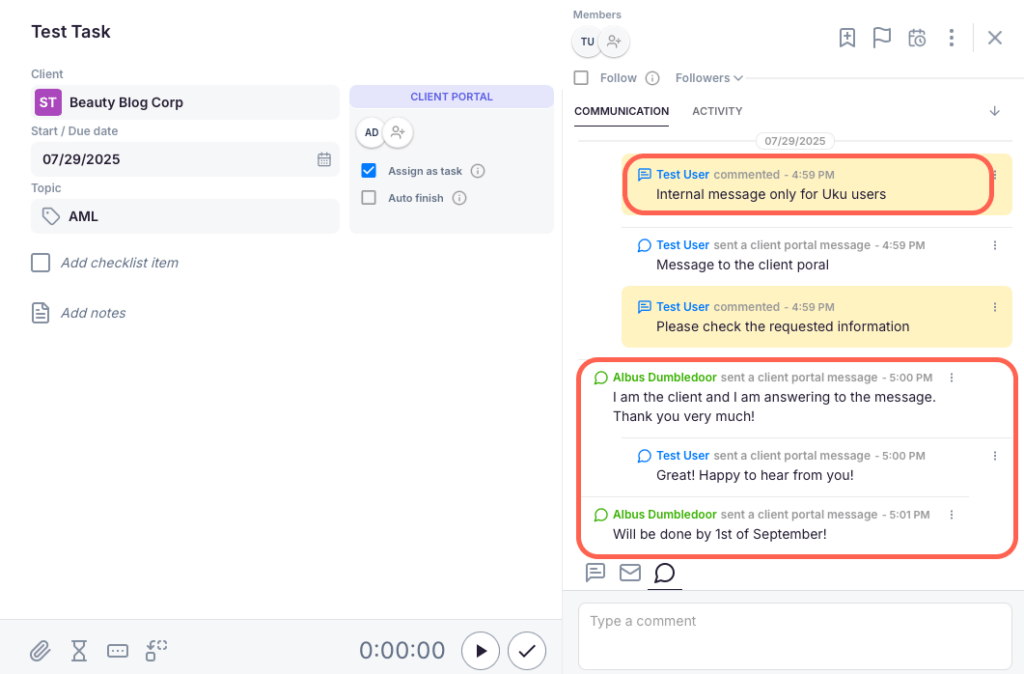

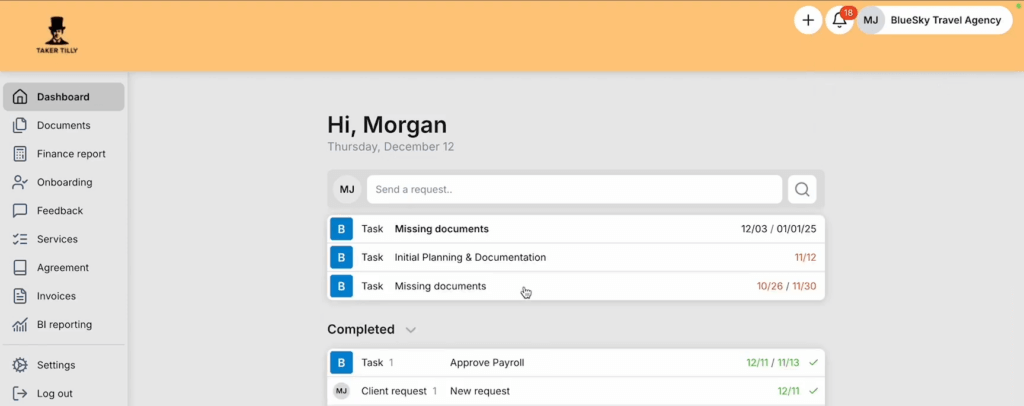

Uku‘s client portal stands out as one of the platform’s strongest features.

Beyond standard document sharing and task management, it offers extensive customization including company branding, custom menus for individual clients, and the ability to offer document management, financial reports, onboarding or even ask clients for feedback. The portal is marketed as “the client portal you don’t have to explain to clients” due to its intuitive design. While there’s no native mobile app, the portal is fully mobile-responsive and can be saved to a phone’s home screen for app-like access.

Time tracking and billing automation

How each platform handles time tracking and billing reveals their understanding of accounting firm economics.

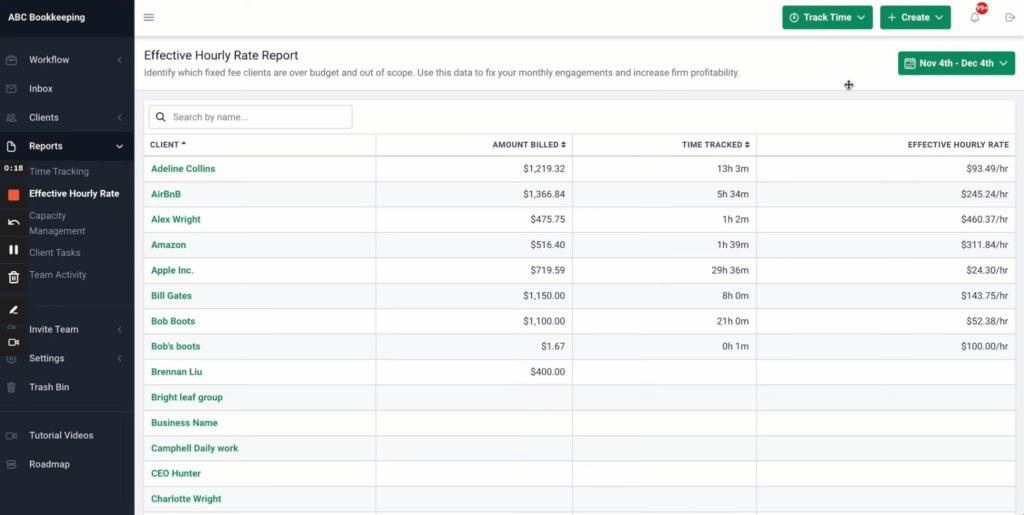

Financial Cents provides essential time tracking with both manual entry and timer options. The Effective Hourly Rate Report helps identify unprofitable clients, particularly valuable for fixed-fee arrangements. You can generate invoices from tracked time and integrate with QuickBooks Online. While functional for basic needs, firms requiring sophisticated billing automation might need to look at higher-tier plans or additional tools.

Source: Financial Cents

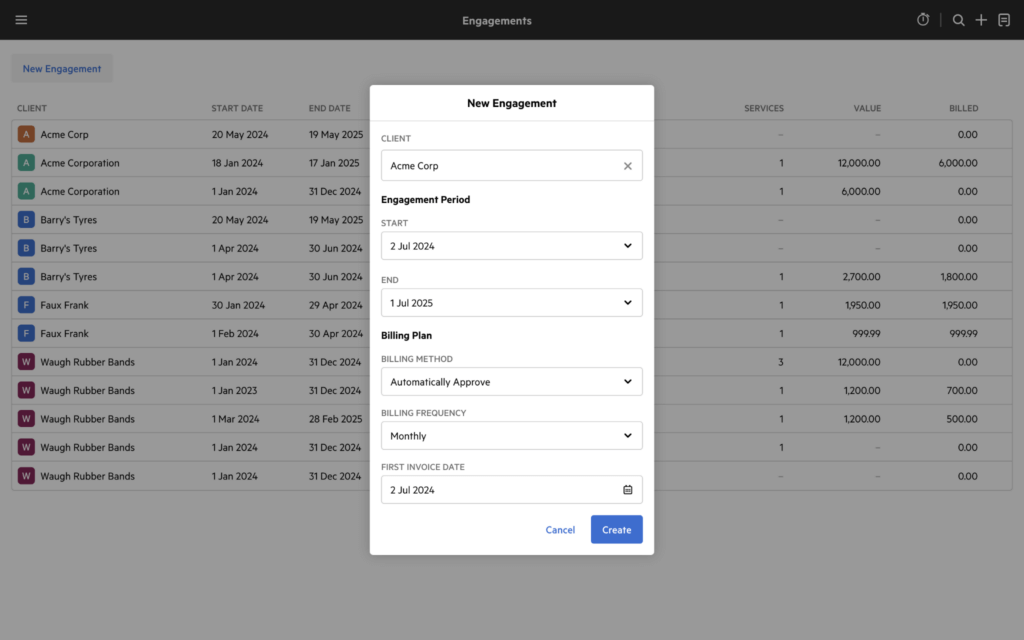

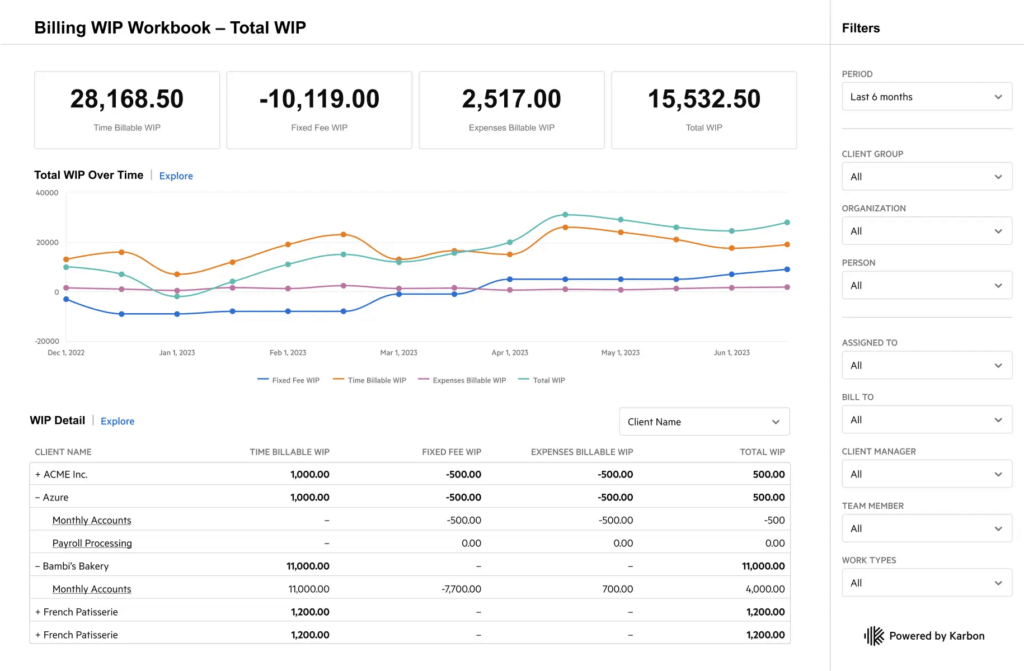

Karbon offers comprehensive time tracking integrated throughout the platform. The Billing & Payments feature (launched in 2024) provides automated invoice generation, multiple billing methods, and payment collection through Karbon Payments. The system handles time and materials, fixed fees, and recurring billing effectively, with ongoing enhancements being added regularly. The setup and confirmation process takes a while.

Source: Karbon

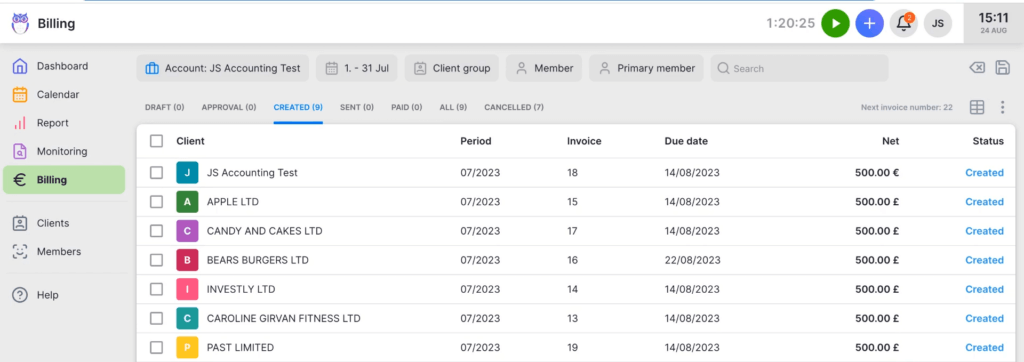

Uku‘s billing system is particularly sophisticated. The platform offers multiple time tracking methods including a stopwatch, manual entry, and bulk time allocation across multiple tasks. Beyond standard time tracking, the platform excels at automated billing. You can create complex pricing models mixing hourly, fixed, and item-based billing.

The system automatically generates invoices based on completed work and client contracts, with users reporting they can review and approve invoices for over 100 clients in about 30 minutes. The integration with multiple accounting platforms (QuickBooks, Xero, e-conomic, and others) ensures smooth financial management. Quick setup and many clients have increased their turnover by over 10% by adopting Uku billing.

Reporting and analytics depth

Data-driven decision making separates growing firms from stagnant ones, and reporting capabilities vary significantly across platforms.

Financial Cents recently launched an advanced reporting suite, including Revenue Insights, Work Insights, and Utilization Reports (beta). These provide valuable insights into firm performance, marking significant progress in the platform’s analytics capabilities. While the new reports offer substantial improvements, users seeking extensive customization options may find some limitations.

Source: Financial Cents

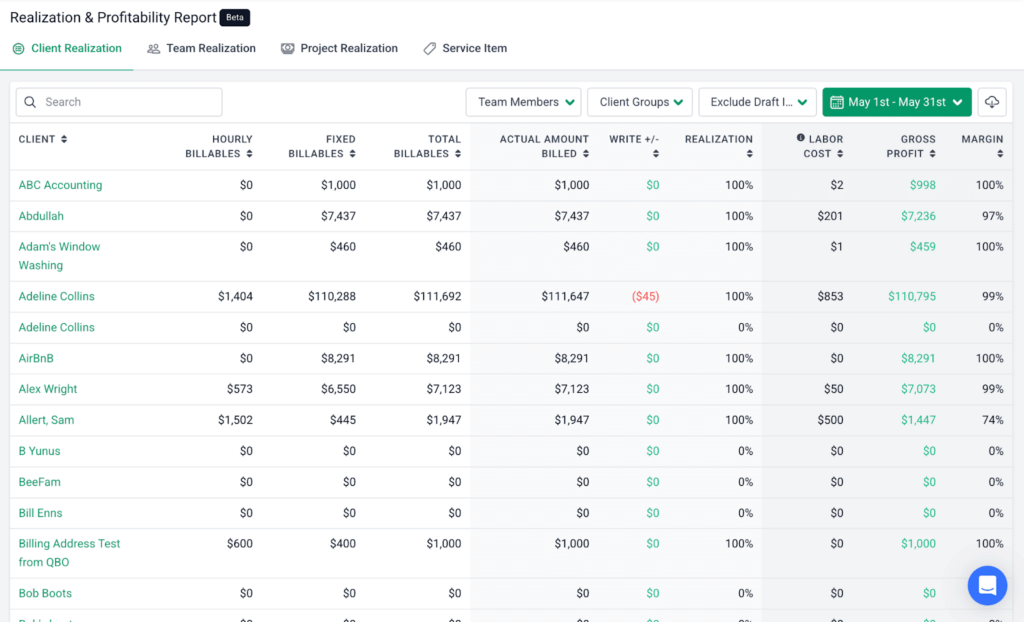

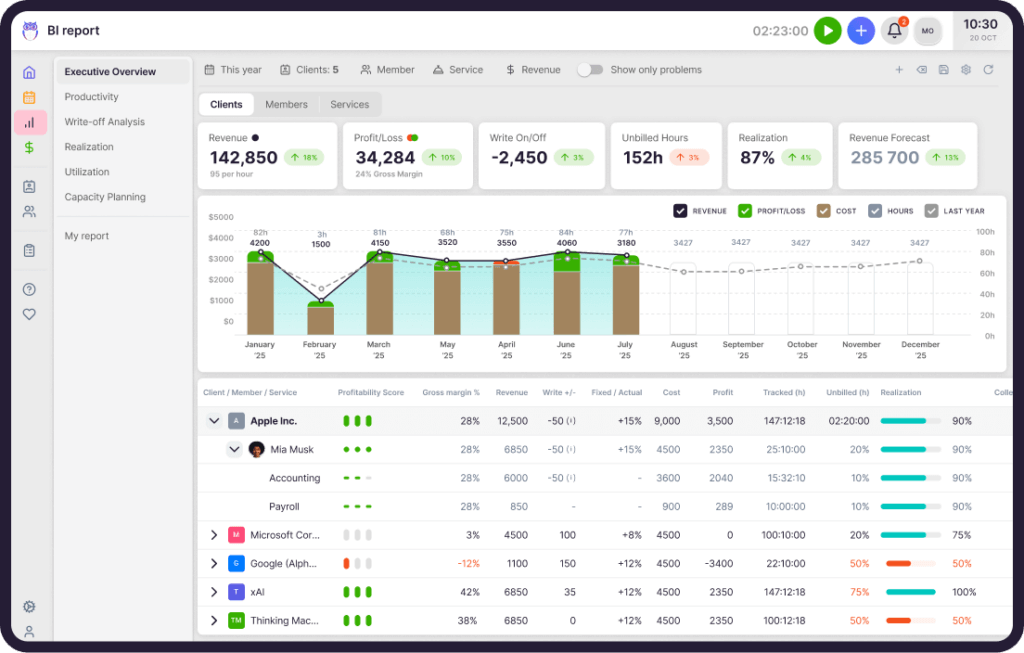

Karbon‘s Practice Intelligence provides comprehensive practice management analytics. With 12 pre-built dashboards covering everything from billing lifecycles to resource planning, the platform provides deep insights into every aspect of your practice. The ability to connect to external BI tools through Snowflake takes reporting to another level, allowing firms with data analysis expertise to create custom reports and integrations. To use it, you must purchase separate Power BI licenses (from $14 user/month).

Source: Karbon

Uku provides practical reporting focused on what matters most to accounting firms through its business analytics report, which is very practical for accounting firms. Team performance reports, client profitability analysis, and task status overviews provide actionable insights. The platform’s Elite plan will include enhanced BI Reporting capabilities, which will further expand analytical capabilities.

Pricing models and value propositions

The pricing structures reveal each platform’s target market and value proposition.

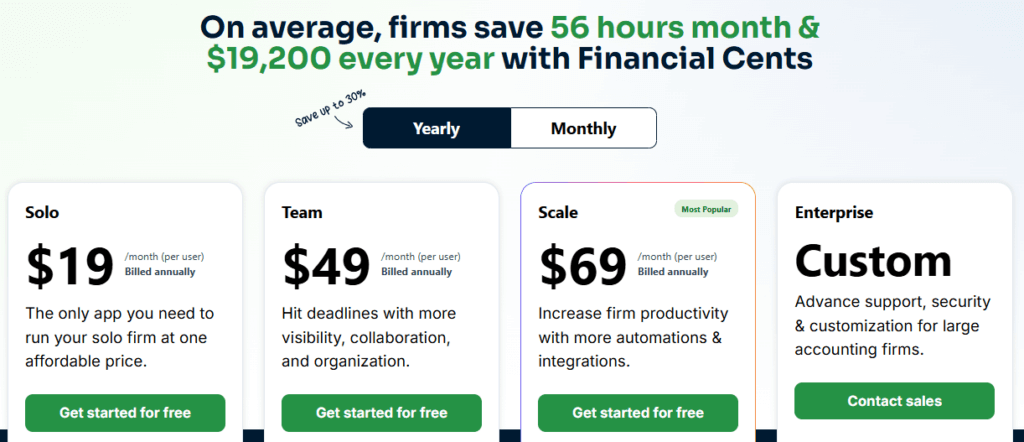

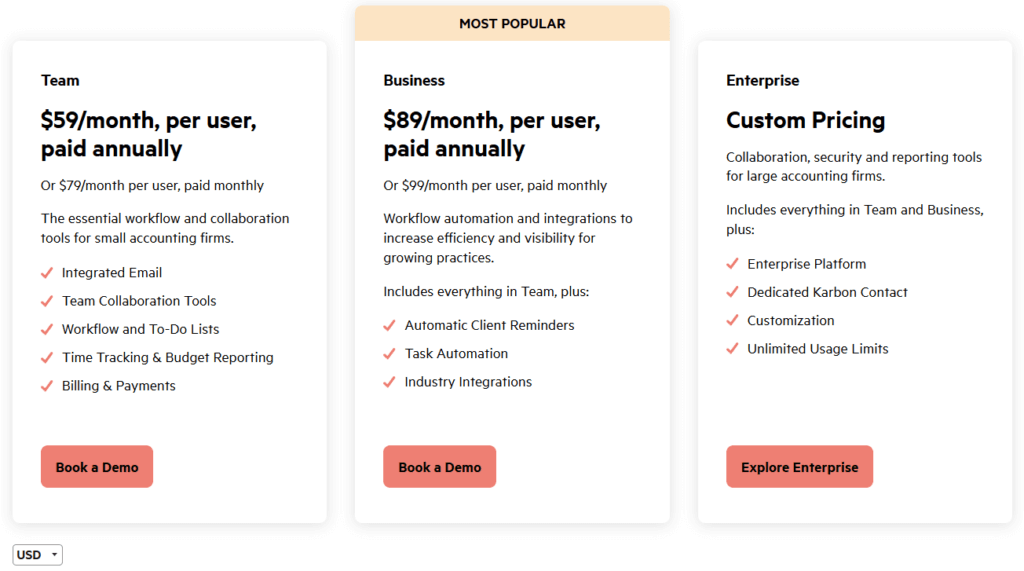

Financial Cents offers the most accessible pricing, with a Solo plan at just $19/month for individual practitioners. The Team plan at $49/month and Scale plan at $69/month provide additional features as firms grow. This graduated pricing makes Financial Cents particularly attractive for firms just starting with practice management software or those with tight budgets.

Karbon commands premium pricing starting at $59/user/month (or $708/user/year) for the Team plan and $89/user/month for the Business plan. While expensive, the pricing reflects the platform’s comprehensive features and enterprise-grade capabilities. For firms that fully utilize Karbon’s capabilities, the ROI can justify the cost, but smaller firms might struggle with the investment.

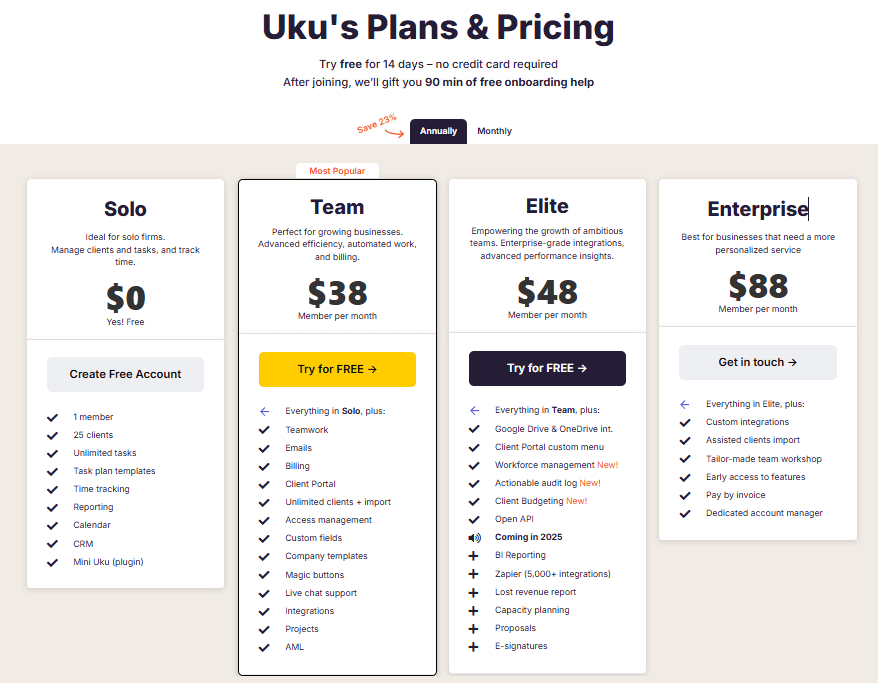

Uku offers competitive pricing starting from $38/user/month for the Team plan and $48/user/month for the Elite plan. This pricing sits between Financial Cents and Karbon while offering features competitive with both.

The 23% discount for annual billing and free 14-day trial of the Elite plan makes it easy to test the platform’s full capabilities. Both monthly and annual billing options are available, giving firms flexibility in how they commit to the platform.

Which platform should you choose?

The choice between these platforms depends on your firm’s specific needs, growth trajectory, and philosophy about practice management.

Choose Financial Cents if:

- You’re a solo practitioner or small firm prioritizing affordability

- You want something that works immediately without extensive setup

- Your workflows are relatively straightforward

- You value excellent customer support and easy onboarding

- You’re looking for your first practice management solution

- Budget constraints are a primary consideration

Choose Karbon if:

- You’re a growth-oriented firm ready to invest in premium tools

- Deep collaboration and email management transformation appeal to you

- You need sophisticated reporting and Practice Intelligence

- Your team can dedicate time to learning and optimizing the platform

- You want a comprehensive solution that can scale with enterprise growth

- Advanced automation and AI-driven insights justify the premium pricing

Choose Uku if:

- You want powerful automation without sacrificing ease of use

- Beautiful design and intuitive interfaces matter to your team

- You need sophisticated billing and client portal capabilities

- You’re looking for the best balance of features and affordability

- You want a platform that can grow from freelancer to enterprise

- You believe practice management software should be both powerful and enjoyable to use

- You need multilingual support (12 languages) or multi-currency capabilities

- You’re transitioning from Excel and want the easiest implementation

- Advanced features like e-signatures for document workflows are important to you

Experience Uku’s perfect balance of power and simplicity with a 14-day free trial

The practice management landscape has room for all three platforms, but the winner isn’t always the most famous or feature-rich option. Sometimes it’s the platform that understands that accounting firms need power without complexity, automation without confusion, and comprehensive features without overwhelming interfaces.

In 2026’s competitive accounting landscape, the right practice management software isn’t just about managing tasks. It’s about transforming how your firm operates, collaborates, and grows. Whether you choose Financial Cents’ approachable simplicity, Karbon’s collaborative power, or Uku’s balanced sophistication, the key is choosing a platform that aligns with your firm’s vision and values.