The most comprehensive directory of apps for accountants, CPAs, bookkeepers, and accounting firms. We’ve researched 150+ tools across 18 categories with honest assessments of strengths, weaknesses, pricing, and real user feedback from G2 and Capterra.

Table of Contents

- Practice Management Software for Accountants

- Tax Preparation Software for CPAs

- Accounting & General Ledger Software

- AI-Powered Accounting Software

- Payroll Software for Accounting Firms

- Engagement Letters & Proposal Software

- Tax Workflow & Client Intake Software

- Month-End Close Automation

- Tax Research Software for CPAs

- Team Communication Tools

- AI Meeting Notetakers for Accountants

- Appointment Scheduling Software

- Time Tracking Software

- Secure File Sharing

- Password Management

- Marketing & Email Software

- AML & KYC Compliance Software

- Wellness & Mental Health

- Additional Tools & Software

- How to Choose Your Stack

- FAQ

Practice Management Software for Accountants & CPA Firms

The global practice management software market is projected to reach $1.45 billion by 2030, growing at 9.9% CAGR. Over 73% of accounting firms have already adopted these solutions, with cloud-based systems commanding 68% market share in 2025. Modern platforms integrate workflow automation, client portals, time tracking, and billing—reducing administrative tasks by over 50%. As AI becomes embedded into core systems (what industry leaders call “ambient AI”), practice management is evolving from simple task tracking to intelligent work orchestration.

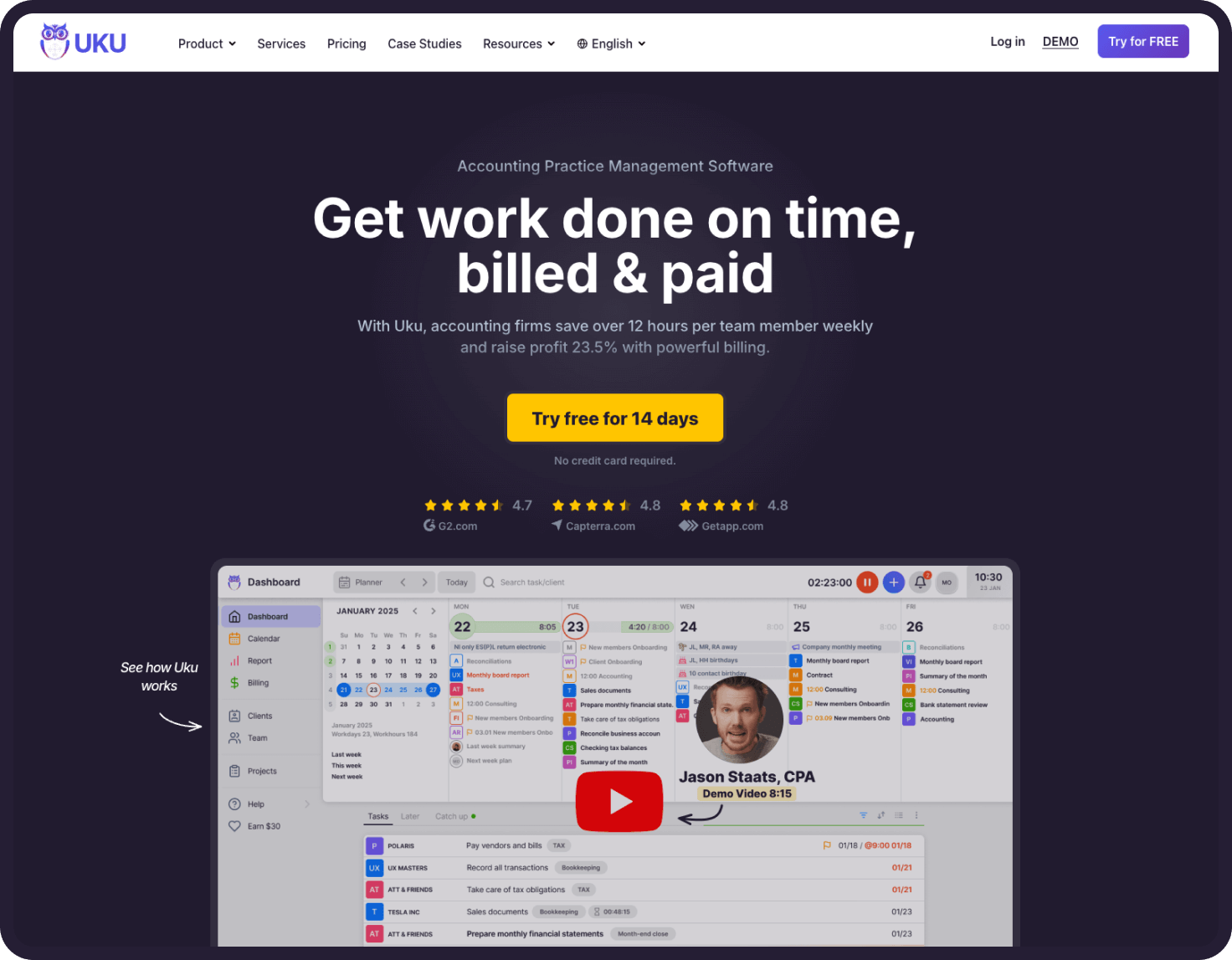

1. Uku

The Unified Practice Management Platform.

Uku connects client agreements, time tracking, and billing into a single ecosystem, solving the disconnect between doing work and getting paid. By unifying CRM and Task Management, it ensures every billable minute is captured without toggling between disconnected tools.

Real result: Firms report an average 20% revenue increase post-implementation by identifying unbilled work and plugging billing leaks.

Strengths:

-

Ecosystem Connectivity: Native integrations with Xero and QuickBooks, plus 1000+ connections via Zapier, allow you to automate data flow between apps without manual entry.

-

High Adoption Rate: Accountants actually use it. Rated 4.8/5 for ease of use, Uku’s clean interface ensures teams are productive within days, not months.

-

Business Intelligence: Real-time monitoring of client profitability and employee capacity helps you make data-driven decisions on pricing and hiring.

- Client Portal: A friction-free way to collect documents without chasing clients.

Weaknesses: Enforces standardization. Uku is built for scalable firms, requiring agreed-upon workflows. It is less effective for “lone wolf” accountants who resist unified processes.

Pricing: Team plan at $38/user/month, Elite plan at $48/user/month. 14-day free trial available.

Best for: Growth-minded firms (5-50 people) who want to stop revenue leakage and automate their operations.

Links: Website • G2 • Capterra • Start Free Trial

2. Karbon

Email-centric workflow management for larger teams.

Karbon is positioned as the market leader in practice management, backed by significant venture capital. The platform transforms email into structured workflows through its Triage feature, offers Practice Intelligence analytics with 10 live dashboards, and AI-driven email prioritization. Serves 30,000+ accounting professionals globally.

Pricing: Team at $59/user/month, Business at $89/user/month. A 10-person firm pays $590-890/month. No free tier—14-day trial only. Extra costs: eSignature credits, advanced reporting.

Integrations: QuickBooks Online, QuickBooks Time, Xero, Xero Practice Manager, Gmail, Microsoft 365, Outlook, Ignition, Zoom, Zapier. View all

Strengths: Strong market presence and brand recognition. Powerful email-to-task automation. Practice Intelligence provides 10 live dashboards. 96% user sentiment on G2 (860+ reviews).

Weaknesses: Implementation complexity is significantly underestimated—firms under 50 users often struggle to complete onboarding even with expert assistance. Marketing promises don’t always match real-world experience. Premium pricing with additional costs for features like eSignatures.

Best for: Large firms (50+ users) with dedicated resources for complex implementation. Smaller teams frequently find the platform overwhelming despite marketing claims of broader suitability.

Links: Website • G2 • Capterra

3. TaxDome

All-in-one practice management with built-in client portal.

TaxDome combines CRM, workflow automation, document management, billing, e-signatures, and client portal into a single platform. Serves 10,000+ firms globally with 3,500+ reviews on G2/Capterra. The platform includes unlimited e-signatures and storage on all plans.

Pricing: Essentials at $800/year, Pro at $1,000/user/year, Business at $1,200/user/year. A 10-person firm on Pro pays $10,000/year upfront. No monthly option—annual commitment only. Multi-year discounts available (3-year saves ~10%).

Integrations: QuickBooks Online, IRS, Lacerte, ProConnect, Drake, UltraTax, CCH Axcess, TaxAct, ProSeries, Calendly, Acuity, Zapier, Google Drive, Dropbox, Gmail, Right Networks. View all

Strengths: True all-in-one eliminates need for multiple subscriptions. Unlimited e-signatures and storage included. Strong client portal with mobile app. Direct IRS integration. 3,500+ reviews with high ratings.

Weaknesses: 6-8 weeks onboarding typical—some firms report longer. Task scheduling requires too many clicks. No QuickBooks Desktop integration—QBO only.

Best for: Mid-size firms (10-50 users) with stable cash flow ready to commit annually and invest 2+ months in implementation. Tax-focused firms benefit most from IRS and tax software integrations.

Links: Website • G2 • Capterra

4. Canopy

Modular practice management with IRS transcript integration.

Canopy pulls 20 years of IRS transcripts directly into the platform—a feature unique in practice management. The modular system lets firms pay only for modules they need: document management, workflow, time & billing, and tax resolution. SOC 2 Type II certified.

Pricing: Small firms (≤4 users): Starter $45/user/month, Essentials $66/user/month. Growing firms: $150/month base + modules ($36 docs, $32 workflow, $22 billing per user). A 10-person firm pays ~$1,050/month with standard modules.

Integrations: QuickBooks Online, Xero, FreshBooks, Gmail, Outlook, Slack, Salesforce, Zoho, Mailchimp, Google Contacts, Zapier, IRS Transcripts. View all

Strengths: Only platform with direct IRS transcript access (20 years history). Modular pricing—pay for what you use. Unlimited eSignatures included. Free tier available (250 contacts).

Weaknesses: Steep learning curve reported by users. US-focused with limited international features. Occasional bugs and glitches reported.

Best for: Tax resolution practices and US-based firms (1-20 users) needing IRS transcript access. Firms wanting to start small and add modules as they grow.

Links: Website • G2 • Capterra

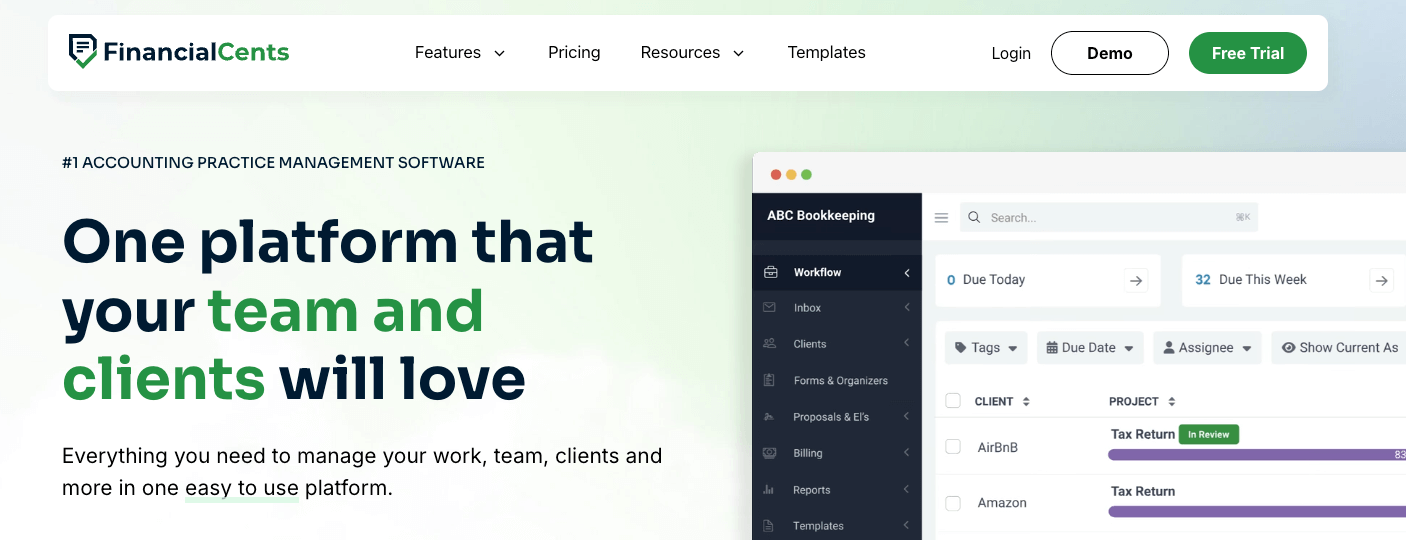

5. Financial Cents

Easy-to-use workflow management for small firms.

Financial Cents won ease-of-use awards from 2023-2025 with 4.9/5 rating. The platform offers 100+ community-shared templates, visual team capacity management, and built-in proposals. Users report being productive within hours of setup.

Pricing: Solo $19/month, Team $49/user/month, Scale $69/user/month (annual billing). Monthly option requires 5-user minimum. A 10-person firm on Team pays $490/month.

Integrations: QuickBooks Online, Gmail, Outlook, SmartVault, Google Drive, OneDrive, Dropbox, Box, ShareFile, Adobe eSign, Ignition, GoProposal, Anchor, Zapier. View all

Strengths: Fastest onboarding in the category—users productive within hours. Strong QuickBooks Online two-way sync. Visual capacity management prevents team overload. 100+ community templates included.

Weaknesses: No native Xero integration—Zapier workaround only. Client emails sent from Financial Cents domain, not your firm’s. US/Canada only. Mobile app significantly weaker than desktop.

Best for: Small firms (1-10 users) using QuickBooks Online who prioritize ease of use over advanced customization. Not for Xero users or firms outside North America.

Links: Website • G2 • Capterra

6. Double (formerly Keeper)

AI-powered bookkeeping automation with month-end close tools.

Double (formerly Keeper) automates bookkeeping workflows with AI bank feeds, error detection, and 2-way sync to QuickBooks Online and Xero. The platform includes file review tools that help complete month-end close up to 3x faster. Unlimited team members on all plans.

Pricing: Per-client pricing: Core $10/client/month, Plus $25/client/month, Scale $50/client/month. A firm with 50 clients on Core pays $500/month. Tax Suite add-on $200/month.

Integrations: QuickBooks Online, Xero, Ping, Abacor, Zapier. View all

Strengths: AI detects miscoded transactions automatically. 2-way sync with QBO and Xero. Month-end close up to 3x faster. Unlimited team members included. Mix-and-match client tiers.

Weaknesses: Per-client pricing gets expensive at scale. Bookkeeping-only—no tax preparation or workflow features. Limited integrations compared to full practice management tools.

Best for: Bookkeeping and CAS practices (any size) wanting AI automation. Not suitable for tax firms or general practice management needs.

Links: Website • G2 • Capterra

7. Jetpack Workflow

Affordable workflow tracking for small accounting firms.

Jetpack Workflow offers 70+ pre-built templates, unlimited projects and clients, and capacity planning for teams. The platform focuses on standardizing recurring work with automated deadlines. 94% user satisfaction rating across review sites.

Pricing: Starter $40/user/month (annual) or $49/user/month (monthly). A 10-person firm pays $400/month annually. Setup packages: Kickstarter $299, Done-For-You $1,299.

Integrations: QuickBooks Online, Gmail, Microsoft Outlook, Google Calendar, Zapier. View all

Strengths: Affordable pricing for small teams. Unlimited projects and clients. 70+ pre-built templates. Free training sessions (3+ users get five 30-min sessions). 30-day money-back guarantee.

Weaknesses: No mobile app. No client portal. Limited integrations compared to competitors. Workflow-only—no billing, document management, or e-signatures.

Best for: Small firms (1-10 users) needing basic workflow tracking at an affordable price. Not for firms wanting all-in-one practice management.

Links: Website • G2 • Capterra

8. Qount

AI-native practice intelligence with eight unified modules.

Qount consolidates practice management, CRM, billing, document management, and client communication into one AI-powered platform. QAI (Qount AI) provides intelligent task prioritization, scope creep detection, and client sentiment analysis. Handles Tax, Accounting, 1099s, and Payroll workflows. Backed by $17M investment in 2025.

Pricing: Essentials $74, Pro $114, Intelligence $139/user/month (annual). 10-person firm: $740-1,390/month. One-time onboarding fee. No free trial.

Integrations: QuickBooks Online, Xero, Gmail, Outlook, HubSpot, Salesforce, CPACharge, Zenwork Tax1099. View all

Strengths: True all-in-one eliminates multiple subscriptions. AI task prioritization and sentiment analysis. Unified communication (email, SMS, portal). Users report 8-hour billing reduced to 10 minutes.

Weaknesses: No free trial. Ease of use rated 30%, steep learning curve. Premium pricing. Newer platform with smaller user base. Limited third-party integrations vs Karbon/TaxDome.

Best for: Mid-size firms (10-50 users) consolidating multiple subscriptions into one AI platform. Not for firms wanting proven stability or free trial.

Links: Website • Pricing • Capterra

9. Client Hub

Bookkeeping-focused practice management with deep QuickBooks integration.

Client Hub combines practice management, client portal, and bookkeeping workflows with month-end close automation. AI-powered features include workflow creation, email drafting, and cross-document search. Mobile apps for team and clients.

Pricing: Practice Manager $59/user/month (annual), PLUS $79/user/month. 10-person firm: $590-790/month. Unlimited clients and storage. Free trial available.

Integrations: QuickBooks Online, Xero, Microsoft 365, Google Workspace, Anchor, Zapier. View all

Strengths: Month-end close with transaction recategorization and anomaly detection. Automated client task reminders. 5.0/5 on G2. Per-user pricing—firms report 40% savings when switching.

Weaknesses: Bookkeeping-focused—no tax software integrations. Recurring jobs can create duplicate sequences. Reporting less robust than larger platforms. Full QBO features require PLUS tier.

Best for: Bookkeeping firms (5-30 users) wanting QBO integration and month-end automation. Not for tax-focused practices.

Links: Website • G2 • Capterra

10. Firm360

All-in-one practice management with strong tax software integrations.

Firm360 combines project management, document management, time tracking, billing, and client portal in one platform. Built by accountants for accountants, with US-based support team. Over 3,000 accounting professionals use Firm360.

Pricing: Basic $49, Standard $79, Premium $99/user/month (annual). 10-person firm: $490-990/month. Custom pricing for 20+ users. Free trial available.

Integrations: QuickBooks Online, Drake Tax, UltraTax CS, Lacerte Tax, Microsoft 365, Gmail, Outlook, Stripe, RightSignature, Zapier (Premium). View all

Strengths: Ease of Use rating 4.6/5. US-based customer support praised as exceptional. Automated A/R collections in Standard tier. Tax software integrations set it apart from competitors.

Weaknesses: No mobile app—clients struggle with mobile document uploads. Onboarding can be challenging. No API in Basic/Standard tiers. Missing AR ledger for tracking invoices.

Best for: US tax and accounting firms (5-20 users) wanting tax software integrations and excellent support. Not for firms needing mobile-first experience.

Links: Website • G2 • Capterra

11. Accelo

Professional services automation (PSA) platform beyond accounting.

Accelo integrates CRM, sales, project management, retainer tracking, time tracking, and invoicing in one platform. Designed for professional services firms broadly, not accounting-specific. Connects entire client journey from quote to cash with automated billing and retainer management.

Pricing: Professional ~$50, Business ~$70, Advanced ~$90/user/month. Minimum 3-7 users depending on plan. Contact for exact pricing. Free trial available, no credit card required.

Integrations: QuickBooks Online, Xero, Microsoft 365, Google Workspace, Salesforce, HubSpot CRM, Zapier, Stripe, PayPal, Ignition, Gusto, Jira. View all

Strengths: Comprehensive PSA covering entire client lifecycle. Strong Microsoft 365 integration with auto-sync. Powerful retainer and recurring work management. Extensive integrations (25+). Regular feature updates and responsive support.

Weaknesses: Steep learning curve—interface can feel cluttered for new users. Not accounting-specific, may be overkill. Ease of use 4.2/5 (below category average). Minimum user requirements. Pricing not transparent.

Best for: Multi-service professional firms (10-50 users) needing full PSA beyond accounting. Not ideal for pure accounting/tax practices or small teams under 5.

Links: Website • G2 • Capterra

12. Aero Workflow

Flat-rate workflow management with 160+ bookkeeping checklists.

Aero Workflow focuses on task scheduling with built-in procedures, client credentials storage, and time tracking. Each task contains step-by-step instructions, screenshots, and links. Includes 160+ ready-to-use bookkeeping checklists. Founded 2011.

Pricing: Startup (1-5 users) $135/month, Growth (6-25 users) $250/month, Scaling (26-50 users) $365/month. Flat rate, no per-user fees. Premium library +$40/month.

Integrations: QuickBooks Online, QuickBooks Time, Zapier, open API for custom integrations. View all

Strengths: Flat pricing regardless of user count within tier. 160+ ready-made bookkeeping checklists. Free onboarding, training, and certification for all users. Time tracking syncs to QBO for billing.

Weaknesses: Dated interface. Steep learning curve—requires watching training videos. Not complete practice management—lacks client communication and email integration. Limited for teams 3+.

Best for: Small bookkeeping firms (1-10 users) wanting flat pricing and detailed task procedures. Not for firms needing modern UI or full practice management.

13. ATOM Software

Tax office management for solo practitioners with client portal.

ATOM (Automated Tax Office Manager) helps tax preparers manage daily activities, client communication, and document exchange. Includes client portal with appointment scheduling, payments, and tax return status tracking. PIN-based e-signatures and centralized messaging.

Pricing: Starting at $149/month flat rate. Reasonable pricing for included functionality.

Integrations: Limited integrations. Basic email and SMS capabilities built-in. View features

Strengths: Client portal with payments, appointments, and status tracking. Flat pricing. Automated task reminders. Good for solo tax preparers managing client activities.

Weaknesses: Dated interface (described as “mid-90s design”). No pipeline or workflow manager. Built for single preparers—doesn’t scale for teams. Messaging not threaded. Clients find portal hard to navigate.

Best for: Solo tax preparers wanting basic client portal and task management. Not suitable for multi-staff firms or those needing modern UX.

14. BQE Core

Professional services platform primarily for architects and engineers.

BQE Core integrates project management, time tracking, billing, accounting, CRM, and HR. Built for architecture, engineering, and consulting firms with complex billing needs (retainers, progress billing). Cloud, on-premise, or hybrid deployment.

Pricing: Modular pricing starting ~$20/user/month. Pay per feature needed. 15-day free trial. Core Plus and Enterprise tiers available.

Integrations: QuickBooks Online, QuickBooks Desktop. View all

Strengths: 24/7/365 live support. 86% user satisfaction. Highly customizable billing. Mobile app for expenses. Scalable from startup to enterprise.

Weaknesses: Designed for AEC firms, not accounting practices. Steep learning curve. Mobile app lags desktop. Modular pricing adds up quickly.

Best for: Architecture/engineering firms (10-100+ users). Not purpose-built for accounting/tax practices.

Links: Website • G2 • Capterra

15. CCH Axcess Practice Management

Enterprise practice management within Wolters Kluwer ecosystem.

CCH Axcess Practice integrates time/billing, project management, and analytics within the CCH Axcess cloud suite. Best for firms already using CCH tax products. Open APIs for custom integrations.

Pricing: Contact for quote. Historically ~$255/user/year. Enterprise pricing varies by firm size.

Integrations: CCH Axcess Tax, CCH ProSystem fx, Microsoft Power BI, mobile app. View all

Strengths: Deep CCH ecosystem integration. 150+ customizable reports. Cloud-based with mobile time entry. Data visualization with Power BI.

Weaknesses: Pricing not transparent. Best value only for existing CCH users. Annual price increases reported without new features.

Best for: Mid-to-large firms (20+ users) already invested in CCH Axcess ecosystem. Not ideal for non-CCH shops.

16. CCH iFirm

Cloud practice management for international markets (UK, AU, CA, Asia).

CCH iFirm offers workflow automation, compliance tracking, client portals, and document management. Cloud-native with real-time access. Part of Wolters Kluwer ecosystem. Used by 24,000+ firms globally.

Pricing: Contact for personalized quote. 14-day free trial. Described as “pricey for small businesses.”

Integrations: CCH tax products, various regional compliance tools. View all

Strengths: Strong in UK/AU/CA markets. Local customer support teams. Integrated compliance and research. Onboarding and training included.

Weaknesses: Pricing not transparent. Best for Wolters Kluwer ecosystem users. Limited US market presence.

Best for: Small-to-mid firms in UK, Australia, Canada, or Asia using CCH products. Limited appeal for US-only practices.

Links: Website • G2 • Capterra

17. Elephant

Affordable all-in-one for small US accounting firms.

Elephant (ElephantCPA) provides client management, task management, time tracking, billing, e-signatures, messaging, and document management. Built by CPAs for CPAs. Cloud-based with no credit card required for trial.

Pricing: Starting at $49.95/user/month. Save 10% with annual billing. Free trial available.

Integrations: Stripe, Twilio. Limited third-party integrations. View all

Strengths: Simple flat per-user pricing. Built by CPAs. Includes e-signatures and payment processing. Good for solo/small firms.

Weaknesses: Limited integrations (only Stripe, Twilio). US-focused. Fewer advanced features than larger platforms.

Best for: Small US accounting firms (1-10 users) wanting affordable, simple practice management. Not for firms needing extensive integrations.

Links: Website • G2 • Capterra

18. IRIS Practice Management

UK-focused practice management with compliance features.

IRIS offers multiple products: IRIS Elements (cloud), IRIS Star (enterprise), and IRIS Accountancy Suite. Handles compliance for AML, FRS, GDPR, and MTD. Used by 24,000+ firms. Integrates with HMRC and Companies House.

Pricing: Contact for quote. 30-day free trial for IRIS Elements. No free version.

Integrations: Xero, QuickBooks, FreeAgent, KashFlow, HMRC, Companies House. View all

Strengths: Strong UK compliance features. Multiple deployment options. Modular approach. API available.

Weaknesses: Pricing not transparent. Gets expensive with more users. Primarily UK-focused.

Best for: UK accounting firms needing compliance automation and HMRC/Companies House integration. Limited appeal outside UK.

Links: Website • G2 • Capterra

19. Mango Practice Management

Affordable all-in-one with tax software integrations.

Mango provides project management, time/billing, document management, engagement letters, e-signatures, client portal, and integrated email. Built by accountants. Up and running in half a day.

Pricing: Starting at $35/user/month. Free trial, no credit card required. Implementation and training included free.

Integrations: Drake Tax, UltraTax CS, Lacerte, ProSeries, Intuit ProConnect, Gmail, Outlook, Mailchimp. View all

Strengths: Affordable pricing. Tax software integrations. Fast implementation. Free training. KBA e-signatures included.

Weaknesses: Less robust than enterprise solutions. Limited advanced reporting. Smaller user community.

Best for: Small-to-mid US tax/accounting firms (1-25 users) wanting affordable all-in-one with tax software integration.

Links: Website • G2 • Capterra

20. OfficeTools

Established practice management with Thomson Reuters backing.

OfficeTools (by CARET/Abacus) offers client management, project tracking, time tracking, billing, document management, and client portal. Cloud or on-premise deployment. Native cybersecurity features.

Pricing: Starting ~$10-100/user/month range. Free trial available. Price increases reported after Abacus acquisition.

Integrations: QuickBooks Online, Lacerte Tax, PayNow (Abacus). View all

Strengths: 82% user satisfaction. Comprehensive feature set. Bi-directional sync with accounting/tax apps. Mobile app included.

Weaknesses: Outdated UI reported. Significant price increases post-acquisition. Portal email issues noted.

Best for: Small-to-mid US accounting firms (5-25 users) wanting established solution. Consider pricing trajectory before committing.

Links: Website • G2 • Capterra

21. Pascal Workflow

Free tier available with patented Pay Lock feature.

Pascal Workflow offers CRM, client portals, proposals, e-signatures, document management, and automated billing. Unique Pay Lock feature requires payment before clients can view documents.

Pricing: Free tier for up to 5 users (250 contacts). Paid plans from $55/user/month. No free trial for paid tiers.

Integrations: Gmail, Outlook, Exchange, Google Drive, iCloud, Xero, QuickBooks. View all

Strengths: Generous free tier. Patented Pay Lock for collections. Complete tax delivery solution. 365-day email lookback imports past documents.

Weaknesses: No reporting features. Limited compared to full practice management platforms.

Best for: Solo practitioners and small firms (1-5 users) wanting free workflow tool. Upgrade for larger teams.

22. Practice CS

Enterprise solution within Thomson Reuters CS Suite.

Practice CS offers time/billing, project management, document management, and 150+ customizable reports. Part of CS Professional Suite alongside UltraTax CS, Accounting CS. SaaS, Virtual Office, or on-premise deployment.

Pricing: Contact for quote. Enterprise pricing. Annual fee increases (~5%) reported without proportional new features.

Integrations: UltraTax CS, Accounting CS, Fixed Assets CS, Planner CS, Microsoft Outlook. View all

Strengths: Deep CS Suite integration. 150+ reports. Multi-level security. Outlook sync. Established platform.

Weaknesses: Best value only for CS Suite users. Requires dedicated admin. Annual price increases.

Best for: Larger firms (50+ users) heavily invested in Thomson Reuters CS Suite. Not for small firms or non-TR shops.

23. PracticePro 365

Microsoft Dynamics 365-based practice management.

PracticePro 365 is built on Microsoft Dynamics 365 and Power Platform. Nine core modules including CRM, billing, project management, and real-time dashboards. SOC 2 Type 1 certified.

Pricing: Starting ~$10-100/user/month range. Contact for custom quote. Subscription model.

Integrations: Microsoft 365, Teams, Outlook, SharePoint, Power BI (native). View all

Strengths: Native Microsoft integration. Replaces 3-5 tools with one platform. SOC 2 certified. Real-time Power BI dashboards.

Weaknesses: Limited reviews (80% satisfaction from 3 reviews). Best for Microsoft-centric firms. Learning curve for non-Microsoft users.

Best for: Firms (10-50 users) already invested in Microsoft 365 wanting unified Dynamics-based solution.

24. Senta

Affordable UK practice management with unlimited e-signing.

Senta offers CRM, task management, document portal, workflows, automated reminders, and Companies House integration. All client accounts free. UK-focused with compliance features.

Pricing: £32/month first user (£25.60 annual), reduced rates for additional users. 30-day free trial. No hidden costs or per-module fees.

Integrations: FreeAgent, QuickBooks, Xero, GoProposal, Companies House, Zapier (1000+ apps). View all

Strengths: Simple transparent pricing. Unlimited e-signing included. Companies House integration. Automated client reminders.

Weaknesses: No inbox sync—email management is manual. UI not the most modern. No mobile app. Missing native invoicing.

Best for: Small UK firms (1-10 users) wanting affordable solution with compliance features. Not for firms needing email integration.

25. TaxFlow

Simple, affordable tax workflow tracking.

TaxFlow focuses specifically on tax workflow—tracking returns (1040s, 1120s, 1065s), deadlines, extensions, and entity associations. Customizable workflows without practice management bloat.

Pricing: $20/user/month (annual) or $25/user/month (monthly). All features included. Free trial, no credit card required.

Integrations: Limited. No API. Designed as one component of firm tech stack. View features

Strengths: Simple and affordable. Focused on tax workflow only. Customizable workflows. Tracks all entity types.

Weaknesses: Not full practice management. No API. Must supplement with other tools for complete solution.

Best for: Small tax practices (1-10 users) wanting simple workflow tracking without full PM overhead.

26. TPS Software (TPS Cloud Axis)

Canadian-focused practice management with 25+ years history.

TPS Cloud Axis offers time/billing, WIP, AR, workflow, scheduling, and client portal. 10,000+ accountants use TPS. Multi-office database support. Power BI analytics included.

Pricing: Starting at $15/user/month. Three tiers: Entrepreneur, Pro, Ultimate. Free trial. No onboarding fee.

Integrations: QuickBooks Online, Microsoft 365 Outlook (bi-directional). View all

Strengths: Very affordable starting price. 25+ years serving Canadian market. Multi-office support. Responsive customer service.

Weaknesses: No API. Primarily Canadian-focused. Learning curve reported. Occasional glitches.

Best for: Canadian accounting firms (1-50 users) wanting affordable, established solution. Strong for multi-office firms.

27. XCM Solutions

Enterprise workflow automation, now CCH Axcess Workflow.

XCM (now part of Wolters Kluwer as CCH Axcess Workflow) provides 360-degree visibility into tasks, projects, and metrics. Automated tracking across Tax, Audit, CAS, HR, and Operations departments.

Pricing: Per-user pricing. Contact Wolters Kluwer for quote. Enterprise-focused.

Integrations: CCH Axcess suite, various tax and accounting platforms. View all

Strengths: 360-degree real-time visibility. Custom “My View” dashboards. Automated task creation. Claims 500% ROI.

Weaknesses: Enterprise pricing. Part of Wolters Kluwer ecosystem—best for existing CCH users.

Best for: Large firms (50+ users) needing enterprise workflow automation, especially CCH Axcess users.

28. Xero Practice Manager

Free for Xero partners at Silver+ status.

Xero Practice Manager (XPM) offers job management, time tracking, invoicing, and workflow customization. Includes Xero Workpapers at no extra cost. Mobile app available. Part of Xero ecosystem.

Pricing: $149/month for up to 10 users (Bronze partners). FREE for Silver/Gold/Platinum partners. 14-day trial.

Integrations: Xero, Xero HQ, Xero Workpapers, 30+ third-party apps. View all

Strengths: Free for established Xero partners. Highly configurable. Mobile app. Includes Workpapers. 4.4/5 on G2.

Weaknesses: Must reach Silver partner status for free access. Best value only within Xero ecosystem.

Best for: Xero-focused firms (3+ staff, 200+ clients) at Silver partner level or above. Not for non-Xero shops.

29. Zoho Practice

Free for small teams within Zoho Finance ecosystem.

Zoho Practice offers client management, task management, workpapers, workflow automation, and client portal. WhatsApp integration for client communication. Preparing firms for MTD ITSA 2026.

Pricing: Free for up to 5 users. $5/user/month for additional users. Standard and Premium tiers for partners. 14-day trial.

Integrations: Zoho Books, Zoho Expense, Zoho Payroll, Zoho Billing, WhatsApp. View all

Strengths: Very affordable/free for small teams. WhatsApp integration. MTD ITSA ready. Part of Zoho ecosystem.

Weaknesses: Best value within Zoho ecosystem. Limited outside Zoho Finance suite.

Best for: Small firms (1-10 users) already using Zoho products. Great for UK firms preparing for MTD ITSA.

30. Acounta

AI-powered practice management with workflow automation.

Acounta offers workflow automation, CRM, document management, task management, billing, time tracking, and AI-powered features. Cloud-based with 30-day free trial.

Pricing: $99/user/month standard. Introductory: first user $65/month, additional users $45/month. Annual: $540/user/year (20% discount).

Integrations: QuickBooks, Google Workspace, Microsoft Outlook, Stripe. View all

Strengths: AI-powered automation. Comprehensive feature set. Introductory pricing available. 30-day free trial.

Weaknesses: Higher standard pricing ($99/user). English only. Newer platform with smaller user base.

Best for: Firms wanting AI automation willing to pay premium pricing. Take advantage of introductory rates.

31. Levvy

Practice management designed for firms with outsourced teams.

Levvy offers work management, workflow automation, time tracking, capacity management, team collaboration, and Smart Assist AI. Designed for accounting firms with distributed/outsourced teams.

Pricing: Starter (1-50 users) $79/user/month, Whole Firm (51-100 users) $99/user/month, Enterprise 101+ custom pricing.

Integrations: QuickBooks Online, Xero, Gmail, Outlook, Slack, Zapier. View all

Strengths: Built for outsourced teams. Smart Assist AI for quick answers. Prebuilt workflow templates. Automated time tracking and billing.

Weaknesses: Premium pricing. Newer platform. Best for firms with outsourcing model.

Best for: Mid-to-large firms (20-100 users) with outsourced or distributed teams needing capacity management.

Tax Preparation Software for Accountants & CPAs

The tax preparation services market reached $34.9 billion in 2025 and is projected to hit $46 billion by 2029. According to a 2024 Journal of Accountancy survey, CPAs most commonly use UltraTax CS (22.6%), Lacerte, and Drake Tax. Nearly 90% of accounting firms raised tax prep rates in 2025, with hourly billing declining as firms shift to fixed-fee and value-based pricing. The competitive landscape is intensifying as electronic filing and AI-powered tools disrupt traditional prep workflows.

1. UltraTax CS

Enterprise tax compliance software from Thomson Reuters.

UltraTax CS is premium tax preparation software used by 22.6% of CPAs according to a 2024 Journal of Accountancy survey—the highest market share among professional tax software. The platform supports individual, business, fiduciary, and multi-state returns with extensive e-filing capabilities and integration with other Thomson Reuters products like Practice CS and Accounting CS.

Pricing: Starting around $2,500/year for limited plans. Unlimited filing options range from $7,000-$25,000/year depending on users and modules. Pay-per-return plans available at $25-$50 per return.

Integrations: Practice CS, Accounting CS, Onvio, GoFileRoom, FileCabinet CS, SmartVault, SurePrep. QuickBooks via third-party hosting. View all

Strengths: Comprehensive form coverage across federal, state, and local jurisdictions. Strong diagnostics and error-checking. Seamless integration with Thomson Reuters ecosystem. Handles complex multi-state returns efficiently.

Weaknesses: Steep learning curve—requires training for new users. Inconsistent customer support with complaints about response times. Premium pricing strains smaller firm budgets. QuickBooks integration requires manual imports or third-party tools.

Best for: Mid-size to large firms (10+ users) already invested in the Thomson Reuters ecosystem handling complex multi-state returns.

Links: Website • G2 • Capterra

2. Intuit Lacerte

Professional desktop tax software for complex returns.

Lacerte is Intuit’s flagship professional tax software designed for large tax and accounting firms handling complex returns. The platform features over 5,700 tax forms and 25,000+ built-in diagnostics. According to a 2024 CPA survey, Lacerte scored highest for overall rating, e-filing ease, and handling multistate business returns—with 73% of CPAs praising its usability.

Pricing: Multiple packages available: Lacerte 200 (limited returns), Lacerte Unlimited, and Pay-as-you-go options. Tax Planner and Analyzer included free with Unlimited. New customers eligible for 40% off hosting for first 4 months.

Integrations: QuickBooks Desktop, QuickBooks Online Accountant, SmartVault, Microsoft Office 365, Adobe Acrobat. Rightworks hosting for third-party apps. View all

Strengths: Excellent state integration and K-1 export/import. Over 25,000 diagnostics catch errors before filing. Automatic updates eliminate manual patching. Strong QuickBooks integration. Highly rated for multistate business returns.

Weaknesses: Expensive with annual price increases. Customer support can be slow—30-45 minute wait times reported during peak periods. All significant workflow improvements sold separately as add-ons. Cannot e-file past years if subscription lapses.

Best for: Large tax and accounting firms with multiple preparers handling complex individual and business returns.

Links: Website • G2 • Capterra

3. Drake Tax

Value-focused tax software with unlimited state filing.

Drake Tax serves over 50,000 tax professionals filing approximately 26 million returns annually. The software includes all state returns without additional modules, free prior-year software with current-year purchase, and the GruntWorx feature for automated data entry. Drake offers U.S.-based phone support included in the price.

Pricing: Pay-Per-Return at $345. Unlimited Package at $1,825. Power Bundle (tax + accounting) at $1,975. All packages include unlimited state filing.

Integrations: Drake Accounting, QuickBooks, SmartVault, TaxDome, GruntWorx, StanfordTax, Soraban, SecureFilePro, TicTie Calculate. View all

Strengths: Competitive pricing—often 1/2 to 1/3 the cost of alternatives. All states included at no extra charge. Free prior-year software. GruntWorx automated data entry. Reliable performance handling high volumes. Free U.S.-based phone support.

Weaknesses: Not beginner-friendly—requires tax knowledge to avoid errors. Windows-only (no Mac support). Built-in CRM lacks robustness. Some users report dated interface. Inconsistent support quality with occasional conflicting advice.

Best for: Cost-conscious small to mid-size firms (1-20 users) with Windows environments who value unlimited state filing.

Links: Website • G2 • Capterra

4. Intuit ProConnect Tax Online

Cloud-based professional tax software with QuickBooks integration.

ProConnect Tax Online is Intuit’s cloud-based solution offering seamless QuickBooks Online integration. The software is free to use—you only pay when e-filing or printing. Features include 5,700+ forms, 25,000 error-spotting diagnostics, and Intuit Link client portal for document collection.

Pricing: Pay-per-return: Individual returns from $25.87, Business returns from $28.67. User Access license required at $105/user/year (or $1,049 flat fee for 10+ users). 25% discount available for new customers Nov 2025-Feb 2026.

Integrations: QuickBooks Online, QuickBooks Online Accountant, Intuit Tax Advisor, SmartVault, Intuit Link. View all

Strengths: True cloud-based—work from anywhere with no local installation. Seamless QuickBooks Online data import. Free Intuit Link client portal included. No upfront software cost—pay only for filed returns.

Weaknesses: Per-return fees accumulate for high-volume filers. User Access license adds $105/user/year cost as of 2025. Struggles with highly complex returns. Occasional bugs reported affecting user experience.

Best for: Small practices (under 50 returns) wanting cloud flexibility and tight QuickBooks Online integration without upfront software costs.

Links: Website • G2 • Capterra

5. CCH Axcess Tax

Cloud-native tax compliance from Wolters Kluwer.

CCH Axcess Tax is trusted by 94 of Accounting Today’s Top 100 Firms. The cloud-based platform offers comprehensive federal, state, and local form coverage with real-time integration to CCH AnswerConnect for tax research. Features include cryptocurrency reporting through CoinTracker and Ledgible integrations.

Pricing: 100 returns with 5 states at $2,299. 100 returns with unlimited states at $2,759. Unlimited returns at $9,999. Additional states $49.95 each. CCH Axcess Tax Essentials available for firms with 4 or fewer tax professionals.

Integrations: CCH Axcess Suite modules, CCH AnswerConnect, Microsoft Power BI, Ignition, third-party apps via CCH Marketplace API. View all

Strengths: Native cloud architecture with anywhere access. Real-time CCH AnswerConnect tax research integration. Crypto reporting capability. Trusted by top accounting firms. Strong integration across CCH Axcess ecosystem.

Weaknesses: Periodic lags and occasional outages during peak filing periods. Cost-prohibitive for firms with fewer than 100 clients. Limited user reviews available (5.3/10 on TrustRadius based on ~15 reviews).

Best for: Mid-size to large firms (5+ professionals) already using CCH Axcess ecosystem seeking cloud-native tax preparation.

Links: Website • G2 • Capterra

6. ATX

Professional tax software with comprehensive form library.

ATX by Wolters Kluwer provides over 6,000 federal, state, local, and specialty tax forms. According to a Journal of Accountancy survey, approximately 70% of respondents rated ATX highly for user-friendliness—higher than Drake, Lacerte, and other competitors. The software is designed for CPAs and small to mid-size firms.

Pricing: Pay-Per-Return at $869 (includes 6 individual returns). ATX 1040, MAX, Total Tax Office, and Advantage packages available at various price points. Contact vendor for specific package pricing.

Integrations: CCH AnswerConnect, CCH iFirm, ATX Payroll, Microsoft Office 365. Limited third-party options. View all

Strengths: High user-friendliness ratings. Flat fee regardless of e-file volume on unlimited plans. Comprehensive form library. All needed forms available without add-on purchases. 15+ years of user loyalty reported.

Weaknesses: Customer service complaints—long hold times and slow problem resolution. Memory requirements increasing (16 GB RAM recommended for 2025). Windows only—requires upgrade to Windows 11 for future compatibility.

Best for: Part-time tax preparers and small firms valuing user-friendly interface and flat-fee pricing.

Links: Website • G2 • Capterra

7. Intuit ProSeries Tax

Desktop tax software for small practices.

ProSeries is Intuit’s desktop-based tax solution known for reliability and affordability among solo practitioners and small firms. The software syncs with QuickBooks Desktop for automated data import and handles multiple states efficiently. Rated 4/5 stars with a score of 77/100 by ITQlick.

Pricing: Pay-Per-Return (Professional) at $419/year. Basic 20 at $599/year. Basic 50 at $969/year. Basic Unlimited at $1,519/year. 1040 Complete (Professional) at $2,199/year. All packages include unlimited e-filing.

Integrations: QuickBooks Desktop, SmartVault, Fixed Asset Manager, eFileCabinet. Rightworks hosting for third-party apps. View all

Strengths: Reliable and affordable for small firms. Good error checking and multi-state handling. QuickBooks Desktop integration. Desktop trial available for evaluation.

Weaknesses: Unused returns don’t credit to following year. Customer support dwindling as prices increase. Manual processes and costs less competitive for high-volume filers. Best suited for under 100 returns.

Best for: Solo practitioners and small firms (under 100 returns) preferring desktop software with QuickBooks Desktop integration.

Links: Website • G2 • Capterra

8. ProSystem fx Tax

Enterprise tax software for large firms.

CCH ProSystem fx Tax is considered the #2 professional tax software on the market for features, handling complex forms and calculations for large firms. The platform supports multi-user concurrent work on single returns, allowing specialists to address specific responsibilities simultaneously. User satisfaction rating of 83% based on 192 reviews.

Pricing: Contact Wolters Kluwer for custom pricing. Generally described as the most expensive professional tax software on the market.

Integrations: CCH ProSystem fx Suite (Engagement, Document, Scan, Fixed Assets, Practice Management), CCH AnswerConnect, QuickBooks. View all

Strengths: Robust handling of complex returns and calculations. Multi-user concurrent editing on single returns. Detailed help documentation. Handles all federal and state return types. Extensive electronic filing services.

Weaknesses: Steep learning curve—not intuitive. Most expensive option on the market. Lack of useful customer support reported. Platforms not modernized in years. Known issues sometimes remain unfixed.

Best for: Large firms with dedicated training resources handling highly complex multi-tiered consolidated returns.

Links: Website • G2 • Capterra

9. TaxAct Professional

Affordable tax software for high-volume preparers.

TaxAct Professional has served tax preparers since 2004, offering cloud and desktop versions at competitive pricing. Rated 4.8/5 on Capterra for ease of use, value, and support. The software is considered a top choice for high-volume preparers handling returns with medium to low complexity.

Pricing: Pay-per-return: Individual at $150 + $25 filing fee, Business at $249 + $40 filing fee. Unlimited plans and bundles available for low-volume preparers (40 or fewer returns). 30-day money-back guarantee.

Integrations: TaxDome, DocuSign, Drake Pay/Launchpay, Koinly (crypto reporting), Microsoft Office. View all

Strengths: Significantly less expensive than Lacerte and competitors. User-friendly and accurate calculations. Cloud version enables remote work. Excellent customer service. Over 12 years of user loyalty reported.

Weaknesses: Depreciation schedule doesn’t auto print. Difficult to convert PDF returns to new clients. Lacks some specialized return types (though common limitation). Basic feature set compared to premium alternatives.

Best for: High-volume preparers handling medium to low complexity returns who prioritize value over advanced features.

Links: Website • G2 • Capterra

10. TaxSlayer Pro

Cloud and desktop tax software with mobile app.

TaxSlayer Pro offers both web and desktop solutions with unlimited federal and state e-filing included in all packages. Features include the TaxesToGo mobile app, integrated bank products, and comprehensive training resources. The premium package includes a full corporate business suite for forms 706, 709, 990, 1041, 1065, 1120, 1120-S, and 5500.

Pricing: Starting at $1,495 for web version. All packages include unlimited federal and state e-filing, all state and local taxes, and top-rated technical support.

Integrations: TaxDome, TaxesToGo mobile app, Twilio, QuickBooks Online. No public API available. View all

Strengths: Affordable for solo practitioners. Reliable customer service. Fast return preparation. Includes client database upload capability. Mobile app for on-the-go access.

Weaknesses: Some users report high error rates affecting business operations. Support quality reportedly declined over years for some users. Less established than major competitors.

Best for: Solo practitioners and small practices wanting affordable cloud/desktop flexibility with mobile access.

Links: Website • G2 • Capterra

11. CrossLink

Professional tax software since 1989.

CrossLink has provided professional tax software solutions since 1989, offering both online and desktop versions. Features include Point-and-Shoot Error Correction for real-time diagnostics, Zapier integration for workflow automation, and remote signing capability. Rated 4/5 and considered a top choice for high-volume preparers.

Pricing: Desktop Unlimited originally $1,795 (sale pricing around $695 through some resellers). Pay-per-return options available. Recent pricing includes $10 per tax filed plus software cost through some service bureaus.

Integrations: Zapier, PayJunction, TaxPass mobile app, ERO-Go mobile app. View all

Strengths: Reliable year-over-year performance. Strong diagnostics with Point-and-Shoot Error Correction. Zapier integration for CRM and automation. Remote signing capability. Multi-user support.

Weaknesses: Lacks browser-based flexibility. Limited banking and support options. Pricing varies significantly by purchase channel. Desktop version requires Windows 10 or 11.

Best for: High-volume tax preparers needing reliable desktop software with strong diagnostics and workflow automation.

Links: Website • G2 • Capterra

12. GoSystem Tax RS

Enterprise cloud tax software from Thomson Reuters.

GoSystem Tax RS is utilized by the top 100 CPA firms and corporate tax departments. The cloud-native platform supports concurrent multi-user editing on single returns, enabling specialists to work simultaneously. Rated 3.9/5 on G2 based on 32 reviews, with 4.2/5 for product capabilities on Gartner Peer Insights.

Pricing: Contact Thomson Reuters for custom pricing. Pricing typically customized based on firm size and needs.

Integrations: CS Professional Suite (Accounting CS, Practice CS, Workpapers CS, GoFileRoom, FileCabinet CS), SurePrep, NetClient CS Portal, QuickBooks, Checkpoint. View all

Strengths: Scalable for firms of any size. Concurrent multi-user editing on single returns. Full federal, state, and local tax program coverage. Cloud-native architecture. Integrates with GoFileRoom and SafeSend.

Weaknesses: Some users report slow performance and confusing interface. No public pricing available. Service and support rated 3.5/5 on Gartner—lower than product capabilities.

Best for: Large firms and corporate tax departments handling bulk tax returns requiring concurrent multi-user collaboration.

Links: Website • G2 • Capterra

Accounting & General Ledger Software for CPA Firms

The general ledger software market is expected to grow from $53.6 billion in 2025 to $134 billion by 2034, driven by demand for real-time financial visibility and automated compliance. Cloud adoption leads the market as organizations prioritize accessibility and scalability over traditional on-premise installations. AI and machine learning are transforming these platforms—automating journal entries, detecting anomalies, and enabling natural-language queries on financial data. Major players include SAP, Oracle, Microsoft, QuickBooks, Xero, NetSuite, and Sage.

1. QuickBooks Online

Market-leading cloud accounting for small businesses.

QuickBooks Online dominates small business accounting with over 7 million subscribers globally. The platform offers tiered plans from Simple Start to Advanced, with built-in AI automation, bank feeds, and extensive third-party integrations. QuickBooks Online Accountant provides a free portal for managing all client books with 30% ProAdvisor discounts.

Pricing: Simple Start at $30/month, Essentials at $60/month, Plus at $90/month, Advanced at $200/month. Prices increased 21% in August 2025. 30-day free trial available.

Integrations: Shopify, Square, Amazon, Stripe, PayPal, Bill.com, Gusto, Mailchimp, Zapier. 750+ apps in App Store. View all

Strengths: Industry standard with massive ecosystem of integrations. Easy client switching in accountant portal. Strong reporting and customization options. Constant feature updates and AI automation improvements.

Weaknesses: Annual price hikes frustrate users ($10+ yearly increases reported). Menu locations constantly changing with updates. Lag and loading issues with large transaction sets. Premium pricing compared to alternatives.

Best for: Small businesses (1-25 employees) and accounting firms wanting the industry-standard platform with maximum third-party integrations.

Links: Website • G2 • Capterra

2. Xero

Cloud accounting with unlimited users on all plans.

Xero serves over 4 million subscribers with cloud-based accounting featuring bank connections from 21,000+ global institutions. Unlike QuickBooks, Xero includes unlimited users on all plans. The platform offers 1,000+ integrations and uses plain-language terminology (“invoices owed” instead of “accounts receivable”).

Pricing: Early at $20/month (limited to 20 invoices/5 bills), Growing at $47/month, Established at $80/month. 30-day free trial. New customers get 90% off for first 3 months.

Integrations: Hubdoc, Stripe, Square, Shopify, Amazon, PayPal, Gusto, Zapier. 1,000+ apps in App Store. View all

Strengths: Unlimited users on all plans—major cost advantage for teams. Clean interface avoiding accounting jargon. Automatic bank feeds and transaction matching. Strong for growing international businesses with multi-currency support.

Weaknesses: No phone support—only email and chat available. Steep learning curve despite simple appearance. Early plan severely limited (20 invoices/month cap). No built-in payroll—requires Gusto or other add-on. Reports lack customization flexibility.

Best for: Growing businesses with multiple team members who need unlimited user access and international multi-currency capabilities.

Links: Website • G2 • Capterra

3. Sage Intacct

Cloud ERP for mid-market finance teams.

Sage Intacct is an AI-driven cloud accounting platform designed for mid-sized businesses with advanced reporting and multi-entity requirements. User satisfaction rating of 86% based on 2,342 reviews. The platform integrates with Salesforce, Expensify, Bill.com, and other enterprise tools. Popular in professional services, nonprofit, retail, and healthcare industries.

Pricing: Starts at $12,000/year for one user. Average customers spend $25,000-$35,000/year. Add-on modules add $3,000-$10,000/year each. Implementation typically costs 1-1.5x first-year subscription.

Integrations: Ramp, MineralTree, Tipalti, Versapay, Paylocity, Salesforce. 350+ marketplace partners. View all

Strengths: 65% of users praise intuitive interface. 94% report excellent scalability and performance. 94% value third-party integrations. Strong multi-entity consolidation and dimensional reporting.

Weaknesses: Subscription pricing exceeds small business budgets. Requires separate payroll integration. 64% of users report slow customer support response times. Feature-rich interface can overwhelm beginners.

Best for: SMBs with 15-250 employees and $5M-$250M annual revenue needing multi-entity consolidation and advanced financial reporting.

Links: Website • G2 • Capterra

4. NetSuite

Enterprise ERP from Oracle for scaling businesses.

Oracle NetSuite is the leading cloud ERP for businesses outgrowing entry-level accounting. The platform offers comprehensive financial management, inventory, CRM, and e-commerce in one system. Used by over 37,000 organizations globally. Modular pricing allows paying only for needed features.

Pricing: Base license at ~$999/month (billed annually). User licenses at $129/user/month (increased from $99 in 2025). Add-on modules $300-$1,500+/month each. Starter, Emerging, and Mid-Market editions available.

Integrations: Celigo, Shopify, Amazon, Salesforce, Avalara, ADP. SuiteApp marketplace with hundreds of certified apps. View all

Strengths: Comprehensive all-in-one ERP with accounting, inventory, CRM. Strong automation and reporting accuracy. Scalable from startup to enterprise. Real-time visibility across all business functions.

Weaknesses: Expensive with hidden fees and costly add-ons. Complex setup requiring proper onboarding and training. Frequent price increases after contracts (up to 28% if declining Advanced Customer Support). No free tier available.

Best for: Growing businesses ($5M+ revenue) that have outgrown QuickBooks/Xero and need unified ERP with inventory, CRM, and advanced financials.

Links: Website • G2 • Capterra

5. FreshBooks

Invoice-first accounting for freelancers and service businesses.

FreshBooks serves over 30 million users with accounting focused on invoicing, time tracking, and expense management. The platform excels at simple, intuitive workflows for freelancers and service-based businesses. Recognized in 2025 Capterra Shortlist for Accounting Software.

Pricing: Lite at $19/month (5 clients), Plus at $33/month (50 clients), Premium at $60/month (unlimited clients). Select plan with custom pricing. Team members +$11/user/month. 30-day free trial.

Integrations: G Suite, Stripe, Square, Squarespace, Bench, Shopify, Gusto, Zapier. 100+ apps. View all

Strengths: Exceptional ease of use—particularly strong invoicing. Built-in time tracking and project management. 24/7 chatbot support plus live chat. Low learning curve for non-accountants.

Weaknesses: Client limits on lower tiers frustrating for growth. No bank reconciliation in Lite plan. Not GAAP/IFRS compliant. Extra users at $11/month adds up quickly. No forecasting or budgeting tools.

Best for: Freelancers and service-based businesses (under 10 employees) prioritizing simple invoicing and time tracking over complex accounting.

Links: Website • G2 • Capterra

6. Zoho Books

Affordable cloud accounting in the Zoho ecosystem.

Zoho Books offers cloud accounting with a genuinely useful free plan (under $50K revenue) and strong automation. Rated 4.4/5 stars. The platform integrates seamlessly with Zoho CRM, Inventory, and Projects. Most small businesses pay $15-$60/month.

Pricing: Free plan (under $50K revenue, 1,000 invoices/year). Standard at $15/month, Professional at $40/month, Premium at $60/month, Elite at $120/month. Save 20-25% paying annually.

Integrations: Zoho CRM, Zoho Inventory, Zoho Projects, Amazon, Etsy, Shopify, Square, Stripe, Zapier. View all

Strengths: Free plan genuinely useful for micro-businesses. Excellent value—Elite plan 30-40% cheaper than comparable competitors. Strong Zoho ecosystem integration. Automation capabilities reduce manual work.

Weaknesses: Best value requires commitment to Zoho ecosystem. Less known than QuickBooks/Xero means fewer accountants familiar with it. Support quality varies. Advanced features require higher tiers.

Best for: Small to midsize businesses (1-200 employees) already using or open to Zoho ecosystem wanting excellent value.

Links: Website • G2 • Capterra

7. Wave

Free accounting software for micro-businesses.

Wave provides genuinely free accounting and invoicing for small businesses, serving over 2 million businesses globally since 2010. Acquired by H&R Block in 2019. The free tier includes unlimited invoicing, expense tracking, and double-entry accounting with financial reports.

Pricing: Free plan includes accounting and invoicing. Pro plan at $16/month adds bank transaction automation and receipt scanning. Payroll at $40/month base + $6/employee.

Integrations: PayPal, Shopify, Etsy, Google Sheets, Zapier, Make. Limited native integrations. View all

Strengths: Truly free accounting—not a limited trial. Unlimited users at no cost. Modern, clean interface. Unlimited professional invoices. Solid for basic bookkeeping needs.

Weaknesses: No third-party integrations. Free users cannot contact human support. Auto-categorization causes issues—duplicates transactions and bank feed delays reported. Account freezes reported by some users. Limited features compared to paid alternatives.

Best for: Freelancers and micro-businesses (under $100K revenue, fewer than 10 employees) with basic accounting needs and limited budget.

Links: Website • G2 • Capterra

8. Campfire

AI-native ERP for startups outgrowing QuickBooks.

Campfire is a modern accounting platform founded in 2023, positioned as a “modern NetSuite” for startups and mid-size tech companies. Raised $108M total funding including $35M Series A led by Accel (2025). Targets companies migrating from QuickBooks, Xero, or frustrated with NetSuite/Sage.

Pricing: Contact for custom pricing. No public pricing tiers available.

Integrations: Ramp, Brex, Rho, Stripe, Salesforce, HubSpot, Snowflake, Looker. 100+ API endpoints. View all

Strengths: Modern LLM-powered alternative to legacy ERPs. Built for startups scaling beyond QuickBooks. Strong investor backing (Accel, Y Combinator). Core accounting plus revenue automation.

Weaknesses: New company (founded 2023)—limited track record. No public pricing transparency. Fewer reviews and user testimonials available compared to established players.

Best for: Venture-funded startups and mid-size tech companies outgrowing QuickBooks/Xero or frustrated with NetSuite complexity.

Links: Website

9. Puzzle

AI accounting software built for startups.

Puzzle offers AI-powered accounting specifically designed for startups, automating 85-95% of repetitive bookkeeping tasks with up to 95% categorization accuracy. Features include real-time financial dashboards showing burn rate, runway, ARR/MRR, and investor-ready reporting. Popular among founders switching from QuickBooks/Pilot.

Pricing: Free tier for companies under $5K monthly expenses. Paid plans starting at $43/month. Custom pricing for larger organizations.

Integrations: Brex, Ramp, Mercury, Stripe, Gusto, Rippling, Deel, BILL, Plaid, Runway. View all

Strengths: AI automates 85-95% of bookkeeping tasks. Clean, simple interface praised by founders. Real-time runway and burn rate visibility. Painless setup with responsive onboarding. Investor-ready dashboards.

Weaknesses: Still requires CPA review for tax filings and audits. Newer platform with less track record than established tools. Best suited for startup use cases—may lack features for complex businesses.

Best for: Early-stage startups wanting automated bookkeeping with runway/burn rate visibility without full-time bookkeeper costs.

Links: Website • G2 • Capterra

10. QuickBooks Enterprise

Advanced desktop accounting for larger businesses.

QuickBooks Enterprise is the only remaining QuickBooks Desktop product available for new purchases (after September 2025). Supports 1-30 simultaneous users with advanced inventory, custom user permissions, and industry-specific editions for manufacturing, contractors, retail, and nonprofits. User satisfaction rating of 90% based on 21,750 reviews.

Pricing: Gold starting at ~$1,740/year, Platinum and Diamond tiers available. Significant price increases in 2025 (some users report 47-75% increases over 3 years). Cloud hosting adds $30-60/user/month.

Integrations: Bill.com, PayPal, Square, Amazon, Tipalti, SOS Inventory, Zapier. 750+ apps via QuickBooks ecosystem. View all

Strengths: Handles complex accounting for manufacturing, construction, retail. Advanced inventory management and reporting. 160+ customizable reports. Supports up to 30 users. Desktop reliability without cloud dependency.

Weaknesses: Steep price increases (2024: $1,325 → 2025: $2,230 reported). Windows only. Less automation than cloud competitors. Intuit discontinuing other Desktop products—Enterprise is only remaining option.

Best for: Businesses (10-100 employees) in manufacturing, construction, or retail needing advanced inventory and preferring desktop software.

Links: Website • G2 • Capterra

11. Rillet

AI-native ERP automating 93% of accounting tasks.

Rillet is an AI-native ERP built by accountants, automating approximately 93% of accounting processes. Raised over $100M in 2025 (Series A from Sequoia, Series B from Andreessen Horowitz and ICONIQ). Features plug-and-play connectors for Stripe, Salesforce, Ramp, Brex, Rippling, and more.

Pricing: Three tiers: Starter, Scale, and Enterprise. Specific pricing not publicly available—contact for quote.

Integrations: Salesforce, HubSpot, Stripe, Ramp, Brex, Rippling, Gusto, ADP, Tipalti, Avalara, Anrok. View all

Strengths: Automates 93% of accounting processes. Real-time financials with automatic bank feeds. White-glove implementation with chart of accounts design support. Users praise “fast, intuitive, and beautifully modern” interface. Slack-based support.

Weaknesses: No public pricing—requires sales contact. Newer company—less established than legacy ERPs. May be overkill for simple accounting needs.

Best for: Venture-funded startups and mid-market companies seeking modern ERP replacement for NetSuite, Sage Intacct, or QuickBooks.

12. SoftLedger

Multi-entity accounting with real-time consolidation.

SoftLedger provides multi-entity accounting designed for organizations managing multiple subsidiaries, entities, or business units. Features real-time consolidation, multi-currency management, and a powerful API. Most clients operational within 30-45 days of implementation.

Pricing: Standard at $750/month, Enterprise at $975/month, Enterprise with Digital Asset at $1,375/month. All plans include unlimited entities.

Integrations: Expensify, Plaid, Stripe, Ramp, BILL, Budgeto, QuickBooks Online. Open API for custom integrations. View all

Strengths: Unlimited entities included in all plans—no per-entity fees. Real-time multi-entity consolidation. Strong API for integrations. Users praise simplicity for family offices and holding companies. Responsive support team.

Weaknesses: AP and AR reports described as “bare.” Opening/closing accounting periods requires manual work for each module. Less feature-rich than enterprise ERPs like NetSuite.

Best for: Family offices, holding companies, and multi-entity organizations needing consolidated reporting across many subsidiaries.

Links: Website • G2 • Capterra

13. Odoo

Open-source modular ERP with free accounting app.

Odoo is an open-source ERP offering modular apps from accounting to inventory, CRM, and project management. The accounting app is free as a standalone; fees apply when adding modules. 88% of reviewers rate it as good value, with 100% positive feedback on integrations. Used by businesses wanting customizable, scalable solutions.

Pricing: One App Free (accounting only with unlimited users). Standard at $24.90/user/month (all apps), Custom at $37.40/user/month (all apps + customization). Save with annual billing.

Integrations: QuickBooks connector, TaxJar, Stripe, PayPal, Shopify, Amazon. Odoo Apps Store with thousands of modules. View all

Strengths: Free accounting app if only one module needed. Open-source enables deep customization. Massive app ecosystem (accounting, inventory, CRM, HR, etc.). Scalable from startup to enterprise. Strong community and documentation.

Weaknesses: Requires technical expertise for customization. Quality depends on implementation partner. Setup can be complex for non-technical users. Support complaints regarding responsiveness.

Best for: Small to mid-size businesses (1-200 employees) in retail, manufacturing, or services wanting customizable, modular ERP with open-source flexibility.

Links: Website • G2 • Capterra

14. E-conomic – Accounting Software for Danish Accountants

E-conomic is the preferred accounting software in Scandinavia. It is highly regarded for its powerful features, which cater specifically to the needs of Danish accounting firms.

E-conomic enhances accounting workflows by:

- Automating essential tasks like invoicing, VAT reporting, and receipt uploads to reduce manual data entry.

- Simplifying client management through streamlined and automated workflows, allowing accountants to focus on strategic activities.

- Offering extensive app integration, facilitating a more cohesive operation and all-in-one solution.

AI-Powered Accounting Software for CPAs

By 2026, AI will shift from optional add-on to native layer inside core accounting systems. 95% of accountants have already adopted some automation, with 98% reporting improved accuracy and efficiency. The fundamental shift: AI is moving from generative support (helping spot anomalies) to agentic support (doing the checking, identification, and reconciliation autonomously). This transforms accountants from Preparers to Reviewers. Firms integrating AI report 5-7 hours saved weekly per professional, though the industry demands algorithmic transparency—”black box” AI won’t fly in accounting.

1. Digits

Next-generation accounting platforms using artificial intelligence to automate transaction categorization, reconciliation, and anomaly detection. Trained on billions of dollars in transaction data, these AI-native tools reduce manual bookkeeping work by 60-80% while improving accuracy. Ideal for CAS-focused firms looking to scale client capacity without proportionally scaling headcount.

Digits represents a new generation of accounting software built from the ground up with AI. The platform delivers real-time financials, 24/7 AI reconciliation handling up to 1M transactions/year, and auto-populated vendor/customer directories.

Pricing: Essentials at $65/month (coming soon), AI Accounting at $100/month, Full-Service at $350+/month with dedicated accountants. Professional tier has custom pricing.

Integrations: Gusto, Mercury, Ramp, BILL, Stripe, Arc. Plaid for 12,000+ bank connections. View all

Strengths: Users describe it as “10x better than any other accounting software.” Dimensional accounting for department, location, and project tracking. W-9 and 1099 tracking built-in. Integrations with Gusto, Mercury, Ramp, BILL, Stripe, and Arc.

Weaknesses: Newer platform with less proven track record. Full-service tier required for dedicated accountant support.

Best for: SMBs (10-500 employees) wanting AI-first accounting.

Links: Website • G2 • Capterra

2. Kick

95% auto-categorization for entrepreneurs.

Kick automates bookkeeping with AI that auto-categorizes approximately 95% of transactions, handles reconciliation, and generates reports automatically.

Pricing: Free under $25k annual expenses. Basic/Plus for $25k-250k (30-day trial then annual). Enterprise for $250k+ (custom pricing via sales call).

Integrations: Stripe, PayPal, Ramp, Mercury, Gusto. Plaid for bank connections. US only. View all

Strengths: Built specifically for entrepreneurs. 95% auto-categorization. Multi-entity at no extra fees. Stripe, PayPal, Mercury integrations.

Weaknesses: 1.8 stars on Trustpilot (early-stage product). US-only. Limited to basic bookkeeping needs.

Best for: US-based entrepreneurs with straightforward books wanting minimal manual work.

Links: Website

3. Synder

Synder automates the transfer of financial data, reducing manual work and errors. By integrating with popular payment platforms and accounting software (e.g., Stripe, PayPal, Square, QuickBooks, and Xero), Synder synchronizes invoices and transactions in real-time. This allows accountants to spend less time on repetitive tasks and focus more on strategic client advising, ultimately improving overall efficiency and accuracy.

Payroll Software for Accounting Firms

Payroll software commands 29.45% of the accounting software market, expanding at 10.91% CAGR through 2030. The HR payroll market alone is valued at $35 billion and growing to $66 billion by 2029. Despite available technology, 51% of organizations still use spreadsheets for payroll processing—creating opportunity for firms offering modern solutions. In 2025, 77% of organizations use AI in payroll processing, and 94% of business leaders want payroll integrated across all HR systems. Data security remains the top improvement priority globally.

1. Gusto

#1 rated payroll on G2 for small businesses.

Gusto serves over 400,000 businesses with payroll, benefits, and HR tools. Ranked #1 in customer satisfaction on G2 Fall 2025. The platform handles payroll tax filing, health benefits administration, and offers a dedicated Gusto Pro plan for accountants managing client payroll with month-long free trials.

Pricing: Simple at $49/month + $6/employee. Plus at $80/month + $12/employee. Premium at $180/month + $22/employee. Contractor-only at $6/contractor/month. Prices increased March 2025.

Integrations: QuickBooks, Xero, Slack, Google Workspace, Zoom, Microsoft 365, Zapier. 180+ apps. View all

Strengths: #1 G2 rating for customer satisfaction. Easy to use interface. Includes multiple pay runs and tax filing at no extra cost. Health benefits administration. Early paydays and spending account features praised by users.

Weaknesses: Some users report inconsistent customer service. Limited PTO administration options. Cannot administer benefits that aren’t 100% employer-funded. Some tax document errors requiring outside accountant fixes reported.

Best for: Small businesses (1-100 employees) wanting all-in-one payroll with benefits administration and strong user experience.

Links: Website • G2 • Capterra

2. Rippling

Unified HR, payroll, and IT management platform.

Rippling combines HR, payroll, benefits, and IT device management in one platform. Highest-rated HR platform on Software Advice 2025 with 4.9/5 from 3,300+ reviews. The platform automates 95% of payroll admin and automatically provisions employee laptops, email, and software access when hiring.

Pricing: Core platform starts at $8/employee/month. Payroll module at $35/month per user. Most businesses pay $25-$50/employee/month with full modules. Quote-based pricing—no public price list.

Integrations: QuickBooks Online, Xero, NetSuite, Sage Intacct, Slack, Zoom, Okta. 650+ apps. View all

Strengths: Automates 95% of payroll administration. 600+ software integrations. Unified HR + IT management (auto-provisions devices and software). Handles federal, state, and local taxes with penalty reimbursement for Rippling errors. 60% of users rate pricing positively.

Weaknesses: No pricing transparency—requires sales contact. No free trial available. Implementation takes 2-4 weeks (6-8 for complex migrations). More expensive than payroll-only solutions for very small teams.

Best for: Tech-forward growing businesses (50-1,000 employees) needing unified HR, payroll, and IT management in one platform.

Links: Website • G2 • Capterra

3. OnPay

Transparent pricing with 30+ years payroll experience.

OnPay evolved from a traditional payroll service with over 30 years of processing experience. Named best payroll service for small businesses by Business News Daily. The platform offers as many or more features than Gusto, ADP, and Paychex while charging less than all three for comparable services.

Pricing: Single plan: $40/month + $6/person. Includes W-2s, 1099s, year-end filings, unlimited pay runs, multi-state tax filing, and HR tools. No setup fees, contracts, or cancellation fees. Free one-month trial.

Integrations: QuickBooks Online, QuickBooks Desktop, Xero, QuickBooks Time, Deputy, When I Work. View all

Strengths: Transparent pricing with no hidden fees. Unlimited payroll runs included. Multi-state tax filing at no extra cost. Free setup and dedicated onboarding support. Guaranteed on-time, accurate tax filing. HR tools included at no extra cost.

Weaknesses: Single plan lacks scalability for complex growing businesses. Mobile admin app has fewer functions than desktop. Less brand recognition than major competitors.

Best for: Small to midsize businesses (up to 500 employees) wanting straightforward pricing with comprehensive features and no hidden costs.

Links: Website • G2 • Capterra

4. ADP RUN

Enterprise payroll giant for small businesses.

ADP serves over 900,000 small business clients with RUN Powered by ADP, designed for 1-49 employees. User satisfaction rating of 90% based on 2,835 reviews. Four plan tiers (Essential, Enhanced, Complete, HR Pro) offer increasing features from basic payroll to full HR suite.

Pricing: Essential starts around $79/month + $4/employee (reported user pricing). Implementation fees around $2,000 reported. Custom quotes based on business size, location, and services. Annual contracts typically required.

Integrations: When I Work, Ease, 401(k) providers, HSA providers. ADP Marketplace for more apps. View all

Strengths: 24/7 customer support on all plans. 88% of users praise intuitive interface including mobile app. Strong automation and reporting. Established reputation with 900K+ clients. Comprehensive compliance coverage.

Weaknesses: Complex, non-transparent pricing with potential hidden fees. Annual contracts with early termination fees. Per-payroll-cycle charges costly for weekly pay schedules. Pricier than simpler alternatives for basic needs.

Best for: Small businesses (10-49 employees) wanting single-vendor solution with strong automation, willing to pay premium for established provider.

Links: Website • G2 • Capterra

5. Justworks

PEO with access to large-group benefits.

Justworks offers Professional Employer Organization (PEO) services, providing access to Fortune 500-level benefits at small business prices. Rated 4.6/5 on G2 from 576 reviews. The platform handles payroll, compliance, HR, and benefits through a co-employment model.

Pricing: Payroll-only at $50/month + $8/employee. PEO Basic at $79/employee/month. PEO Plus at $109/employee/month (adds health insurance). EOR (international) at $599/employee/month. Time tracking add-on at $8/employee.

Integrations: QuickBooks Online, Xero, NetSuite, Sage Intacct, Greenhouse, 15Five, Carta, Brex, Ramp. View all

Strengths: Access to large-group health insurance rates. Clear pricing with no hidden fees or setup costs. 24/7 support through multiple channels. Intuitive, easy-to-implement platform. Compliance expertise included.

Weaknesses: PEO model means less control—reps are service people, not payroll/tax experts. Limited reporting and onboarding functionality vs. full HRIS. Higher cost than simple payroll tools ($59-$599/employee).

Best for: U.S.-based small to mid-size businesses (5-500 employees) wanting PEO benefits access and compliance support without enterprise complexity.

Links: Website • G2 • Capterra

6. Patriot Payroll

Budget-friendly payroll for very small businesses.

Patriot Payroll serves U.S. businesses with 1-500 employees at highly competitive pricing. Rated 4.8/5 overall with 5 stars on Trustpilot from 3,177 reviews. Over 70% of reviewers come from companies with 2-10 employees, confirming its small business focus.