Accounting firm owners typically underprice their services. A 2025 industry survey shows around 80% of firms plan to increase fees, yet most only raise prices by 5–13%, which barely moves the needle on profitability. If you want real impact on profit, workload, and capacity, you need more than a small annual uplift. You need a pricing strategy.

This guide is written for owners and managers of accounting and bookkeeping firms searching for answers to questions like:

- How do I price my accounting firm services?

- What is the best way to price bookkeeping services?

- How should I structure my accounting firm pricing strategy?

- What is value-based pricing and how does it work?

It shows how to move from hourly billing to packaged, value-based pricing, how to use time tracking to protect margins, and how to implement it cleanly with practice management software.

Why Your Accounting Firm Pricing Strategy Matters Most

Pricing is the single biggest financial lever in your firm. Small, thoughtful changes in how you charge have an outsized impact compared to cutting costs or chasing more clients.

Most firms searching for “how to price accounting services” face at least one of these problems:

- Billing is based on hours, not outcomes, creating unpredictable revenue

- Legacy clients are paying old rates from years ago

- No consistent pricing structure—different team members charge different amounts for similar work

- No clear link between workload and profitability

Modern, profitable firms shift toward fixed-fee and value-based pricing. They package services, define clear tiers, and track time internally to understand where profit is made or lost.

The Real Financial Impact of Better Pricing

Imagine a firm with 150 clients at an average annual fee of $4,000 per client.

Scenario A: Current State (No Changes)

| Metric | Amount |

|---|---|

| Number of Clients | 150 |

| Average Fee per Client | $4,000/year |

| Total Annual Revenue | $600,000 |

| Annual Operating Costs | $420,000 |

| Annual Profit | $180,000 |

| Profit Margin | 30% |

This is where many firms stay for years.

Scenario B: Modest Price Increase (10% Across the Board)

| Metric | Amount | Change |

|---|---|---|

| Number of Clients | 150 | Same |

| Average Fee per Client | $4,400/year | +10% |

| Total Annual Revenue | $660,000 | +$60,000 |

| Annual Operating Costs | $420,000 | Unchanged |

| Annual Profit | $240,000 | +$60,000 |

| Profit Margin | 36% | +6 points |

Key insight: By raising prices just 10% with no extra work, profit increases by $60,000 annually. Yet this is still “light touch” compared to what is possible with intentional pricing strategy.

Scenario C: Strategic 3-Tier Pricing Model

You introduce three clear packages (Essential, Strategic, Comprehensive) and migrate clients over time. Your average fee per client rises to $5,400 per year.

| Metric | Amount | Change |

|---|---|---|

| Number of Clients | 150 | Same |

| Average Fee per Client | $5,400/year | +35% |

| Total Annual Revenue | $810,000 | +$210,000 |

| Annual Operating Costs | $420,000 | Unchanged |

| Annual Profit | $390,000 | +$210,000 |

| Profit Margin | 48% | +18 points |

Key insight: Profit more than doubles, without adding staff or burning more hours. That is what good pricing structure does.

When you distribute clients across tiers realistically (roughly 13% Essential, 67% Strategic, 20% Comprehensive), revenue reaches approximately $810,000, demonstrating that strategic pricing transforms profitability without increasing workload.

Accounting Firm Pricing Models: Which One Works?

Before you decide how to price your own services, understand the main models used in accounting and bookkeeping firms:

| Model | What It Is | Best For | Typical Range |

|---|---|---|---|

| Hourly Billing | Client pays per hour worked | One-off projects, advisory experiments | $75–$250/hour |

| Fixed-Fee / Flat Fee | Set fee for defined scope | Compliance work, tax returns, bookkeeping | $300–$3,000/month |

| Value-Based Pricing | Fees aligned to outcomes, savings, or growth | Tax planning, CFO work, advisory | Based on client ROI |

| Subscription / Retainer | Monthly packages with defined services | Ongoing bookkeeping, CAS, full-service | $500–$5,000/month |

| Cost-Plus / Competitive | Based on internal cost + margin | Early-stage, price-sensitive markets | Varies |

Most modern, scalable firms combine fixed-fee + value-based + subscription models. Hourly billing becomes the exception, not the norm.

If you want a pricing model that scales, protects margins, and attracts quality clients, focus on fixed-fee packages tied to deliverables rather than time.

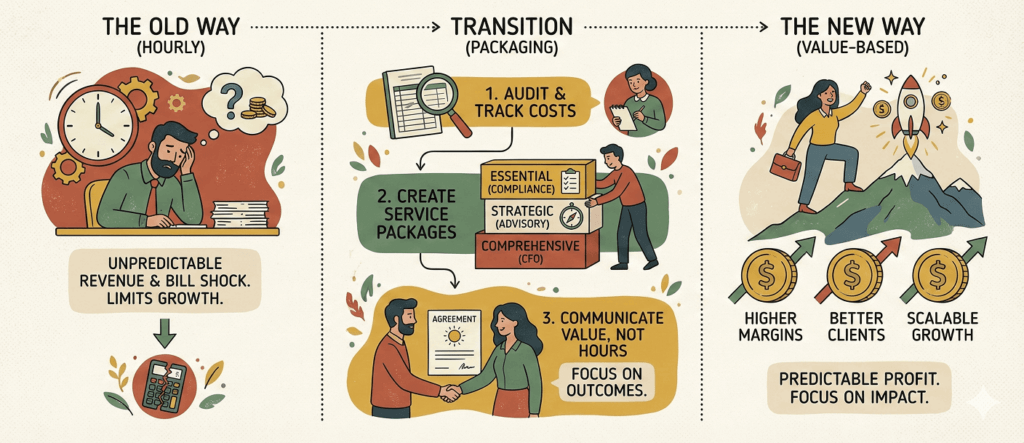

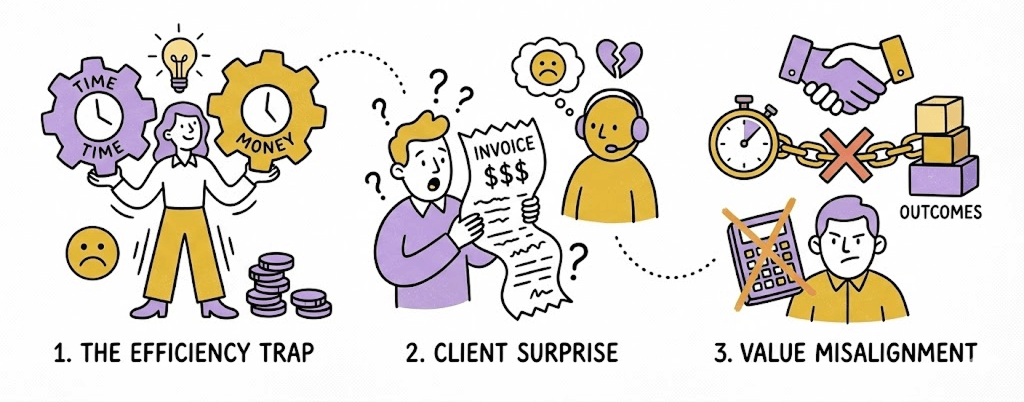

Why Hourly Billing Hurts Your Accounting Firm

Hourly billing feels safe because it’s familiar, but it systematically undermines both profit and client satisfaction:

It penalizes efficiency. As your team becomes faster through experience and better systems, your revenue per client often goes down. A junior accountant might take 10 hours on a reconciliation that an experienced one completes in 5 hours. With hourly billing, the faster person is less profitable.

It creates bill shock. Clients do not know what the invoice will be month to month. Unpredictable bills breed resentment and churn, even if they ultimately pay.

It anchors value to time, not to expertise. A tax strategy that saves a client $50,000 should not cost less than basic compliance work just because it involves fewer billable hours. You are solving a bigger problem; you should be paid accordingly.

It limits your effective hourly rate. When you stop tracking hours (which happens as you grow), your effective rate gets stuck at whatever your hourly rate was. You never benefit from efficiency gains.

Thought leaders in accounting practice management consistently recommend moving away from hourly billing if you want sustainable margins and better work-life balance.

The Best Pricing Strategy: Three-Tier, Value-Based Packaging

The sweet spot for most small and mid-sized accounting and bookkeeping firms is a three-tier, value-based pricing structure for each core service line (bookkeeping, accounting, CAS, tax, payroll).

Step 1: Define Your Core Service

Start with one service area where margins are thin or pricing is messy—for example, monthly bookkeeping for small businesses.

Clarify the minimum viable scope that keeps you comfortable and compliant:

- Bank and credit card reconciliation

- Monthly P&L and balance sheet

- Year-end support for the tax return

- Quarterly check-in

This becomes your Essential tier.

Sustainable pricing for basic monthly bookkeeping typically starts around $300–$500 per month. Many successful firms will not go below $500 for business clients because the compliance and risk simply do not justify lower rates.

Step 2: Design Three Clear Tiers

Use names that signal increasing value and support:

- Essential (compliance-focused)

- Strategic (performance-focused, recommended)

- Comprehensive (advisory-focused, premium)

Structure them so each tier feels distinctly different—not just a small price bump.

Tier 1: Essential (Compliance)

What’s included:

- Monthly bookkeeping & reconciliations

- Quarterly financial reports

- Email support, 48-hour response time

- Year-end support for tax return

Who it’s for: Straightforward businesses with minimal tax complexity, low transaction volume

Typical pricing: $250–$500/month

Effective hourly rate when priced right: $60–$120/hour (if you deliver it lean)

Tier 2: Strategic (Recommended)

What’s included:

- Everything in Essential

- Monthly management reports with insights

- Monthly call for cash flow planning, tax strategy

- Email + phone support, 24-hour response time

- Proactive quarterly tax planning (not just year-end)

Who it’s for: Growing businesses that want guidance, not just compliance; typically 50% of your clients should land here

Typical pricing: $450–$1,200/month

Effective hourly rate: $90–$180/hour with reasonable scope

Tier 3: Comprehensive (Premium Advisory)

What’s included:

- Everything in Strategic

- Weekly calls or on-demand access

- Advanced forecasting, cash flow modeling, budgeting

- Strategy sessions on entity structure, tax optimization

- Real-time dashboard access & custom reporting

- Direct access to senior advisor / virtual CFO relationship

Who it’s for: Complex or fast-growing businesses, multi-entity structures, owners who rely heavily on your guidance

Typical pricing: $2,000–$4,500/month

Effective hourly rate: $200–$400/hour (and worth it for them)

Why three tiers work:

- The Essential tier feels “light” and cheap, making Strategic look reasonable

- Most clients naturally choose Strategic (the middle option feels smart)

- Premium clients self-select into Comprehensive and feel they got what they paid for

- You have a clear upgrade path if a client’s needs grow

Time Tracking: Your Hidden Profitability Tool

Switching away from hourly billing does not mean you stop tracking time. Smart firms treat time tracking as a management and pricing tool, not a billing mechanism.

1. Calculate Effective Hourly Rate by Client

Time tracking lets you calculate the effective hourly rate per client:

Effective Hourly Rate = Client’s Monthly Fee ÷ Total Hours Spent (by all team members)

For example:

| Client | Monthly Fee | Total Hours (Team) | Effective Hourly Rate | Health |

|---|---|---|---|---|

| Client A | $400 | 4 hours | $100/hour | Healthy |

| Client B | $400 | 10 hours | $40/hour | Unprofitable |

| Client C | $400 | 16 hours | $25/hour | Loss maker |

All three pay the same fee, but only Client A is profitable.

Why this matters: With systematic time tracking, you can:

- See when a client’s workload has quietly doubled over 12–18 months

- Spot when a “simple” client has become complex due to growth or tax issues

- Decide early when to re-scope or move a client to a higher tier, instead of discovering the problem a year later

- Identify which clients are subsidizing others

Firms that track effective hourly rate at the client level make better decisions on repricing, letting go of unprofitable relationships, and staffing.

2. Protect Your Internal Investment Time

Healthy, growing firms also invest time in non-billable internal work:

- Improving processes, documentation, and templates

- Testing new tools and automations

- Onboarding, mentoring, and training colleagues

- Building checklists, playbooks, and best practices

- Working on marketing, positioning, and pricing strategy

Many high-performing firms deliberately aim for 10–15% of total firm hours spent on internal development and improvement.

Why track this: Time tracking reveals whether:

- You are running at only 1–3% internal time (warning sign: burnout and stagnation ahead)

- You are investing 12% (healthy)

- You are under-investing relative to your growth ambitions

When you move to fixed-fee or value-based pricing, you must price in this internal time. Otherwise your margins erode even if revenue rises.

Example calculation:

A firm with five team members has:

- 10,000 billable hours annually to clients

- 1,200 hours annually on internal work (training, process improvement, system updates)

- Total value-creation capacity: 11,200 hours

Your true delivery cost is spread across 11,200 hours of value creation, not just 10,000. If you price as if only 10,000 hours matter, you are under-recovering.

A robust time tracking + pricing loop lets you:

- See true delivery cost per tier and per client

- Adjust prices based on real complexity, not guesswork

- Justify increases to clients with data about scope and involvement

- Invest in your team and firm without sacrificing margin

Communicating Price Changes to Clients

A strong pricing model is only useful if you can communicate it clearly. Industry best practices include:

Give Proper Notice

Communicate price changes 60–90 days in advance. This shows respect and gives clients time to budget. A CPA firm that implemented pricing restructuring found that announcing changes in early February (before tax season crunch) improved acceptance rates significantly.

Be Transparent About the Change

Explain what is changing and why. Example positioning:

“We are restructuring how we package services to give you more choice and clarity. You can now select the level of support that fits your business, with transparent pricing for each level. Based on the work we currently do for you, here’s where you naturally fit.”

Firms citing rising business costs, regulatory complexity, or enhanced service capabilities as reasons for increases received better acceptance than those offering vague justifications.

Offer Tiers Instead of a Single Price

Rather than forcing everyone into a new rate, present it as a menu:

“Here is your current level of service (let’s call it ‘Strategic’). You can stay there at this new rate, move down to ‘Essential’ if you want lower cost, or move up to ‘Comprehensive’ if your needs have grown.”

One CPA firm achieved a 94% acceptance rate on price increases by presenting each existing client with their “natural fit” tier and clear trade-offs.

Have Individual Conversations for Key Clients

For your highest-value or longest-standing clients, take time for a personal conversation. Frame it as a value-creation discussion:

“I want to make sure you’re getting maximum benefit from our relationship. Your business has grown, and your accounting needs with it. Let’s discuss what level of service makes sense now.”

Important mindset shift: You do not have to convince every client. Clients who leave over reasonable price increases are often unprofitable accounts or poor fits. One CPA firm that raised prices 30% lost only 8% of its client base, but the clients it kept were more engaged, less demanding, and more profitable.

Real-World Examples: How Firms Increased Revenue With Better Pricing

Example 1: Solo Tax Practice Transitioning to Tiered Pricing

A solo CPA had been pricing tax returns at $400–800 depending on complexity, all with hourly billing for planning and review work. Clients got surprise bills; margins were unpredictable.

She restructured into three tiers:

- Essential: Tax return preparation and filing only — $600/year

- Strategic: Quarterly tax planning meetings + return preparation — $1,500/year

- Comprehensive: Monthly planning + return + entity optimization guidance — $3,000/year

Results:

- Average client revenue increased from $650 to $1,890 annually (190% increase)

- Churn dropped because Strategic and Comprehensive clients felt they were getting ongoing value, not just a transaction

- Her effective hourly rate for Strategic clients: ~$150/hour (sustainable, scalable)

Example 2: Mid-Size Bookkeeping Firm

A firm with 60 bookkeeping clients at an average of $700/month ($8,400/year per client) restructured with tiered packages:

- Essential: Transactions, P&L, email support — $500/month

- Strategic: Essential + bi-weekly calls + payroll setup — $1,100/month

- Comprehensive: Full service + weekly calls + cash flow forecasting + tax planning — $2,200/month

Client distribution after repricing:

- 22% chose Essential

- 48% chose Strategic (the recommended tier)

- 30% chose Comprehensive

Results:

- Monthly revenue from same 60 clients: increased from $42,000 to $82,400 (96% increase)

- Average annual fee per client: up from $8,400 to $16,480

- Client retention: 91% of existing clients accepted the new pricing within 90 days

- Team satisfaction: Better margins meant higher staff compensation and lower turnover

Handling Common Pricing Objections

When you reprices or introduce tiered pricing, some clients will push back.

Objection: “This is way more than before.”

Response: “You’re right that the price has increased. What’s also increased is the value. Your plan now includes monthly strategic planning and quarterly tax optimization. That planning alone would cost $X if you hired a consultant separately. You’re getting it built in.”

Objection: “I could hire someone cheaper.”

Response: “You absolutely could. But you’d also be managing that person’s time, reviewing their work, potentially dealing with errors, rebuilding relationships when they leave. What we provide is the expertise to help you make better decisions, not just accurate books. That’s valued differently.”

Objection: “I need to think about it.”

Response: “That’s wise. Here’s what I suggest: try the Strategic tier for three months. If it’s not delivering value, we can adjust. But I think you’ll find the planning and regular communication is what you’ve actually needed.”

Why Tiers Work: The Psychology of Pricing

Three-tier pricing works because of how people choose:

- Single price = binary decision: “Do I buy yes or no?”

- Three options = selection decision: “Which option is right for me?”

The middle option (Strategic) naturally attracts the most clients because it feels like the sensible choice between “too basic” and “more than I need.”

Clients feel in control when they choose a tier. They rarely feel pressured. And when you communicate clearly, they rarely leave.

Time Tracking: Protecting Your Margins Long-Term

Tiered pricing is a pricing structure. Time tracking is how you protect and optimize that structure over time.

Without time tracking:

- Scope creep happens silently; you do not notice until it is too late

- You cannot justify price increases with hard data

- Internal improvements never get measured, so you never raise prices to offset them

- You make staffing decisions blind

With time tracking:

- You see which clients are becoming more complex (repricing signal)

- You document the internal work that justifies your pricing

- You build a data-driven case for annual pricing increases

- You hire confidently because you understand your true margins

The best firms use time tracking + tiered pricing + annual price reviews as a system. Not one without the others.

The Bigger Picture: Building a Sustainable Firm

Pricing isn’t just about revenue—it’s about sustainability. Firms with structured pricing models and clear service tiers report:

- Higher margins: 48% average margins vs. 30% for firms using hourly billing

- Better retention: 88% average retention vs. 82% for hour-based firms

- Improved team satisfaction: Better margins mean higher staff compensation and lower turnover

- Better capacity management: Clear packages make it obvious when you’re overcommitted, allowing you to raise prices or add staff strategically

When your pricing reflects value, not hours, you:

- Attract clients who value expertise, not just low cost

- Create predictable revenue that supports sustainable growth

- Build relationships with clients who are invested in your success

- Give yourself permission to refuse unprofitable work

- Have time and energy to improve your firm

Implementing Structured Pricing With Practice Management Software

Designing three tiers on paper is easy. Making sure your whole team actually uses them consistently is where many firms fail.

This is where practice management software becomes a key part of your pricing strategy, not just an operational tool.

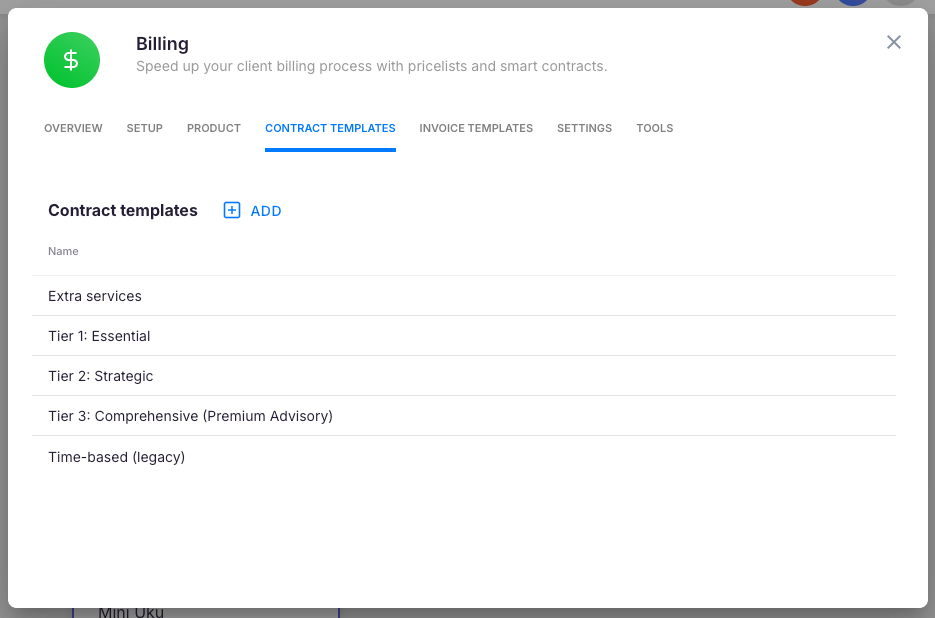

How Modern Practice Management Software Supports Tiered Pricing

A robust practice management platform like Uku lets you:

1. Create Tiered Contract Templates

Set up three master engagement letter templates, one for each tier (Essential, Strategic, Comprehensive). These templates define:

- Scope and deliverables for the tier

- Billing frequency and amounts

- Response times and support channels

- Review frequency and reporting level

Each template becomes your single source of truth for that tier across the entire firm.

2. Assign the Right Tier to Each Client

When you onboard a new client or reprice an existing one, you:

- Select the appropriate tier template

- Make small customizations if needed (extra meetings, industry-specific add-ons)

- Apply it to the client engagement

The core structure stays intact. Customization happens within boundaries.

3. Keep Billing and Scope Synchronized

Once a client is assigned to a tier:

- Billing follows the agreement automatically (monthly, quarterly, annual invoicing)

- Tasks and workflows reflect the agreed scope (e.g., if Strategic tier includes monthly calls, the workflow reminds you)

- When you improve a package, you update the template and roll it out to all clients on that tier

This removes the chaos of:

- Different team members promising different things to similar clients

- “Exceptions” that nobody documents

- Forgotten price increases

- Forgotten service level commitments

4. Make Firm-Wide Changes Easily

When you need to implement a firm-wide price increase or add a new service to all Strategic clients:

- You update the tier templates in the software

- New or renewed engagements use the new terms automatically

- You communicate changes to existing clients and transition them smoothly

- No hunting through old emails or Word docs

This is how firms scale pricing without operational chaos.

5. Track Time to Protect Margins

Practice management software often includes time tracking integrated with your billing and client profitability data. You can see:

- Effective hourly rate per client

- Time spent on internal work vs. billable work

- Scope creep by client (when hours rise without corresponding price increases)

- Staff utilization and billable hour targets

This intelligence feeds back into your pricing decisions.

Your Action Plan: Implementing Tiered Pricing

1. Audit Your Current Pricing

- List all clients and their current fees

- Track time by client for 1–2 weeks to understand actual hours spent

- Calculate effective hourly rate per client

- Identify unprofitable relationships

2. Design Your Three Tiers

- Define the scope for Essential (minimum viable)

- Design Strategic (what most clients should get)

- Design Comprehensive (premium, full service)

- Set prices for each tier based on value and effective hourly rate targets

3. Set Up in Your Software

- Create three engagement letter templates in your practice management system

- Populate each template with scope, deliverables, price, and SLAs

- Test the templates with a new client

4. Communicate to Existing Clients

- Identify which tier each client naturally fits

- Schedule conversations or send personalized letters explaining the new structure

- Offer tiers as a choice, not a mandate

- Give 60–90 days’ notice before pricing changes take effect

Ongoing: Monitor and Adjust

- Track effective hourly rate monthly

- Review scope and pricing quarterly

- Adjust tier definitions annually based on market and costs

- Celebrate margin improvements

Final Thoughts: The Power of Strategic Pricing

Most accounting firms stay stuck at thin margins and burning hours because they never made a deliberate choice about pricing. They inherited hourly rates from early in their career or matched competitors.

The firms that excel do something different. They:

- Define value clearly in service packages

- Track time to protect that value

- Communicate pricing as choice, not imposition

- Use software to scale pricing consistently

- Review and adjust annually

The result: more profit, fewer hours, better clients, and a sustainable firm.

The question is not whether you can afford to implement strategic pricing. The question is whether you can afford not to.

Uku will help you implement it all. Book a demo👇