Choosing the digital nomad lifestyle can be challenging but rewarding. Working anywhere opens up the chance to explore the world freely. However, managing finances effectively can make it tricky to sustain this lifestyle, whether temporarily or long-term.

Staying on top of your expenses ensures nomads have the financial stability to cover all the essential necessities to navigate fluctuating exchange rates and any unforeseen emergencies. Fortunately, there are financial tools that can help digital nomads manage funds, even with multiple income streams, regardless of the currency.

In this post, you’ll learn how digital nomads can maximize the use of financial tools, and 8 of the best tools for managing your finances.

How financial tools help digital nomads

Every app has unique features that allow it to help you in many ways. Some may have a combination of several capabilities that can make it useful for your priorities. Here are some of the best ways that financial tools can help you.

- Currency Conversion & Management

Some of the best financial tools best suited for digital nomads are those that offer currency conversion for managing funds. In this way, users can avoid the struggle of computing how much they spend, send, and receive money in various currencies with minimal hassle. - Expense Tracking

Financial tools help users identify spending patterns for living expenses, which can aid in maintaining financial control even with frequent location changes and multiple currencies in use. - Invoicing & Tax Management

Compliance with global tax obligations can be challenging if you’re constantly moving and you have no constant connection to a tax professional. Some tools have features for invoicing and tax management that can effectively streamline billing and other requirements to help reduce the stress of working with multiple income sources across international boundaries. - Savings & Investments

These tools make it easy to grow savings and invest in stocks, ETFs, and other assets with minimal fees, ensuring long-term financial growth. This helps secure different financial goals, such as retirement funds and family planning. - Emergency Funds & Insurance

Managing travel and health insurance while also accounting for an emergency fund can provide financial protection for medical issues or unexpected travel disruptions. By ensuring enough funds are set aside for reliable health insurance platforms like Nomad, digital nomads can rest assured that their safety and well-being are protected.

The best financial tools for digital nomads

Managing finances as a digital nomad requires tools that offer flexibility, accessibility, and efficiency. Some of these tools also offer the opportunity to explore multiple income sources like stock investments.

1. Uku

Uku is a task and client management tool designed for accounting firms, freelancers, digital agencies, and small teams. It shines in handling business finances, making fund management and workflows a more optimized experience. With this tool, digital nomads can effectively keep track of tasks, organize client information, and automate invoicing.

Uku combines task management with financial tracking, allowing users to manage productivity and invoicing in one platform. This is also particularly helpful for service-based freelancers.

Key Features

- Task Automation and Management – Users can easily enter, schedule, and prioritize tasks based on their urgency. The tasks appear on your dashboard automatically.

- Client Management – Effortlessly organize every client’s information and check on project progress in one place.

- Automated Invoicing – Instantly generate and send invoices automatically based on tracked time or tasks.

- Time Tracking – Track time spent on each task for more accurate billing information, minimizing errors in generated invoices.

- Reports and Analytics – Monitor performance, billing, and productivity metrics for retros as needed.

Challenges

- Limited Integrations – There are fewer integrations with popular financial tools than some competitors, but works with some of the most recognized tools like QuickBooks and Xero.

Pricing

- Starts with a basic plan of around €29 per month.

- Premium options with advanced features are available at higher prices.

2. Revolut

Revolut is a digital banking platform with a range of financial services available on its mobile app. The platform is ideal for individuals managing personal and business expenses across multiple countries.

Revolut provides multi-currency accounts with interbank exchange rates, making international transactions a seamless process.

Key Features

- Multi-Currency Accounts – Hold and exchange over 30 currencies at interbank rates.

- Global Spending – The app also has a Revolut card, which can be used worldwide without hidden fees.

- Instant Transfers – Send money instantly to other Revolut users.

- Cryptocurrency Exchange – Expand income streams with the ability to buy, hold, and sell cryptocurrencies within the app.

- Budgeting Tools – Track your spending and set personal budgets to manage finances effectively.

Challenges

- Customer Support – Users have reported delays in resolving issues.

- Geographical Restrictions – Certain features are not available in all countries, which may be worth looking into before traveling to a new location.

Pricing

- Revolut offers a free standard account.

- Premium plans start at €7.99 monthly, providing additional benefits like higher withdrawal limits and insurance.

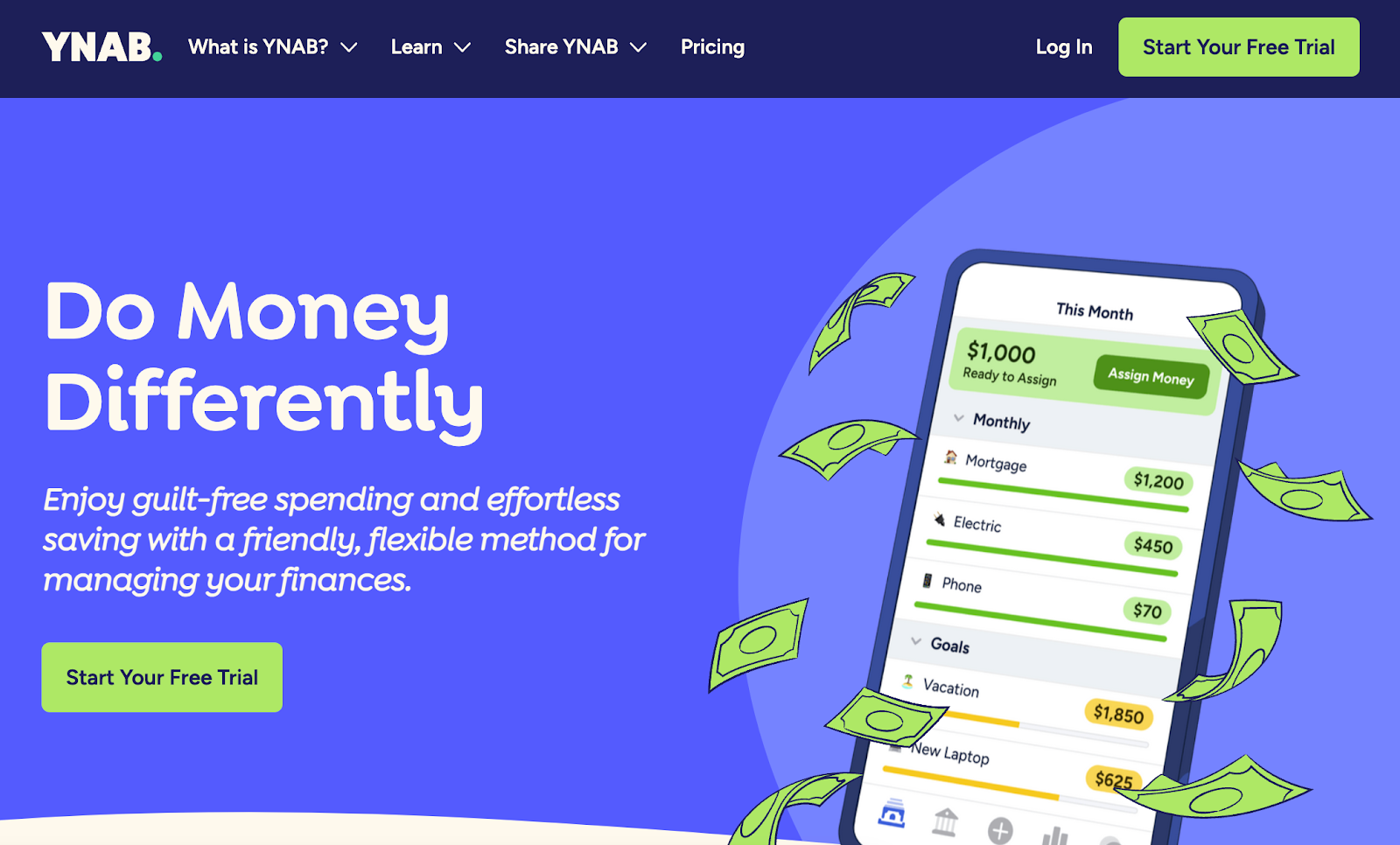

3. YNAB (You Need A Budget)

YNAB is a financial tool for budgeting designed to help users gain control over their finances by assigning every dollar a purpose. The app stands out because it emphasizes proactive budgeting, encouraging users to plan for future expenses rather than just tracking past spending.

Key Features

- Goal Tracking – Users can set and monitor financial goals.

- Real-Time Sync – Access your budget across multiple devices and see changes reflected in real time.

- Debt Paydown Tool – Create strategies to eliminate debt.

- Detailed Reporting – Reports allow users to analyze spending patterns and trends.

Challenges

- Manual Entry – Some transactions require manual input.

- Subscription Cost – The service requires a paid subscription, which may not suit all budgets.

Pricing

- Offers a 34-day free trial.

- Subscription is at $14.99 per month or $98.99 annually.

4. Xero

Xero is a cloud-based accounting software popular among freelancers and small business owners for its ease of use and comprehensive accounting features. It helps digital nomads manage invoicing, expense tracking, and tax compliance from anywhere.

Xero offers extensive integrations with banks and third-party apps, making it versatile for international financial management.

Key Features

- Invoicing – Create and send professional invoices with automatic reminders.

- Bank Reconciliation – Connect bank accounts for seamless transaction reconciliation.

- Expense Tracking – Track expenses by category to monitor spending.

- Multi-Currency Support – Manage finances in different currencies with real-time conversion rates.

Challenges

- Costly for Solo Users – Monthly fees can be high for individual freelancers.

- Limited Customer Support – Response times can be delayed for support inquiries.

Pricing

- Plans start at $13 per month.

- Advanced features are available in higher-tier plans.

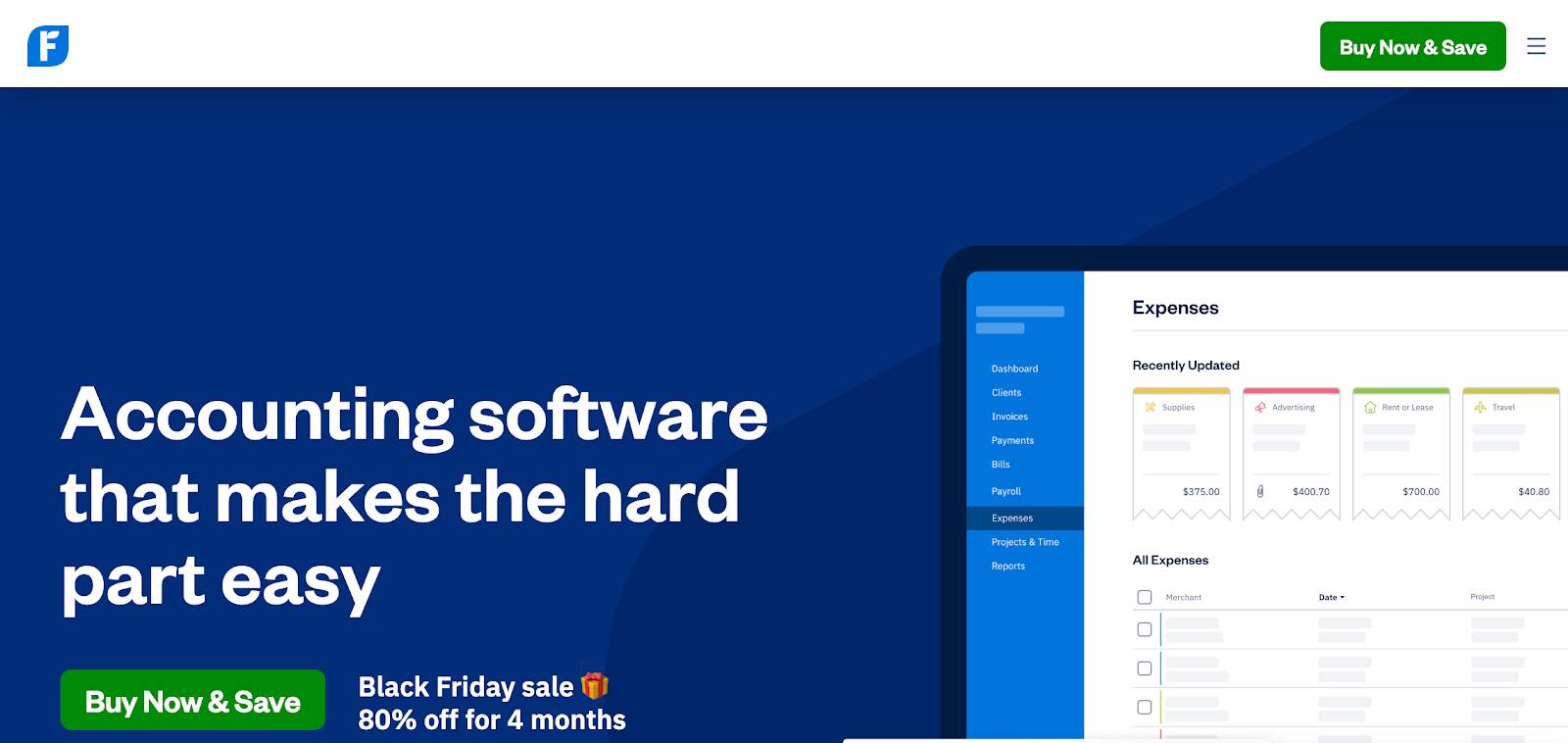

5. FreshBooks

FreshBooks is an accounting software designed for freelancers and small businesses. It’s particularly user-friendly and well-suited to service-based companies.

FreshBooks excels in creating professional invoices with customizable templates and built-in automated reminders.

Key Features

- Customizable Invoices – Design on-brand invoices.

- Expense Categorization – Organize expenses for tax obligations.

- Time Tracking – Track billable hours directly linked to projects.

- Financial Reports – Generate reports like profit and loss, expense summaries, etc.

Challenges

- Limited Multi-Currency Options – Multi-currency invoicing can be complex.

- Learning Curve – It may take time for non-finance users to master.

Pricing

- Starts at $15 per month.

- Premium options are available for additional features.

6. Mint

Mint is a free budgeting tool from Intuit that helps users track expenses, set budgets, and monitor credit scores. It is a good choice for digital nomads who need an overview of personal finances without business features.

Key Features

- Automatic Categorization – Sort expenses automatically into categories.

- Bill Reminders – Receive notifications for upcoming bills.

- Investment Tracking – Monitor investments alongside expenses.

- Credit Score Monitoring – Free credit score updates and tracking.

Challenges

- Limited International Support – Not all features work globally.

- Limited Customer Support – Support options are limited for troubleshooting.

Pricing

- Free to use with optional premium services.

7. QuickBooks Online

QuickBooks is a popular accounting tool freelancers and small business owners use to manage invoicing, expenses, and tax compliance. QuickBooks offers robust accounting features and because it is widely used, it’s easy to find tutorials and integrate with third-party apps.

Key Features

- Invoicing and Payments – Send professional invoices and accept online payments.

- Tax Preparation – Generate reports that simplify tax filing.

- Multi-Device Sync – Access and update accounts from any device.

- Integrations – Connects with many banks and apps for seamless financial management.

Challenges

- Costly for Small Freelancers – Monthly fees can add up for solo users.

- Complex for Non-Accountants – Some users find the features overwhelming.

- Data Syncing Issues – Occasional syncing delays with bank accounts.

Pricing

- Starts at $25 per month.

- Higher-tier plans offer additional features.

8. Empower

Empower, previously Personal Capital, is a comprehensive financial management tool that combines budgeting and investment tracking. It’s widely used for financial planning, giving users a detailed look at their net worth, cash flow, and investment performance.

Key Features

- Net Worth Tracking – Aggregates accounts to show your real-time net worth.

- Investment Analysis – Analyze your portfolio allocation and performance.

- Retirement Planner – Run simulations for retirement savings projections.

- Fee Analyzer – Identify hidden fees in investment accounts.

Challenges

- Limited Custom Budgeting – Less focused on detailed monthly budgeting than some budgeting apps available on the market.

- High Minimum for Wealth Management Services – Wealth management services require a minimum balance of $100,000, which may not be accessible to everyone.

- No Bill Payment Features – The app doesn’t handle direct bill payment.

Pricing

- The app’s budgeting and tracking tools are free. Wealth management services are fee-based, starting at 0.89% for assets under management.

Finding the best financial management tools for digital nomads

Using fund management tools is great for gaining the flexibility and security that comes with financial freedom. From converting currencies to tracking expenses or even exploring other income streams, these tools help make the nomadic lifestyle one that is truly sustainable and stress-free.

Finding the right tool, of course, depends on your financial priorities. Hopefully, you find the right combination of financial tools from the list as you embark on your journey across the world.